According to Singapore Financial Reporting Standards (International) (SFRS(I)) 1-37, Provisions, Contingent Liabilities and Contingent Assets, a contingent liability is not recognised but is disclosed

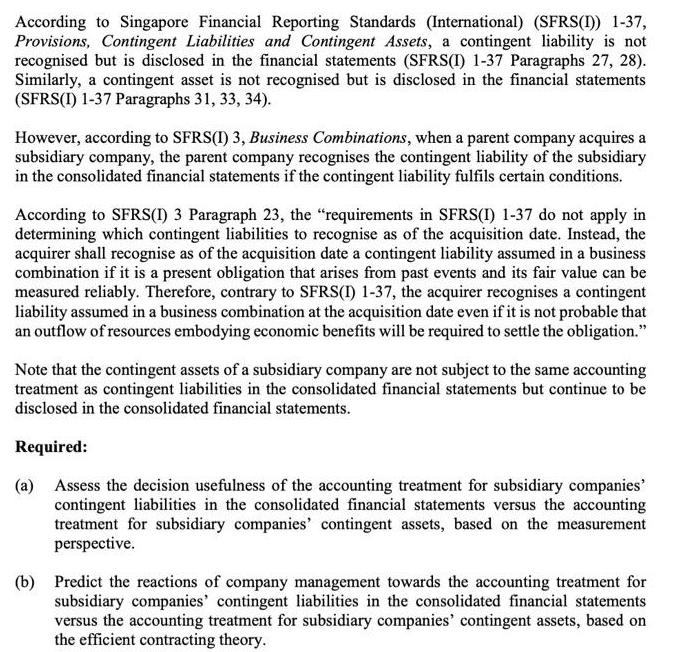

According to Singapore Financial Reporting Standards (International) (SFRS(I)) 1-37, Provisions, Contingent Liabilities and Contingent Assets, a contingent liability is not recognised but is disclosed in the financial statements (SFRS(I) 1-37 Paragraphs 27, 28). Similarly, a contingent asset is not recognised but is disclosed in the financial statements (SFRS(I) 1-37 Paragraphs 31, 33, 34). However, according to SFRS(1) 3, Business Combinations, when a parent company acquires a subsidiary company, the parent company recognises the contingent liability of the subsidiary in the consolidated financial statements if the contingent liability fulfils certain conditions. According to SFRS(I) 3 Paragraph 23, the "requirements in SFRS(I) 1-37 do not apply in determining which contingent liabilities to recognise as of the acquisition date. Instead, the acquirer shall recognise as of the acquisition date a contingent liability assumed in a business combination if it is a present obligation that arises from past events and its fair value can be measured reliably. Therefore, contrary to SFRS(I) 1-37, the acquirer recognises a contingent liability assumed in a business combination at the acquisition date even if it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation." Note that the contingent assets of a subsidiary company are not subject to the same accounting treatment as contingent liabilities in the consolidated financial statements but continue to be disclosed in the consolidated financial statements. Required: (a) Assess the decision usefulness of the accounting treatment for subsidiary companies' contingent liabilities in the consolidated financial statements versus the accounting treatment for subsidiary companies' contingent assets, based on the measurement perspective. (b) Predict the reactions of company management towards the accounting treatment for subsidiary companies' contingent liabilities in the consolidated financial statements versus the accounting treatment for subsidiary companies' contingent assets, based on the efficient contracting theory.

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 a The decision usefulness of the accounting treatment for subsidiary companies contingent li...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started