Answered step by step

Verified Expert Solution

Question

1 Approved Answer

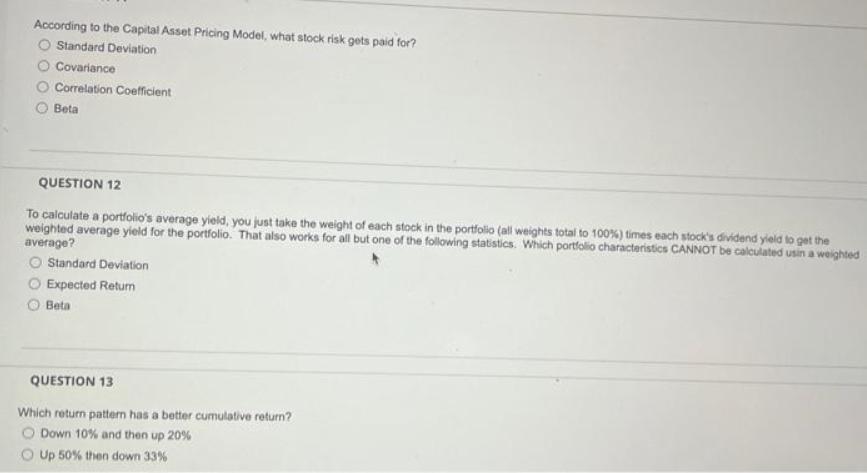

According to the Capital Asset Pricing Model, what stock risk gets paid for? Standard Deviation Covariance Correlation Coefficient Beta QUESTION 12 To calculate a

According to the Capital Asset Pricing Model, what stock risk gets paid for? Standard Deviation Covariance Correlation Coefficient Beta QUESTION 12 To calculate a portfolio's average yield, you just take the weight of each stock in the portfolio (all weights total to 100%) times each stock's dividend yield to get the weighted average yield for the portfolio. That also works for all but one of the following statistics. Which portfolio characteristics CANNOT be calculated usin a weighted average? O Standard Deviation Expected Return Beta QUESTION 13 Which return pattern has a better cumulative return? O Down 10% and then up 20% O Up 50% then down 33 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answers to Your Questions Question 11 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started