Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Charles Court owns and operates the Seacourt Restaurant as a proprietorship. The restaurant has gained a reputation for offering quality food, good service, and

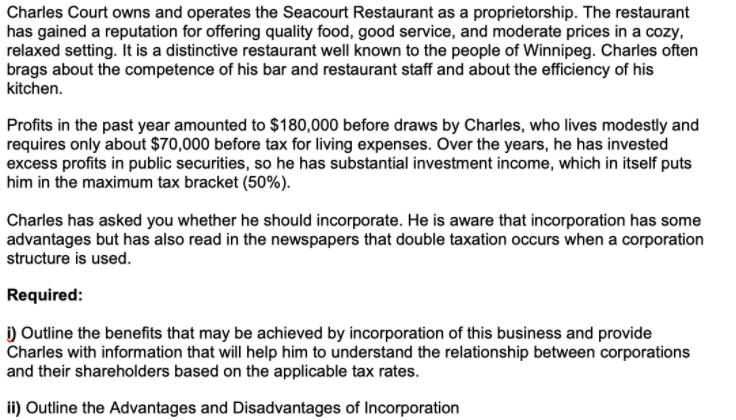

Charles Court owns and operates the Seacourt Restaurant as a proprietorship. The restaurant has gained a reputation for offering quality food, good service, and moderate prices in a cozy, relaxed setting. It is a distinctive restaurant well known to the people of Winnipeg. Charles often brags about the competence of his bar and restaurant staff and about the efficiency of his kitchen. Profits in the past year amounted to $180,000 before draws by Charles, who lives modestly and requires only about $70,000 before tax for living expenses. Over the years, he has invested excess profits in public securities, so he has substantial investment income, which in itself puts him in the maximum tax bracket (50%). Charles has asked you whether he should incorporate. He is aware that incorporation has some advantages but has also read in the newspapers that double taxation occurs when a corporation structure is used. Required: ) Outline the benefits that may be achieved by incorporation of this business and provide Charles with information that will help him to understand the relationship between corporations and their shareholders based on the applicable tax rates. ii) Outline the Advantages and Disadvantages of Incorporation

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The Benefits of a Companys Incorporation Creates a Separate Legal Entity This states that a corporation is separate and independent from its members and that the members cannot be held accountable for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started