Answered step by step

Verified Expert Solution

Question

1 Approved Answer

account names are already completed, please just enter debits and credits During the recent recession. Polydorous incorporated accumulated a deficit in retained earnings. Although stili

account names are already completed, please just enter debits and credits

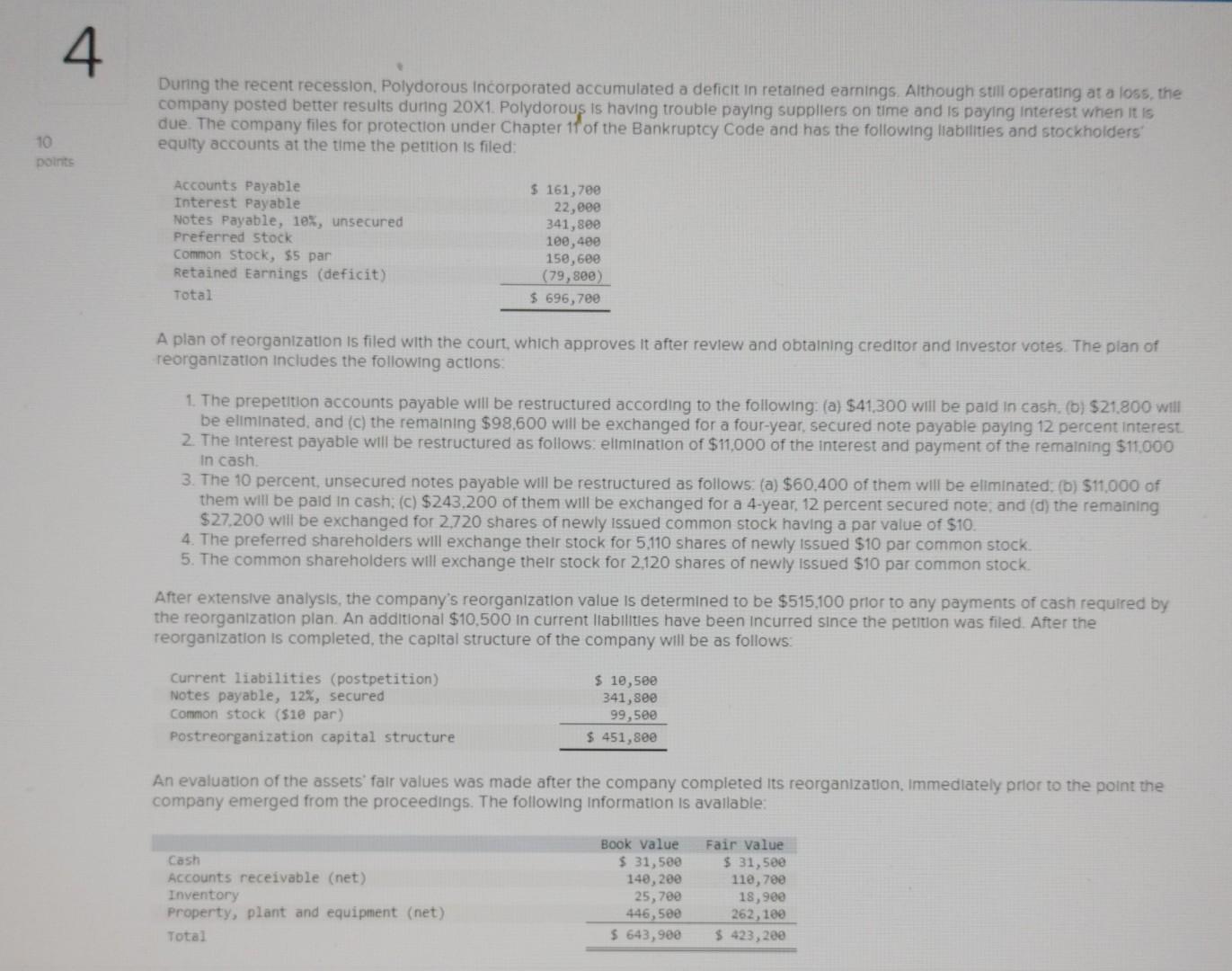

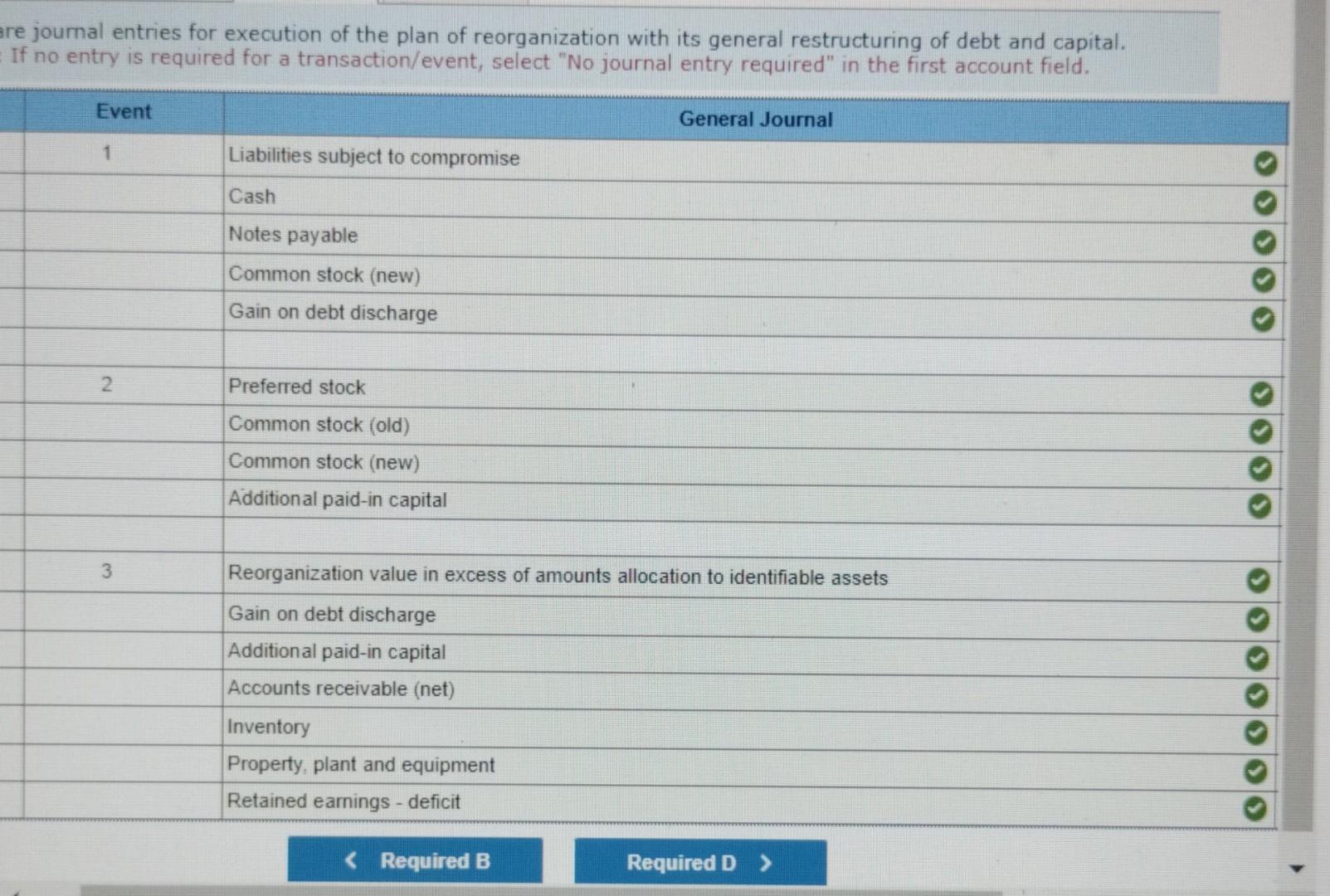

During the recent recession. Polydorous incorporated accumulated a deficit in retained earnings. Although stili operating at a loss, the company posted better results duning 20X1. Polydorous is having trouble paying suppllers on time and is paying interest when it is due. The company files for protection under Chapter 1 f of the Bankruptcy Code and has the following llabilities and stockholders' equity accounts at the time the petition is filed: A plan of reorganization is filed with the court, which approves it after review and obtaining creditor and investor votes. The plan of reorganization includes the following actions: 1. The prepetition accounts payable will be restructured according to the following: (a) $41,300 will be pald in cash, (b) $21,800 will be eliminated, and (c) the remaining $98,600 will be exchanged for a four-year, secured note payable paying 12 percent interest. 2. The interest payable will be restructured as follows: ellmination of $11,000 of the interest and payment of the remaining $11,000 in cash. 3. The 10 percent, unsecured notes payable will be restructured as follows: (a) $60,400 of them will be elliminated: (b) $11,000 of them will be paid in cash; (c) $243,200 of them will be exchanged for a 4 -year, 12 percent secured note; and (d) the remaining $27,200 will be exchanged for 2,720 shares of newly issued common stock having a par value of $10 4. The preferred shareholders will exchange their stock for 5,110 shares of newly issued $10 par common stock. 5. The common shareholders will exchange their stock for 2,120 shares of newly issued $10 par common stock. After extensive analysis, the company's reorganization value is determined to be $515,100 prior to any payments of cash required by the reorganization plan. An additional $10,500 In current llabilitles have been Incurred since the petition was filed. After the reorganization is completed, the capital structure of the company will be as follows: An evaluation of the assets' falr values was made after the company completed its reorganization, Immediately prior to the point the company emerged from the proceedings. The following information is avallable: e journal entries for execution of the plan of reorganization with its general restructuring of debt and capital. If no entry is required for a transaction/event, select "No journal entry required" in the first account field Record the debt discharge. Record the exchange of stock for stock. Record the fresh start accounting and the elimination of the deficit. During the recent recession. Polydorous incorporated accumulated a deficit in retained earnings. Although stili operating at a loss, the company posted better results duning 20X1. Polydorous is having trouble paying suppllers on time and is paying interest when it is due. The company files for protection under Chapter 1 f of the Bankruptcy Code and has the following llabilities and stockholders' equity accounts at the time the petition is filed: A plan of reorganization is filed with the court, which approves it after review and obtaining creditor and investor votes. The plan of reorganization includes the following actions: 1. The prepetition accounts payable will be restructured according to the following: (a) $41,300 will be pald in cash, (b) $21,800 will be eliminated, and (c) the remaining $98,600 will be exchanged for a four-year, secured note payable paying 12 percent interest. 2. The interest payable will be restructured as follows: ellmination of $11,000 of the interest and payment of the remaining $11,000 in cash. 3. The 10 percent, unsecured notes payable will be restructured as follows: (a) $60,400 of them will be elliminated: (b) $11,000 of them will be paid in cash; (c) $243,200 of them will be exchanged for a 4 -year, 12 percent secured note; and (d) the remaining $27,200 will be exchanged for 2,720 shares of newly issued common stock having a par value of $10 4. The preferred shareholders will exchange their stock for 5,110 shares of newly issued $10 par common stock. 5. The common shareholders will exchange their stock for 2,120 shares of newly issued $10 par common stock. After extensive analysis, the company's reorganization value is determined to be $515,100 prior to any payments of cash required by the reorganization plan. An additional $10,500 In current llabilitles have been Incurred since the petition was filed. After the reorganization is completed, the capital structure of the company will be as follows: An evaluation of the assets' falr values was made after the company completed its reorganization, Immediately prior to the point the company emerged from the proceedings. The following information is avallable: e journal entries for execution of the plan of reorganization with its general restructuring of debt and capital. If no entry is required for a transaction/event, select "No journal entry required" in the first account field Record the debt discharge. Record the exchange of stock for stock. Record the fresh start accounting and the elimination of the deficitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started