Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider an individual who lives for two periods with preferences given by U (,)= u() + pu(c) where u(e) is the one period

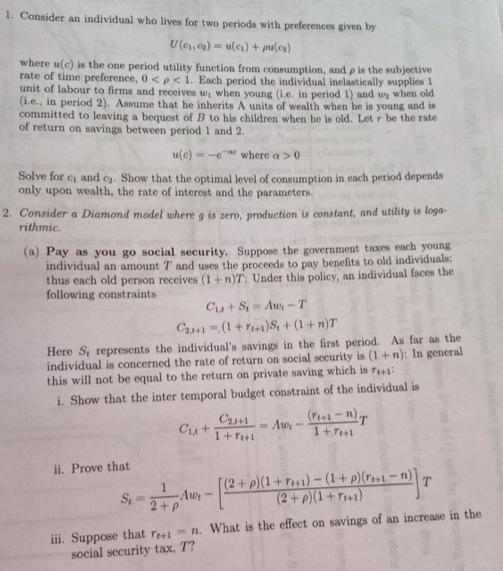

1. Consider an individual who lives for two periods with preferences given by U (,)= u() + pu(c) where u(e) is the one period utility function from consumption, and p is the subjective rate of time preference, 0 < p < 1. Each period the individual inelastically supplies 1 unit of labour to firms and receives w, when young (i.e. in period 1) and wy when old (i.e., in period 2). Assume that he inherits A units of wealth when he is young and is committed to leaving a bequest of B to his children when he is old. Let r be the rate of return on savings between period 1 and 2. u(c) - where a > 0 Solve for c, and c. Show that the optimal level of consumption in each period depends only upon wealth, the rate of interest and the parameters. 2. Consider a Diamond model where g is zero, production is constant, and utility is loga rithmic. (a) Pay as you go social security. Suppose the government taxes each young individual an amount 7 and uses the proceeds to pay benefits to old individuals; thus each old person receives (1+n)T: Under this policy, an individual faces the following constraints Cu+S Aw-T C2+1(1+1)S+(1+n)T Here S, represents the individual's savings in the first period. As far as the individual is concerned the rate of return on social security is (1+n): In general this will not be equal to the return on private saving which is F+1: i. Show that the inter temporal budget constraint of the individual is Cu+ C,4+1 1+7+1 - Aur 1+7+1 ii. Prove that 1 [(2+ p)(1+re+1)-(1+p) (.1 St -Aw- - [( + p)(1- (2+p)(1+7+1) 2+p iii. Suppose that re+1n. What is the effect on savings of an increase in the social security tax, T?

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started