Answered step by step

Verified Expert Solution

Question

1 Approved Answer

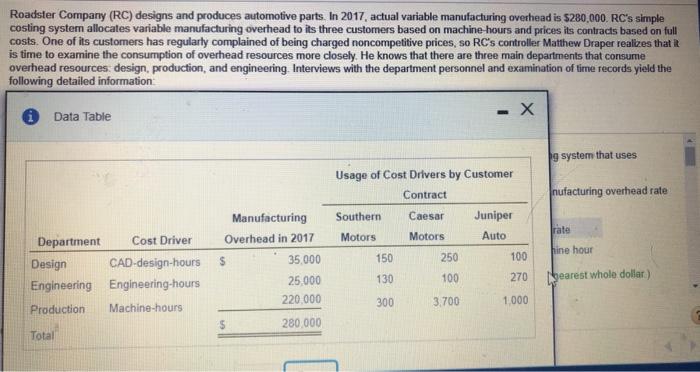

Roadster Company (RC) designs and produces automotive parts. In 2017, actual variable manufacturing overhead is $280,000. RC's simple costing system allocates variable manufacturing overhead

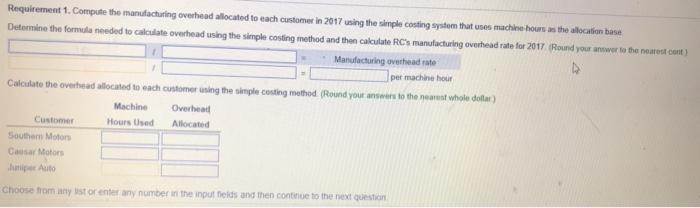

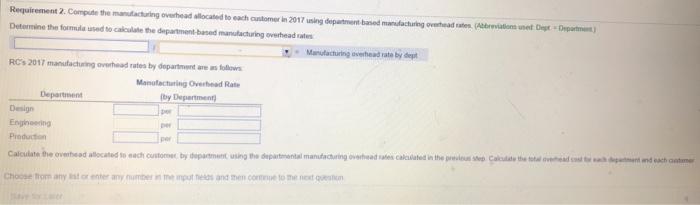

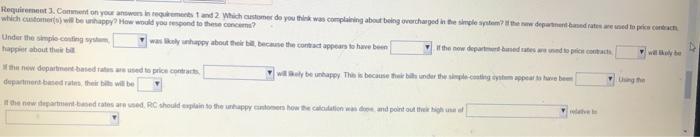

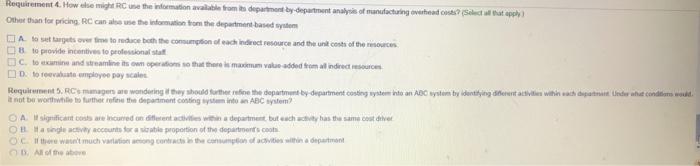

Roadster Company (RC) designs and produces automotive parts. In 2017, actual variable manufacturing overhead is $280,000. RC's simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompetitive prices, so RC's controller Matthew Draper realizes that it is time to examine the consumption of overhead resources more dlosely. He knows that there are three main departments that consume overhead resources design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information Data Table g system that uses Usage of Cost Drivers by Customer Contract nufacturing overhead rate Manufacturing Southern Caesar Juniper rate Department Cost Driver Overhead in 2017 Motors Motors Auto hine hour Design CAD-design-hours 35,000 150 250 100 130 100 270 bearest whole dollar) 25,000 Engineering Engineering-hours 220,000 300 3,700 1.000 Production Machine-hours 280,000 Total Requirement 1. Compute the manufacturing overhead allocated to each customer in 2017 using the simple costing system that uses machine hours as the allocation base Determine the formula needed to calculate overhead using the simple costing method and then calculate RC's manufacturing overhead rate for 2017 (Round your anwer to the nearest cont) Manufacturing overhead rate per machine hour Calculate the overhead allocated to each customer using the simple costing method. (Round your anseers to the nearest whole dollar) Machine Overhead Customer Hours Used Allocated Southem Motorns Casar Motors haniper Auto Choose from iany st or enter any number in the input fieids and then continue to the next question Requirement 2. Compute the manufacturing overhead allocated to each customer in 2017 uning depatment baned manulactung ovehead tes (Arvatiom unet DetDepartmet) Determine the fomla used to calculate the department based manutachuring ovehead ates Manutachuring overhead rate by dept RCs 2017 manutacturing overhead rates by department are an follows Manufacturing Overhead Rate Department (by Department) per Design Engineering per Pioduction per Calculate the overhead allocated to each customer by department using the departmantal manutacturing overhead ates calclated in the previeu p Calulate the total oveead t dpent nd ach ontme Choose trom any ist or enter any number in me input hels and then comue to me next queston Requirement 3. Conment on your answen in reguements t and 2 Which customer de you think was complaining about being overcharged in the simple sytem? he w departnent aned raten are sed to price cortact which customertsj wil be unihappy? How would you respond to these concerms? Under the simple conting syst was lkoly unhappy about their bill, because the contact appears to have been If the now departmntbaned ates a uned to pricn contacts wil oly be happier about the bil he new departnent based rats ae used to price contracts wi ely be unhappy Thie is because thee bill under the sinple-coting ystmappeala have bee Ung the department based rates their bi will be tve he new department-based cates are used,RC should explain to the unhappy cantomers how the caloulation wan do and point out thek high une of Requirement 4. How ese might RC une the information available fom its department by-department analysis of manufacturing overhead costs? (Select al hat apply Other than for pricing RC can ale use the information tom the department based system OA set targets over fie to reduce both the consumpton of each indirect resource and the unit costs of the resources 8 to provide incentives to professional stat OC. to eanine and streamline is owm operations so that there is maximum value added kom al indirect resources DD. to reevahuata employee pay scales Requirement 5. RCs mamagers ae wondering ihey should further refine the department by department costing system into an ABC system by identitying dferent attivies wihinach dapatnat Under ahat condtioms wd. it not be worthwhle to further refine the department conting system into an ABC system? OA significarnt costs are ncured on diferent activies within a department but each acvty has the same cost dtiver OB Ha single activty accounts for a sirable proportion of the departments coot. OC there wasnt much varlation aong contractse the consumpton of adivities within a departmant OB Aofthe above

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started