Answered step by step

Verified Expert Solution

Question

1 Approved Answer

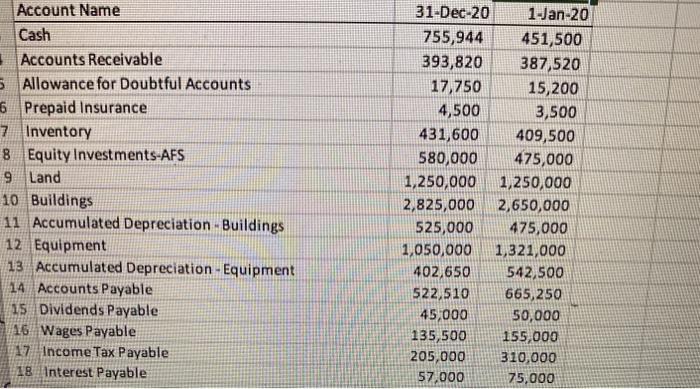

Account Name Cash Accounts Receivable 5 Allowance for Doubtful Accounts 6 Prepaid Insurance 7 Inventory 8 Equity Investments-AFS 9 Land 10 Buildings 11 Accumulated

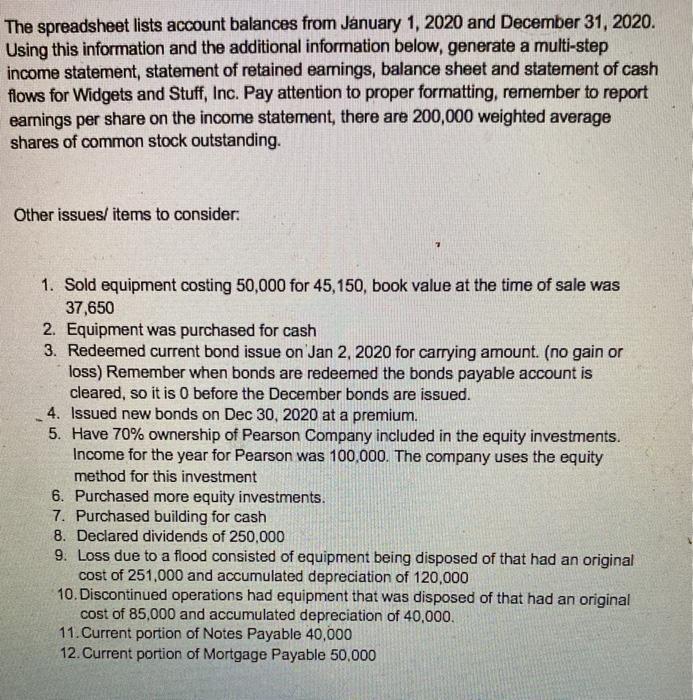

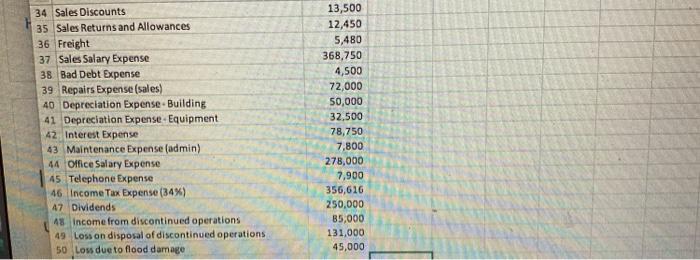

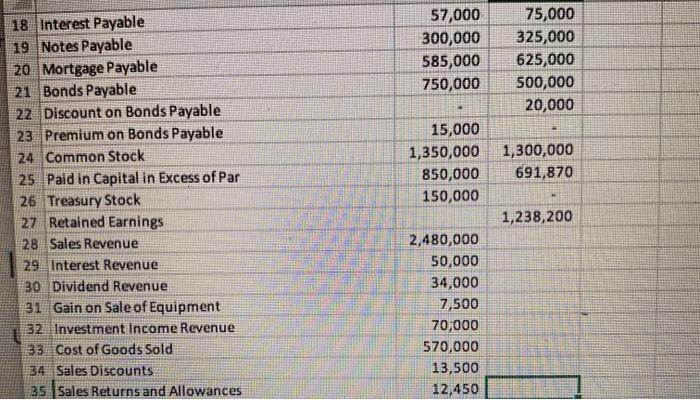

Account Name Cash Accounts Receivable 5 Allowance for Doubtful Accounts 6 Prepaid Insurance 7 Inventory 8 Equity Investments-AFS 9 Land 10 Buildings 11 Accumulated Depreciation - Buildings 12 Equipment 13 Accumulated Depreciation - Equipment 14 Accounts Payable 15 Dividends Payable 16 Wages Payable 17 Income Tax Payable 31-Dec-20 1-Jan-20 755,944 451,500 393,820 387,520 17,750 15,200 4,500 3,500 431,600 409,500 475,000 580,000 1,250,000 1,250,000 2,825,000 2,650,000 525,000 475,000 1,050,000 1,321,000 402,650 542,500 522,510 665,250 45,000 50,000 135,500 155,000 205,000 310,000 18 Interest Payable 57,000 75,000 The spreadsheet lists account balances from Jnuary 1, 2020 and December 31, 2020. Using this information and the additional information below, generate a multi-step income statement, statement of retained earnings, balance sheet and statement of cash flows for Widgets and Stuff, Inc. Pay attention to proper formatting, remember to report earnings per share on the income statement, there are 200,000 weighted average shares of common stock outstanding. Other issues/ items to consider: 1. Sold equipment costing 50,000 for 45,150, book value at the time of sale was 37,650 2. Equipment was purchased for cash 3. Redeemed current bond issue on Jan 2, 2020 for carrying amount. (no gain or loss) Remember when bonds are redeemed the bonds payable account is cleared, so it is 0 before the December bonds are issued. 4. Issued new bonds on Dec 30, 2020 at a premium. 5. Have 70% ownership of Pearson Company included in the equity investments. Income for the year for Pearson was 100,000. The company uses the equity method for this investment 6. Purchased more equity investments. 7. Purchased building for cash 8. Declared dividends of 250,000 9. Loss due to a flood consisted of equipment being disposed of that had an original cost of 251,000 and accumulated depreciation of 120,000 10. Discontinued operations had equipment that was disposed of that had an original cost of 85,000 and accumulated depreciation of 40,000. 11.Current portion of Notes Payable 40,000 12. Current portion of Mortgage Payable 50,000 34 Sales Discounts 13,500 12,450 35 Sales Returns and Allowances 36 Freight 37 Sales Salary Expense 38 Bad Debt Expense 39 Repairs Expense (sales) 40 Depreciation Expense - Building 41 Depreciation Expense - Equipment 42 Interest Expense 43 Maintenance Expense (admin) 5,480 368,750 4,500 72,000 50,000 32,500 78,750 7,800 44 Office Salary Expense 278,000 7,900 45 Telephone Expense 46 Income Tax Expense (34%) 47 Dividends 48 income from discontinued operations 49 Loss on disposal of discontinued operations 50 Loss due to flood damage 356,616 250,000 85,000 131,000 45,000 57,000 75,000 18 Interest Payable 19 Notes Payable 20 Mortgage Payable 21 Bonds Payable 22 Discount on Bonds Payable 23 Premium on Bonds Payable 24 Common Stock 25 Paid in Capital in Excess of Par 26 Treasury Stock 27 Retained Earnings 28 Sales Revenue 29 Interest Revenue 30 Dividend Revenue 31 Gain on Sale of Equipment 300,000 585,000 750,000 325,000 625,000 500,000 20,000 15,000 1,300,000 691,870 1,350,000 850,000 150,000 1,238,200 2,480,000 50,000 34,000 7,500 32 Investment Income Revenue 70,000 33 Cost of Goods Sold 570,000 13,500 34 Sales Discounts 35 Sales Returns and Allowances 12,450

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Widgets and Stuff Incorporation MultiStep Income Statement f or the year ended 31 Dec 2020 Sales 2480000 Add Equipment Sold 45150 less Sales Return 12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started