Answered step by step

Verified Expert Solution

Question

1 Approved Answer

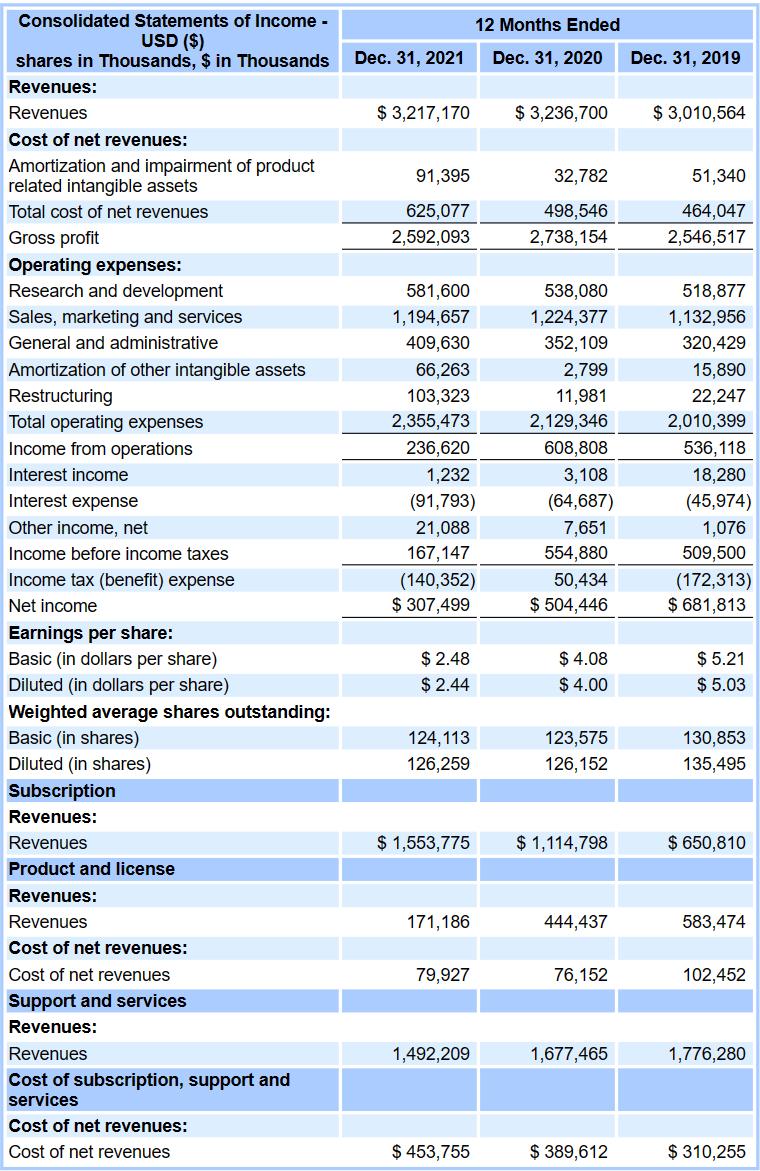

According to the income statement of Citrix, what is the PE multiple for the acquisition using 2021 earnings? Consolidated Statements of Income - USD ($)

According to the income statement of Citrix, what is the PE multiple for the acquisition using 2021 earnings?

Consolidated Statements of Income - USD ($) shares in Thousands, $ in Thousands Revenues: Revenues Cost of net revenues: Amortization and impairment of product related intangible assets Total cost of net revenues Gross profit Operating expenses: Research and development Sales, marketing and services General and administrative Amortization of other intangible assets Restructuring Total operating expenses Income from operations Interest income Interest expense Other income, net Income before income taxes Income tax (benefit) expense Net income Earnings per share: Basic (in dollars per share) Diluted (in dollars per share) Weighted average shares outstanding: Basic (in shares) Diluted (in shares) Subscription Revenues: Revenues Product and license Revenues: Revenues Cost of net revenues: Cost of net revenues Support and services Revenues: Revenues Cost of subscription, support and services Cost of net revenues: Cost of net revenues Dec. 31, 2021 $3,217,170 91,395 625,077 2,592,093 581,600 1,194,657 409,630 66,263 103,323 2,355,473 236,620 1,232 (91,793) 21,088 167,147 (140,352) $ 307,499 $2.48 $ 2.44 124,113 126,259 $ 1,553,775 171,186 79,927 1,492,209 12 Months Ended Dec. 31, 2020 Dec. 31, 2019 $ 453,755 $ 3,236,700 32,782 498,546 2,738,154 538,080 1,224,377 352,109 2,799 11,981 2,129,346 608,808 3,108 (64,687) 7,651 554,880 50,434 $504,446 $4.08 $4.00 123,575 126,152 $ 1,114,798 444,437 76,152 1,677,465 $ 389,612 $ 3,010,564 51,340 464,047 2,546,517 518,877 1,132,956 320,429 15,890 22,247 2,010,399 536,118 18,280 (45,974) 1,076 509,500 (172,313) $ 681,813 $5.21 $5.03 130,853 135,495 $ 650,810 583,474 102,452 1,776,280 $ 310,255 Consolidated Statements of Income - USD ($) shares in Thousands, $ in Thousands Revenues: Revenues Cost of net revenues: Amortization and impairment of product related intangible assets Total cost of net revenues Gross profit Operating expenses: Research and development Sales, marketing and services General and administrative Amortization of other intangible assets Restructuring Total operating expenses Income from operations Interest income Interest expense Other income, net Income before income taxes Income tax (benefit) expense Net income Earnings per share: Basic (in dollars per share) Diluted (in dollars per share) Weighted average shares outstanding: Basic (in shares) Diluted (in shares) Subscription Revenues: Revenues Product and license Revenues: Revenues Cost of net revenues: Cost of net revenues Support and services Revenues: Revenues Cost of subscription, support and services Cost of net revenues: Cost of net revenues Dec. 31, 2021 $3,217,170 91,395 625,077 2,592,093 581,600 1,194,657 409,630 66,263 103,323 2,355,473 236,620 1,232 (91,793) 21,088 167,147 (140,352) $ 307,499 $2.48 $ 2.44 124,113 126,259 $ 1,553,775 171,186 79,927 1,492,209 12 Months Ended Dec. 31, 2020 Dec. 31, 2019 $ 453,755 $ 3,236,700 32,782 498,546 2,738,154 538,080 1,224,377 352,109 2,799 11,981 2,129,346 608,808 3,108 (64,687) 7,651 554,880 50,434 $504,446 $4.08 $4.00 123,575 126,152 $ 1,114,798 444,437 76,152 1,677,465 $ 389,612 $ 3,010,564 51,340 464,047 2,546,517 518,877 1,132,956 320,429 15,890 22,247 2,010,399 536,118 18,280 (45,974) 1,076 509,500 (172,313) $ 681,813 $5.21 $5.03 130,853 135,495 $ 650,810 583,474 102,452 1,776,280 $ 310,255

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the pricetoearnings PE multiple for the acquisi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started