Question

According to the solution: The current real exchange rate = $0.62 (1.5/1) = $0.93 per Swiss franc. The inflation differential between the United States and

According to the solution:

The current real exchange rate = $0.62 (1.5/1) = $0.93 per Swiss franc. The inflation differential between the United States and Switzerland is 2.5%. Thus, for real exchange rates to remain the same, the Swiss franc will have to depreciate by 2.5%.

The expected exchange rate = 0.62 (1 - 0.025) = $0.6045 per Swiss franc.

The real exchange rate would then be = $0.6045 (1.56/1.015) = $0.93 per Swiss franc.

The expected return on the Swiss bond = (1 + 0.045) (1 - 0.025) -1 = 1.9%.

* I understand everything except the solution for the expected return (bolded part). There is no explanation given in the solution manual, which formula is this?

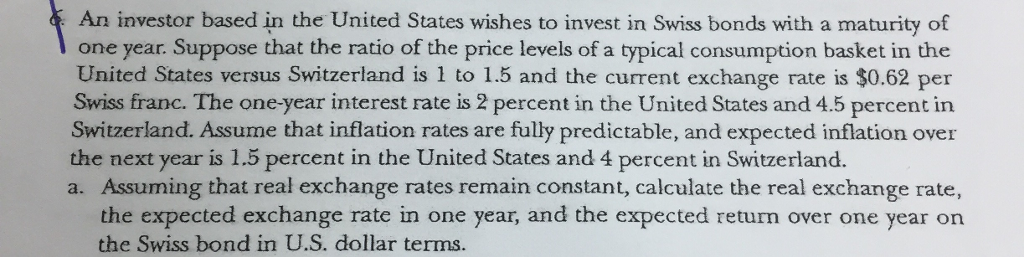

An investor based in the United States wishes to invest in Swiss bonds with a maturity of one year. Suppose that the ratio of the price levels of a typical consumption basket in the United States versus Switzerland is 1 to 1.5 and the current exchange rate is $0.62 per Swiss franc. The one-year interest rate is 2 percent in the United States and 4.5 percent in Switzerland. Assume that inflation rates are fully predictable, and expected inflation over the next year is 1.5 percent in the United States and 4 percent in Switzerland. a. Assuming that real exchange rates remain constant, calculate the real exchange rate, the expected exchange rate in one year, and the expected return over one year on the Swiss bond in U.S. dollar terms

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started