Question: According to the information given above answer the following questions: What is the portfolios expected return? What is the variance of the portfolio and standard

According to the information given above answer the following questions:

- What is the portfolio’s expected return?

- What is the variance of the portfolio and standard deviation?

- If you have to choose only one type of securities (stock A, B, C or D) which one will you choose and why? To answer this question, you need to calculate the expected return for each stock and the standard deviation, and compare their values.

- What is the expected return and variance of a portfolio invested 25% each in A, B, C and D? Will the resulting portfolio structure bring you a higher expected return?

- How should you change the shares of securities A, B, C and D in your portfolio in order to minimize risk and maximize expected returns? Explain your answers.

* You should describe each step in detail and provide intermediate calculations. Add tables from Excel if necessary.

*Write your answers after each question.

* Be careful when rounding. Leave two decimal places

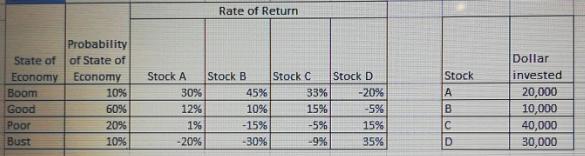

Rate of Return Probability Dollar State of of State of Economy Economy Boom Good Poor Bust invested 20,000 10,000 40,000 30,000 Stock B 30% Stock A Stock A Stock C Stock D 10% 45% 33% -20% 60% 12% 10% 15% -5% 20% 1% -15% -5% 15% 10% -20% -30% -9% 35%

Step by Step Solution

There are 3 Steps involved in it

1 Expected Return SUM Return i x Probability i Stock A 103060122011020 372022 84 Stock B 10456010201... View full answer

Get step-by-step solutions from verified subject matter experts