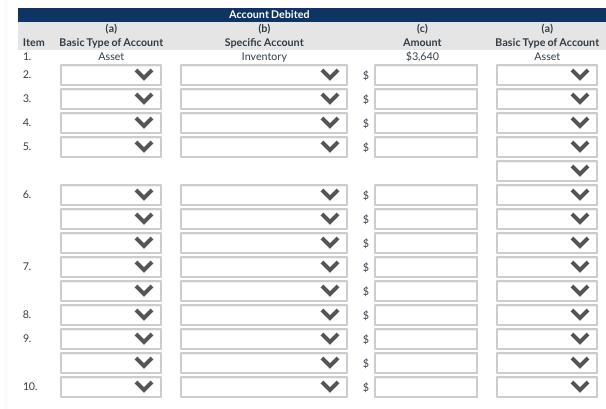

Question: Options Column (a): Contra Sales, Liability, Revenue, Expense, Asset Options Column (b): Cash, Accounts Payable, Accounts Receivable, Sales, Freight Out, Sales Return and Allowance, Inventory,

Options Column (a): Contra Sales, Liability, Revenue, Expense, Asset

Options Column (b): Cash, Accounts Payable, Accounts Receivable, Sales, Freight Out, Sales Return and Allowance, Inventory, Cost of Goods Sold

Options Column (c): $ Amount

Second Side is based on Account Credited...

Options Column (a): Contra Sales, Liability, Revenue, Expense, Asset

Options Column (b): Cash, Accounts Payable, Accounts Receivable, Sales, Freight Out, Sales Return and Allowance, Inventory, Cost of Goods Sold

Options Column (c): $ Amount

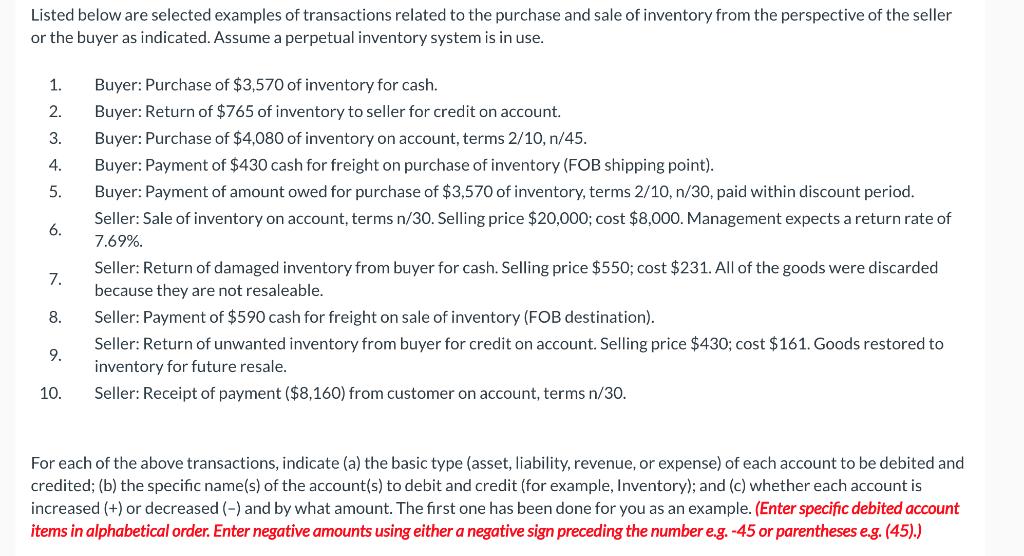

Listed below are selected examples of transactions related to the purchase and sale of inventory from the perspective of the seller or the buyer as indicated. Assume a perpetual inventory system is in use. 1. Buyer: Purchase of $3,570 of inventory for cash. 2. Buyer: Return of $765 of inventory to seller for credit on account. 3. Buyer: Purchase of $4,080 of inventory on account, terms 2/10, n/45. 4. Buyer: Payment of $430 cash for freight on purchase of inventory (FOB shipping point). 5. Buyer: Payment of amount owed for purchase of $3,570 of inventory, terms 2/10, n/30, paid within discount period. Seller: Sale of inventory on account, terms n/30. Selling price $20,000; cost $8,000. Management expects a return rate of 6. 7.69%. Seller: Return of damaged inventory from buyer for cash. Selling price $550; cost $231. All of the goods were discarded 7. because they are not resaleable. 8. Seller: Payment of $590 cash for freight on sale of inventory (FOB destination). Seller: Return of unwanted inventory from buyer for credit on account. Selling price $430; cost $161. Goods restored to 9. inventory for future resale. 10. Seller: Receipt of payment ($8,160) from customer on account, terms n/30. (a) the basic type (asset, liability, revenue, or expense) of each account to be debited and credited; (b) the specific name(s) of the account(s) to debit and credit (for example, Inventory); and (c) whether each account is increased (+) or decreased (-) and by what amount. The first one has been done for you as an example. (Enter specific debited account items in alphabetical order. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) For each of the above transactions, indic

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

i In item 5 buyer gets discount as he pays within the discount period ii So discount is recorded as ... View full answer

Get step-by-step solutions from verified subject matter experts