According to the journal to prepare income statement, balance sheet and owner's equity

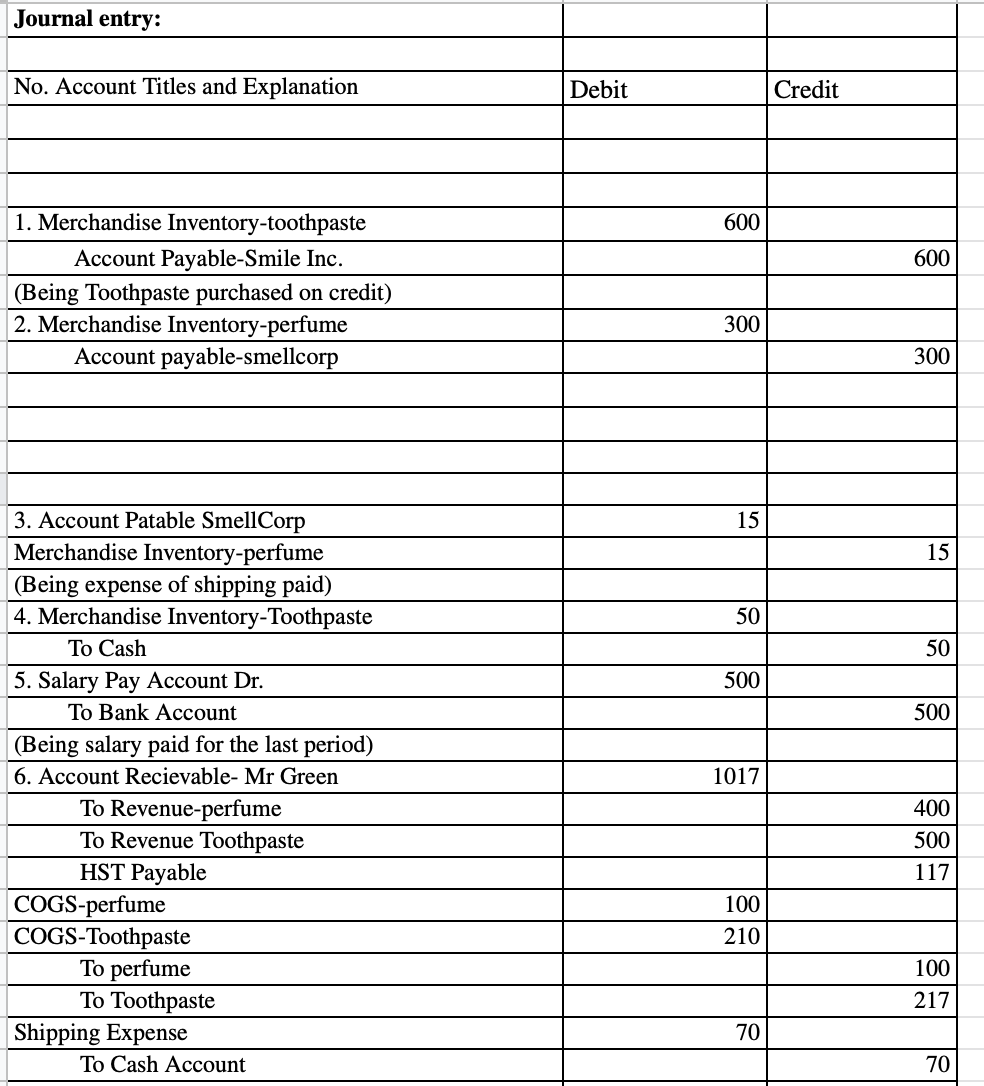

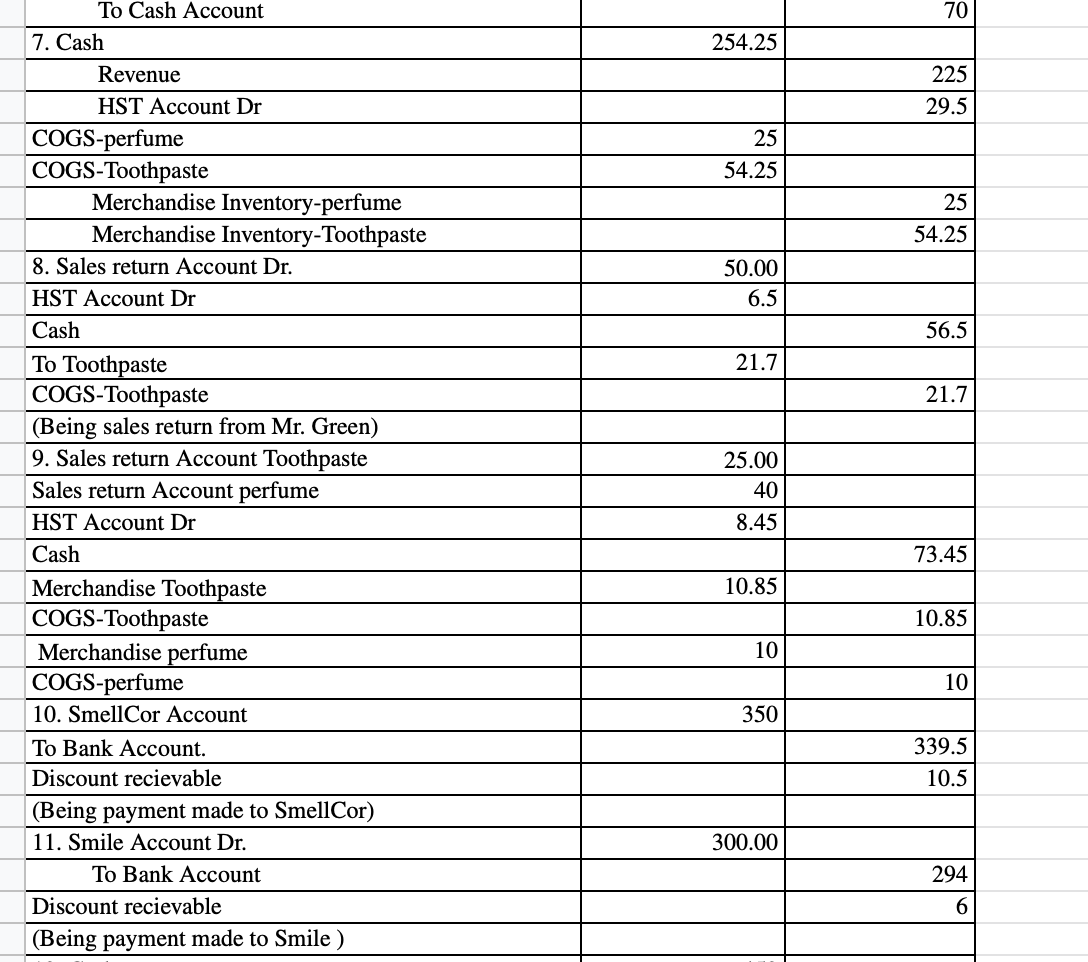

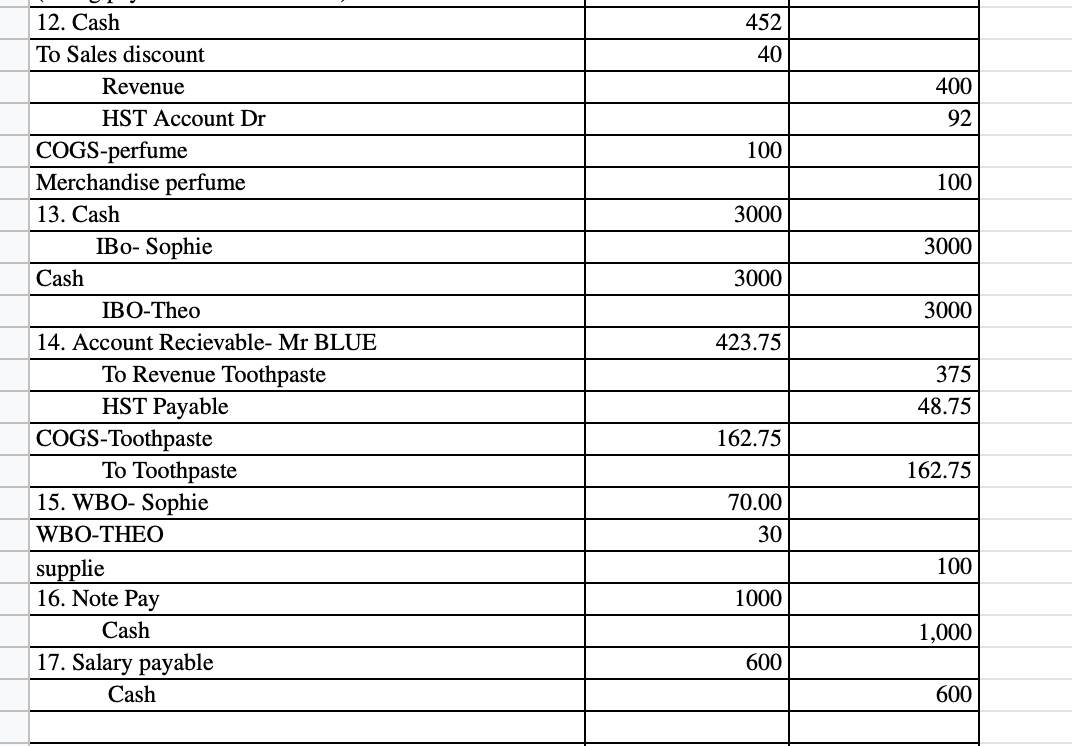

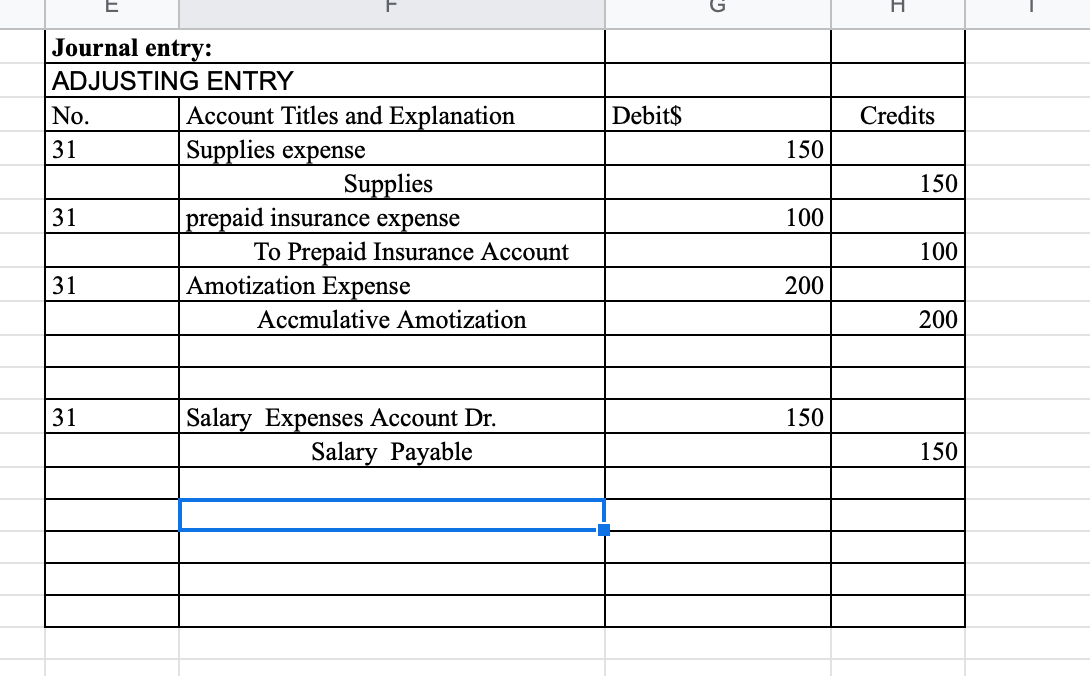

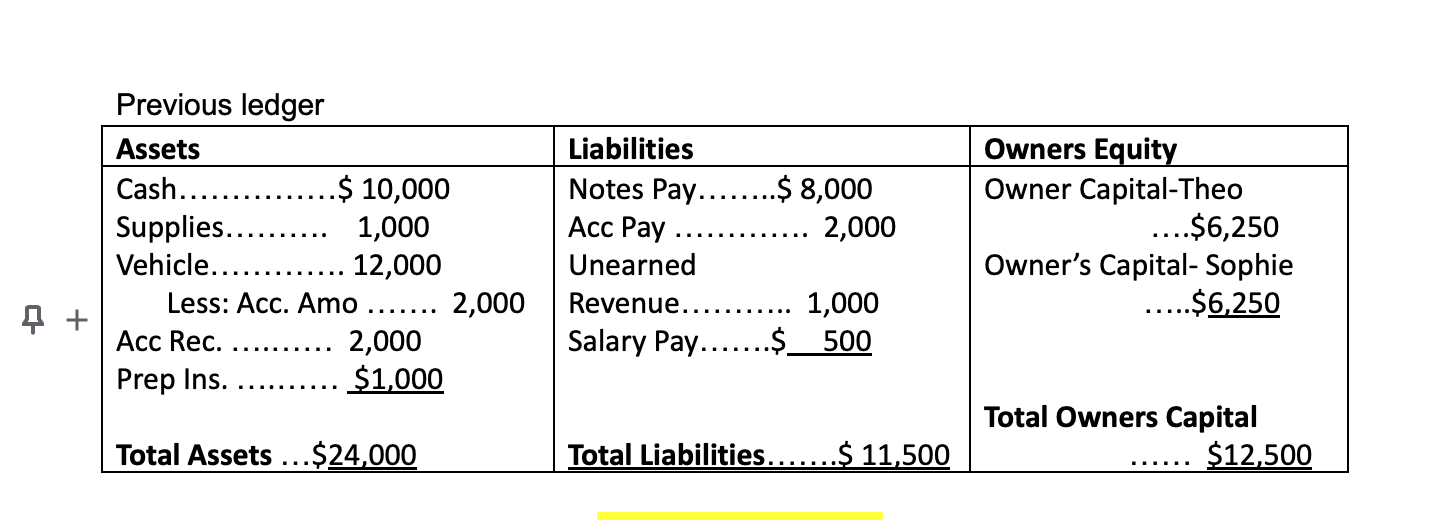

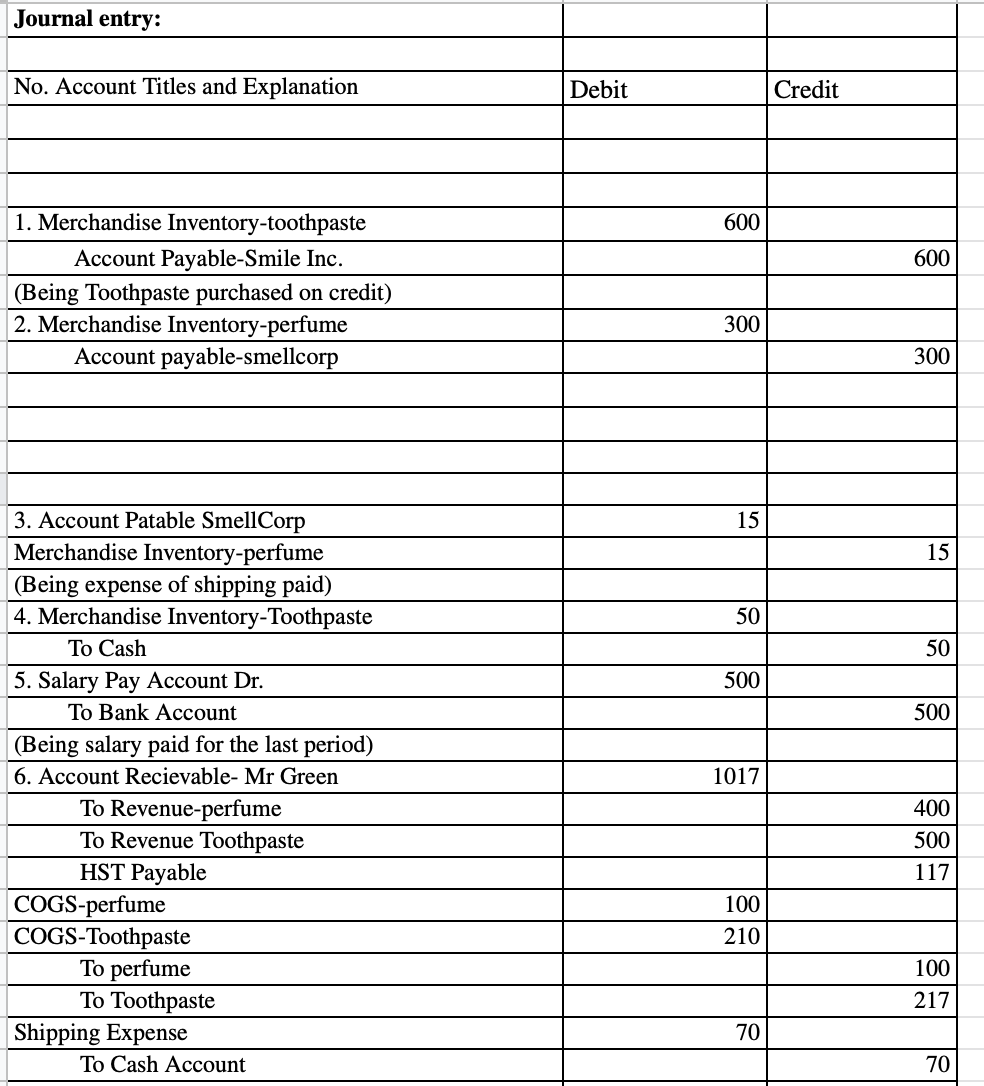

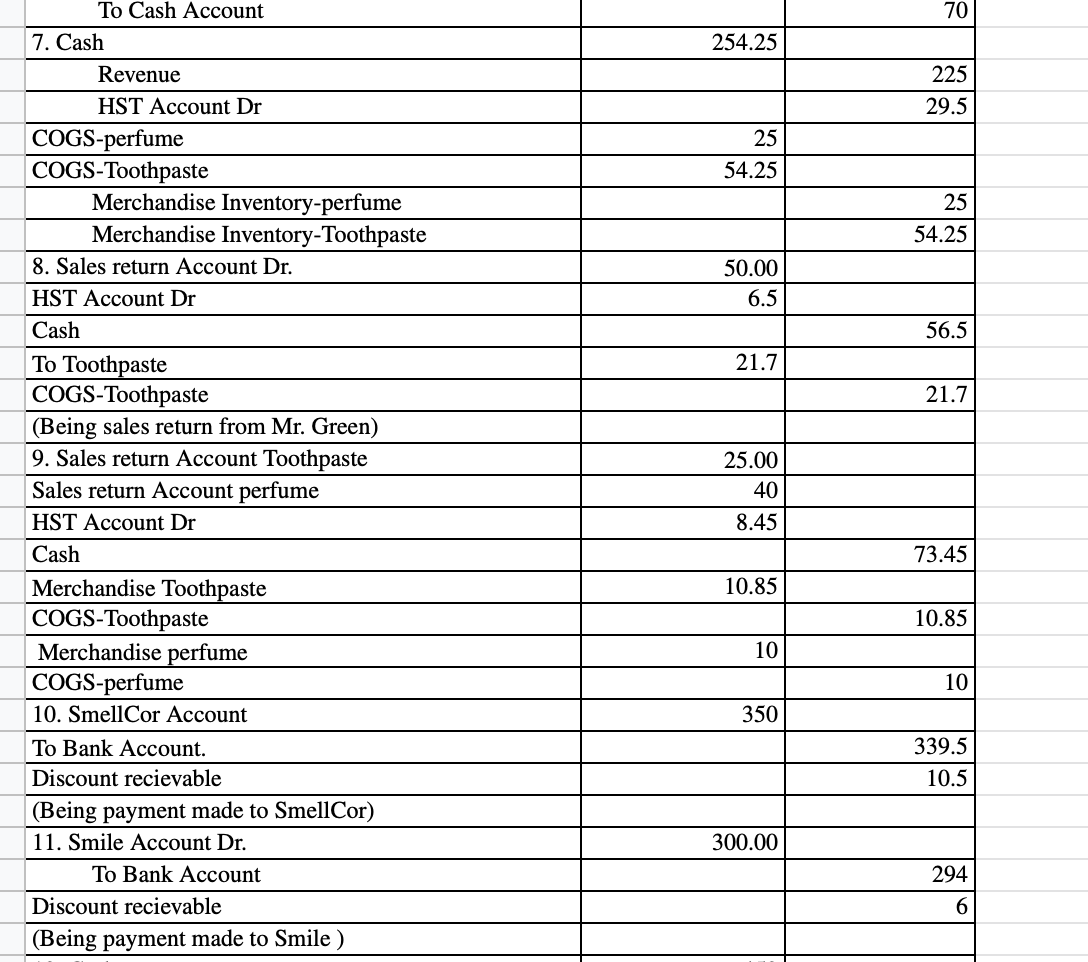

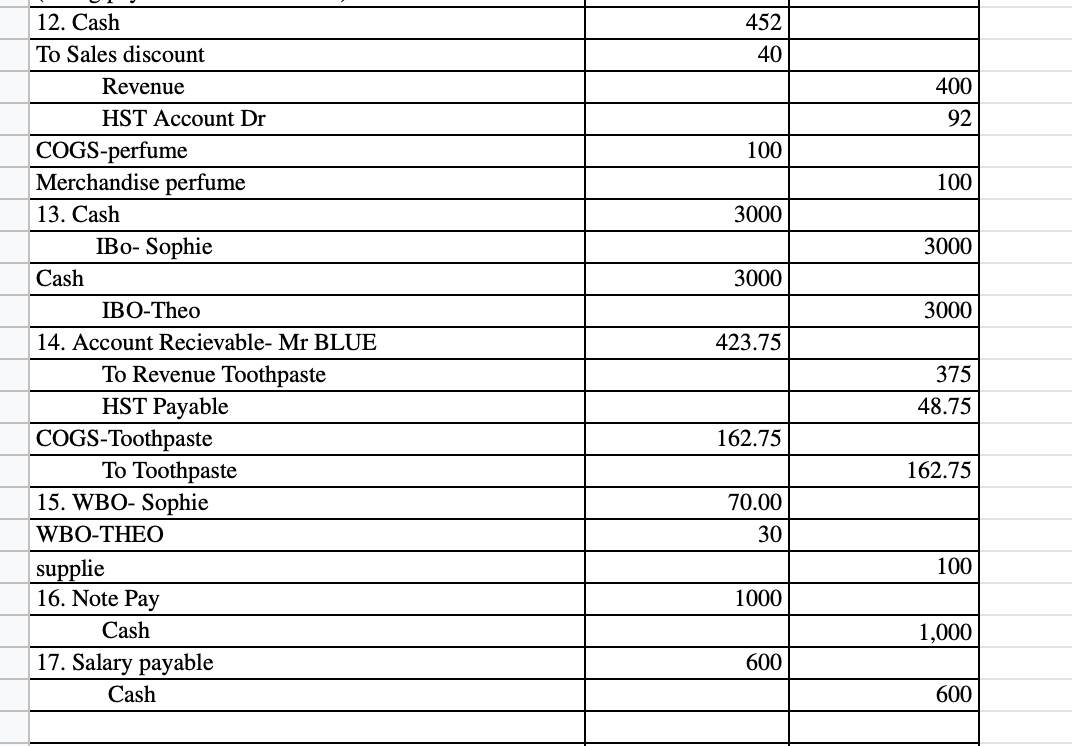

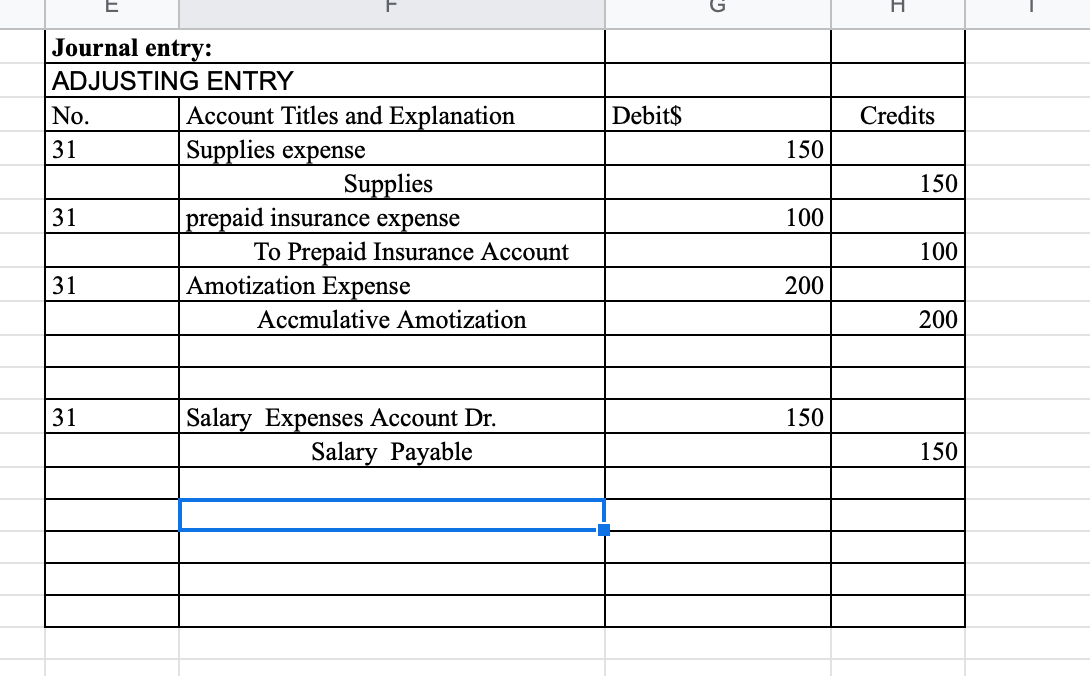

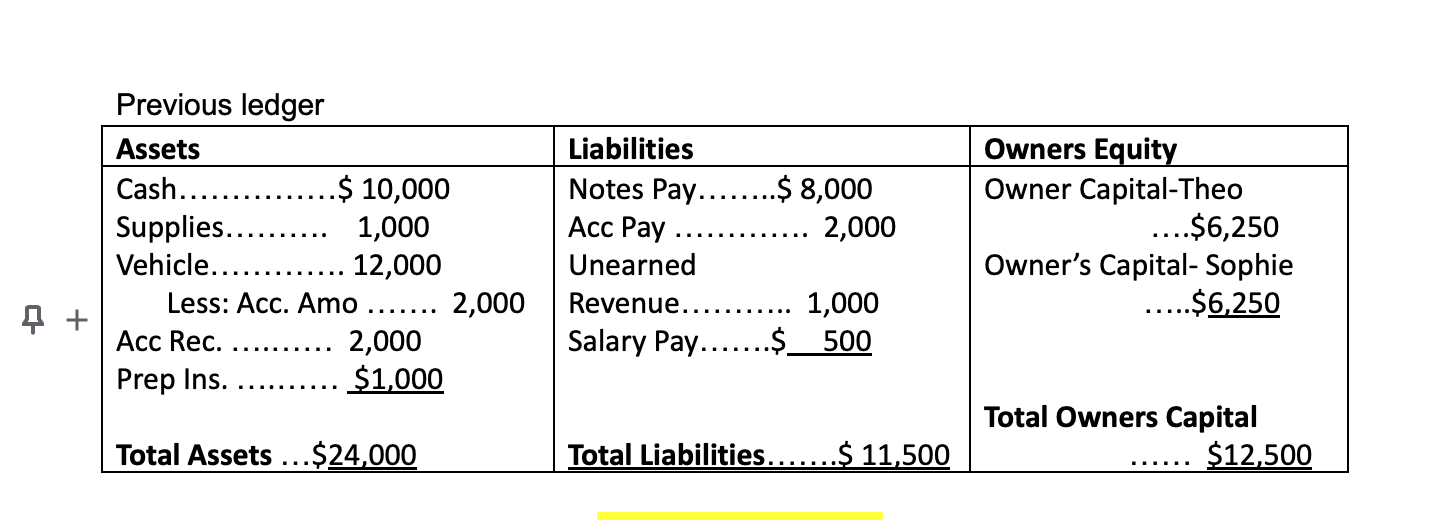

Journal entry: No. Account Titles and Explanation Debit Credit 600 600 1. Merchandise Inventory-toothpaste Account Payable-Smile Inc. (Being Toothpaste purchased on credit) 2. Merchandise Inventory-perfume Account payable-smellcorp 300 300 15 15 50 50 500 500 1017 3. Account Patable SmellCorp Merchandise Inventory-perfume (Being expense of shipping paid) 4. Merchandise Inventory-Toothpaste To Cash 5. Salary Pay Account Dr. To Bank Account (Being salary paid for the last period) 6. Account Recievable- Mr Green To Revenue-perfume To Revenue Toothpaste HST COGS-perfume COGS-Toothpaste To perfume To Toothpaste Shipping Expense To Cash Account 400 500 117 100 210 100 217 70 70 70 254.25 225 29.5 25 54.25 25 54.25 50.00 6.5 56.5 21.7. 21.7 To Cash Account 7. Cash Revenue HST Account Dr COGS-perfume COGS-Toothpaste Merchandise Inventory-perfume Merchandise Inventory-Toothpaste 8. Sales return Account Dr. HST Account Dr Cash To Toothpaste COGS-Toothpaste (Being sales return from Mr. Green) 9. Sales return Account Toothpaste Sales return Account perfume HST Account Dr Cash Merchandise Toothpaste COGS-Toothpaste Merchandise perfume COGS-perfume 10. SmellCor Account To Bank Account. Discount recievable (Being payment made to SmellCor) 11. Smile Account Dr. To Bank Account Discount recievable (Being payment made to Smile ) 25.00 40 8.45 73.45 10.85 10.85 10 10 350 339.5 10.5 300.00 294 6 452 40 400 92 100 100 3000 3000 3000 3000 423.75 12. Cash To Sales discount Revenue HST Account Dr COGS-perfume Merchandise perfume 13. Cash IB0-Sophie Cash IB0-Theo 14. Account Recievable- Mr BLUE To Revenue Toothpaste HST Payable COGS-Toothpaste To Toothpaste 15. WBO- Sophie WBO-THEO supplie 16. Note Pay Cash 17. Salary payable Cash 375 48.75 162.75 162.75 70.00 30 100 1000 1,000 600 600 Debit$ Credits 150 Journal entry: ADJUSTING ENTRY No. Account Titles and Explanation 31 Supplies expense Supplies 31 prepaid insurance expense To Prepaid Insurance Account 31 Amotization Expense Accmulative Amotization 150 100 100 200 200 31 150 Salary Expenses Account Dr. Salary Payable 150 Previous ledger Assets Cash... $ 10,000 Supplies. 1,000 Vehicle.. 12,000 Less: Acc. Amo ..., 2,000 Acc Rec. 2,000 Prep Ins. $1,000 .$ 8,000 2,000 Liabilities Notes Pay. Acc Pay Unearned Revenue.. Salary Pay.. Owners Equity Owner Capital-Theo ....$6,250 Owner's Capital- Sophie ..$6,250 4 + 1,000 $ 500 Total Owners Capital $12,500 Total Assets ... $24,000 Total Liabilities.......$ 11,500