Question

You are a graduate tax advisor, employed by Tax Advisors Pty Ltd. Your partner has assigned you the following client file after attending a meeting

You are a graduate tax advisor, employed by Tax Advisors Pty Ltd. Your partner has assigned you the following client file after attending a meeting with the client.

Client Background

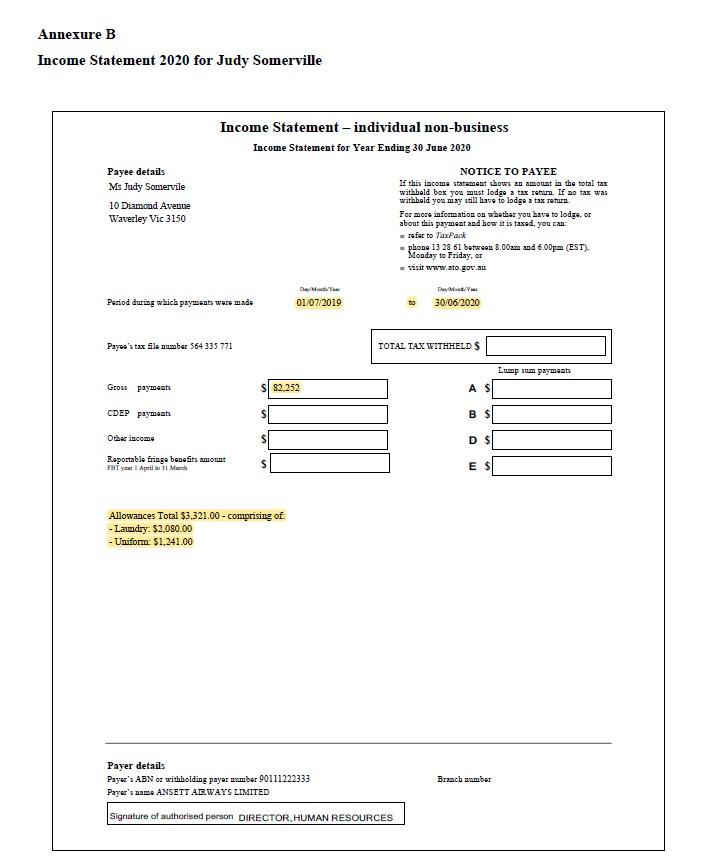

Judy Somerville is employed by Ansett Airways Limited (‘Ansett’) since 2003 as a long-haul flight attendant based in Melbourne, Australia. The nature of Judy’s position with Ansett sees her flying to

international ports where she spends 183 days away from her home base each calendar year. The remaining days of each calendar year are spent in Australia and Judy uses non-flying time to organise the importation of textiles into Australia from Textiles Inc. (a company registered in the USA). Until recently, Judy was the exclusive distributor of textiles to retailers in Australia.

Client File Contents

The client file has the following relevant documents:

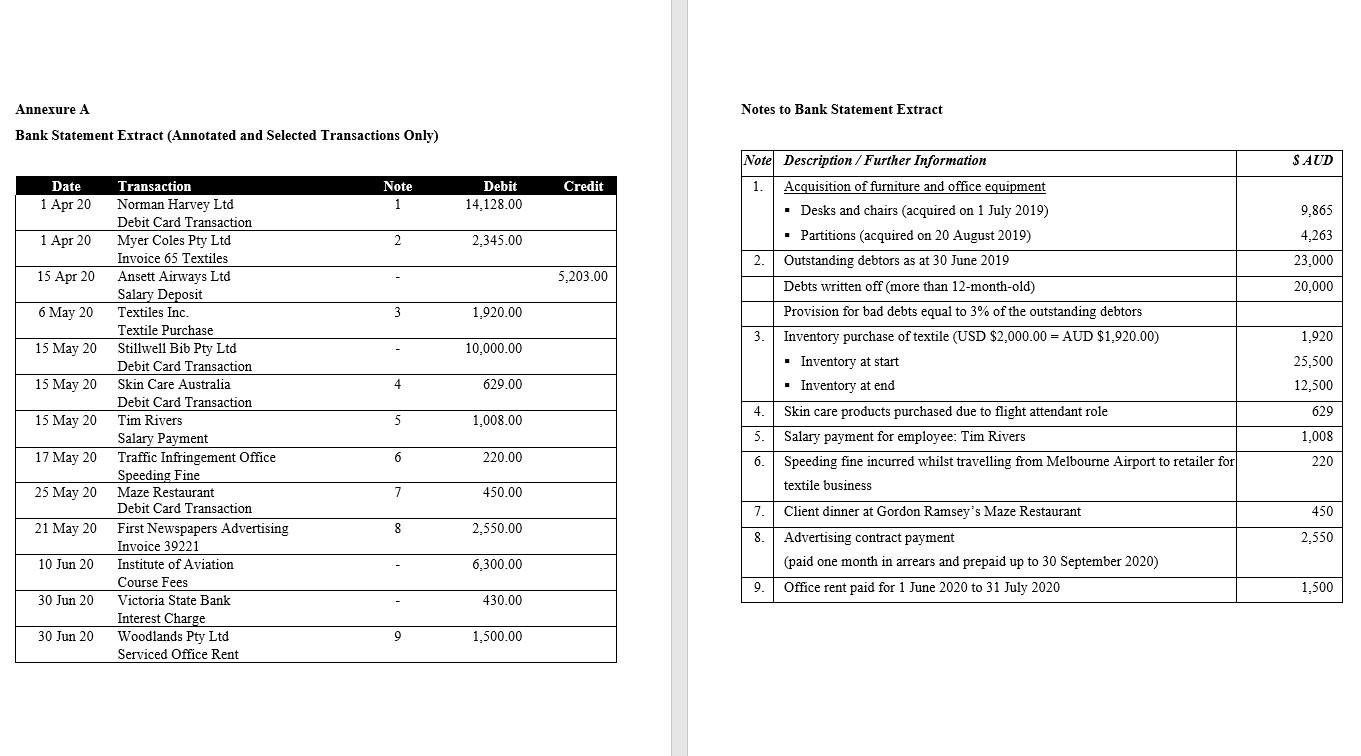

- Extract of bank statement for selected transactions during the financial year ended 30 June 2020 togetherwith its accompanying notes from Judy (see Annexure A);

- Income statement 2020 from Ansett (see Annexure B);

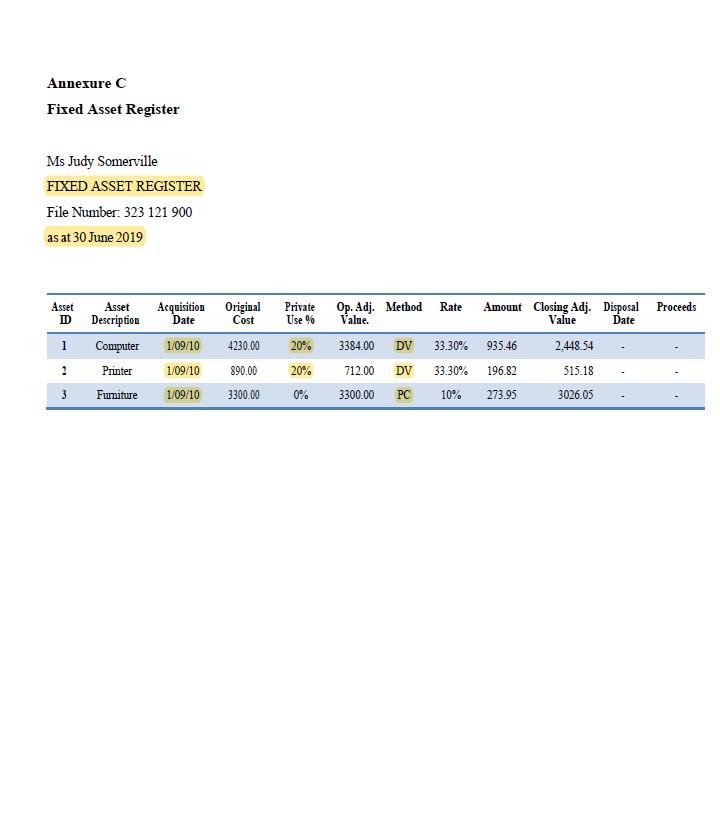

- Fixed assets register (see Annexure C)

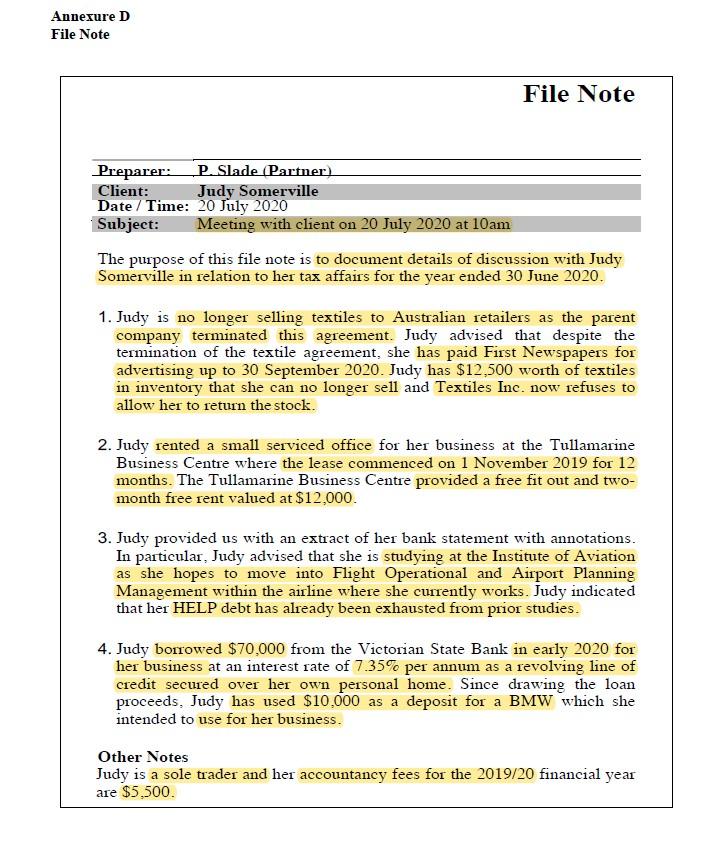

- File note prepared by your partner who had a meeting with Judy (see Annexure D)

Questions:

Required:

Judy Somerville has engaged Tax Advisors Pty Ltd to advise her of all her tax issues which will arise from the documents provided in respect of the tax year ending 30 June 2020. Your partner has requested that you: Under Australian Taxation;

- show the calculation of Judy’s taxable income and tax payable for the tax year ending 30 June 2020.

Annexure A Notes to Bank Statement Extract Bank Statement Extract (Annotated and Selected Transactions Only) Note Description / Further Information S AUD Date Transaction Norman Harvey Ltd Note Debit Credit 1. Acquisition of furniture and office equipment 1 Apr 20 1 14,128.00 Desks and chairs (acquired on 1 July 2019) 9,865 Debit Card Transaction 1 Apr 20 Myer Coles Pty Ltd Partitions (acquired on 20 August 2019) 4,263 2 2,345.00 Invoice 65 Textiles 2. Outstanding debtors as at 30 June 2019 23,000 Ansett Airways Ltd Salary Deposit Textiles Inc. 15 Apr 20 5,203.00 Debts written off (more than 12-month-old) - 20,000 6 May 20 3 1,920.00 Provision for bad debts equal to 3% of the outstanding debtors Textile Purchase 3. Inventory purchase of textile (USD $2,000.00 = AUD $1,920.00) 1,920 15 May 20 Stillwell Bib Pty Ltd 10,000.00 Debit Card Transaction Inventory at start 25,500 15 May 20 Skin Care Australia 4 629.00 Inventory at end 12,500 Debit Card Transaction 4. Skin care products purchased due to flight attendant role 629 15 May 20 Tim Rivers 1,008.00 5. Salary payment for employee: Tim Rivers 1,008 Salary Payment Traffic Infringement Office Speeding Fine Maze Restaurant 17 May 20 6 220.00 6. Speeding fine incurred whilst travelling from Melbourne Airport to retailer for 220 textile business 25 May 20 7 450.00 Debit Card Transaction 7. Client dinner at Gordon Ramsey's Maze Restaurant 450 21 May 20 First Newspapers Advertising 8 2,550.00 8. Advertising contract payment 2,550 Invoice 39221 10 Jun 20 Institute of Aviation 6,300.00 (paid one month in arrears and prepaid up to 30 September 2020) Course Fees Victoria State Bank Interest Charge Woodlands Pty Ltd 9. Office rent paid for 1 June 2020 to 31 July 2020 1,500 30 Jun 20 430.00 30 Jun 20 1,500.00 Serviced Office Rent

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Exract of bank statement for selected transactions during the financial year ended 30 June 2020 toge...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started