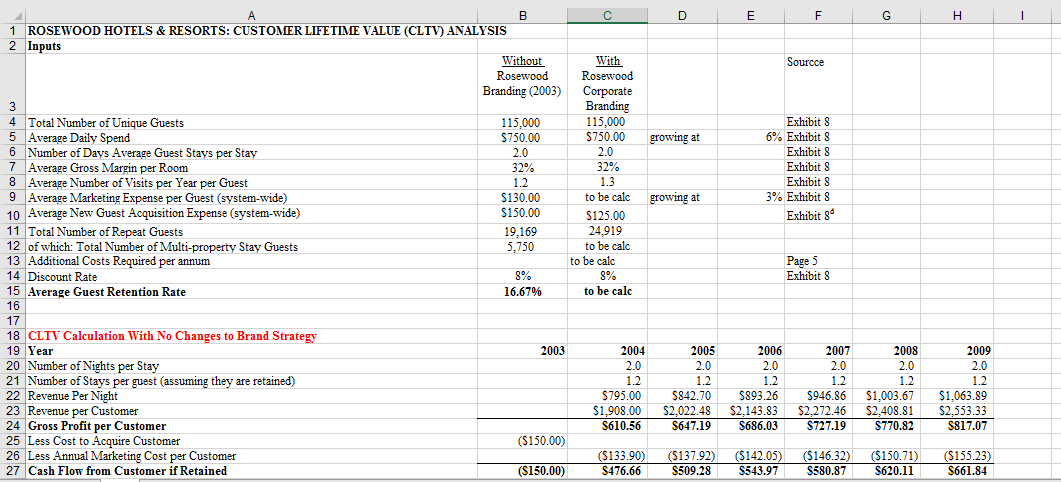

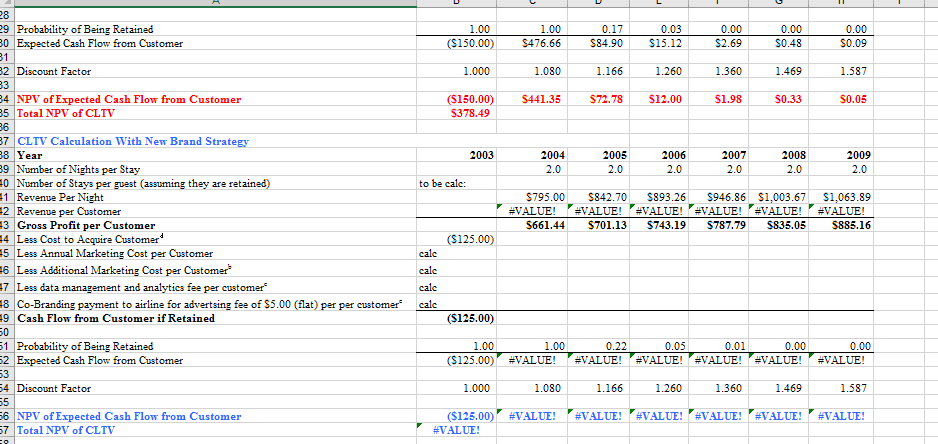

According to the Rosewood case study,moving to a corporate brand from an individual brand is expected to improve customer lifetime value (CLV).Use the Rosewood excel

According to the Rosewood case study,moving to a corporate brand from an individual brand is expected to improve customer lifetime value (CLV).Use the Rosewood excel fileRosewood to calculate the impact of the new brand strategy on customer lifetime value.

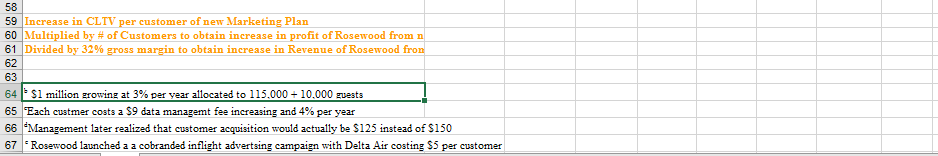

Please note that there are items in the spreadsheet to be included in the analysis that are not mentioned in thecase study that will impactlifetime value. The assumed of 115,000 guests has been increased to 125,000 guests as a result of an inflight advertising campaign with business class customers of Delta airlines.

After determining the increase in CLV resulting from the changes, use it to estimate the additional sales to be targeted (see lower left of the spreadsheet).

Please submit your spread sheet with the analysis (in Excel format) along with a word file (single-spaced not more then half page):

(a)explaining your analysis, and

(b) suggesting some possible reasons for the reduction in customer acquisition cost from $150 to $125 with the new brand strategy.

Note: You only need to make changes to row 37 downwards of the spreadsheet. No changes are needed above row 37.

\f\f\fFor the exclusive use of A. Jedraszewska, 2020. 2087 JUNE 15, 2007 CHEKITAN S. DEV LAURE MOUGEOT STROOCK Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value Introduction For nearly 25 years, Rosewood Hotels & Resorts (Rosewood), a private hotel management company, sought to build a global reputation with iconic luxury hotels such as The Mansion on Turtle Creek in Dallas and The Carlyle in New Yorktrophy properties so distinctive, each could thrive on its own name, without any \"corporate\" identification (see Exhibit 1 for brand history). The Rosewood brand was muted, unmentioned in advertising, and known mainly to hotel professionals. However, in early 2004, to boost the company's growth, John Scott, Rosewood's new president and CEO, and Robert Boulogne, vice president of sales and marketing, were considering a new brand strategy. As Boulogne recalled: We thought the time was right to establish Rosewood as a true brand incorporated into the name of each hotel and prominently displayed in all communications for and at our properties. This would help provide us with a platform for encouraging guests who stay at one of our properties to stay at some of the others. But, they wondered how far they could push this branding strategy without undercutting the distinctiveness of each individually branded hotel. Company Profile and Background Headquartered in Dallas, Texas, Rosewood Hotels & Resorts, L.L.C, was a privately held company, established in 1979 by the Caroline Rose Hunt Trust Estate (see Exhibit 2 for biographies of key figures). The first hotel Rosewood managed was The Mansion on Turtle Creek, opened in 1980. This hotel was an old mansion in Dallas rescued from demolition by Mrs. Hunt, the daughter of Texas oil tycoon H.L. Hunt. Rosewood worked with Hunt to transform the property into a worldclass hotel and restaurant. After successful conversions of existing hotels (The Mansion on Turtle Creek and Little Dix Bay in the British Virgin Islands), and new builds (The Lanesborough in London ________________________________________________________________________________________________________________ Chekitan S. Dev and Laure Mougeot Stroock prepared this case solely as a basis for class discussion and not as an endorsement, a source of primary data, or an illustration of effective or ineffective management. Chekitan S. Dev is Associate Professor of Marketing and Brand Management at Cornell University's School of Hotel Administration. Laure Mougeot Stroock is an independent business research analyst and casewriter working for the School of Hotel Administration and Cornell's Johnson Graduate School of Management. This case, though based on real events, is fictionalized, and any resemblance to actual persons or entities is coincidental. There are occasional references to actual companies in the narration. Copyright 2007 President and Fellows of Harvard College. To order copies or request permission to reproduce materials, call 1-800-545-7685, write Harvard Business Publishing, Boston, MA 02163, or go to http://www.hbsp.harvard.edu. This publication may not be digitized, photocopied, or otherwise reproduced, posted, or transmitted, without the permission of Harvard Business School. This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. 2087 | Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value and Las Ventanas Al Paraiso in Mexico), the company became known for its ability to enhance a property's value by creating unique, one-of-a-kind properties with a small ultra-luxury residential style that differentiated it from other chain-like luxury competitors.1 As of 2003, Rosewood had 12 hotels worldwide, with a total capacity of 1,513 rooms, for which the nightly rate ranged from a low of $120 for one of the Saudi Arabian properties to $9,000 for a Canadian lodge. In the previous year, 115,000 unique guests2 had stayed at Rosewood hotels (see Exhibit 3 for operating profile). Rosewood competed with two groups of luxury hotels: the corporate branded Ritz-Carlton, Four Seasons, St. Regis, One&Only, and Mandarin Oriental hotels, and the \"collections\" of individually branded unique hotels, such as Auberge, RockResorts, and Orient-Express (Exhibits 4 and 5). The Individual Brand/Collection Strategy Unlike the corporate brand model, in which luxury tended to follow (as Scott dubbed it) a \"canned and cookie cutter\" approach across properties, Rosewood operated a \"collection\" of unique properties, each with its own name or brand (see Exhibit 6, Rosewood Properties and Signed Agreements). Each hotel and resort featured architectural details, interiors, and culinary concepts that reflected local character and culture and defined Rosewood's \"Sense of Place\" philosophy. Scott explained: What makes Rosewood different is its commitment to unique, one-of-a-kind, luxury properties. Our brand compass has always been built on our concept of \"A Sense of Place\" which, at its core, means that each of our properties seeks to capture what is unique about the given location. From design to service to programming, we try and tailor each property experience to what is special about a given location, architecture, history, and culture. To this end, our Rosewood design and service standards are meant to be flexible enough to adapt to local conditions. Our local teams are expected to have some degree of flexibility and creativity to reflect \"A Sense of Place\" from menu design to how a guest is greeted. This is a very different approach from our chain-like competitors. In the 1990s, Rosewood's management believed that the individual property brand or collection strategy was a powerful tool to differentiate Rosewood properties from competitors with a corporate brand. Scott explained: Our original collection growth strategy was two-fold. We sought to convert existing iconic, luxury hotels with strong brand equity which needed to be re-positioned and re-launched with professional management (i.e., The Carlyle and Little Dix Bay). We also sought to help developers conceive and create the next generation of luxury hotels and resorts around the world, and in doing so create brand equity in the property itself (i.e., The Mansion on Turtle Creek and Las Ventanas al Paraiso). Under the individual brand or collection strategy, the Rosewood hotel marketed itself under its own brand name in addition to participating in Rosewood-related advertising. \"The Rosewood branding was soft and meant to be complementary, not intrusive,\" remarked Boulogne. The Rosewood logo appeared discreetly on low-profile amenities such as clothes hangers or stationery. Higher-profile amenities, such as bathrobes and towels (which also provided a profitable souvenir business), bore the logo of the hotel. Hotel phone greetings did not mention the Rosewood name. 1 In December 2002, Las Ventanas Al Paraiso's RevPAR index was 3.62 (the index measures the Revenue per Available Room of a hotel compared to the ones of its competitors in the same market). The Lanesborough's was 1.5, the Mansion on Turtle Creek's was 1.96 and Little Dix Bay's was 1.25. 2 For example, a couple or family staying in the same hotel room counted as one unique guest. 2 BRIEFCASES | HARVARD BUSINESS SCHOOL This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value | 2087 Through the 1990s, Rosewood's advertising was property-specific: the property name appeared first, then the location. In the early 2000s, Rosewood's advertising began to feature a list of all Rosewood properties, but the Rosewood logo remained secondary to the hotel logo. The Limitations of Individual Branding In April 2003, John Scott, who was the director of acquisitions and asset management at a private real estate investment group and a Rosewood board member, was asked by the Board to become CEO and help chart a new direction for Rosewood. He recognized that the Rosewood brand had low recognition and brand-wide usage among guests and was an untapped asset. Scott and Boulogne concluded: Our emphasis on individual property brands was not working from a number of fronts. While guests were seeking a unique Rosewood property experience and product, they were not making the connection between Rosewood properties and were increasingly identifying with other strong hotel brands. Competition in the luxury hotel segment is intense and it was becoming difficult to position Rosewood's collection of properties in an increasingly crowded field of luxury operators. Philip Maritz, chairman of the board, went further in questioning Rosewood's individual branding positioning: \"I think we are underestimating the power of corporate brands, such as Four Seasons, as status symbols. At this time, we are after only a subset of the luxury marketthe sophisticated customers who value the distinctive, exclusive 'collection' hotelwhen in fact the vast majority of the luxury market seem to value the corporate-branded version of luxury. Our current brand positioning substantially limits our market.\" The Case for Corporate Branding Rosewood Hotels & Resorts had very low brand awareness with its guests. A 2003 report from Strategic Marketing Solutions commissioned by Rosewood showed that a majority of consumers did not know the brandand the few who did had learned the name Rosewood from their travel agents (see Exhibit 7, Selected Quotes). In spite of this, Scott had high hopes for Rosewood: \"I want to emulate the AmanResorts model and develop 'Rosewood junkies' who will seek out Rosewood properties exclusively.\" AmanResorts was a luxury resort hotel management company with corporate-branded properties located in remote natural settings. Its core followers, nicknamed \"Aman Junkies,\" prided themselves on collecting Aman experiences and generally rejected the other luxury corporate brands. Aman resorts sold the promise of pure, unadulterated quiet. It offered a consistent service formula with healthful, uncomplicated food; Asian-themed spa treatments; and an uncannily attentive staff. Although Aman had only around 500 rooms across 15 resorts in 2003, it counted more than 100,000 repeat guests.3 Inspired by Aman, Scott and Boulogne thought Rosewood could do better. Toward this end, Scott and Boulogne were taking steps to learn more about Rosewood guests' habits and profile in order to improve Rosewood's guest recognition capabilities and promote crossproperty usage. The company, which had been manually collecting guest data from its 12 separate hotel management systems, had just switched to automated data-gathering through its central 3Jonathan Gregson, \"Loyal Beyond Reason,\" Financial Times, June 11, 2004. HARVARD BUSINESS SCHOOL | BRIEFCASES 3 This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. 2087 | Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value reservation system (CRS), and was creating one global, flexible data warehouse for all its hotels. Boulogne explained: Our traditional guest-recognition service was to provide a guest with, for example, a specific type of pillow upon arrival. Now we are also able to track the repeat factor for that guest and how much they spent on room, food and beverages, and activities for stays across all Rosewood properties. In the not-so-distant future, we will combine this data with specific guest preferences provided by the guest into a comprehensive guest profile to be housed in our global data warehouse. With this, we will have the ability to expand our customer preference program across the entire brand. 4 Preliminary results from an analysis of consolidated guest data revealed that, although some properties enjoyed return visits of up to 40% of guests, only 5% of Rosewood guests had stayed in more than one of Rosewood's properties. Such low percentages were typical of the luxury hotel segment, where the expense per visit was high, loyalty was typically property-specific, and therefore the number of visits per year was usually only one or two. While the proportion of repeat guests at a single property could reach 40%,5 the individual brand or collection hotel brands typically had 5% to 10% multiproperty cross-selling rates6 while corporate-branded hotels enjoyed 10% to 15% crossproperty usage rates.7 Rosewood was at the low end of the scale and management felt there was an opportunity for increasing cross-property usage. To encourage guests to use more than one Rosewood hotel, two possible approaches were considered. One possibility to boost Rosewood's customer multiproperty visits was to set up a frequent-stay program.8 According to Market Metrixa provider of market research services for the hospitality industrythe number of guests enrolled in frequent-stay programs (mostly point-based) grew by nearly 12% in 2003, and such programs were believed to double repeat business.9 But while such programs had proved successful for large multiple-segment operators with broad geographic distribution, where guests could easily redeem their reward (such as Marriott, Starwood, and Hilton), few luxury hotels had adopted them. Neither Four Seasons nor Ritz-Carlton had point-based loyalty programs, although members of Marriott Rewards could redeem their points for stays at RitzCarlton. In March 2003, Leading Hotels10 was the first luxury hotelier to offer its frequent customers 4 \"Ultra-Luxury Segment Stays Strong in $525 Billion Travel Industry. Rosewood Hotels & Resorts Consolidates Global Guest History to Target 10% Increase in Repeat Business from World's Traveling Elite,\" www.hotel-online.com. September 30, 2003. 5 A 40% return visit rate meant that if 10,000 guests stayed at a \"Hotel X\" in a given year, 4,000 of those guests had stayed in Hotel X within the previous year. 6 A 5% multiproperty return visit rate for a hotel brand which has 100,000 guests in a given year meant that 5,000 of those guests were guests returning to the same hotel brand, but to a property different from the one they visited the previous year. 7 Cross selling rates for Orient-Express Hotels, for example, was 5% to 10% in 2002. See Francis X. Frei, \"Orient-Express Hotels,\" HBS Case 603-024 (Boston: Harvard Business School Publishing, 2002), p.5. Cross selling rates for Four Seasons Hotels was 9% in 2000. See Roger Hallowell, \"Four Seasons Hotels and Resorts,\" HBS Case 800-385 (Boston: Harvard Business School Publishing, 2000). 8 Loyalty programs in the hotel industry were either based on points (guests earned points, based on spending or stays, which could be exchanged for rooms or other benefits) or on guest recognition (guests' preferences were captured, retained, and communicated throughout the brand and utilized to enhance future visits). 9 \"Market Metrix Announces Fourth Quarter 2003 Hospitality Index Results: Membership in Frequent-Stay Programs Double Repeat Business,\" Hospitality.net, Industry News, February 3, 2004. http://www.hospitalitynet.orgews/4018442.html, accessed on 04/22/2007. 10 Leading Hotels of the World was a hospitality organization that provided sales, marketing, and other services to luxury hotels and resorts. Besides Rosewood, Leading handled reservations for over 400 hotels worldwide, including the Mandarin Oriental and the Peninsula hotel brands. 4 BRIEFCASES | HARVARD BUSINESS SCHOOL This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value | 2087 the possibility to earn rewards for stays at its properties worldwide.11 Research on luxury hotel guests revealed that loyalty was fostered by offering the following benefits: room upgrades, flexible check-in and check-out, personalized services, expedited registration, the freedom to request a specific room, and the capacity of employees to take guests' problemseven the most unusual seriously.12 Scott therefore deemed it wiser for Rosewood not to invest in a frequent-stay program. The other way to create guest connection with Rosewood properties was to adopt a corporate branding approach, which Scott and Boulogne believed would encourage multiproperty guest stays, as delighted guests at, say, Mexico's Las Ventanas would be encouraged to stay at another Rosewood property when they visited a different part of the world. However, a fair amount of marketing expense (not to mention cultural change) would go into building and promoting the Rosewood corporate brand, and before they could justify the costs, Scott and Boulogne needed to test their hypothesis. A New Brand Strategy to Build Customer Lifetime Value By late 2003, Scott and Boulogne began to wrestle with the nuances of corporate branding. Boulogne favored the immediate implementation of a corporate branding strategy, with the Rosewood brand directly preceding the name of properties (e.g., Rosewood Al Faisaliah Hotel, or Rosewood Little Dix Bay). \"We are sitting on a great brand. The people who know it, love it. Unlike One&Only Resorts, we do not need to start from scratch, we just need to expose it,\" he argued. But he conceded that outright full branding carried some risks. \"Prominently imposing the Rosewood brand might alienate some of our guests at well-established properties such as The Carlyle or The Mansion on Turtle Creek,\" he admitted. In practice, adopting a new branding strategy meant that the Rosewood name would become ubiquitous across all operational dimensions, from the telephone greetings to in-room amenities and beyond. Scott observed: To keep our brand promise, we would need to ensure perfect product/service performance consistency across our portfolio, internal soft branding initiatives to link property-level people to the Rosewood organization, and significant marketing investment to boost guest retention and cross-selling. Scott wondered how far he could develop consistent brand-wide performance standards while preserving the uniqueness and individuality of Rosewood properties. Boulogne explained: Many of the hotel managers have mixed feelings about spreading the Rosewood corporate brand in their properties. They are more inclined to promote just their own individual hotel brands, particularly if they have a strong brand. I think some hotel managers may also feel threatened in their autonomy to manage the properties because with more brand standards come all kinds of other things like spa branding or other branded programs. Some resistance to Rosewood branding came from guests as well as managers. The Carlyle in New York, a signature, 1930s-era, 35-story hotel overlooking Central Park, was a notable example. About one-third of The Carlyle's 179 rooms and suites had been purchased by private owners who organized into a cooperative (\"co-op\"). James McBride, managing director of The Carlyle, explained: 11 Ron Lieber, \"Better Coddling? Chic Hotel Group To Offer Rewards,\" Wall Street Journal, January 23, 2003. 12 John T. Bowen and Stowe Shoemaker, \"Loyalty: A Strategic Commitment,\" Cornell Quarterly, 1998, 39(1), pp. 12-25. HARVARD BUSINESS SCHOOL | BRIEFCASES 5 This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. 2087 | Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value Most of the co-op owners are reluctant to go toward a more visible Rosewood brand, because they do not view being a part of a bigger organization as positive. They feel that The Carlyle brand is powerful and they view the association of a brand like Rosewood as unnecessary. They have an emotional bond with The Carlyle's branded products that they feel would be lost with Rosewood's branded items. Ultimately, Scott and Boulogne needed to use guest revenue and expense data to convince themselves that the potential benefitsgreater customer lifetime valuewould outweigh the marketing and operations costs associated with promoting the new branding to guests. A spreadsheet model that projected Rosewood's brand-wide customer lifetime value (CLTV) was developed, using nine financial and operational input variables related to rooms, guests, and marketing and acquisition costs. To estimate the impact of Rosewood's corporate branding strategy on profit per guest, the initial analysis resulted in the following working assumptions: 1. The number of multiproperty guest stays was anticipated to double to 10% from the 5% rate the company experienced during the previous year, raising the average number of visits per year per guest from 1.2 to 1.3 and inflating the total number of repeat guests. While it was expected that this initiative would also bring new guests to Rosewood, to simplify the analysis the overall total number of unique guests was kept constant at 115,000. 2. A marketing and operations investment of $1 million per year would be necessary to implement the corporate branding strategy. Boulogne needed to calculate and forecast the CLTV for six years with and without a Rosewood corporate brand in order to compare both results to determine how the branding strategy would affect profit per guest (see Exhibit 8). Despite various sources of resistance and conflicting evidence, Scott was now fully convinced that a branding decision had to be made to clarify the company's future. Rosewood's board of directors was scheduled to meet in late January 2004 to discuss Rosewood's future plans. Scott knew he would need to put forth a compelling strategic and financial argument for the board's consideration. \"We need to complete our calculation of the costs and benefits of this new branding strategy and evaluate if its potential positive impact on guest retention and revenues can offset the increased marketing and operational cost and effort it requires. This will be the perfect venue to discuss the branding issue, but it is likely to be a contentious meeting, given the long-term strategic change of direction.\" 6 BRIEFCASES | HARVARD BUSINESS SCHOOL This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value | 2087 Exhibit 1 Rosewood's History 1979 The Caroline Rose Hunt Trust Estate establishes Rosewood Hotels & Resorts. 1980 Rosewood launches its first hotelThe Mansion on Turtle Creek, Dallas, Texas. 1982 Rosewood refurbishes and opens Hotel Bel-Air, Los Angeles, California. 1984 Rosewood develops the Hotel Hana Maui in Hawaii. 1985 Rosewood opens Hotel Crescent Court in Dallas, Texas, including The Crescent Club and The Spa at The Crescent. 1987 Rosewood positions the opening of Hotel Seiyo Ginza in Tokyo, Japan. 1989 Rosewood sells the Hotel Bel-Air and Hotel Hana Maui for record prices, reflecting the company's ability to create value through positioning strategies and marketing. 1991 Rosewood opens The Lanesborough in London, England. 1992 Rosewood assumes management of Caneel Bay, St. John, U.S.V.I. and Little Dix Bay, Virgin Gorda, B.V.I. 1995 Rosewood is awarded management contracts in Riyadh, Saudi Arabia: Hotel Al Khozama and Al Faisaliah Hotel. 1997 Rosewood opens The Bristol in Panama City, Las Ventanas al Paraiso in Los Cabos, Mexico, and The Dharmawangsa in Jakarta. The Rosewood Corporation announces joint-venture partnership with Maritz, Wolff & Co. in Rosewood Hotels & Resorts, L.L.C. 1999 Rosewood assumes management of Badrutt's Palace, St. Moritz, Switzerland; opens Al Faisaliah Hotel; and announces a long-term contract for Hotel Seiyo Ginza. 2000 Rosewood announces purchase and management of The Carlyle in New York and engages in a marketing arrangement with King Pacific Lodge in British Columbia, Canada. 2001 Acqualina Resort & Residences selects Rosewood to manage its resort under development in Sunny Isles Beach, Florida. 2002 Rosewood takes on management, renovation, and relaunch of Jumby Bay in Antigua. Source: Rosewood Hotels & Resorts' Website HARVARD BUSINESS SCHOOL | BRIEFCASES 7 This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. 2087 | Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value Exhibit 2 Biographies of Rosewood's Executive Officers as of 2003 Caroline Rose Hunt, Honorary Chairman: Over 25 years ago, Caroline Rose Hunt opened The Mansion on Turtle Creek, the first Rosewood hotel, by transforming an old Dallas mansion in peril of being demolished into a world-class restaurant and hotel. Mrs. Hunt's goal with The Mansion, and each ensuing Rosewood hotel and resort, has been to create an ambience of elegance without ostentation, an unrivaled level of personal service, and attention to detail. Each property acts as a quintessential expression of its location. This long-existing mantra of the company has become its guiding principle, inspiring the phrase \"A Sense of Place\". Philip Maritz, Chairman of the Board: Maritz is President and founding partner of Maritz, Wolff & Company. Since 1994 Maritz has helped establish Maritz, Wolff as a leading private real estate investment company focused on the luxury hospitality industry. Since its inception Maritz, Wolff has acquired 19 luxury hotel properties and significant interests in Rosewood Hotels & Resorts and Fairmont Hotels, two leading luxury hotel management companies. Prior to founding Maritz, Wolff & Company Maritz was active in real estate acquisition and development with Morgan Stanley & Company and Spieker Properties. He received a BA from Princeton and a MBA from Stanford University Graduate School of Business. John Scott, President and Chief Executive Officer: John M. Scott III is president and CEO of Rosewood Hotels & Resorts. Scott joined Rosewood as president and CEO in 2003. In his role as senior executive, he leads Rosewood in pursuing growth opportunities and further refining its renowned standard of luxury. Scott has served as a member of the company's board of directors since 1997. His experience as both owner and operator of world-class hotels has proven to be a great asset to the company. Scott came to Rosewood from Maritz, Wolff & Co., where he was managing director of acquisitions and asset management, responsible for building and overseeing the company's $1.5 billion portfolio of luxury hotels and resorts. Before joining Maritz, Wolff, Scott held leadership positions with Interpacific Group, where he was responsible for hotel projects in Micronesia, Indonesia, and Thailand; and the Walt Disney Company, where he led strategic planning and development efforts for Walt Disney World's theme parks, hotels, and entertainment-related businesses. He holds a Master's Degree in Business Administration from Harvard Business School and a Bachelor of Arts Degree from Dartmouth College. Robert Boulogne, Chief Operating Officer: Robert Boulogne joined Rosewood Hotels & Resorts in 2001 with over 20 years of experience in the hospitality and travel industry. He assumed the position of vice president of sales and marketing where he oversaw all aspects of marketing, public relations, advertising, and central reservations for all of the company's properties. Previously, Boulogne served as vice president of sales for Youpowered Inc., a company specializing in personalization and privacy software for the Internet, and as vice president, Americas for Rezsolutions, Inc., where he was responsible for managing sales and marketing initiatives for Summit Hotels and Resorts and Sterling Hotels and Resorts. Additionally, Boulogne has held various sales and marketing positions with Four Seasons Hotels and Resorts. James McBride, Managing Director of The Carlyle, New York: James McBride joined Rosewood as managing director of The Carlyle in December 2003. McBride joined The Carlyle from The Grosvenor House in London where, as general manager, he was recruited to reposition this landmark hotel after an extensive renovation. A native of South Africa, McBride received his diploma in hotel management before moving to the United States to further his education at Cornell University's School of Hotel Administration. He then joined The Ritz-Carlton Hotel Group, working for the company throughout the world starting in Boston followed by San Francisco, Hawaii, Singapore, Hong Kong, Kuala Lumpur, and Washington D.C. 8 BRIEFCASES | HARVARD BUSINESS SCHOOL This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value | 2087 Exhibit 3 Rosewood's Operating Profile, 2001-2003 Number of hotels (year beginning) Number of hotels added Number of hotels lost Total number of hotels (year end) Total number of rooms (year end) 2001 2002 2003 11 2 0 13 1,859 13 2 (2) 13 1,714 13 0 (1) 12 1,513 Source: Rosewood Hotels & Resorts. Exhibit 4 Rosewood's Competition Number of Properties in 1996 Number of Properties in 2003 Number of Properties Added % Property Growth 1996-2003 Four Seasons 38 58 20 53% Ritz-Carlton 30 52 22 73% Fairmont 25 46 21 84% Park Hyatt 13 21 8 62% Mandarin Oriental 9 19 10 111% St. Regis/Luxury Collection 5 9 4 80% One&Only 0 9 9 n/a Regent 6 9 3 50% Peninsula 5 7 2 40% Raffles 1 5 4 400% Average 13 24 11 85% Orient Express 13 25 12 92% Rosewood 6 12 6 100% RockResorts 6 10 4 67% Rocco Forte 0 8 8 n/a Auberge 1 5 4 400% Dorchester 2 4 2 100% Average 5 11 6 120% Selected Luxury Hotel Brands Corporate Branded Properties Individually Branded Properties Source: Rosewood Hotels & Resorts HARVARD BUSINESS SCHOOL | BRIEFCASES 9 This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. 2087 | Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value Exhibit 5 Select Operational Statistics of Rosewood's Competitors in the Luxury Hotel Segment 2001 2002 2003 $344 57% $197 1,859 $334 61% $204 1,714 $351 62% $217 1,513 Four Seasons Hotels ADRa Occupancy RevPARb Number of rooms $287 65% $187 14,598 $289 65% $187 15,433 $299 62% $185 15,726 Ritz-Carlton (Marriott International) ADRa Occupancy RevPARb Number of rooms $250 67% $167 14,826 $233 66% $154 16,566 $231 66% $152 18,347 $276 63% $173 1,914 $286 59% $168 2,104 $340 54% $184 2,177 Rosewood Hotels & Resorts ADRa Occupancy RevPARb Number of rooms Orient-Express Hotels ADRa Occupancy RevPARb Number of rooms Source: Operating statistics for Ritz-Carlton come from the Annual Reports of Marriott International, Inc. Operating statistics for Four Seasons and Orient-Express Hotels come from the companies' Annual Reports. Operating statistics for Rosewood come from Rosewood Hotels & Resorts. aADR (average daily room rate) is obtained by dividing room revenue by the total number of rooms occupied by hotel and resort guests during the applicable period. bRevPAR is a commonly used measure within the lodging industry to evaluate hotel and resort operations. RevPAR is obtained by multiplying the average daily room rate charged (ADR) with the average daily occupancy achieved. RevPAR does not include revenues from food and beverage, telephone services, or other guest services generated by the property, which can account for over 50% of total hotel revenues in the luxury segment. 10 BRIEFCASES | HARVARD BUSINESS SCHOOL This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value | 2087 Exhibit 6 Rosewood Properties and Signed Agreements in 2003 Rosewood Properties Opening Name Location Rooms Property North America The Carlyle The Mansion on Turtle Creek Hotel Crescent Court King Pacific Lodge New York, NY Dallas, TX Dallas, TX BC, Canada 2002 1998 1998 Marketing agreement 179 143 220 17 Conversion Conversion New Build New Build Caribbean Jumby Bay Little Dix Bay Caneel Bay Antigua, WI Virgin Gorda, BVI St. John, USVI 2002 1998 2003 39 100 166 Conversion Conversion Conversion Latin America Las Ventanas al Paraiso Los Cabos, Mexico 1997 61 New Build Middle East Hotel Al Khozama Al Faisaliah Hotel Riyadh, Saudi Arabia Riyadh, Saudi Arabia 1995 1999 187 224 New Build New Build Asia Pacific Hotel Seiyo Ginza Dharmawangsa Tokyo, Japan Jakarta, Indonesia 2001 1997 77 100 Conversion New Build Name Rosewood Signed Agreements Location Opening Acqualina Tuanovo Bay La Solana Laguna Kai Sunny Isles Beach, FL Viti Levu, Fiji Punta Mita, Mexico Riviera Maya, Mexico 2005 To be defined 2005 2006 Status Under construction Development/Planning Under construction Under construction Source: Rosewood Hotels & Resorts HARVARD BUSINESS SCHOOL | BRIEFCASES 11 This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. 2087 | Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value Exhibit 7 Selected Quotes from the Strategic Marketing Solutions Report on Rosewood's Branding What does Rosewood Hotels & Resorts mean to you (or your clients)? Guest: It means nothing to me; I went to Little Dix. Later I went to Mansion on Turtle Creek. I had no idea until much later that they were connected through Rosewood. Guest: I don't know Rosewood. Travel Agent: Not much. I book the hotel, not Rosewood. Travel Agent: It means quality, luxury, service, and value to consumers. But the brand is not nearly as important as the properties. Travel Agent: Rosewood is a collection of brands; it is not a brand! Travel Agent: Initially, it meant a quality brand of hotel. The brand is not nearly as strong as it was in the past. Travel Agent: A little amorphous now; it is less of a brand than it used to beknown just by the individual properties. Travel Agent: Clients are not aware of it. They do not come to me asking for Rosewood properties. Rosewood Employee: A collection of individualistic properties; Rosewood as a brand is a dilemmadon't see great opportunity, few business opportunities. Rosewood Employee: It's a secret clubknown by some guests who go and the industry. What percent of your clients/guests do you believe know the Rosewood name? Travel Agent: At least 50% know the name Rosewood, but only because I educate them on the brand. Travel Agent: Perhaps 25% know the name Rosewood. They know the hotel name better. Travel Agent: They may know the name, but there are no positive connotations like there are for Four Seasons maybe 60% know the actual name. Rosewood Employee: Very low awareness, less than 5%. Those who know are \"past\" Rosewood guests. Is the name Rosewood meaningful in encouraging you (or your clients) to try different properties? Guest: No, I do not really know the name Rosewood, even after staying at the property. Guest: No, it has not been for me. Guest: Yes, I once tried one or two hotels, then my travel agent started telling me if a hotel was Rosewood or not. Travel Agent: Once they understand what Rosewood is, it does mean something. It means something only after they have stayed there. The travel agent has to drive understanding of Rosewood. Travel Agent: In Dallas, yes it definitely helps. Source: 12 Adapted from \"Rosewood Hotels & Resorts, Branding Recommendation,\" Strategic Marketing Solutions, Inc., November 24, 2003. BRIEFCASES | HARVARD BUSINESS SCHOOL This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. For the exclusive use of A. Jedraszewska, 2020. Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value | 2087 Exhibit 8 Rosewood's Brand-wide Customer Lifetime Value Spreadsheet Model Total number of unique guests a Average daily spendb Number of days average guest stays Average gross margin per room Average number of visits per year per guest Average marketing expense per guest (systemwide) d Average new guest acquisition expense (systemwide) Total number of repeat guests e Of which: Total number of multiproperty stay guests Average Guest Retention Ratef Average Gross Profit per Guest Years Gross profit per guest Acquisition expense per new guest Marketing expense per guest Net Profit per Guest With Rosewood Corporate Branding c 115,000 $750 2 32% 1.3 Without Rosewood Branding (2003) 115,000 $750 2 32% 1.2 $130 $150 19,169 5,750 To be calculated $150 To be calculated To be calculated 16.67% To be calculated To be calculated To be calculated 0 1 2 3 4 5 6 Retention factor Discount factor Net Present Value (NPV) g Source: Rosewood Hotels & Resorts. All numbers are approximate and have been disguised to preserve confidentiality. Note: The company used an 8% discount rate and assumed marketing costs increased at a rate of 3% per year and guest revenues at a rate of 6% per year. a For the purpose of this analysis, Rosewood treats double occupancy (i.e., John Doe and Jane Doe staying in the same room) as one guest. b The average daily spend is the total expenditure per guest per day on room, food, beverage, and other services. c Twice more multi-property guests, inflating the overall number of repeat guests, 1.3 stays per guest per year, and $1,000,000 marketing expenses. d Cost of marketing communication with a Rosewood corporate brand: [(total number of guests * average cost of marketing per guest in 2003) + $1,000,000] / total number of guests. e Repeat guests were guests who, after staying once in a Rosewood hotel, returned to a Rosewood property the year after (the same one or a different one). Repeat guests included multiproperty guests. f Guest retention rate: the probability that a guest comes back to a Rosewood hotel the following year (number of repeat guests/total number of guests). g Net Present Value (NPV): the future stream of benefits and costs converted into equivalent values today, by discounting future benefits and costs using an appropriate discount rate. HARVARD BUSINESS SCHOOL | BRIEFCASES 13 This document is authorized for use only by Anita Jedraszewska in MKTG 562.2020Summer taught by PATRALI CHATTERJEE, Montclair State University from Jul 2020 to Dec 2020. ROSEWOOD HOTELS & RESORTS: CUSTOMER LIFETIME VALUE (CLTV) ANALYSIS Inputs Without Rosewood Branding (2003) Total Number of Unique Guests Average Daily Spend Number of Days Average Guest Stays per Stay Average Gross Margin per Room Average Number of Visits per Year per Guest Average Marketing Expense per Guest (system-wide) Average New Guest Acquisition Expense (system-wide) 115,000 $750.00 2.0 32% 1.2 $130.00 $150.00 Total Number of Repeat Guests of which: Total Number of Multi-property Stay Guests Additional Costs Required per annum Discount Rate Average Guest Retention Rate 19,169 5,750 8% 16.67% CLTV Calculation With No Changes to Brand Strategy Year Number of Nights per Stay Number of Stays per guest (assuming they are retained) Revenue Per Night Revenue per Customer Gross Profit per Customer Less Cost to Acquire Customer Less Annual Marketing Cost per Customer Cash Flow from Customer if Retained 2003 ($150.00) ($150.00) Probability of Being Retained Expected Cash Flow from Customer 1.00 ($150.00) Discount Factor 1.000 NPV of Expected Cash Flow from Customer Total NPV of CLTV ($150.00) $378.49 CLTV Calculation With New Brand Strategy Year Number of Nights per Stay Number of Stays per guest (assuming they are retained) Revenue Per Night Revenue per Customer Gross Profit per Customer Less Cost to Acquire Customerd Less Annual Marketing Cost per Customer Less Additional Marketing Cost per Customerb Less data management and analytics fee per customer 2003 to be calc: ($125.00) calc calc c calc Co-Branding payment to airline for advertsing fee of $5.00 (flat) per per customere Cash Flow from Customer if Retained calc Probability of Being Retained Expected Cash Flow from Customer Discount Factor NPV of Expected Cash Flow from Customer Total NPV of CLTV Increase in CLTV per customer of new Marketing Plan Multiplied by # of Customers to obtain increase in profit of Rosewood from new brand strate Divided by 32% gross margin to obtain increase in Revenue of Rosewood from new brand str $1 million growing at 3% per year allocated to 115,000 + 10,000 guests b c Each custmer costs a $9 data managemt fee increasing and 4% per year Management later realized that customer acquisition would actually be $125 instead of $150 d e Rosewood launched a a cobranded inflight advertsing campaign with Delta Air costing $5 per customer ($125.00) 1.00 ($125.00) 1.000 ($125.00) #VALUE! With Rosewood Corporate Branding 115,000 $750.00 2.0 32% 1.3 to be calc Sourcce growing at growing at Exhibit 8 6% Exhibit 8 Exhibit 8 Exhibit 8 Exhibit 8 3% Exhibit 8 $125.00 24,919 to be calc to be calc 8% to be calc Exhibit 8d Page 5 Exhibit 8 2004 2.0 1.2 $795.00 $1,908.00 $610.56 2005 2.0 1.2 $842.70 $2,022.48 $647.19 2006 2.0 1.2 $893.26 $2,143.83 $686.03 2007 2.0 1.2 $946.86 $2,272.46 $727.19 2008 2.0 1.2 $1,003.67 $2,408.81 $770.82 2009 2.0 1.2 $1,063.89 $2,553.33 $817.07 ($133.90) $476.66 ($137.92) $509.28 ($142.05) $543.97 ($146.32) $580.87 ($150.71) $620.11 ($155.23) $661.84 1.00 $476.66 0.17 $84.90 0.03 $15.12 0.00 $2.69 0.00 $0.48 0.00 $0.09 1.080 1.166 1.260 1.360 1.469 1.587 $441.35 $72.78 $12.00 $1.98 $0.33 $0.05 2004 2.0 2005 2.0 2006 2.0 2007 2.0 2008 2.0 2009 2.0 $795.00 #VALUE! $661.44 $842.70 #VALUE! $701.13 $893.26 #VALUE! $743.19 $946.86 #VALUE! $787.79 $1,003.67 #VALUE! $835.05 $1,063.89 #VALUE! $885.16 1.00 #VALUE! 0.22 #VALUE! 0.05 #VALUE! 0.01 #VALUE! 0.00 #VALUE! 0.00 #VALUE! 1.080 1.166 1.260 1.360 1.469 1.587 #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE