Answered step by step

Verified Expert Solution

Question

1 Approved Answer

According to the given data analyze the companies deferred tax asset and liabilities, do you except lower or higher tax payments in the future? Deferred

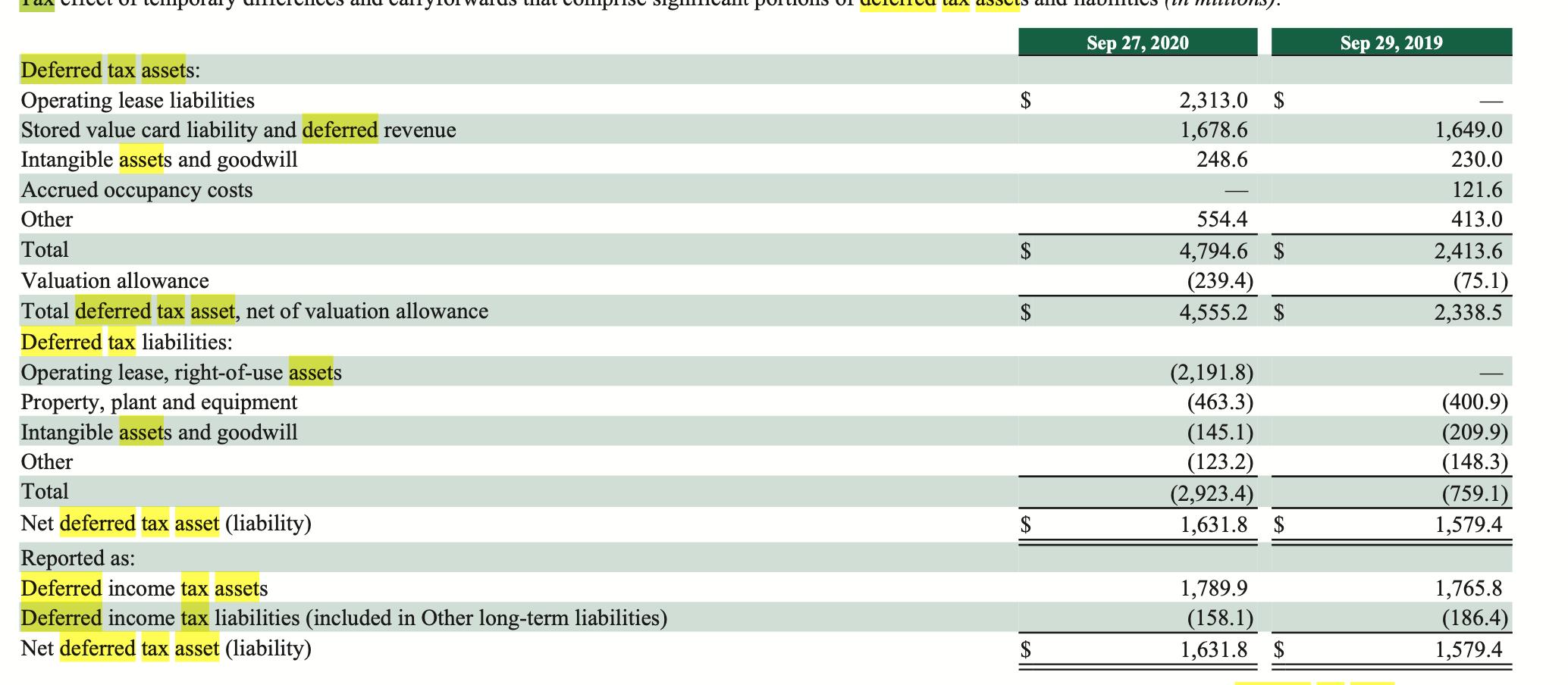

According to the given data analyze the companies deferred tax asset and liabilities, do you except lower or higher tax payments in the future?

Deferred tax assets: Operating lease liabilities Stored value card liability and deferred revenue Intangible assets and goodwill Accrued occupancy costs Other Total Valuation allowance Total deferred tax asset, net of valuation allowance Deferred tax liabilities: Operating lease, right-of-use assets Property, plant and equipment Intangible assets and goodwill Other Total Net deferred tax asset (liability) Reported as: Deferred income tax assets Deferred income tax liabilities (included in Other long-term liabilities) Net deferred tax asset (liability) $ $ $ Sep 27, 2020 2,313.0 $ 1,678.6 248.6 554.4 4,794.6 $ (239.4) 4,555.2 $ (2,191.8) (463.3) (145.1) (123.2) (2,923.4) 1,631.8 1,789.9 $ (158.1) 1,631.8 $ Sep 29, 2019 1,649.0 230.0 121.6 413.0 2,413.6 (75.1) 2,338.5 (400.9) (209.9) (148.3) (759.1) 1,579.4 1,765.8 (186.4) 1,579.4

Step by Step Solution

★★★★★

3.52 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

The deferred tax asset is the amount of taxes that a company expects to pay in the future while the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started