Answered step by step

Verified Expert Solution

Question

1 Approved Answer

According to the Image data draw a Security Market Line on a line graph (i.e. SML) .Explain how to draw the SML line? How will

According to the Image data draw a Security Market Line on a line graph (i.e. SML) .Explain how to draw the SML line? How will the SML look like?

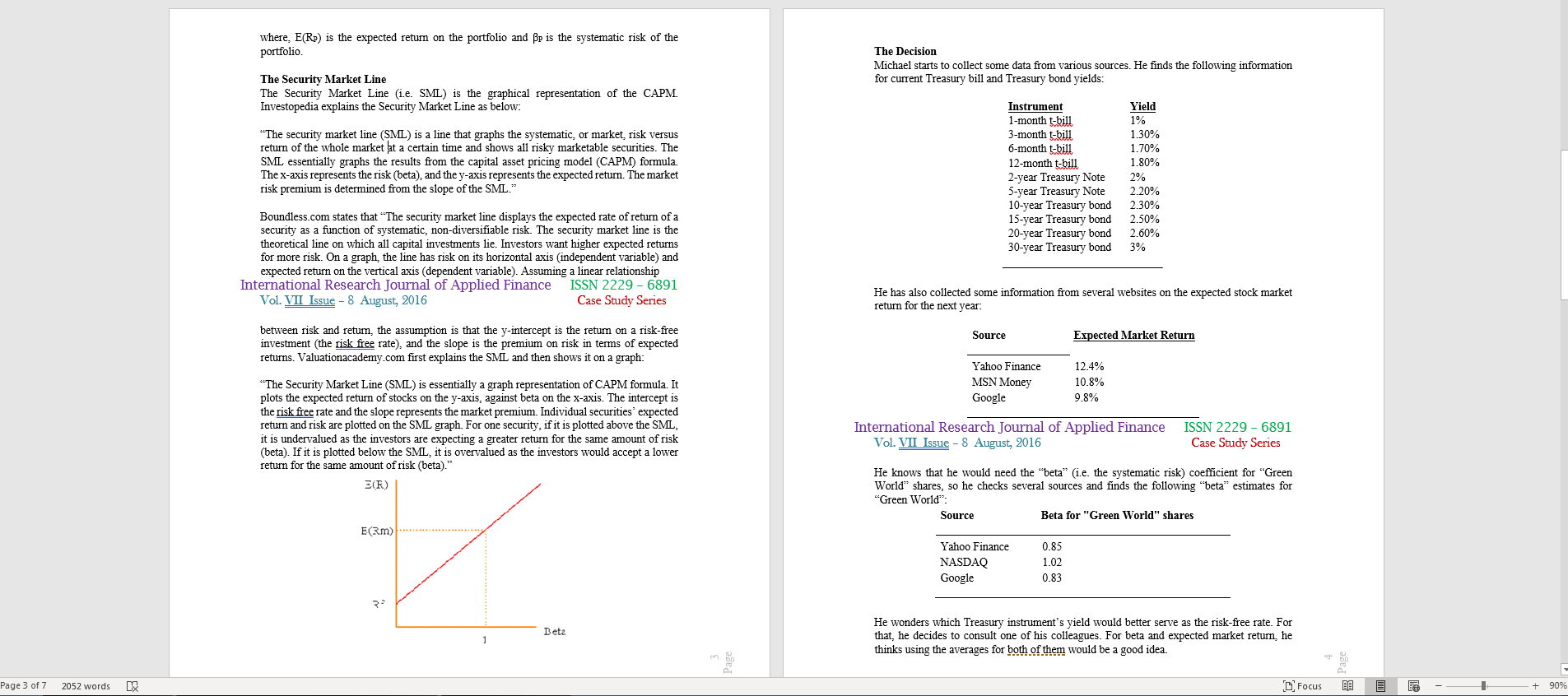

where, E(R) is the expected return on the portfolio and Bp is the systematic risk of the portfolio The Decision Michael starts to collect some data from various sources. He finds the following information for current Treasury bill and Treasury bond yields: The Security Market Line The Security Market Line (1.e. SML) is the graphical representation of the CAPM. Investopedia explains the Security Market Line as below: **The security market line (SML) is a line that graphs the systematic, or market, risk versus return of the whole market at a certain time and shows all risky marketable securities. The SML essentially graphs the results from the capital asset pricing model (CAPM) formula. The x-axis represents the risk (beta), and the y-axis represents the expected return. The market risk premium is determined from the slope of the SML." Instrument 1-month t-bill 3-month t-bill 6-month t-bill 12-month t-bill 2-year Treasury Note 5-year Treasury Note 10-year Treasury bond 15-year Treasury bond 20-year Treasury bond 30-year Treasury bond Yield 1% 1.30% 1.70% 1.80% 2% 2.20% 2.30% 2.50% 2.60% 3% Boundless.com states that The security market line displays the expected rate of return of a security as a function of systematic, non-diversifiable risk. The security market line is the theoretical line on which all capital investments lie. Investors want higher expected returns for more risk. On a graph the line has risk on horizontal axis (independent variable) and expected return on the vertical axis (dependent variable). Assuming a linear relationship International Research Journal of Applied Finance ISSN 2229 - 6891 Vol. VII Issue - 8 August, 2016 Case Study Series He has also collected some information from several websites on the expected stock market return for the next year Source Expected Market Return Yahoo Finance MSN Money Google 12.4% 10.8% 9.8% between risk and return the assumption is that the y-intercept is the return on a risk-free investment (the risk free rate), and the slope is the premium on risk in terms of expected returns. Valuationacademy.com first explains the SML and then shows it on a graph: "'The Security Market Line (SML) is essentially a graph representation of CAPM formula. It plots the expected return of stocks on the y-axis, against beta on the x-axis. The intercept is the risk free rate and the slope represents the market premium. Individual securities' expected return and risk are plotted on the SML graph. For one security, if it is plotted above the SML, it is undervalued as the investors are expecting a greater return for the same amount of risk (beta). If it is plotted below the SML, it is overvalued as the investors would accept a lower return for the same amount of risk (beta)." E(R) International Research Journal of Applied Finance Vol. VII Issue - 8 August, 2016 ISSN 2229-6891 Case Study Series He knows that he would need the "beta" (1.e. the systematic risk) coefficient for "Green World" shares, so he checks several sources and finds the following "beta" estimates for "Green World": Source Beta for "Green World" shares E(3) Yahoo Finance NASDAQ Google 0.85 1.02 0.83 Beta He wonders which Treasury instrument's yield would better serve as the risk-free rate. For that, he decides to consult one of his colleagues. For beta and expected market return, he thinks using the averages for both of them would be a good idea. Page 3 of 7 2052 words C Focus 10 90% where, E(R) is the expected return on the portfolio and Bp is the systematic risk of the portfolio The Decision Michael starts to collect some data from various sources. He finds the following information for current Treasury bill and Treasury bond yields: The Security Market Line The Security Market Line (1.e. SML) is the graphical representation of the CAPM. Investopedia explains the Security Market Line as below: **The security market line (SML) is a line that graphs the systematic, or market, risk versus return of the whole market at a certain time and shows all risky marketable securities. The SML essentially graphs the results from the capital asset pricing model (CAPM) formula. The x-axis represents the risk (beta), and the y-axis represents the expected return. The market risk premium is determined from the slope of the SML." Instrument 1-month t-bill 3-month t-bill 6-month t-bill 12-month t-bill 2-year Treasury Note 5-year Treasury Note 10-year Treasury bond 15-year Treasury bond 20-year Treasury bond 30-year Treasury bond Yield 1% 1.30% 1.70% 1.80% 2% 2.20% 2.30% 2.50% 2.60% 3% Boundless.com states that The security market line displays the expected rate of return of a security as a function of systematic, non-diversifiable risk. The security market line is the theoretical line on which all capital investments lie. Investors want higher expected returns for more risk. On a graph the line has risk on horizontal axis (independent variable) and expected return on the vertical axis (dependent variable). Assuming a linear relationship International Research Journal of Applied Finance ISSN 2229 - 6891 Vol. VII Issue - 8 August, 2016 Case Study Series He has also collected some information from several websites on the expected stock market return for the next year Source Expected Market Return Yahoo Finance MSN Money Google 12.4% 10.8% 9.8% between risk and return the assumption is that the y-intercept is the return on a risk-free investment (the risk free rate), and the slope is the premium on risk in terms of expected returns. Valuationacademy.com first explains the SML and then shows it on a graph: "'The Security Market Line (SML) is essentially a graph representation of CAPM formula. It plots the expected return of stocks on the y-axis, against beta on the x-axis. The intercept is the risk free rate and the slope represents the market premium. Individual securities' expected return and risk are plotted on the SML graph. For one security, if it is plotted above the SML, it is undervalued as the investors are expecting a greater return for the same amount of risk (beta). If it is plotted below the SML, it is overvalued as the investors would accept a lower return for the same amount of risk (beta)." E(R) International Research Journal of Applied Finance Vol. VII Issue - 8 August, 2016 ISSN 2229-6891 Case Study Series He knows that he would need the "beta" (1.e. the systematic risk) coefficient for "Green World" shares, so he checks several sources and finds the following "beta" estimates for "Green World": Source Beta for "Green World" shares E(3) Yahoo Finance NASDAQ Google 0.85 1.02 0.83 Beta He wonders which Treasury instrument's yield would better serve as the risk-free rate. For that, he decides to consult one of his colleagues. For beta and expected market return, he thinks using the averages for both of them would be a good idea. Page 3 of 7 2052 words C Focus 10 90%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started