Consider a whole life insurance policy of benefit amount $10,000 issued to an individual aged 40. You are given the following information: (i) (ii)

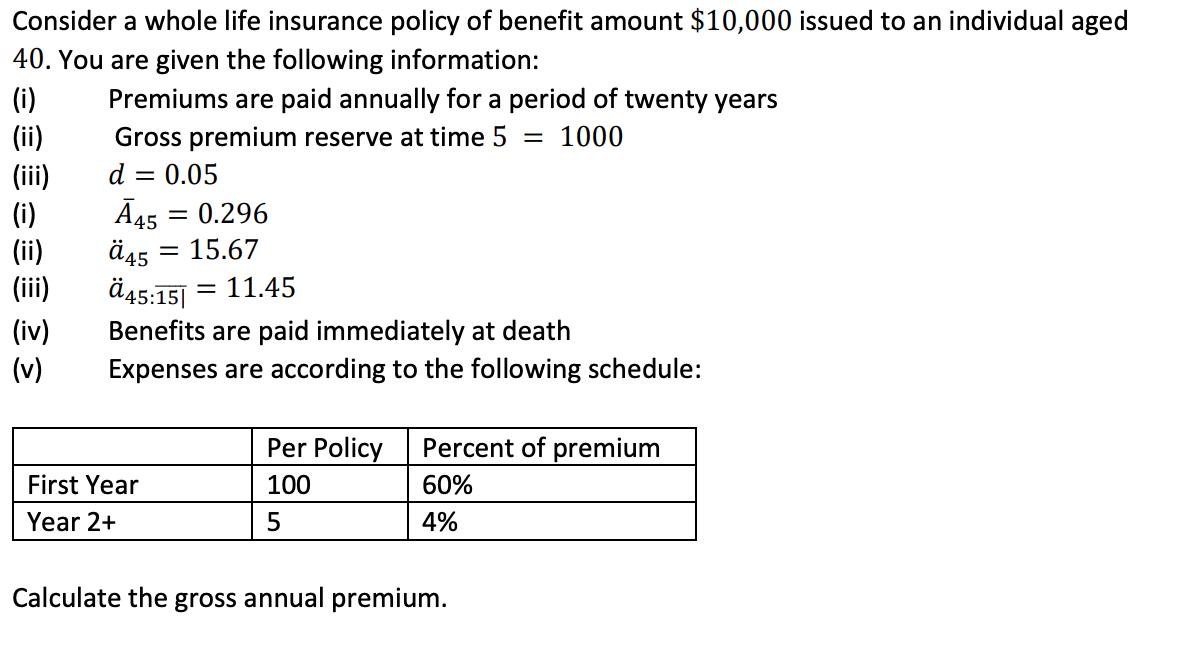

Consider a whole life insurance policy of benefit amount $10,000 issued to an individual aged 40. You are given the following information: (i) (ii) (iii) (i) (ii) (iii) (iv) (v) Premiums are paid annually for a period of twenty years Gross premium reserve at time 5 = 1000 d = 0.05 45 45 = 0.296 First Year Year 2+ = 15.67 45:15| = 11.45 Benefits are paid immediately at death Expenses are according to the following schedule: Per Policy 100 5 Percent of premium 60% 4% Calculate the gross annual premium.

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To complete the requirements in Section E we need to prepare a cash budget for the coming year taking into account patient revenues and cash collectio...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started