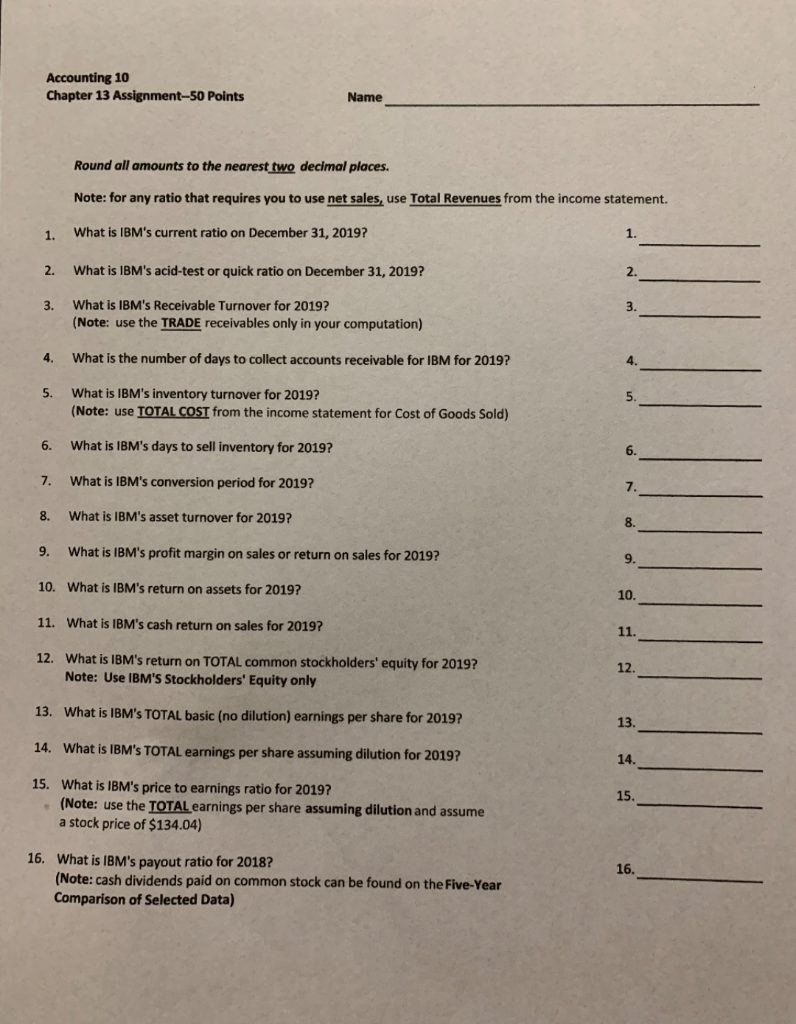

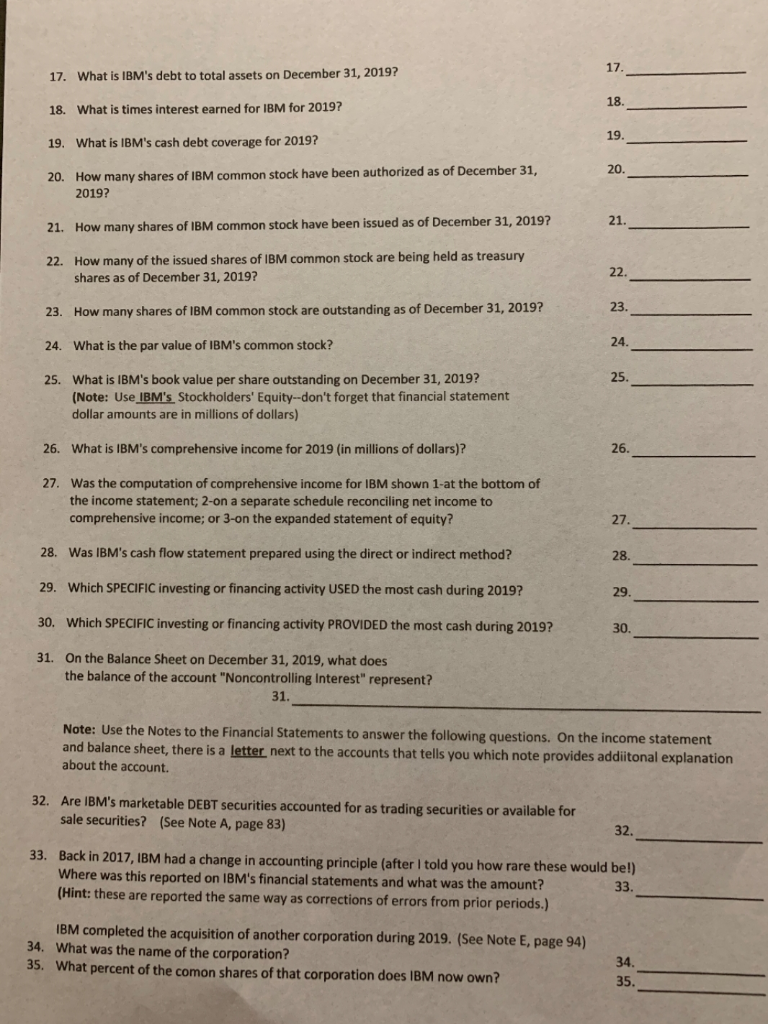

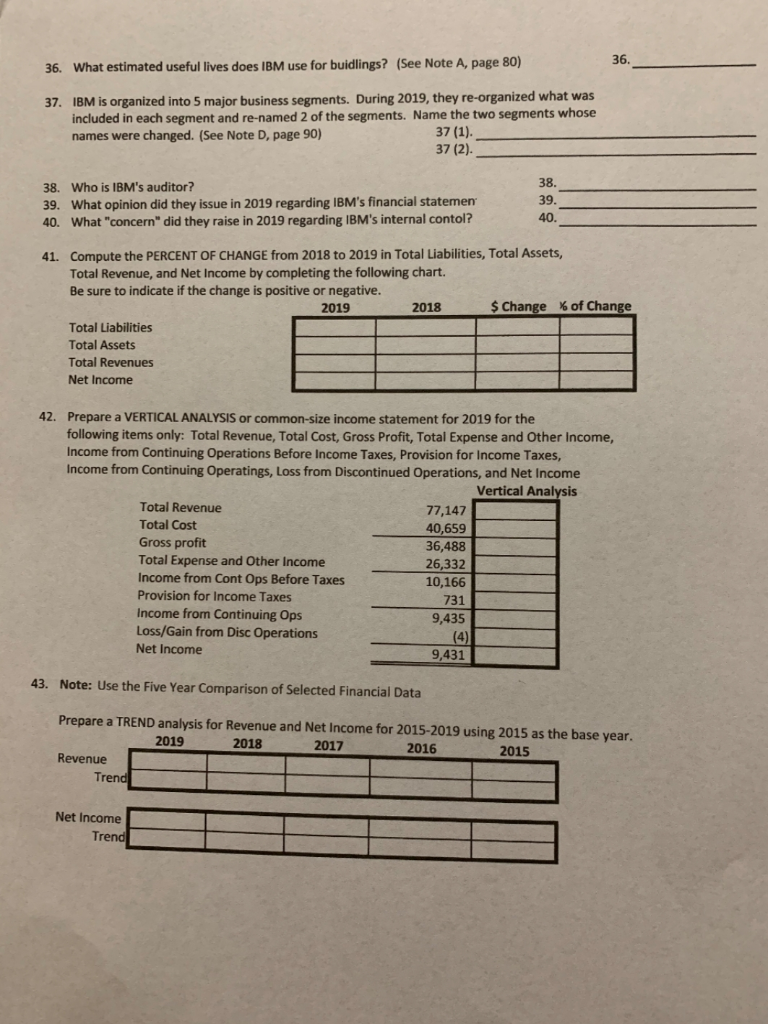

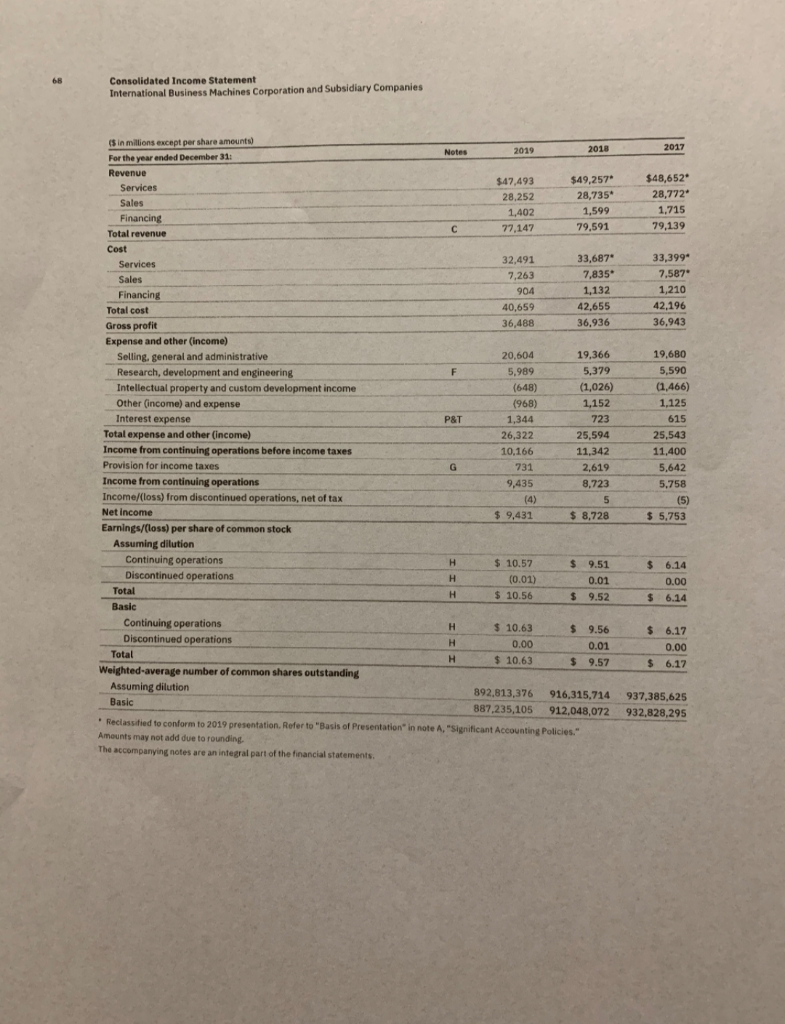

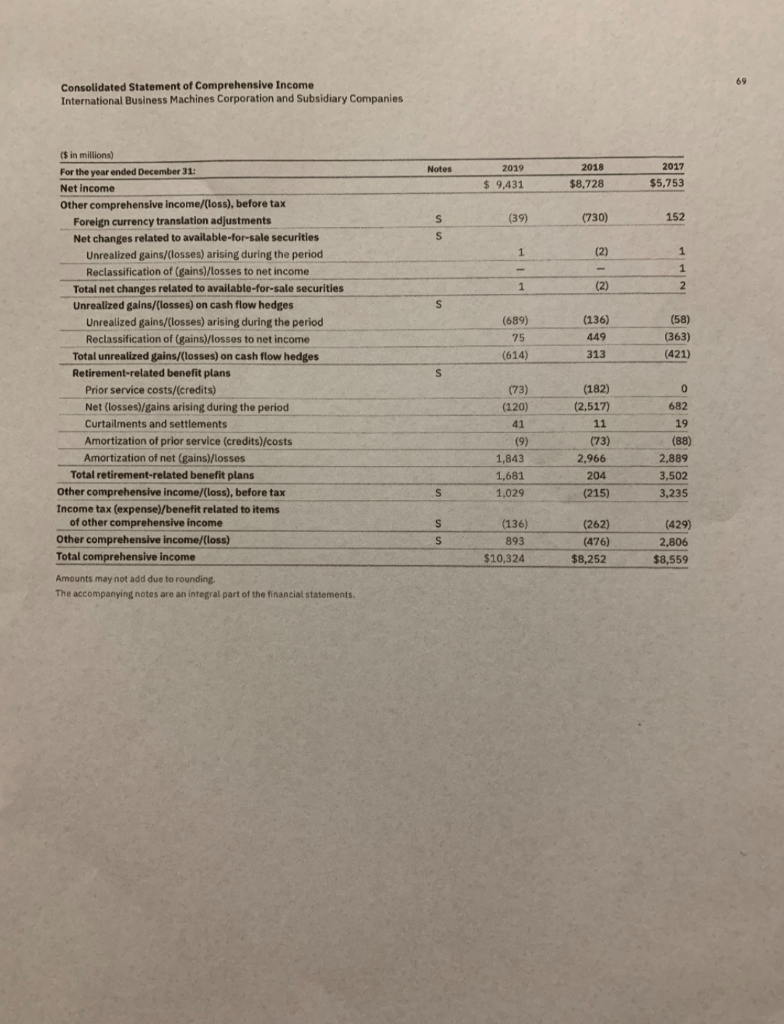

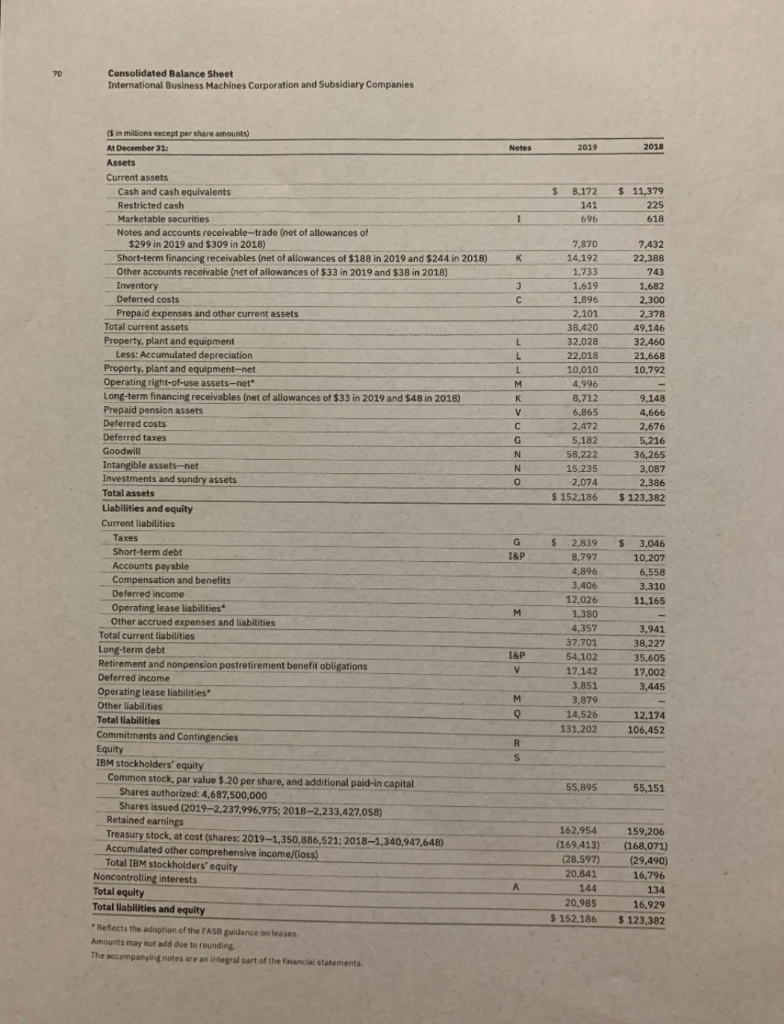

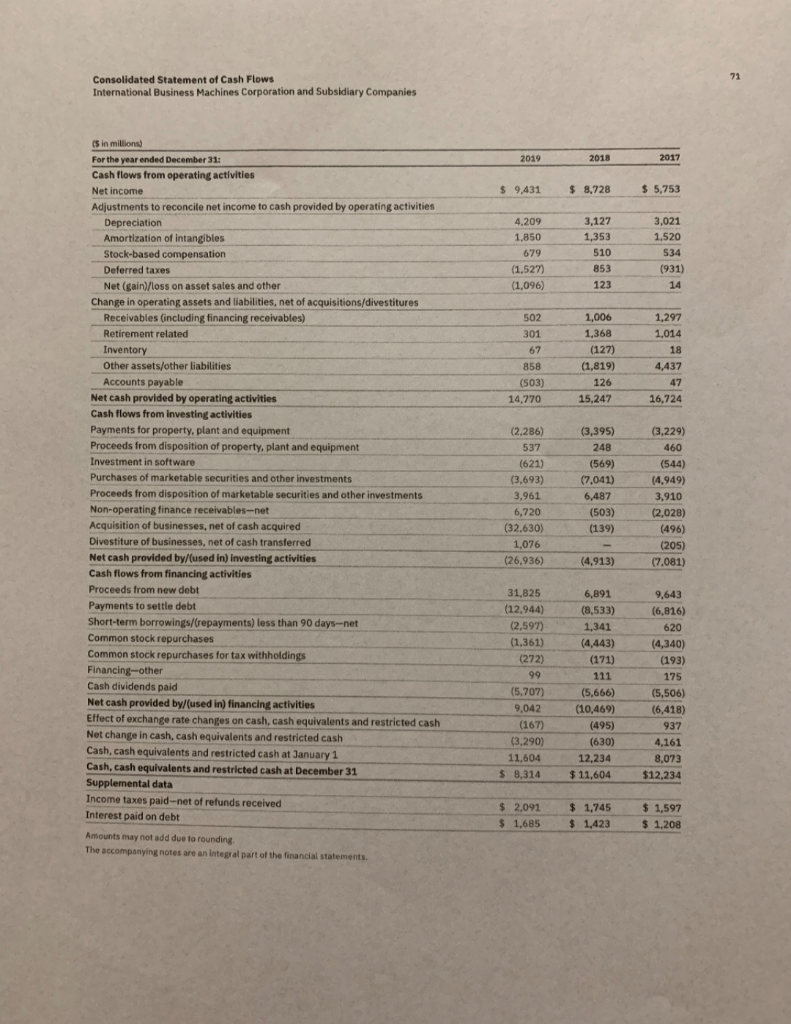

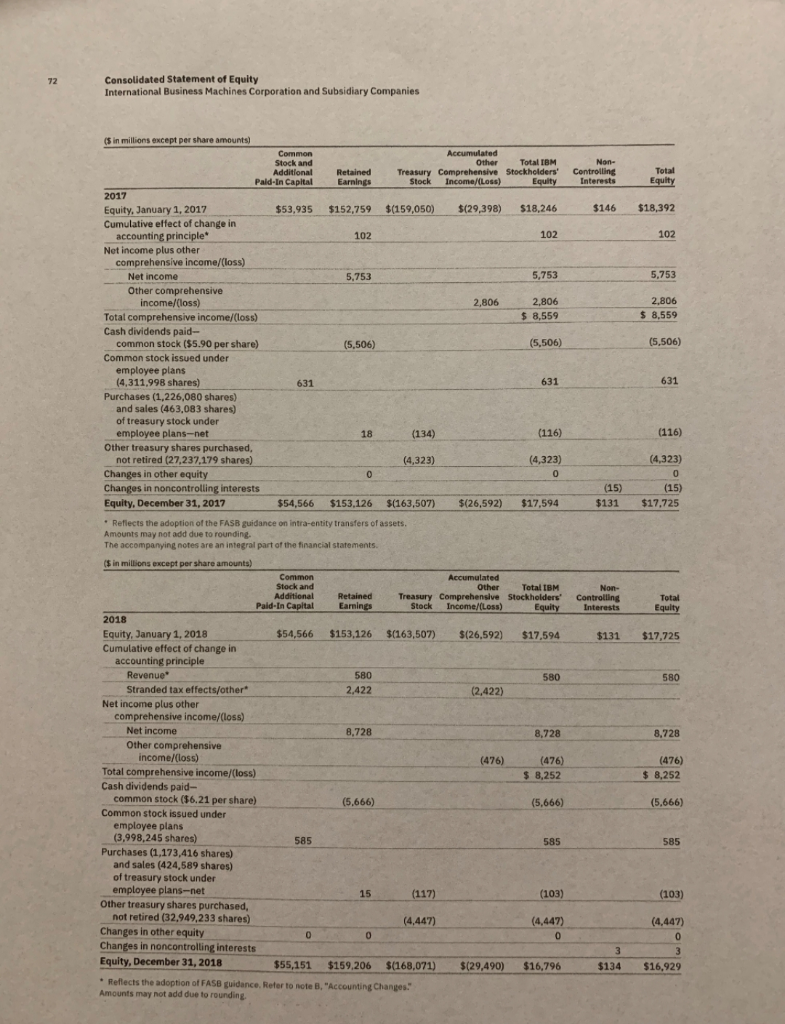

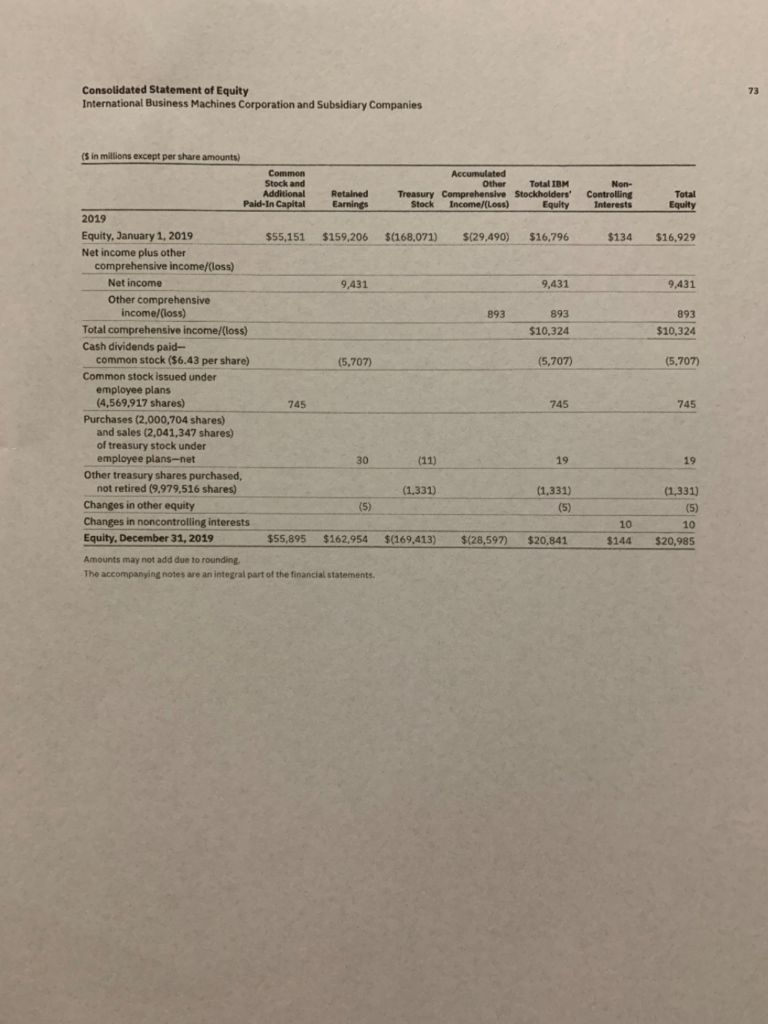

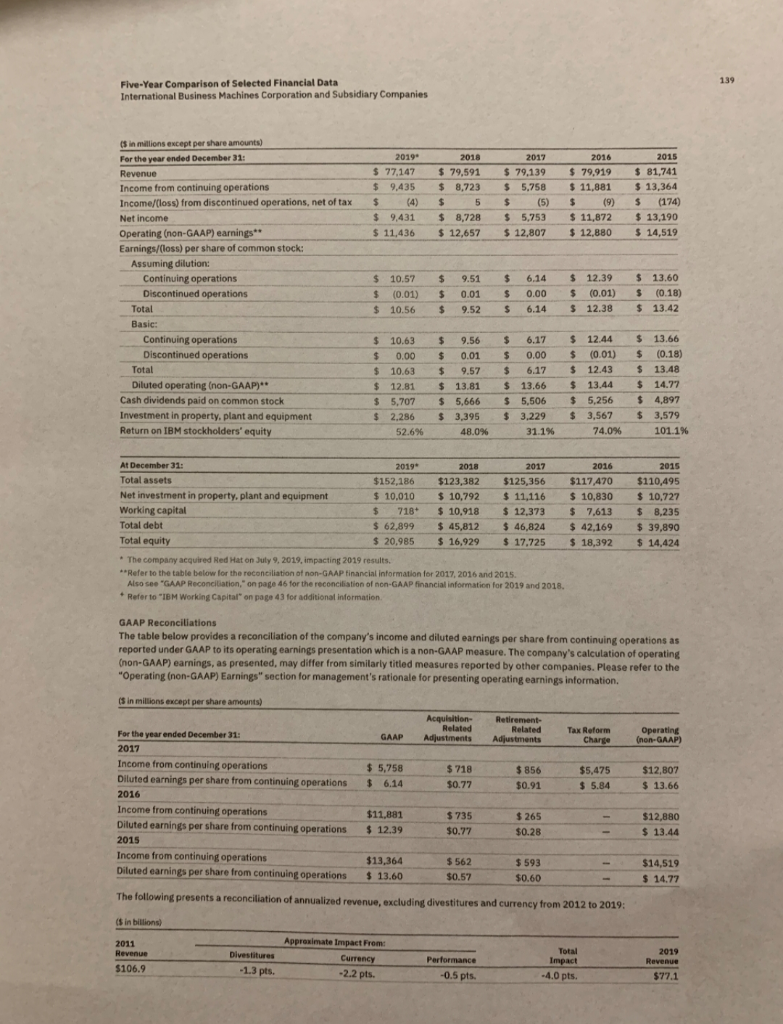

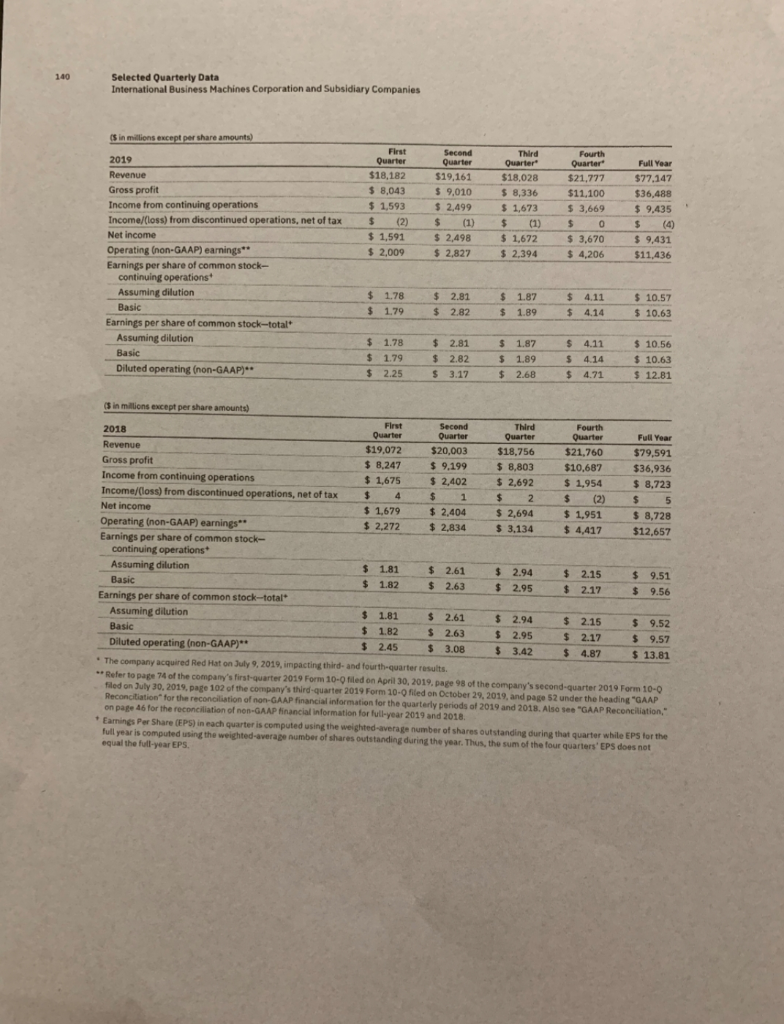

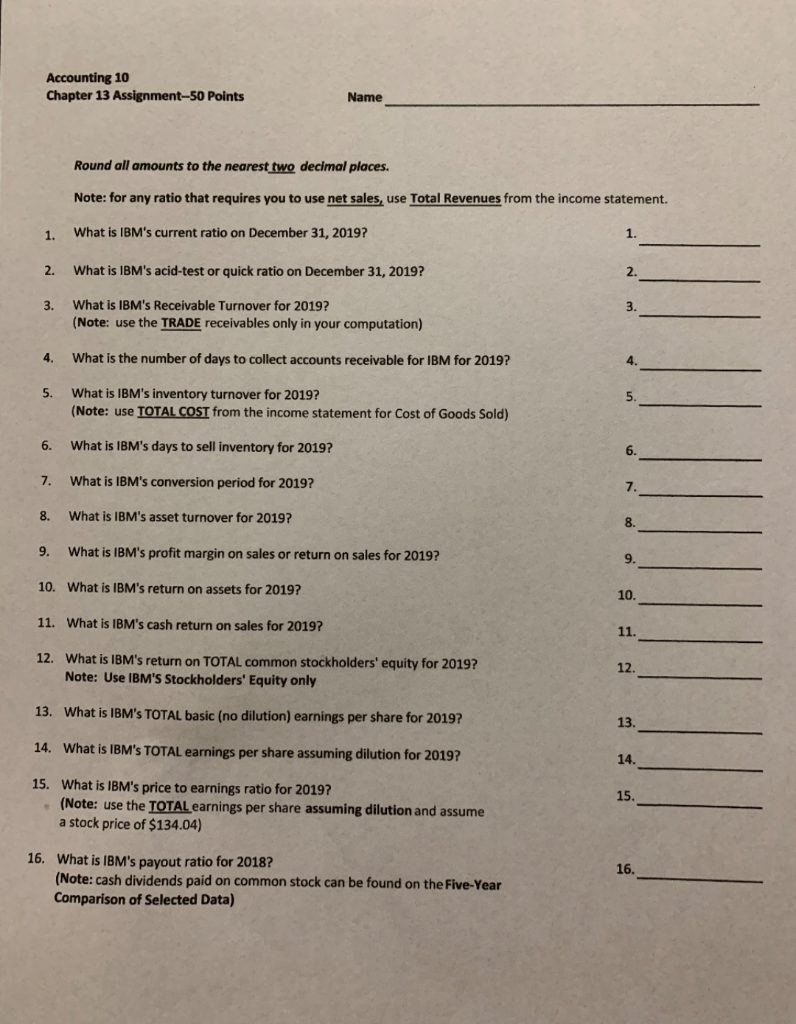

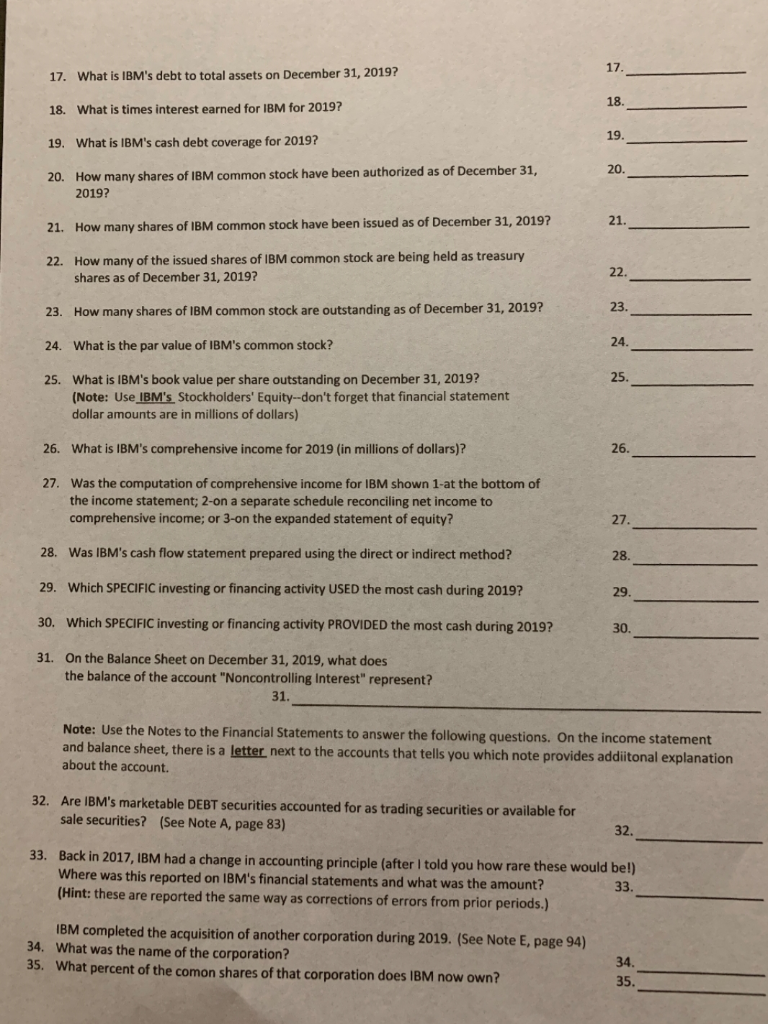

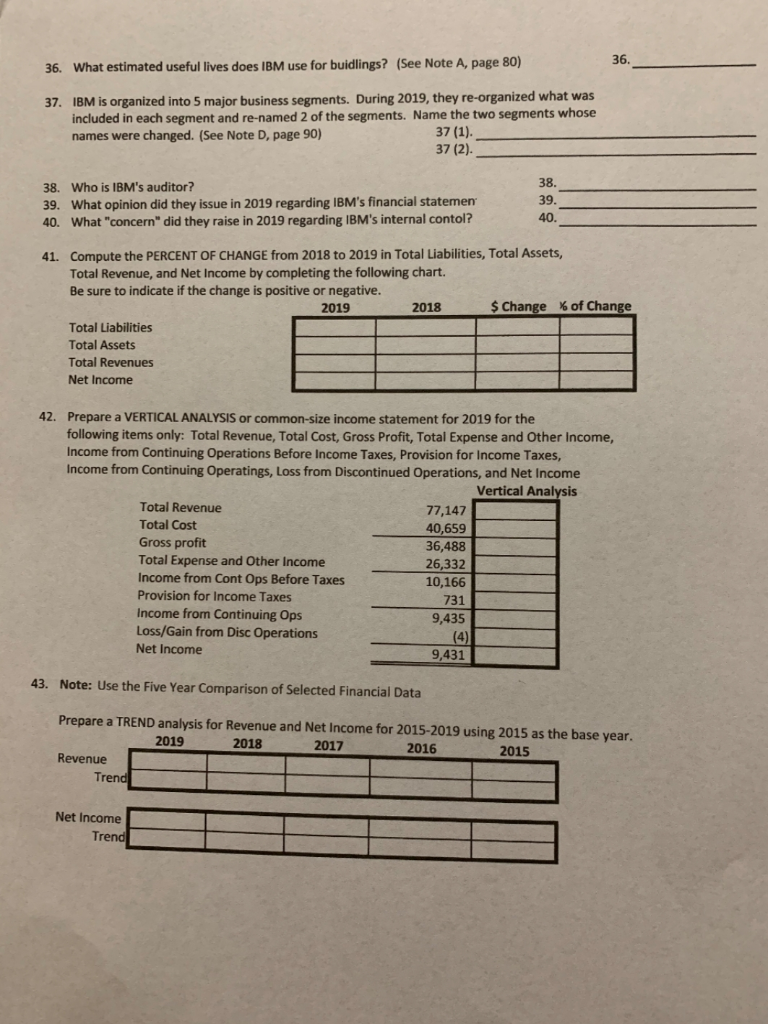

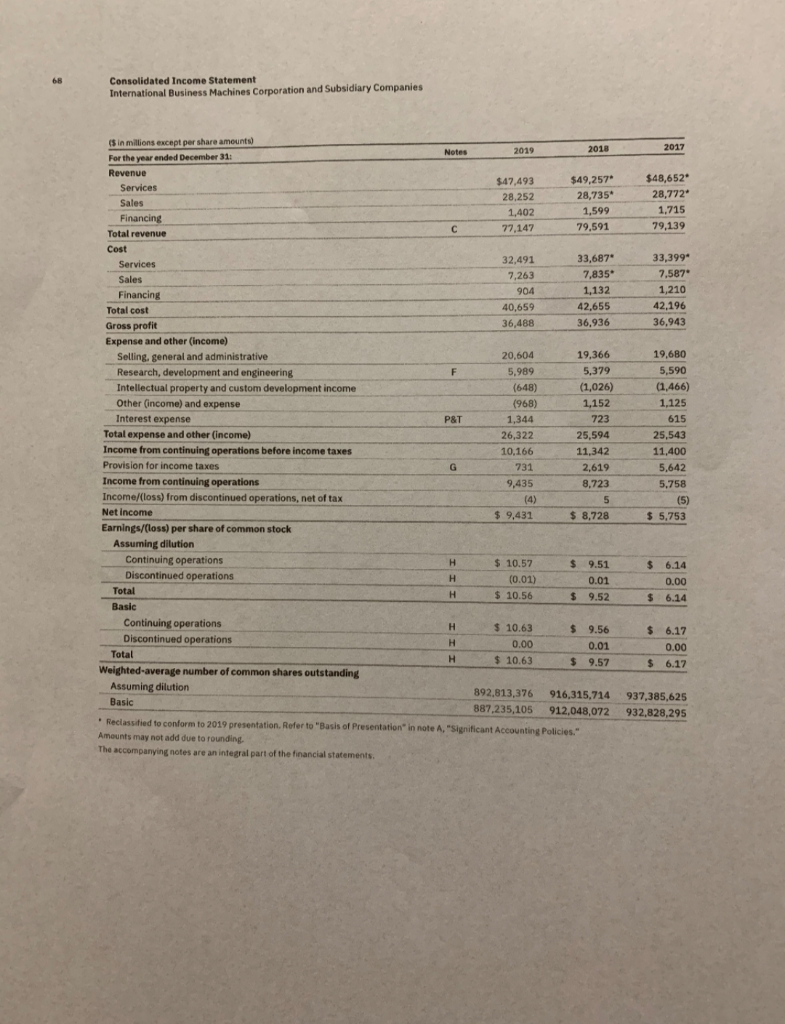

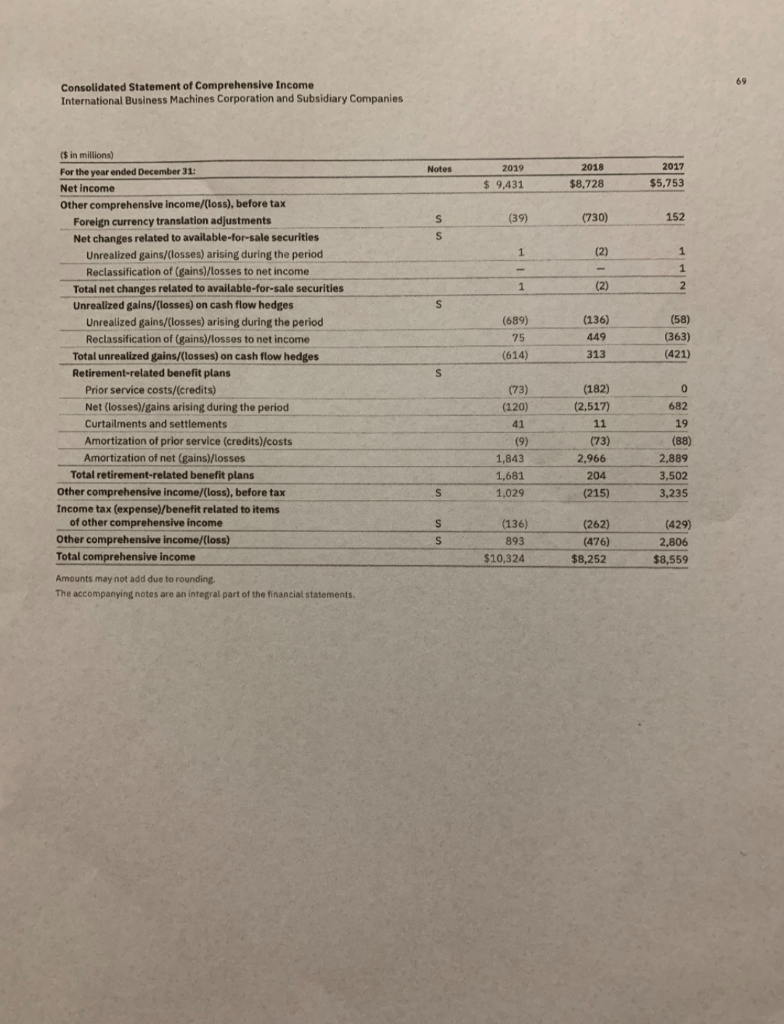

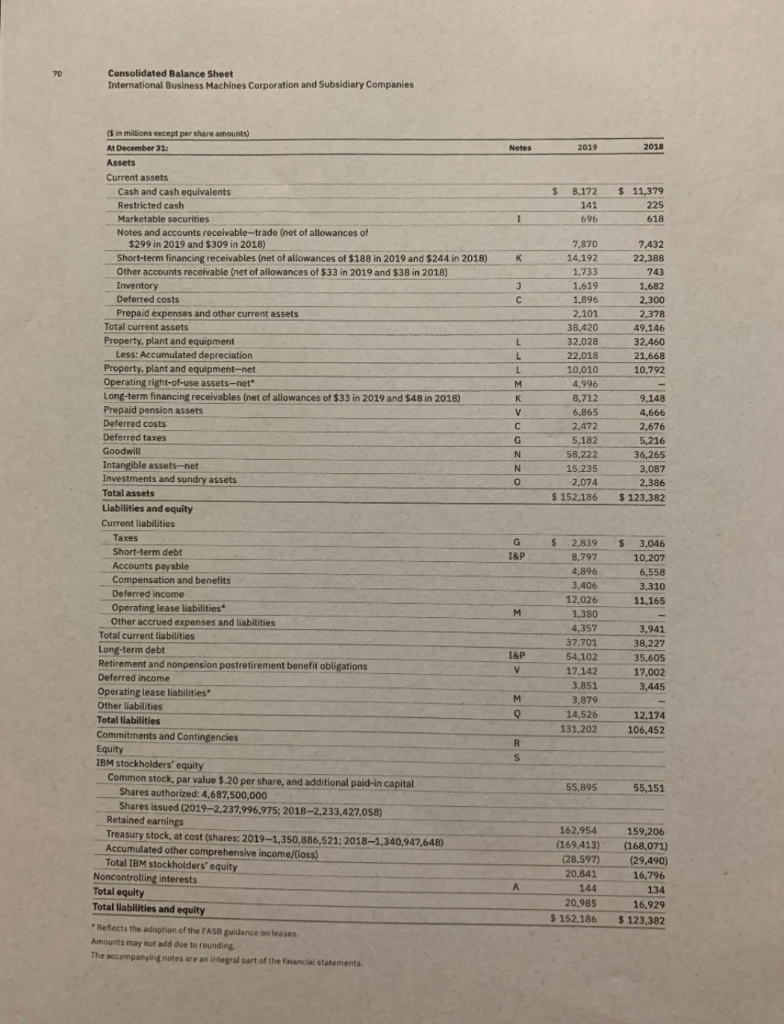

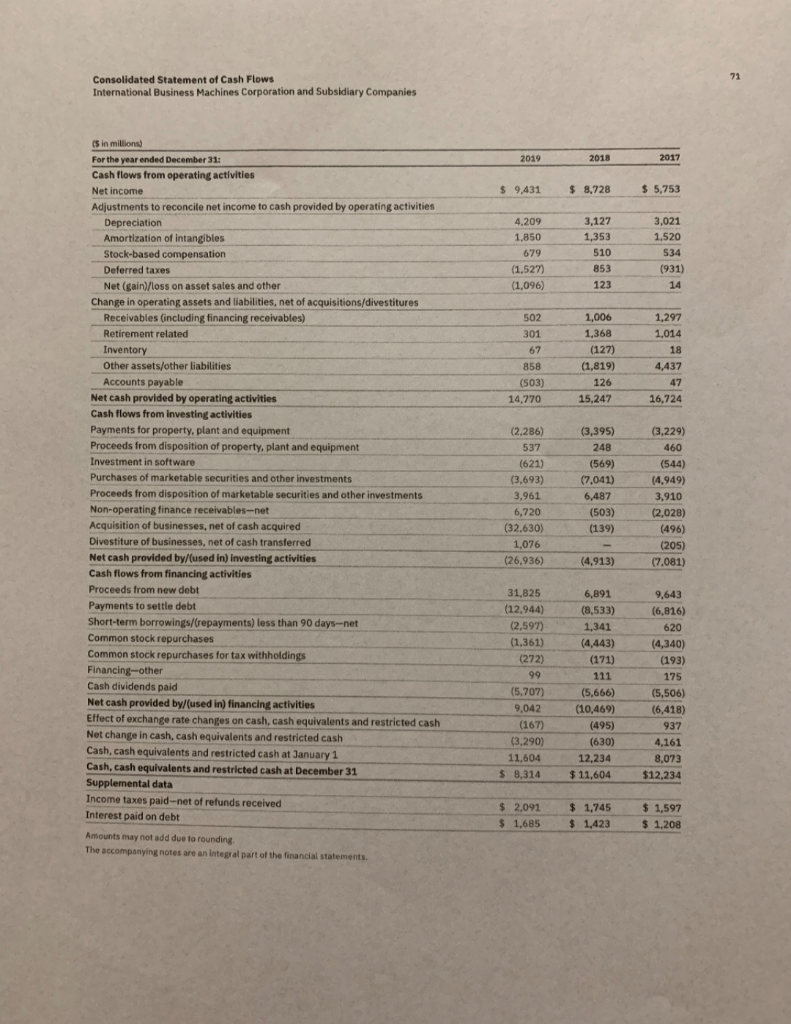

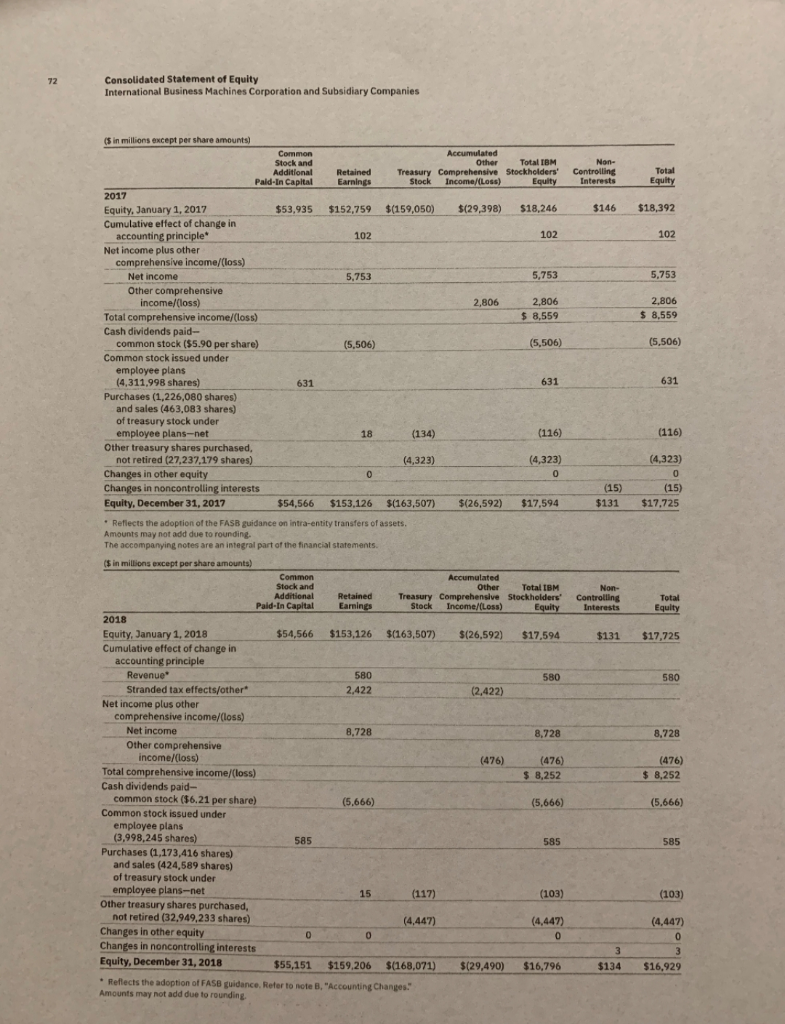

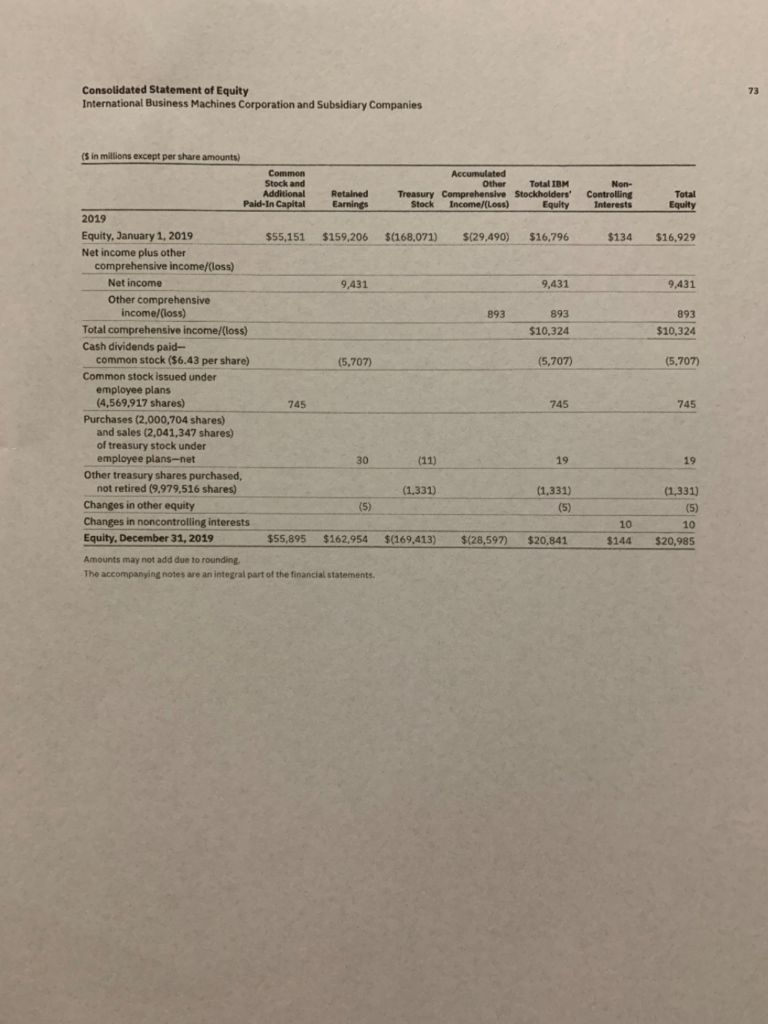

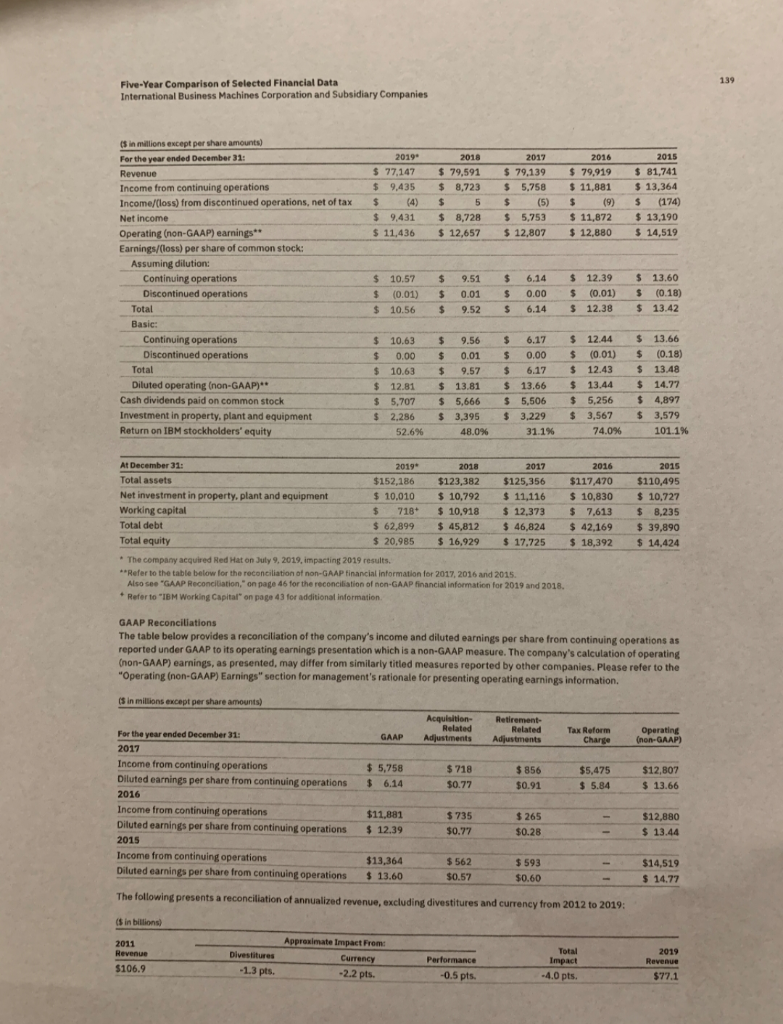

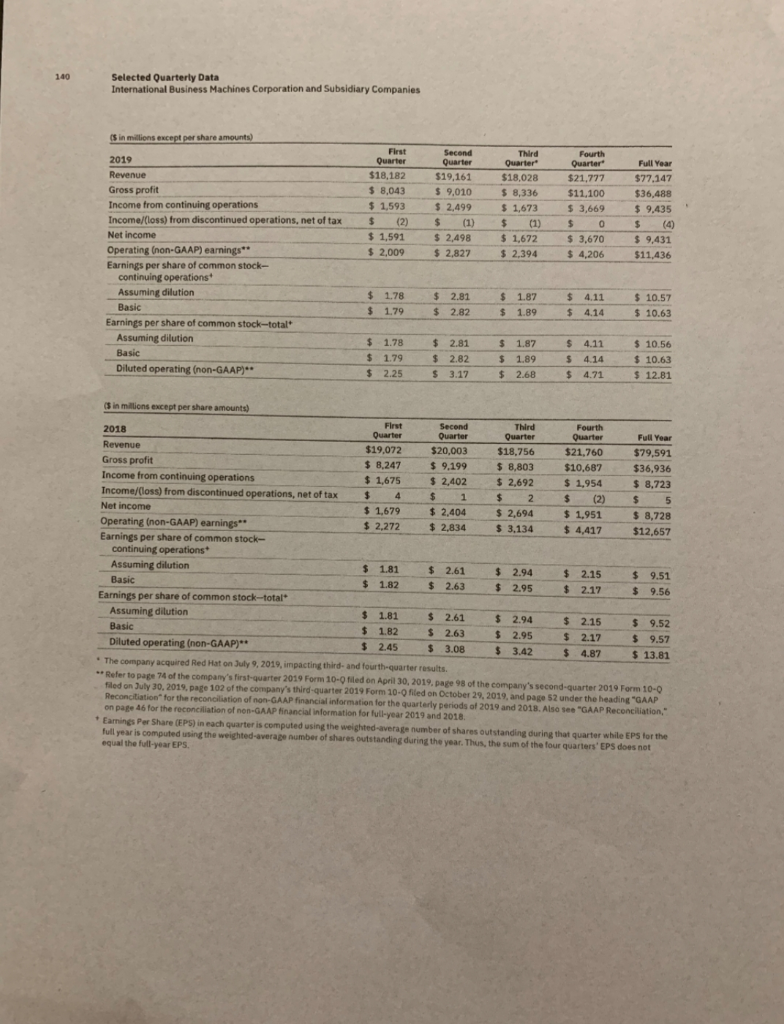

Accounting 10 Chapter 13 Assignment-50 Points Name Round all amounts to the nearest two decimal places. Note: for any ratio that requires you to use net sales, use Total Revenues from the income statement. 1. What is IBM's current ratio on December 31, 2019? 1. 2. What is IBM's acid-test or quick ratio on December 31, 2019? 2. 3. 3. What is IBM's Receivable Turnover for 2019? (Note: use the TRADE receivables only in your computation) 4. What is the number of days to collect accounts receivable for IBM for 2019? 4. 5. What is IBM's inventory turnover for 2019? (Note: use TOTAL COST from the income statement for Cost of Goods Sold) 5 6. What is IBM's days to sell inventory for 2019? 6. 7. What is IBM's conversion period for 2019? 7 8. What is IBM's asset turnover for 2019? 8. 9. What is IBM's profit margin on sales or return on sales for 2019? 9. 10. What is IBM's return on assets for 2019? 10. 11. What is IBM's cash return on sales for 2019? 11. 12. What is IBM's return on TOTAL common stockholders' equity for 2019? Note: Use IBM'S Stockholders' Equity only 12. 13. What is IBM's TOTAL basic (no dilution) earnings per share for 2019? 13. 14. What is IBM's TOTAL earnings per share assuming dilution for 2019? 14. 15. What is IBM's price to earnings ratio for 2019? (Note: use the TOTAL earnings per share assuming dilution and assume a stock price of $134.04) 15. 16. 16. What is IBM's payout ratio for 2018? (Note: cash dividends paid on common stock can be found on the Five-Year Comparison of Selected Data) 17 17. What is IBM's debt to total assets on December 31, 2019? 18. 18. What is times interest earned for IBM for 2019? 19. 19. What is IBM's cash debt coverage for 2019? 20. 20. How many shares of IBM common stock have been authorized as of December 31, 2019? 21. 21. How many shares of IBM common stock have been issued as of December 31, 2019? 22. How many of the issued shares of IBM common stock are being held as treasury shares as of December 31, 2019? 22. 23. How many shares of IBM common stock are outstanding as of December 31, 2019? 23. 24. What is the par value of IBM's common stock? 24. 25. 25. What is IBM's book value per share outstanding on December 31, 2019? (Note: Use IBM's Stockholders' Equity--don't forget that financial statement dollar amounts are in millions of dollars) 26. What is IBM's comprehensive income for 2019 (in millions of dollars)? 26. 27. Was the computation of comprehensive income for IBM shown 1-at the bottom of the income statement; 2-on a separate schedule reconciling net income to comprehensive income; or 3-on the expanded statement of equity? 27. 28. Was IBM's cash flow statement prepared using the direct or indirect method? 28. 29. Which SPECIFIC investing or financing activity USED the most cash during 2019? 29. 30. Which SPECIFIC investing or financing activity PROVIDED the most cash during 2019? 30. 31. On the Balance Sheet on December 31, 2019, what does the balance of the account "Noncontrolling Interest" represent? 31. Note: Use the Notes to the Financial Statements to answer the following questions. On the income statement and balance sheet, there is a letter next to the accounts that tells you which note provides additonal explanation about the account. 32. Are IBM's marketable DEBT securities accounted for as trading securities or available for sale securities? (See Note A, page 83) 32. 33. Back in 2017, IBM had a change in accounting principle (after I told you how rare these would be!) Where was this reported on IBM's financial statements and what was the amount? 33. (Hint: these are reported the same way as corrections of errors from prior periods.) IBM completed the acquisition of another corporation during 2019. (See Note E, page 94) 34. What was the name of the corporation? 35. What percent of the comon shares of that corporation does IBM now own? 34. 35. 36. 36. What estimated useful lives does IBM use for buidlings? (See Note A, page 80) 37. IBM is organized into 5 major business segments. During 2019, they re-organized what was included in each segment and re-named 2 of the segments. Name the two segments whose names were changed. (See Note D, page 90) 37 (1) 37 (2) 38. Who is IBM's auditor? 39. What opinion did they issue in 2019 regarding IBM's financial statemen 40. What "concern" did they raise in 2019 regarding IBM's internal contol? 38. 39. 40. 41. Compute the PERCENT OF CHANGE from 2018 to 2019 in Total Liabilities, Total Assets, Total Revenue, and Net Income by completing the following chart. Be sure to indicate if the change is positive or negative. 2019 2018 $ Change 6 of Change Total Liabilities Total Assets Total Revenues Net Income 42. Prepare a VERTICAL ANALYSIS or common-size income statement for 2019 for the following items only: Total Revenue, Total Cost, Gross Profit, Total Expense and Other Income, Income from Continuing Operations Before Income Taxes, Provision for Income Taxes, Income from Continuing Operatings, Loss from Discontinued Operations, and Net Income Vertical Analysis Total Revenue 77,147 Total Cost 40,659 Gross profit 36,488 Total Expense and Other Income 26,332 Income from Cont Ops Before Taxes 10,166 Provision for Income Taxes 731 Income from Continuing Ops 9,435 Loss/Gain from Disc Operations Net Income 9,431 43. Note: Use the Five Year Comparison of Selected Financial Data Prepare a TREND analysis for Revenue and Net Income for 2015-2019 using 2015 as the base year. 2019 2018 2017 2015 Revenue Trend 2016 Net Income Trend Consolidated Income Statement International Business Machines Corporation and Subsidiary Companies 2017 $48,652 28,772 1,715 79,139 Financing 33,3999 7,587 1,210 42,196 36,943 19,60 5,590 (1,466) 1,125 615 in millions except per share amounts) Notes 2019 2018 For the year ended December 31 Revenue Services $47,493 $49,257 Sales 28,252 28,735 1,402 1,599 Financing Total revenue C 77,147 79,591 Cost Services 32,491 33,687 Sales 7,263 7,835 904 1,132 Total cost 40,659 42,655 Gross profit 36,488 36,936 Expense and other (income) Selling, general and administrative 20,604 19,366 Research, development and engineering 5220 5,989 F 5,379 Intellectual property and custom development income (648) (1,026) Other (income) and expense (968) 1,152 Interest expense P&T 1,344 723 Total expense and other (income) 26,322 25,594 Income from continuing operations before income taxes 10,166 11,342 Provision for income taxes mo G 731 2,619 Income from continuing operations 9,435 8,723 Income/(loss) from discontinued operations, net of tax (4) 5 Net Income $ 9,431 $ 8,728 Earnings/(loss) per share of common stock Assuming dilution Continuing operations $ 10.57 $ 9.51 Discontinued operations (0.01) 0.01 Total $ 10.56 $ 9.52 Basic Continuing operations H $ 10.63 $ 9.56 Discontinued operations 0.00 Total 0.01 $ 10.63 $ 9.57 Weighted-average number of common shares outstanding Assuming dilution 892,813,376 916,315,714 Basic 887.235,105 912,048,072 Reclassified to conform to 2019 presentation. Refer to "Basis of Presentation in note A. "Significant Accounting Policies." Amounts may not add due to rounding. The accompanying notes are an integral part of the financial statements 25,543 11,400 5,642 5,758 (5) $ 5,753 $ 6.14 0.00 $ 6.14 II III $ 6.17 0.00 $ 6.17 937,385,625 932,828,295 69 Consolidated Statement of Comprehensive Income International Business Machines Corporation and Subsidiary Companies Notes 2019 $ 9,431 2018 $8,728 2017 $5,75 S (39) (730) 152 S 1 (2) - 1 1 2 1 (2) S (689) 75 (614) (136) 449 313 (58) (363) (421) ($ in millions) For the year ended December 31: Net Income Other comprehensive income/(loss), before tax Foreign currency translation adjustments Net changes related to available-for-sale securities Unrealized gains/losses) arising during the period Reclassification of (gains)/losses to net income Total net changes related to available-for-sale securities Unrealized gains/(losses) on cash flow hedges Unrealized gains/(losses) arising during the period Reclassification of (gains)/losses to net income Total unrealized gains/(losses) on cash flow hedges Retirement-related benefit plans Prior service costs/(credits) Net (losses)/gains arising during the period Curtailments and settlements Amortization of prior service (credits)/costs Amortization of net (gains)/losses Total retirement-related benefit plans Other comprehensive income/(loss), before tax Income tax (expense)/benefit related to items of other comprehensive income Other comprehensive income/(loss) Total comprehensive income Amounts may not add due to rounding, The accompanying notes are an integral part of the financial statements. S 0 (73) (120) 41 (9) 1,843 1,681 1,029 (182) (2,517) 11 (73) 2,966 204 (215) 682 19 (88) 2.889 3,502 3,235 S S S (136) 893 $10,324 (262) (476) $8,252 (429) 2,806 $8,559 70 Consolidated Balance Sheet International Business Machines Corporation and Subsidiary Companies Notes 2019 2018 $ 8.172 141 696 $ 11,379 225 618 1 K J 7.870 14,192 1,733 1.619 1,896 2.101 38,420 32,028 22.018 10,010 4,996 8,712 6,865 2,472 5,182 58,222 15,235 2,074 $ 152,186 7.432 22,388 743 1,682 2,300 2,378 49,146 32,460 21,668 10,792 L L L M V G N N 9.148 4,666 2,676 5,216 36,265 3.087 2,386 $ 123,382 0 $ (in millions except per share amounts) At December 31: Assets Current assets Cash and cash equivalents Restricted cash Marketable securities Notes and accounts receivable-trade (net of allowances of $299 in 2019 and $309 in 2018) Short-term financing receivables (net of allowances of $188 in 2019 and $244 in 2018) Other accounts receivable (net of allowances of $33 in 2019 and $38 in 2018) Inventory Deferred costs Prepaid expenses and other current assets Total current assets Property, plant and equipment Less: Accumulated depreciation Property, plant and equipment-net Operating right-of-use assets-net Long-term financing receivables (net of allowances of $33 in 2019 and 548 in 2018) Prepaid pension assets Deferred costs Deferred taxes Goodwill Intangible assets-net Investments and sundry assets Total assets Liabilities and equity Current liabilities Taxes Short-term debt Accounts payable Compensation and benefits Deferred income Operating lease liabilities Other accrued expenses and liabilities Total current liabilities Long-term debt Retirement and nonpension postretirement benefit obligations Deferred income Operating tease liabilities Other liabilities Total liabilities Commitments and Contingencies Equity IBM stockholders' equity Common stock, par value $.20 per share, and additional paid-in capital Shares authorized: 4,687,500,000 Shares issued (2019-2,237,996,975: 2018-2,233,427,058) Retained earnings Treasury stock, at cost (shares: 2019-1,350.886,521: 2018-1,340,947,648) Accumulated other comprehensive income/(loss) Total IBM stockholders' equity Noncontrolling interests Total equity Total llabilities and equity * Reflects the adoption of the FASB guidance on leases Amounts may not add due to rounding The accompanying notes are an integral part of the financial statements. $ G I&P 3,046 10,207 6,558 3,310 11,165 M 2,839 8.797 4,896 3,406 12,026 1,380 4,357 37,701 54,102 17,142 3.851 3,879 14,526 131,202 I&P v 3,941 38,227 35,605 17.002 3,445 M Q 12,174 106,452 R S 55,895 55,151 162,954 (169,413) (28,597) 20.841 144 20,985 $152,186 159,206 (168,071) (29.490) 16,796 134 16,929 $ 123,382 A 71 Consolidated Statement of Cash Flows International Business Machines Corporation and Subsidiary Companies ($ in millions) For the year ended December 31: Cash flows from operating activities 2019 2018 2017 $ 9,431 $ 8,728 $ 5,753 Net income Adjustments to reconcile net income to cash provided by operating activities Depreciation 4,209 1,850 679 (1,527 (1,096) 3,127 1,353 510 3,021 1,520 534 (931) 14 853 123 502 301 67 1,006 1,368 (127) (1,819) 126 15,247 1,297 1,014 18 4,437 47 16,724 858 (503) 14,770 Amortization of intangibles Stock-based compensation Deferred taxes Net (gain)/loss on asset sales and other Change in operating assets and liabilities, net of acquisitions/divestitures Receivables (including financing receivables) Retirement related Inventory To endly Other assets/other liabilities Accounts payable Net cash provided by operating activities Cash flows from investing activities Payments for property, plant and equipment Proceeds from disposition of property, plant and equipment Investment in software Purchases of marketable securities and other investments Proceeds from disposition of marketable securities and other investments Non-operating finance receivables--net Acquisition of businesses, net of cash acquired Divestiture of businesses, net of cash transferred Net cash provided by/(used in) Investing activities Cash flows from financing activities Proceeds from new debt elle debe Payments to settle debt Short-term borrowings/(repayments) less than 90 days-net Common stock repurchases Com Common stock repurchases for tax withholdings Financing-other Cash dividends paid Net cash provided by/(used in) financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Net change in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at January 1 Cash, cash equivalents and restricted cash at December 31 Supplemental data Income taxes paid-net of refunds received Interest paid on debt (2,286) 537 (621) (3,693) 3,961 6,720 (32.630) 1,076 (26,936) (3,395) 248 (569) (7,041) 6,487 (503) (139) (3,229) 460 (544) (4.949) 3,910 (2,028) (496) (205) (7,081) (4,913) 9,643 (6,816) 620 (4,340) (193) 175 31,825 (12,944) (2,597) (1,361) (272) 99 (5,707) 9,042 (167) (3.290) 11,604 $ 8,314 6,891 (8,533) 1,341 (4,443) (171) 111 11 (5,666) (10,469) (495) (630) 12,234 $ 11,604 (5,506) (6,418) 937 4,161 8,073 $12,234 $ 2,091 $ 1,685 $ 1,745 $ 1,423 $ 1,597 $ 1,208 Amounts may not add due to rounding The accompanying notes are an integral part of the financial statements 72 Consolidated Statement of Equity International Business Machines Corporation and Subsidiary Companies Non- Controlling Interests Total Equity $146 $18,392 102 5,753 2,806 $ 8,559 (5,506) 631 (116) (15) $131 (4,323) 0 (15) $17,725 (5 in millions except per share amounts) Common Accumulated Stock and Other Total IBM Additional Retained Treasury Comprehensive Stockholders' Pald-In Capital Earnings Stock Income/(Loss) Equity 2017 Equity, January 1, 2017 $53,935 $152,759 $(159,050) $(29,398) $18,246 Cumulative effect of change in accounting principle 102 102 Net income plus other comprehensive income/(loss) Net income 5,753 5,753 Other comprehensive income/(loss) 2,806 2,806 Total comprehensive income/(loss) $ 8,559 Cash dividends paid- common stock ($5.90 per share) (5,506) (5,506) Common stock issued under employee plans (4,311,998 shares) 631 631 Purchases (1,226,080 shares) and sales (463,083 shares) of treasury stock under employee plans-net 18 (134) (116) Other treasury shares purchased, not retired (27,237,179 shares) (4,323) (4,323) Changes in other equity 0 0 Changes in noncontrolling interests Equity, December 31, 2017 $54,566 $153.126 $(163,507) $(26,592) $17,594 Reflects the adoption of the FASB guidance on intra-entity transfers of assets. Amounts may not add due to rounding. The accompanying notes are an integral part of the financial statements in millions except per share amounts) Common Accumulated Stock and Other Total IBM Additional Retained Treasury Comprehensive Stockholders' Pald-In Capital Earnings Stock Inceme/(Loss) Equity 2018 Equity, January 1, 2018 $54,566 $153,126 $(163,507) $(26,592) $17,594 Cumulative effect of change in accounting principle Revenue 580 580 Stranded tax effects/other 2,422 (2,422) Net income plus other comprehensive income/(loss) Net income 8,728 8,728 Other comprehensive income/(loss) (476) (476) Total comprehensive income/(loss) $ 8,252 Cash dividends paid- common stock ($6.21 per share) (5,666) (5,666) Common stock issued under employee plans (3,998,245 shares) 585 585 Purchases (1,173,416 shares) and sales (424,589 shares) of treasury stock under employee plans-net 15 (117) (103) Other treasury shares purchased, not retired (32,949,233 shares) (4,447) (4,447) Changes in other equity 0 0 0 Changes in noncontrolling interests Equity, December 31, 2018 $55,151 $159,206 $(168,071) $(29,490) $16,796 Reflects the adoption of FASB guidance. Refer to note 3,"Accounting Changes." Amounts may not add due to rounding. Non- Controlling Interests Total Equity $131 $17,725 580 8,728 (476) $ 8,252 (5.666) 585 (103) (4,447) 0 3 $16,929 3 $134 73 Consolidated Statement of Equity International Business Machines Corporation and Subsidiary Companies Retained Earnings Accumulated Other Total IBM Treasury Comprehensive Stockholders' Stock Income/(Loss) Equity Non- Controlling Interests Total Equity $159,206 $(168,071) $(29,490) $16,796 $134 $16,929 9,431 9,431 9,431 893 893 $10,324 893 $10,324 ($ in millions except per share amounts) Common Stock and Additional Paid-In Capital 2019 Equity, January 1, 2019 $55,151 Net income plus other comprehensive income/(loss) Net income Other comprehensive income/(loss) Total comprehensive income/(loss) Cash dividends paid- common stock ($6.43 per share) Common stock issued under employee plans (4,569,917 shares) 745 Purchases (2,000,704 shares) and sales (2,041,347 shares) of treasury stock under employee plans-net Other treasury shares purchased, not retired (9,979,516 shares) Changes in other equity Changes in noncontrolling interests Equity, December 31, 2019 $55,895 (5,707) (5,707) (5,707) 745 745 30 (11) 19 19 (1,331) (1,331) (5) (5) (1,331) (5) 10 $20,985 $162,954 $(169,413) $(28,597) 10 $144 $20,841 Amounts may not add due to rounding, The accompanying notes are an integral part of the financial statements. 139 Five-Year Comparison of Selected Financial Data International Business Machines Corporation and Subsidiary Companies 2019 $ 77,147 $ 9,435 $ $ 9,431 $ 11,436 2018 $ 79,591 $ 8,723 $ 5 $ 8,728 $ 12,657 2017 $ 79,139 $ 5,758 $ (5) $ 5,753 $ 12,807 2016 $ 79,919 $ 11,881 $ (9) $ 11,872 $ 12.880 2015 $ 81,741 $ 13,364 $ (174) $ 13,190 $ 14,519 is in millions except per share amounts) For the year ended December 31: Revenue Income from continuing operations Income/Closs) from discontinued operations, net of tax Net income Operating (non-GAAP) earnings ** Earnings/(loss) per share of common stock: Assuming dilution: Continuing operations Discontinued operations Total Basic: Continuing operations Discontinued operations Total Diluted operating (non-GAAP)** Cash dividends paid on common stock Investment in property, plant and equipment Return on IBM stockholders' equity $ 10.57 $ (0.01) $ 10.56 $ $ $ 9.51 0.01 9.52 $ $ $ 6.14 0.00 $ 12.39 $ (0.01) $ 12.38 $ 13.60 $ (0.18) $ 13.42 6.14 $ 10.63 $ 0.00 $ 10.63 $ 12.81 $ 5,707 $ 2.286 52.6% $ 9.56 $ 0.01 $ 9.57 $ 13.81 $ 5,666 $ 3,395 48.0% $ 6.17 $ 0.00 $ 6.17 $ 13.66 $ 5,506 $ 3.229 31.1% $ 12.44 $ (0.01) $ 12.43 $ 13.44 $ 5,256 $ 3,567 74.0% $ 13.66 $ (0.18) $ 13.48 $ 14.77 $ 4,897 $ 3,579 101.1% At December 31: 2019 2018 2017 2016 Total assets $152,186 $123,382 $125,356 $117,470 Net investment in property, plant and equipment $ 10,010 $ 10,792 $ 11.116 $ 10,830 Working capital $ 718+ $ 10,918 $ 12,373 $ 7,613 Total debt $ 62,899 $ 45,812 $ 46,824 $ 42,169 Total equity $ 20,985 $ 16,929 $ 17,725 $ 18,392 The company acquired Red Hat on July 9, 2019, impacting 2019 results. **Refer to the table below for the reconciliation of non-GAAP financial information for 2017, 2016 and 2015. Also see "GAAP Reconciliation," on page 46 for the reconciliation of non-GAAP financial information for 2019 and 2018, *Refer to "IBM Working Capital on page 43 for additional information 2015 $110,495 $ 10,727 $ 8,235 $ 39,890 $ 14,424 GAAP Reconciliations The table below provides a reconciliation of the company's income and diluted earnings per share from continuing operations as reported under GAAP to its operating earnings presentation which is a non-GAAP measure. The company's calculation of operating (non-GAAP) earnings, as presented, may differ from similarly titled measures reported by other companies. Please refer to the "Operating (non-GAAP) Earnings" section for management's rationale for presenting operating earnings information, (Sin millions except per share amounts) Acquisition Related Adjustments Retirement Related Adjustments GAAP Tax Reform Charge Operating (non-GAAP) $ 5,758 $ 6.14 $ 718 $0.77 $ 856 $0.91 $5,475 $ 5.84 $12,807 $ 13.66 For the year ended December 31: 2017 Income from continuing operations Diluted earnings per share from continuing operations 2016 Income from continuing operations Diluted earnings per share from continuing operations 2015 Income from continuing operations Diluted earnings per share from continuing operations $11,881 $ 12.39 $ 735 $0.77 $ 265 $0.28 $12,880 $ 13.44 $13,364 $ 13.60 $ 562 $0.57 $ 593 $0.60 $14,519 $ 14.77 The following presents a reconciliation of annualized revenue, excluding divestitures and currency from 2012 to 2019: (5 in billions 2011 Revenue $106.9 Divestitures -1.3 pts Approximate Impact From: Currency -2.2 pts. Performance -0.5 pts Total Impact 2019 Revenue $77.1 -4.0 pts. 140 Selected Quarterly Data International Business Machines Corporation and Subsidiary Companies is in millions except per share amounts) First Quarter $18,182 $ 8,043 $ 1,593 $ (2) $ 1,591 $ 2,009 Second Quarter $19,161 $ 9,010 $ 2,499 $ (1) $ 2,498 $ 2,827 Third Quarter $18,028 $ 8,336 $ 1,673 $ (1) $ 1,672 $ 2.394 Fourth Quarter $21,777 $11,100 $ 3,669 $ 0 $ 3,670 $ 4,206 Full Year $77,147 $36,488 $ 9,435 $ (4) $ 9,431 $11,436 2019 Revenue Gross profit Income from continuing operations Income/(loss) from discontinued operations, net of tax Net income Operating (non-GAAP) earnings** Earnings per share of common stock- continuing operations Assuming dilution Basic Earnings per share of common stock-total Assuming dilution Basic Diluted operating (non-GAAP)** $ 1.78 $ 1.79 $ 2.81 $ 2.82 $ 1.87 $ 1.89 $ 4.11 $ 4.14 $ 10.57 $ 10.63 $ 1.78 $ 1.79 $ 2.25 $ 2.81 $ 2.82 $ 3.17 $ 1.87 $ 1.89 $ 2.68 $ 4.11 $ 4.14 $ 4.71 $ 10.56 $ 10.63 $ 12.81 (5 in millions except per share amounts) First Second Third Fourth 2018 Quarter Quarter Quarter Quarter Full Year Revenue $19,072 $20,003 $18.756 $21,760 $79,591 Gross profit $ 8.247 $ 9,199 $ 8,803 $10.687 $36,936 Income from continuing operations $1,675 $ 2,402 $ 2,692 $ 1,954 $ 8,723 Income/(loss) from discontinued operations, net of tax $ 4 $ 1 $ 2 $ (2) $ 5 Net income $ 1,679 $ 2,404 $ 2,694 $ 1.951 $ 8,728 Operating (non-GAAP) earnings** $ 2.272 $ 2,834 $ 3,134 $ 4,417 $12,657 Earnings per share of common stock- continuing operations Assuming dilution $ 1.81 $ 2.61 $ 2.94 $ 2.15 $ 9.51 Basic $ 1.82 $ 2.63 $ 2.95 $ 2.17 $ 9.56 Earnings per share of common stock-total Assuming dilution $ 1.81 $ 2.61 $ 2.94 $ 2.15 $ 9.52 Basic $ 1.82 $ 2.63 $ 2.95 $ 2.17 $ 9.57 Diluted operating (non-GAAP)** $ 2.45 $ 3.08 $ 3.42 $ 4.87 $ 13.81 The company acquired Red Hat on July 9, 2019, impacting third- and fourth-quarter results, **Refer to page 74 of the company's first quarter 2019 Form 10-filed on April 30, 2019, page 98 of the company's second-quarter 2019 Form 10-0 filed on July 30, 2019, page 102 of the company's third-quarter 2019 Form 10-0 filed on October 29, 2019, and page 52 under the heading "GAAP Reconciliation for the reconciliation of non-GAAP financial information for the quarterly periods of 2019 and 2018. Also se "GAAP Reconciliation, on page 46 for the reconciliation of non-GAAP financial Information for full-year 2019 and 2018. Earnings Per Share (EPS) in each quarter is computed using the weighted average number of shares outstanding during that quarter while EPS for the full year is computed using the weighted average number of shares outstanding during the year. Thus, the sum of the four quarters'EPS does not equal the full-year EPS