Question

Account titles to be used: Accounts payable Accounts receivable Accumulated depreciationBuilding Accumulated depreciationEquipment Amortization expense Bonds payable Brokerage fee expense Building Cash Common stock, $10

Account titles to be used:

Accounts payable Accounts receivable Accumulated depreciationBuilding Accumulated depreciationEquipment Amortization expense Bonds payable Brokerage fee expense Building Cash Common stock, $10 par value Cost of goods sold Debt investments - AFS Debt investments - HTM Debt Investments - Trading Depreciation expenseBuilding Depreciation expenseEquipment Discount on bonds payable Dividend revenue Earnings from equity method investments Equipment Equity method investments Fair value adjustment - AFS Fair value adjustment - Stock Fair value adjustment - Trading Gain on retirement of bonds payable Gain on sale of debt investments Gain on sale of stock investments Income summary Interest expense Interest payable Interest receivable Interest revenue Inventory Land Loss on retirement of bonds payable Loss on sale of debt investments Loss on sale of stock investments Notes payable Paid-in capital in excess of par value, common stock Paid-in capital in excess of par value, preferred stock Paid-in capital, treasury stock Preferred stock, $100 par value Premium on bonds payable Rental expense Rental revenue Retained earnings Salaries expense Sales Sales discounts Sales returns and allowances Stock investments Supplies Supplies expense Treasury stock Unrealized gain - Equity Unrealized gain - Income Unrealized loss - Equity Unrealized loss - Income

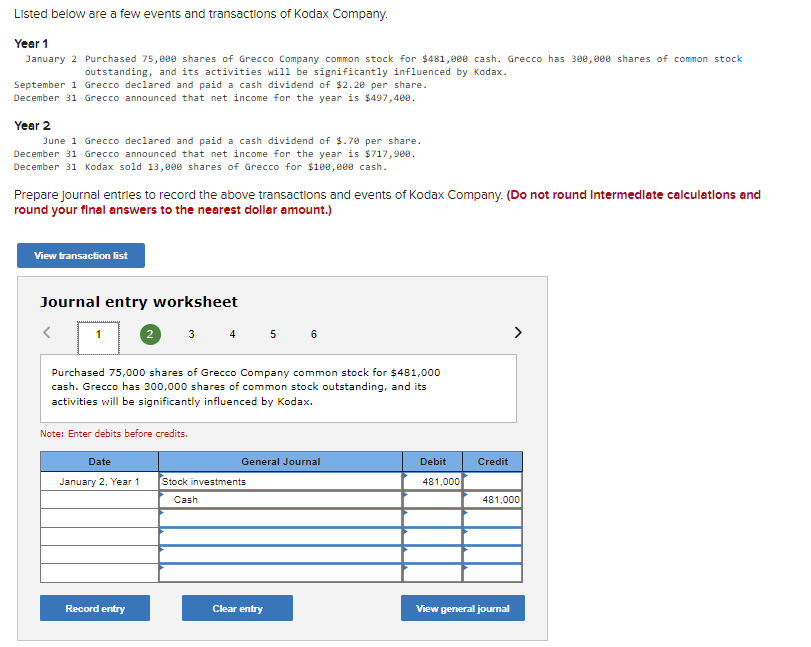

Listed below are a few events and transactions of Kodax Company. Year 1 January 2 Purchased 75, shares of Grecco Company common stock for $481,900 cash. Grecco has 390,900 shares of common stock outstanding, and its activities will be significantly influenced by Kodax. September 1 Grecco declared and paid a cash dividend of $2.20 per share. December 31 Grecco announced that net income for the year is $497,400. Year 2 June 1 Grecco declared and paid a cash dividend of \$.70 per share. December 31 Grecco announced that net income for the year is $717,960. December 31 Kodax sold 13,000 shares of Grecco for $10,00 cash. Prepare journal entrles to record the above transactions and events of Kodax Company. (Do not round Intermedlate calculatlons and round your final answers to the nearest dollar amount.) Journal entry worksheet Purchased 75,000 shares of Grecco Company common stock for $481,000 cash. Grecco has 300,000 shares of common stock outstanding, and its activities will be significantly influenced by Kodax. Note: Enter debits before creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started