Answered step by step

Verified Expert Solution

Question

1 Approved Answer

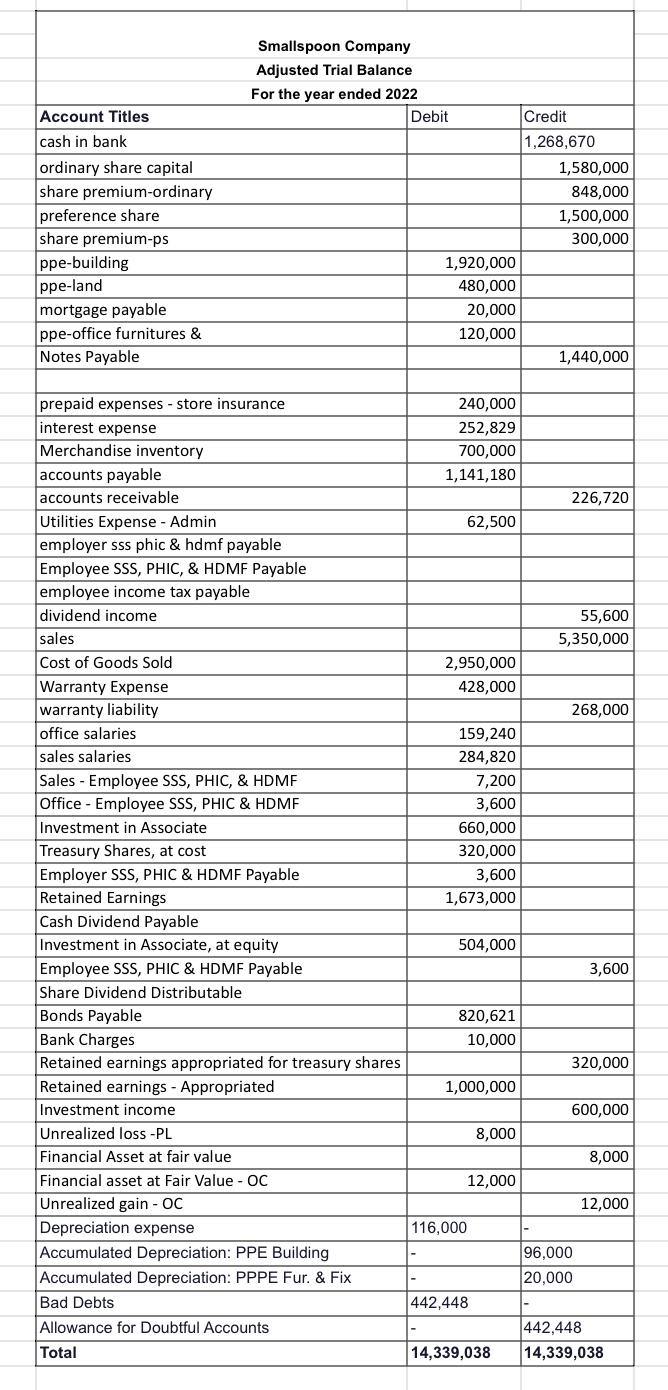

Account Titles cash in bank ordinary share capital share premium-ordinary preference share share premium-ps ppe-building ppe-land mortgage payable ppe-office furnitures & Notes Payable Smallspoon

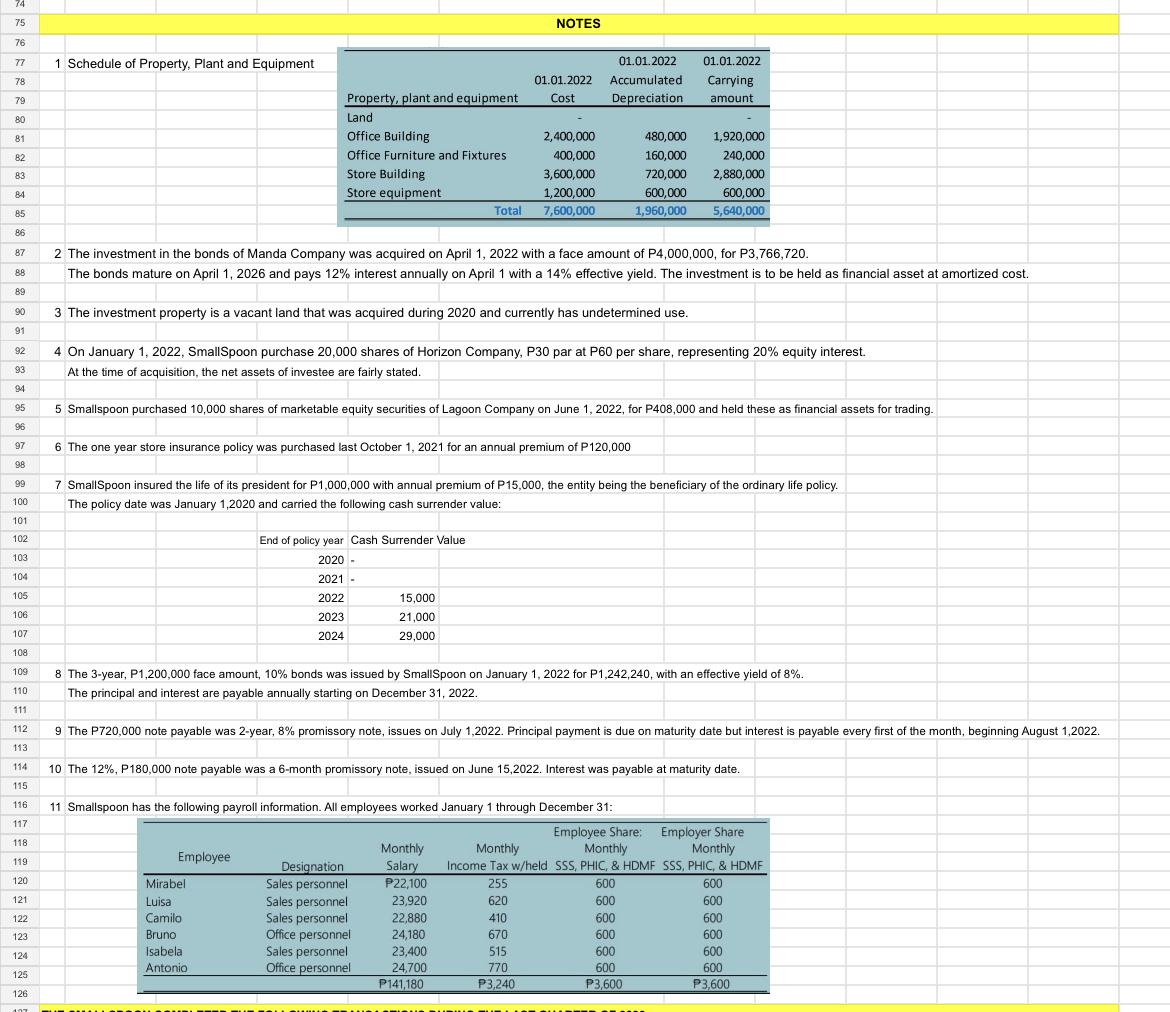

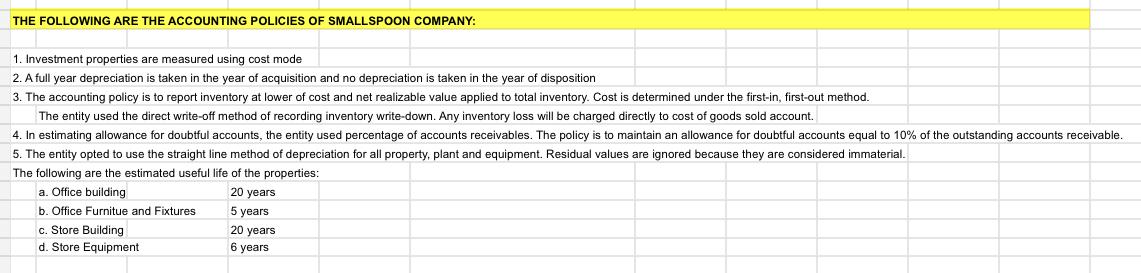

Account Titles cash in bank ordinary share capital share premium-ordinary preference share share premium-ps ppe-building ppe-land mortgage payable ppe-office furnitures & Notes Payable Smallspoon Company Adjusted Trial Balance For the year ended 2022 prepaid expenses - store insurance interest expense Merchandise inventory accounts payable accounts receivable Utilities Expense - Admin employer sss phic & hdmf payable Employee SSS, PHIC, & HDMF Payable employee income tax payable dividend income sales Cost of Goods Sold Warranty Expense warranty liability office salaries sales salaries Sales - Employee SSS, PHIC, & HDMF Office - Employee SSS, PHIC & HDMF Investment in Associate Treasury Shares, at cost Employer SSS, PHIC & HDMF Payable Retained Earnings Cash Dividend Payable Investment in Associate, at equity Employee SSS, PHIC & HDMF Payable Share Dividend Distributable Bonds Payable Bank Charges Retained earnings appropriated for treasury shares Retained earnings - Appropriated Investment income Unrealized loss -PL Financial Asset at fair value Financial asset at Fair Value - OC Unrealized gain - OC Depreciation expense Accumulated Depreciation: PPE Building Accumulated Depreciation: PPPE Fur. & Fix Bad Debts Allowance for Doubtful Accounts Total Debit 1,920,000 480,000 20,000 120,000 240,000 252,829 700,000 1,141,180 62,500 2,950,000 428,000 159,240 284,820 660,000 320,000 3,600 1,673,000 7,200 3,600 504,000 820,621 10,000 1,000,000 116,000 12,000 442,448 8,000 14,339,038 Credit 1,268,670 1,580,000 848,000 1,500,000 300,000 1,440,000 226,720 55,600 5,350,000 268,000 3,600 320,000 600,000 96,000 20,000 8,000 12,000 442,448 14,339,038 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23. 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 The Smallspoon Company is a retail company that began operations on January 1, 2018. The Smallspoon Company is authorized to issue 1,000,000 shares of P10 par value ordinary share and 500,000 sahres of 3%, 250 par value preferred share. The company sells a product that includes a one-year warranty and records estimated warranty payable each month. The company uses a perpetual inventory system, FIFO method. Note TOTAL The following is the trial balance of Smallspoon Company as of September 30, 2022: Acct No. 1 000 1 2 000 2 000 3 000 4 000 5 3 000 6 4 000 7 000 8 000 9 00 10 00 11 5:00 12 00 13 6:00 14 00 15 00 16 00 17 00 18 00 19 7 00 20 00 21 00 22 00 23 00 24 00 25 00 26 00 27 00 28 00 29 8 00 30 00 31 9 00 32 00 33 00 34 10 00 35 00 36 00 37 00 38 11 00 39 11 00 40 11 00 41 00 42 00 43 00 44 00 45 00 46 00 47 00 48 00 49 00 50 00 51 00 52 00 53 00 54 00 55 00 56 00 57 00 28 00 59 00 60 00 61 00 62 00 63 00 64 Acct No. Property, Plant & Equipment, net Investment in bonds Cash in bank Cost of Goods sold Accounts Receivable Invesment property Investment in Associate, at equity Sales Salaries Warranty Expense Merchandise Inventory Office Salaries Financial assets at Fair Value Utilities Expense - Store Prepaid Expenses - Store Insurance Utilities Expense - Admin Store Supplies Expenses Sales - Employer SSS, PHIC, & HDMF Expense Taxes and licences Office Supplies Expenses Life Insurance Expense Cash Surrender value Office - Employer SSS, PHIC, & HDMF Expense Advertising Expenses Interest Expense Sales Prefence Share Capital, 3%, P50 par Ordinary Share Capital, P10 par Retained Earnings Share premium - ordinary Bonds Payable Retained Earnings appropriated for contingencies Note payable, 8% due July 1, 2022 Share premium - preference Accounts Payable Notes payable, 12%, due Dec 15, 2020 Warranty liability Premium on Bonds Payable Allowance for doubtful accounts Employer SSS, PHIC, & HDMF Payable Employee SSS, PHIC, & HDMF Payable Employee Income Tax Payable Accrued Interest Payable Accrued Interest Receivable Bank Charges Cash Dividend Payable Depreciation Expense - Admin Depreciation Expense - Store Dividend Income Doubtful accounts expense Financial assets at Fair Value - OC Interest Income Debit 5,640,000 3,766,720 3,653,240 3,543,600 1,960,000 1,800,000 1,200,000 830,700 720,000 560,000 Investment Income Miscellaneous Expense Miscellaneous Income Mortgage Payable Notes payable, 10% due Oct 1, 2021 Retained Earnings appropriated for treasury shares Share Dividend Distributable Store Insurance Expense Treasury Shares, at cost. Unrealized Gain - OCI Unrealized Gain - PL Unrealized Loss - OCI Unrealized Loss - PL 439,920 408,000 121,875 90,000 65,625 51,000 21,600 20,000 20,000 15,000 15,000 10,800 10,000 9,600 24,972,680 Credit 5,906,000 5,000,000 5,000,000 2,810,800 2,000,000 1,200,000 1,000,000 720,000 500,000 420,000 180,000 144,000 42,240 39,200 3,600 3,600 3,240 24972680 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 107 1 Schedule of Property, Plant and Equipment Property, plant and equipment Land Office Building Office Furniture and Fixtures Store Building Store equipment 2 The investment in the bonds of Manda Company was acquired on April 1, 2022 with a face amount of P4,000,000, for P3,766,720. The bonds mature on April 1, 2026 and pays 12% interest annually on April 1 with a 14% effective yield. The investment is to be held as financial asset at amortized cost. 3 The investment property is a vacant land that was acquired during 2020 and currently has undetermined use. Total 4 On January 1, 2022, SmallSpoon purchase 20,000 shares of Horizon Company, P30 par at P60 per share, representing 20% equity interest. At the time of acquisition, the net assets of investee are fairly stated. 6 The one year store insurance policy was purchased last October 1, 2021 for an annual premium of P120,000 End of policy year Cash Surrender Value 2020 2021 - 2022 2023 2024 5 Smallspoon purchased 10,000 shares of marketable equity securities of Lagoon Company on June 1, 2022, for P408,000 and held these as financial assets for trading. Employee Mirabel Luisa Camilo Bruno Isabela Antonio 7 SmallSpoon insured the life of its president for P1,000,000 with annual premium of P15,000, the entity being the beneficiary of the ordinary life policy. The policy date was January 1,2020 and carried the following cash surrender value: 15,000 21,000 29,000 NOTES 01.01.2022 01.01.2022 01.01.2022 Accumulated Carrying Cost Depreciation amount 2,400,000 400,000 3,600,000 1,200,000 7,600,000 Designation Sales personnel Sales personnel Sales personnel Office personnel 8 The 3-year, P1,200,000 face amount, 10% bonds was issued by SmallSpoon on January 1, 2022 for P1,242,240, with an effective yield of 8%. The principal and interest are payable annually starting on December 31, 2022. Sales personnel Office personnel 9 The P720,000 note payable was 2-year, 8% promissory note, issues on July 1,2022. Principal payment is due on maturity date but interest is payable every first of the month, beginning August 1,2022. 10 The 12%, P180,000 note payable was a 6-month promissory note, issued on June 15,2022. Interest was payable at maturity date. 11 Smallspoon has the following payroll information. All employees worked January 1 through December 31: Employee Share: Monthly SSS, PHIC, & HDMF 600 600 600 600 Monthly Salary P22,100 23,920 22,880 24,180 23,400 24,700 P141,180 480,000 160,000 720,000 600,000 1,960,000 1,920,000 240,000 2,880,000 600,000 5,640,000 410 670 515 Monthly Income Tax w/held 255 620 770 P3,240 600 600 P3,600 Employer Share Monthly SSS, PHIC, & HDMF 600 600 600 600 600 600 P3.600 THE FOLLOWING ARE THE ACCOUNTING POLICIES OF SMALLSPOON COMPANY: 1. Investment properties are measured using cost mode 2. A full year depreciation is taken in the year of acquisition and no depreciation is taken in the year of disposition 3. The accounting policy is to report inventory at lower of cost and net realizable value applied to total inventory. Cost is determined under the first-in, first-out method. The entity used the direct write-off method of recording inventory write-down. Any inventory loss will be charged directly to cost of goods sold account. 4. In estimating allowance for doubtful accounts, the entity used percentage of accounts receivables. The policy is to maintain an allowance for doubtful accounts equal to 10% of the outstanding accounts receivable. 5. The entity opted to use the straight line method of depreciation for all property, plant and equipment. Residual values are ignored because they are considered immaterial. The following are the estimated useful life of the properties: a. Office building 20 years b. Office Furnitue and Fixtures 5 years c. Store Building d. Store Equipment 20 years 6 years

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Smallspoon Company Adjusted Trial Balance as of December 31 2022 Account Titles Debit PHP Credit PHP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started