Answered step by step

Verified Expert Solution

Question

1 Approved Answer

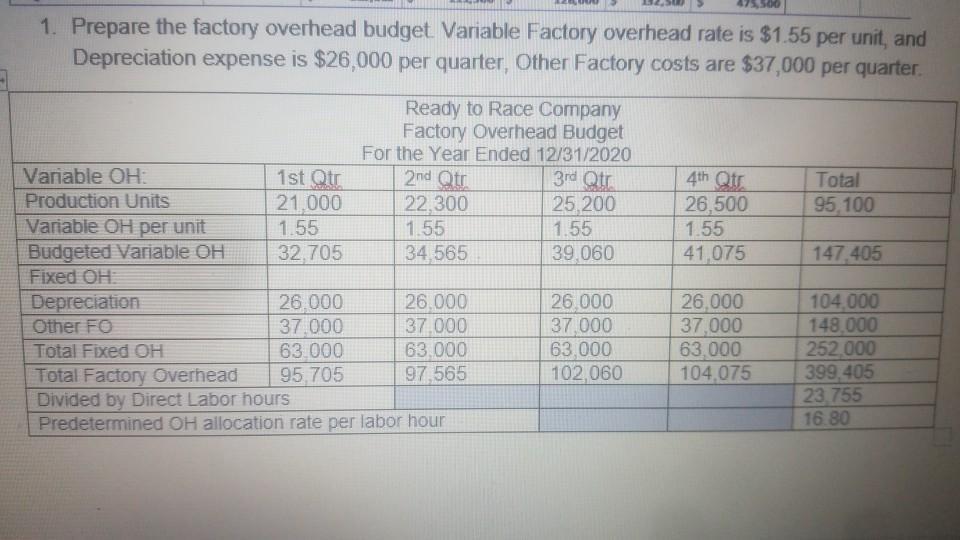

475,500 1. Prepare the factory overhead budget Variable Factory overhead rate is $1.55 per unit, and Depreciation expense is $26,000 per quarter, Other Factory

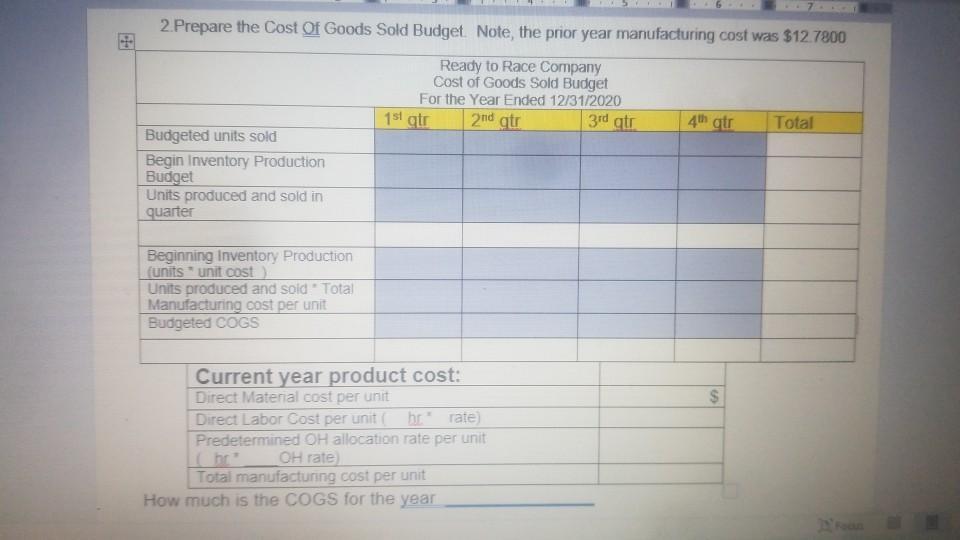

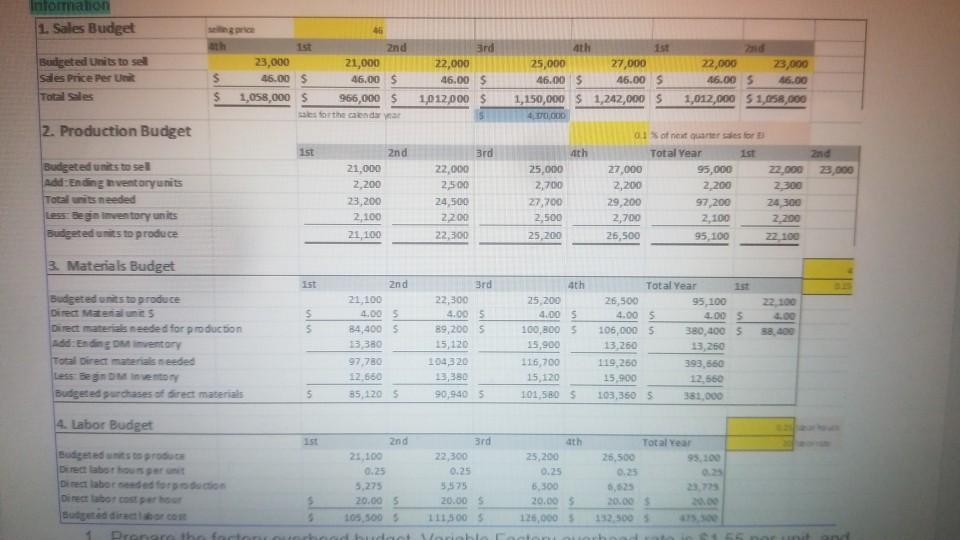

475,500 1. Prepare the factory overhead budget Variable Factory overhead rate is $1.55 per unit, and Depreciation expense is $26,000 per quarter, Other Factory costs are $37,000 per quarter. Ready to Race Company Factory Overhead Budget For the Year Ended 12/31/2020 3rd Qtr 25.200 2nd Qtr Variable OH: Production Units Variable OH per unit Budgeted Variable OH Fixed OH: 1st Qtr 21,000 4th Qtr 26,500 Total 95,100 22.300 1.55 34,565 1.55 1.55 1.55 32,705 39.060 41,075 147 405 Depreciation 26.000 37 000 63,000 102,060 26.000 26,000 37,000 63,000 104,075 104,000 148,000 252,000 399 405 23,755 16.80 26.000 37.000 Other FO Total Fixed OH Total Factory Overhead Divided by Direct Labor hours Predetermined OH allocation rate per labor hour 37.000 63.000 63.000 95,705 97 565 2.Prepare the Cost Of Goods Sold Budget. Note, the prior year manufacturing cost was $12.7800 Ready to Race Company Cost of Goods Sold Budget For the Year Ended 12/31/2020 1st gtr 2nd qtr 3rd gtr 4th qtr Total Budgeted units sold Begin Inventory Production Budget Units produced and sold in quarter Beginning Inventory Production (units unit cost) Units produced and sold Total Manufacturing oost per unit Budgeted COGS Current year product cost: Direct Material cost per unit Direct Labor Cost per unit ( hr* Predetermined OH allocation rate per unit OH rate) Total manufacturing cost per unit How much is the COGS for the year rate) Informahon 1. Sales Budget selng price 46 ath 1st 2nd 3rd 4th 1st 2nd Budgeted Units to sell Sales Price Per Unit 25,000 23,000 46.00 $ 21,000 27,000 46.00 S 22,000 23,000 46.00 22,000 %24 46.00 $ 46.00 $ 46.00 S 46.00 S Total Sales %24 1,058,000 $ 966,000 $ 1,012,000 S 1,150,000 S 1,242,000 S 1,012,000 S1,058,000 sales forthe caendar yar 4,/0,000 2. Production Budget saes auenb prau os to 1st 2nd Brd 4th Total Year 1st 2nd Budgeted units to sell add:Ending hventoryunits Total units needed Less Be gin inventory units Budgeted units to produce 21,000 22,000 25,000 27,000 95,000 22,000 23,000 2,200 2,500 2,700 2,200 2,200 2.300 23,200 24,500 27,700 2,500 29,200 97,200 24,300 2,100 2200 2,700 2,100 2,200 21,100 22,300 25,200 26,500 95,100 22,100 3. Materials Budget ist 2nd 3rd 4th Total Year 1st 2.25 Budgeted units to produce Direct Matenal unit S Direct materials needed for production Add: Ending DM inventory Total Direct materials needed 21,100 22,300 25,200 4.00 S 26,500 22,100 4.00 95,100 4.00 5 84,400 S 13,380 4.00 5 4.00 S 4.00 S 380,400 $ 13, 260 89,200 S 100,800 S 106,000 S 38,400 15,120 15,900 13,260 97,780 104320 116,700 119,260 393,660 12,660 13,380 15,120 15,900 12,660 381,000 Budgeted purchases of direct materials Au asuan GNag ssa 85,120 5 90,940 5 101,580 S 103,350 5 4. Labor Budget 62ar 1st 2nd 3rd 4th Total Year Budgeted units to produce Direct labor hous per unit Direct labor need ed forpodu ction Di rect labor cost per hour Budgeted directibor cot 21,100 22,300 25,200 26,500 95,100 0.25 0.25 0.25 0.25 0.25 5,275 20.00 5 5575 20.00 S 6,300 20.00 S 6,625 23,775 20.00 $ 20.00 105,500 S 111500 S 126,000 S 132,500 S 475,500 Prengro the foct dact Vo

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Direct material cost per unit 4 Direct labor cost per unit 025 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started