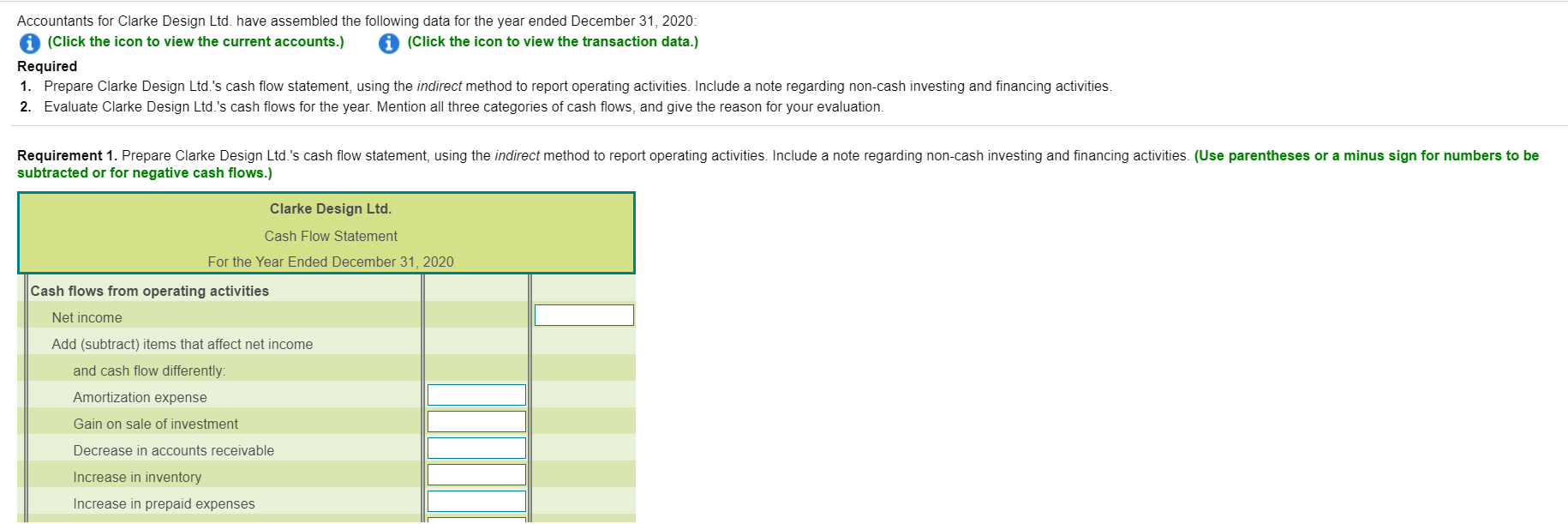

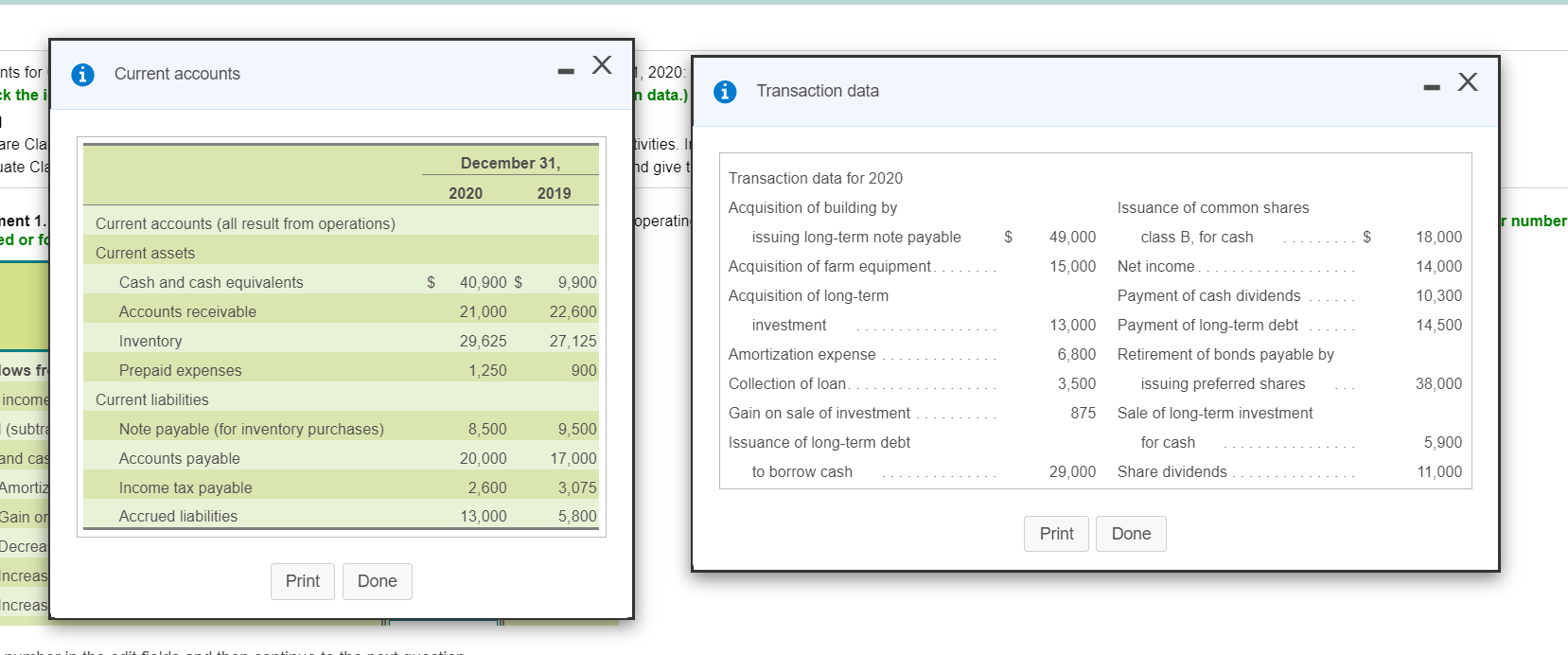

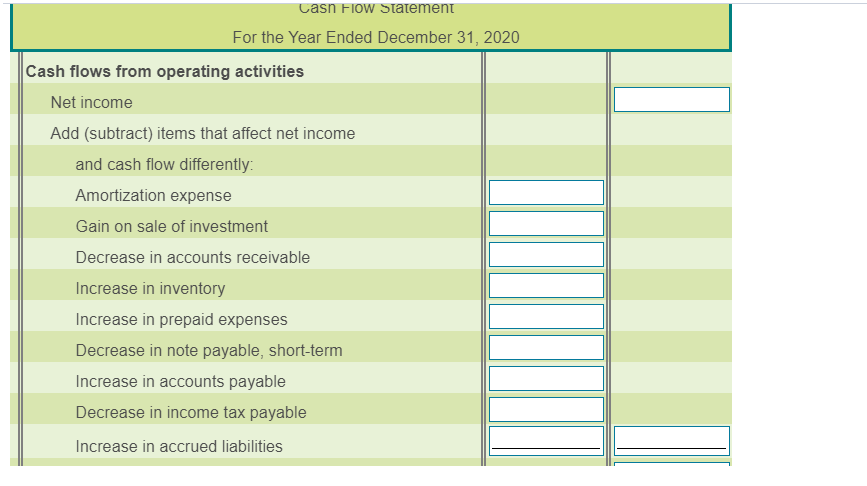

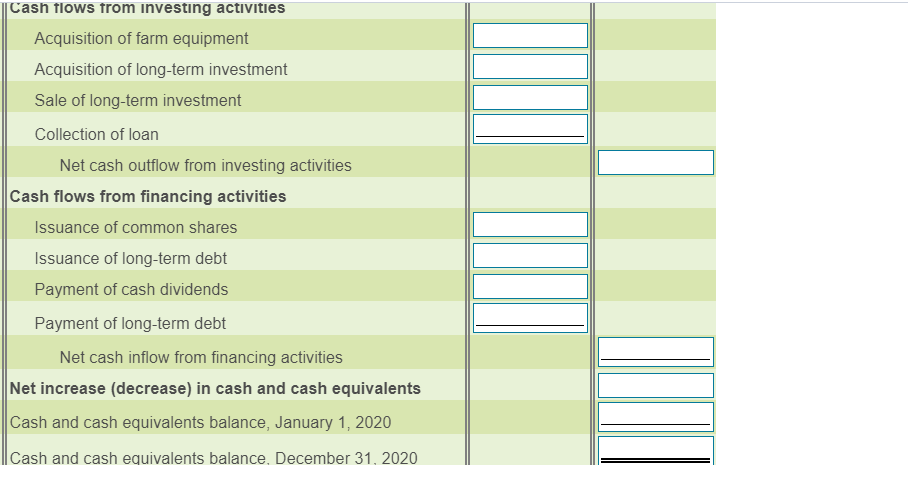

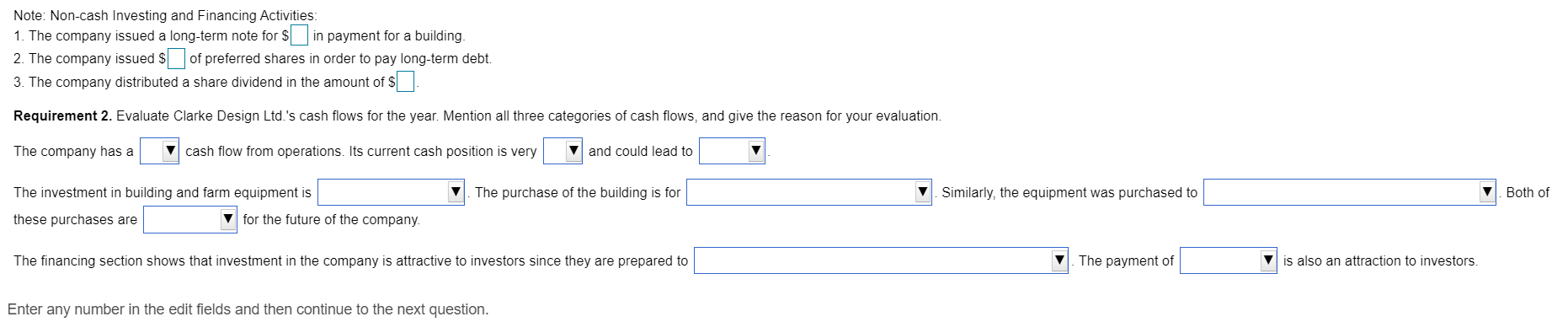

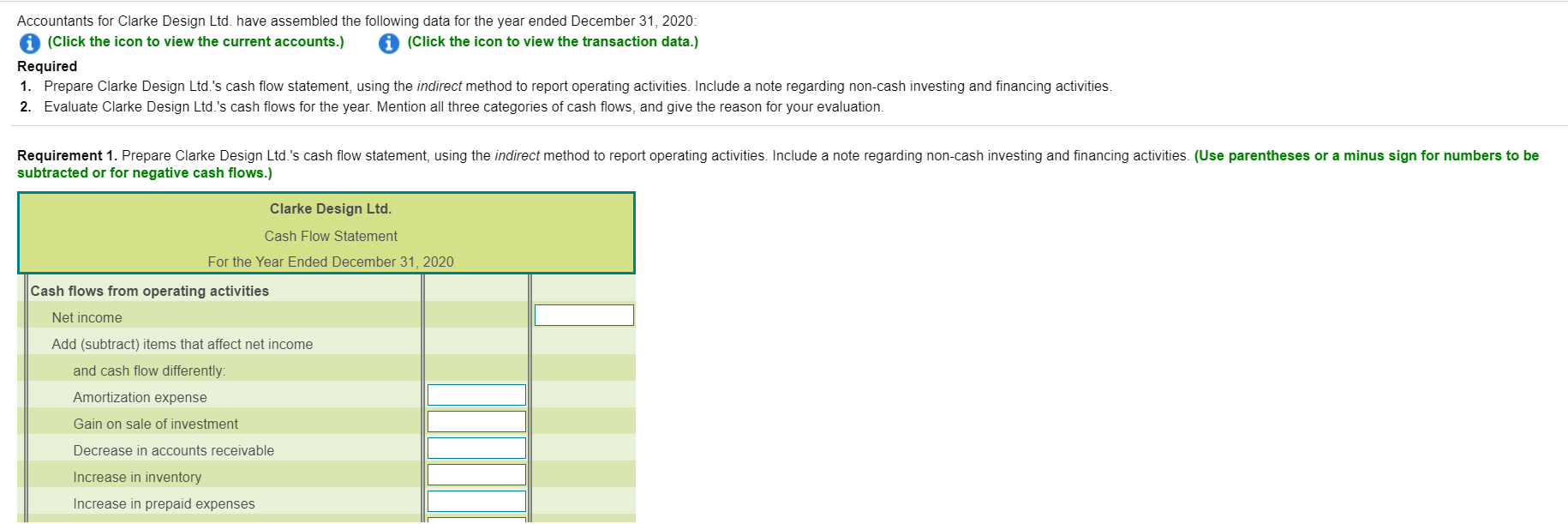

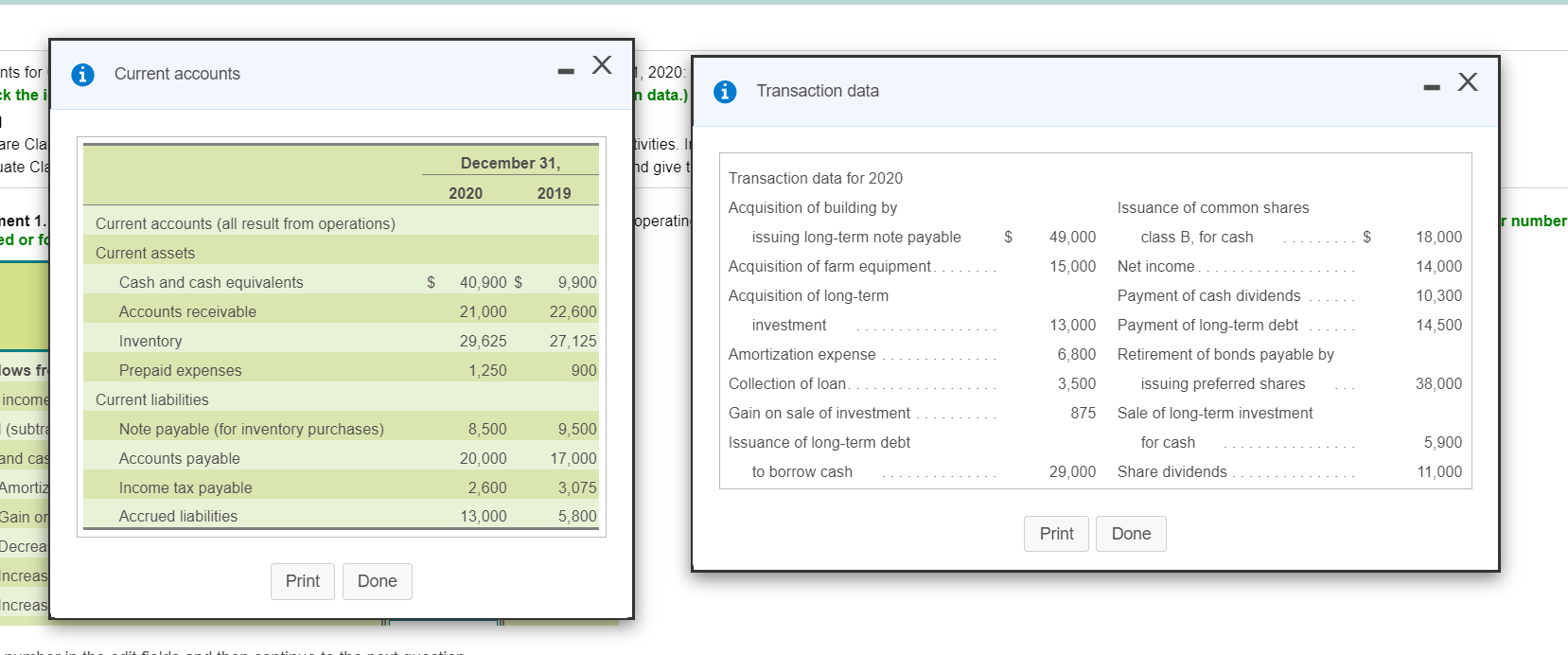

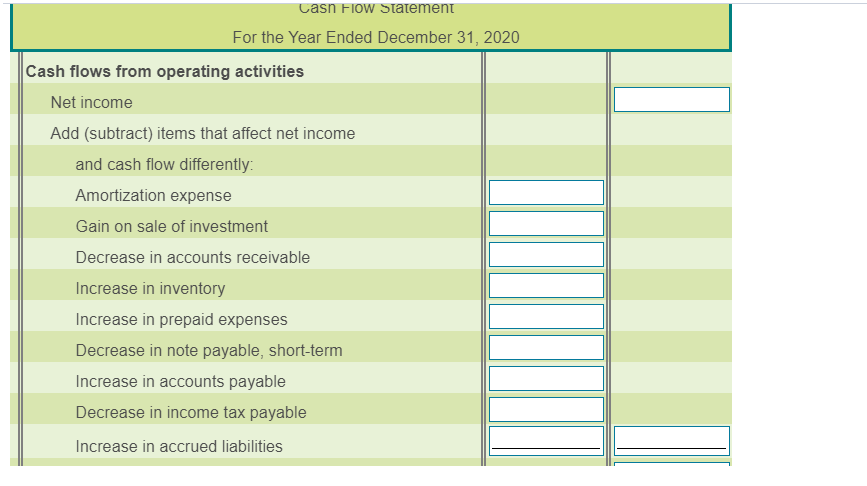

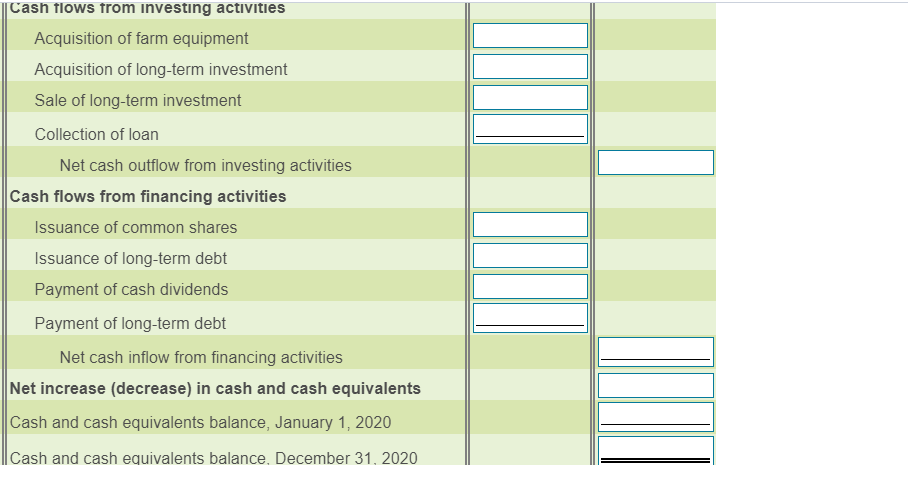

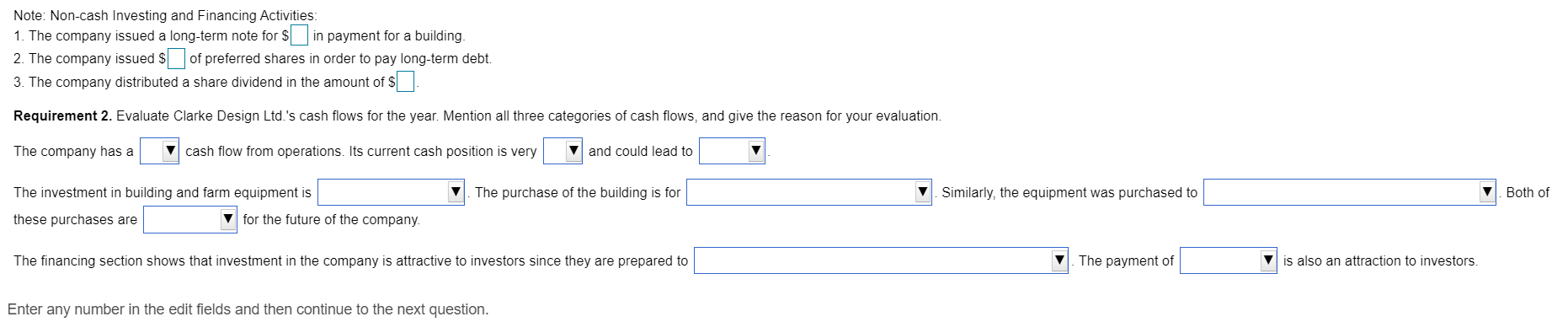

Accountants for Clarke Design Ltd. have assembled the following data for the year ended December 31, 2020: (Click the icon to view the current accounts.) (Click the icon to view the transaction data.) Required 1. Prepare Clarke Design Ltd.'s cash flow statement, using the indirect method to report operating activities. Include a note regarding non-cash investing and financing activities. 2. Evaluate Clarke Design Ltd.'s cash flows for the year. Mention all three categories of cash flows, and give the reason for your evaluation Requirement 1. Prepare Clarke Design Ltd.'s cash flow statement, using the indirect method to report operating activities. Include a note regarding non-cash investing and financing activities. (Use parentheses or a minus sign for numbers to be subtracted or for negative cash flows.) Clarke Design Ltd. Cash Flow Statement For the Year Ended December 31, 2020 Cash flows from operating activities Net income Add (subtract) items that affect net income and cash flow differently: Amortization expense Gain on sale of investment Decrease in accounts receivable Increase in inventory Increase in prepaid expenses nts for i Current accounts 2020: h data.) - Ek the i Transaction data tivities. I are Cla uate cia December 31, hd givet Transaction data for 2020 2020 2019 Acquisition of building by Issuance of common shares nent 1. ed or fd Current accounts (all result from operations) operatin Ir number issuing long-term note payable $ 49,000 class B, for cash 18,000 Current assets 15,000 Net income.... Cash and cash equivalents $ 9,900 40,900 $ 21,000 Acquisition of farm equipment. Acquisition of long-term 14,000 10,300 14,500 Accounts receivable 22,600 investment 13,000 29,625 27,125 Amortization expense 6,800 Payment of cash dividends Payment of long-term debt Retirement of bonds payable by issuing preferred shares Sale of long-term investment lows fr 1,250 900 Collection of loan 3,500 38,000 income Gain on sale of investment 875 (subtr Inventory Prepaid expenses Current liabilities Note payable (for inventory purchases) Accounts payable Income tax payable Accrued liabilities 8,500 9,500 Issuance of long-term debt for cash 5,900 and cas 20,000 17,000 to borrow cash 29,000 Share dividends 11,000 Amortiz 2.600 3,075 Gain or 13,000 5,800 Print Done Decreal Increas Print Done ncreas Casn Flow Statement For the Year Ended December 31, 2020 Cash flows from operating activities Net income Add (subtract) items that affect net income and cash flow differently: Amortization expense Gain on sale of investment Decrease in accounts receivable Increase in inventory Increase in prepaid expenses Decrease in note payable, short-term Increase in accounts payable Decrease in income tax payable Increase in accrued liabilities Cash flows from investing activities Acquisition of farm equipment Acquisition of long-term investment Sale of long-term investment Collection of loan Net cash outflow from investing activities Cash flows from financing activities Issuance of common shares Issuance of long-term debt Payment of cash dividends Payment of long-term debt Net cash inflow from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents balance, January 1, 2020 Cash and cash equivalents balance, December 31, 2020 Note: Non-cash Investing and Financing Activities: 1. The company issued a long-term note for sin payment for a building. 2. The company issued $(of preferred shares in order to pay long-term debt. 3. The company distributed a share dividend in the amount of $ Requirement 2. Evaluate Clarke Design Ltd.'s cash flows for the year. Mention all three categories of cash flows, and give the reason for your evaluation. The company has a cash flow from operations. Its current cash position is very vand could lead to The investment in building and farm equipment is The purchase of the building is for Similarly, the equipment was purchased to Both of these purchases are v for the future of the company. The financing section shows that investment in the company is attractive to investors since they are prepared to The payment of Vis also an attraction to investors. Enter any number in the edit fields and then continue to the next