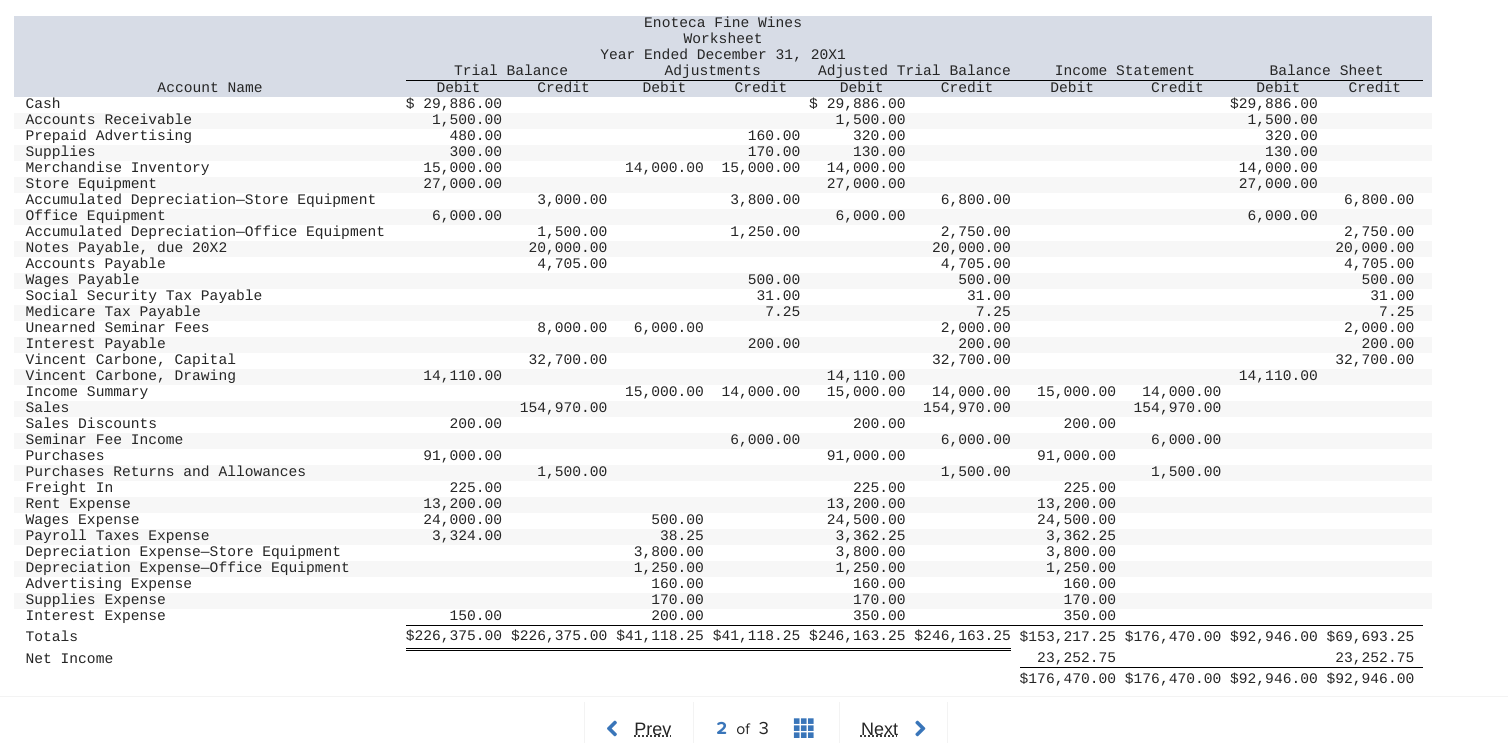

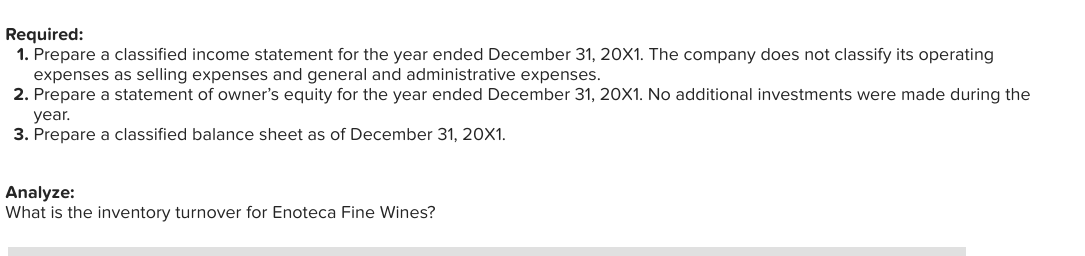

Account Name Cash Accounts Receivable Prepaid Advertising Supplies Merchandise Inventory Store Equipment Accumulated Depreciaticnistore Equipment office Equipment Accumulated Depreciaticngoffice Equipment Notes Payable, due 20X2 Accounts Payable Wages Payable Social Security Tax Payable Medicare Tax Payable Unearned Seminar Fees Interest Payable Vincent Carbone, Capital Vincent Carbone, Drawing Income Summary Sales Sales Discounts Seminar Fee Income Purchases Purchases Returns and Allowances Freight In Rent Expense Wages Expense Payroll Taxes Expense Depreciation Expenseestore Equipment Depreciation ExpenseOffice Equipment Advertising Expense Supplies Expense Interest Expense Totals Net Income Enoteca Fine wines Worksheet Year Ended December 31, 20x1 Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Debit Credit Debit credit Debit credit Debit credit Debit credit $ 29,386.00 $ 29,886.00 $29,886.00 1,500.00 1,500.00 1,500.00 480.00 160.00 320.00 320.00 300.00 170.00 130.00 130.00 15,000.00 14,000.00 15,000.00 14,000.00 14,000.00 27,000.00 27,000.00 27,000.00 3,000.00 3,600.00 6,800.00 6,000.00 6,000.00 6,000.00 6,000.00 1,500.00 1,250.00 2,750.00 2,750.00 20,000.00 20,000.00 20,000.00 4,705.00 4,705.00 4,705.00 500.00 500.00 500.00 31.00 31.00 31.00 7.25 7.25 7.25 8,000.00 6,000.00 2,000.00 2,000.00 200.00 200.00 200.00 32,700.00 32,700.00 32,700.00 14,110.00 14,110.00 14,110.00 15,000.00 14,000.00 15,000.00 14,000.00 15,000.00 14,000.00 154,970.00 154,970.00 154,970.00 200.00 200.00 200.00 6,000.00 6,000.00 6,000.00 91,000.00 91,000.00 91,000.00 1,500.00 1,500.00 1,500.00 225.00 225.00 225.00 13,200.00 13,200.00 13,200.00 24,000.00 500.00 24,500.00 24,500.00 3,324.00 33.25 3,362.25 3,362.25 3,800.00 3,800.00 3,300.00 1,250.00 1,250.00 1,250.00 160.00 160.00 160.00 170.00 170.00 170.00 150.00 200.00 350.00 350.00 $226,375.00 $226,375.00 $41,110.25 $41,118.25 $246,163.25 $246,163.25 $153,217.25 $176,470.00 $92,946.00 $69,693.25 23,252.75 23,252.75 $176,470.00 $176,470.00 $92,946.00 $92,946.00 ( may 2 cf3 Next > Required: 1. Prepare a classified income statement for the year ended December 31. 20x1. The company does not classify its operating expenses as selling expenses and general and administrative expenses. 2. Prepare a statement of owner's equity for the year ended December 31, 20x1. No additional investments were made during the year 3. Prepare a classified balance sheet as of December 31. 20x1. Analyze: What is the inventory turnover for Enoteca Fine Wines