Answered step by step

Verified Expert Solution

Question

1 Approved Answer

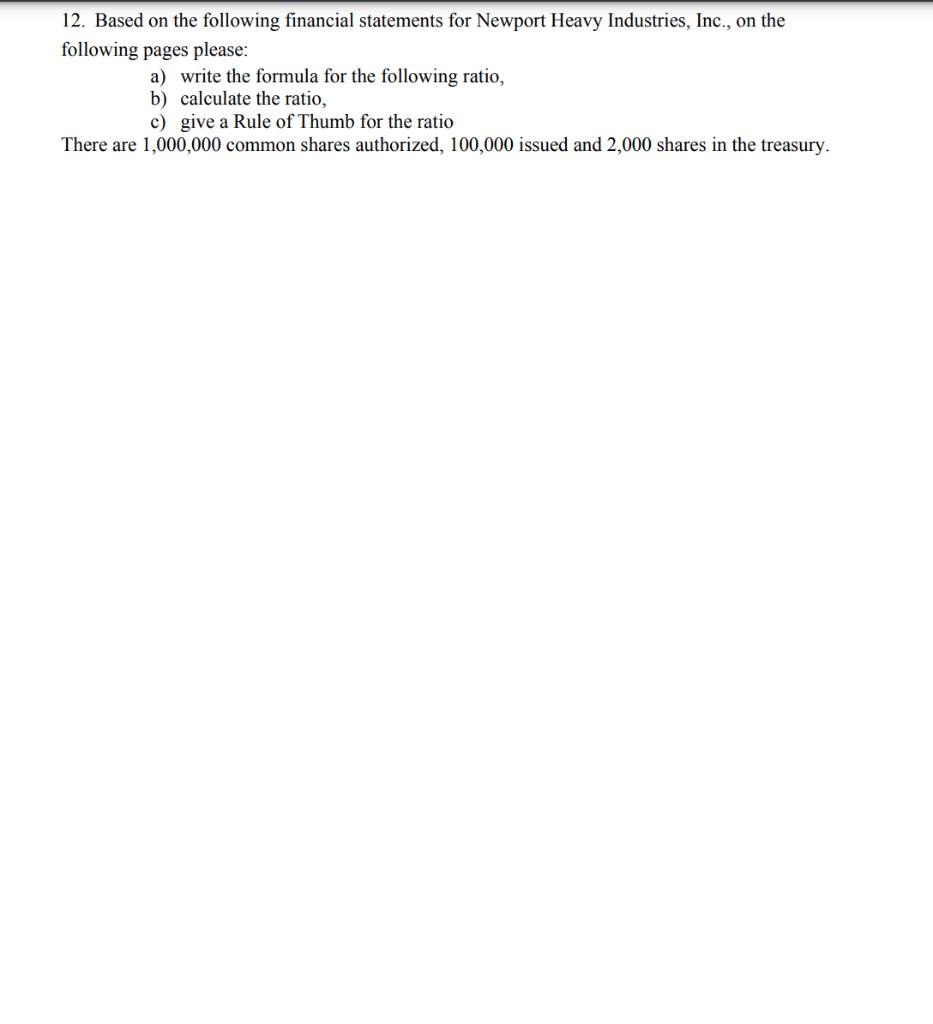

12. Based on the following financial statements for Newport Heavy Industries, Inc., on the following pages please: a) write the formula for the following

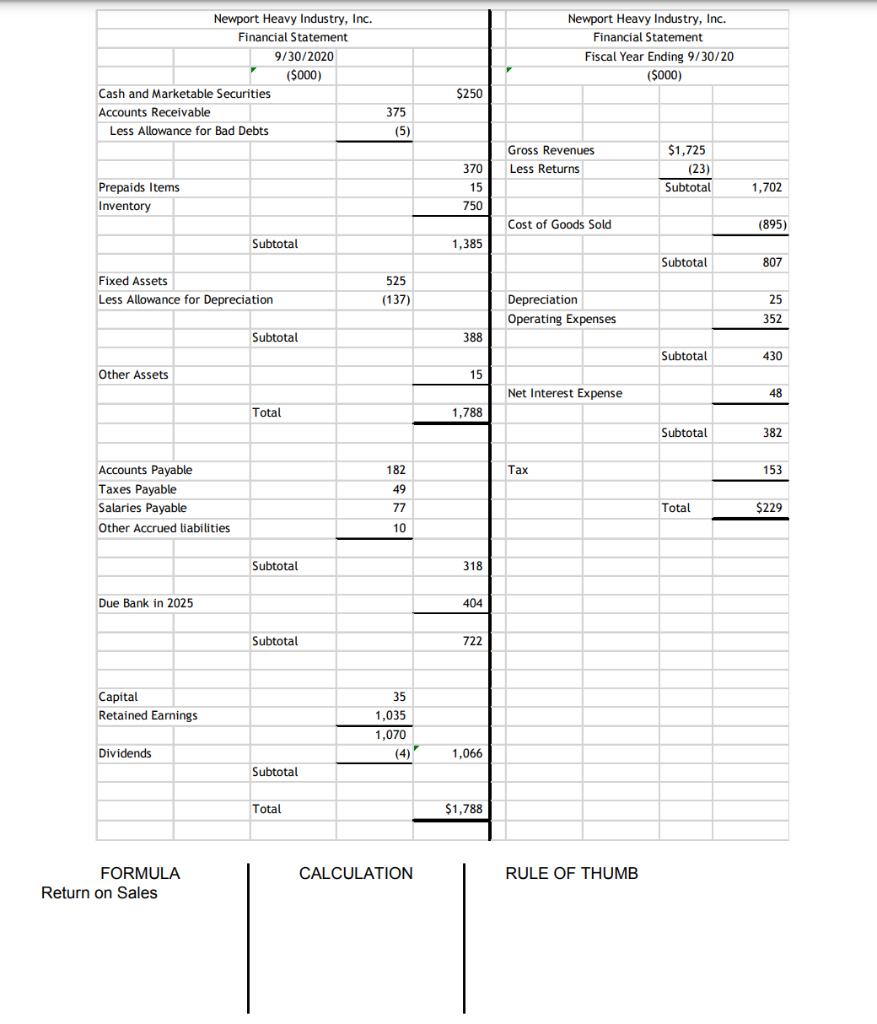

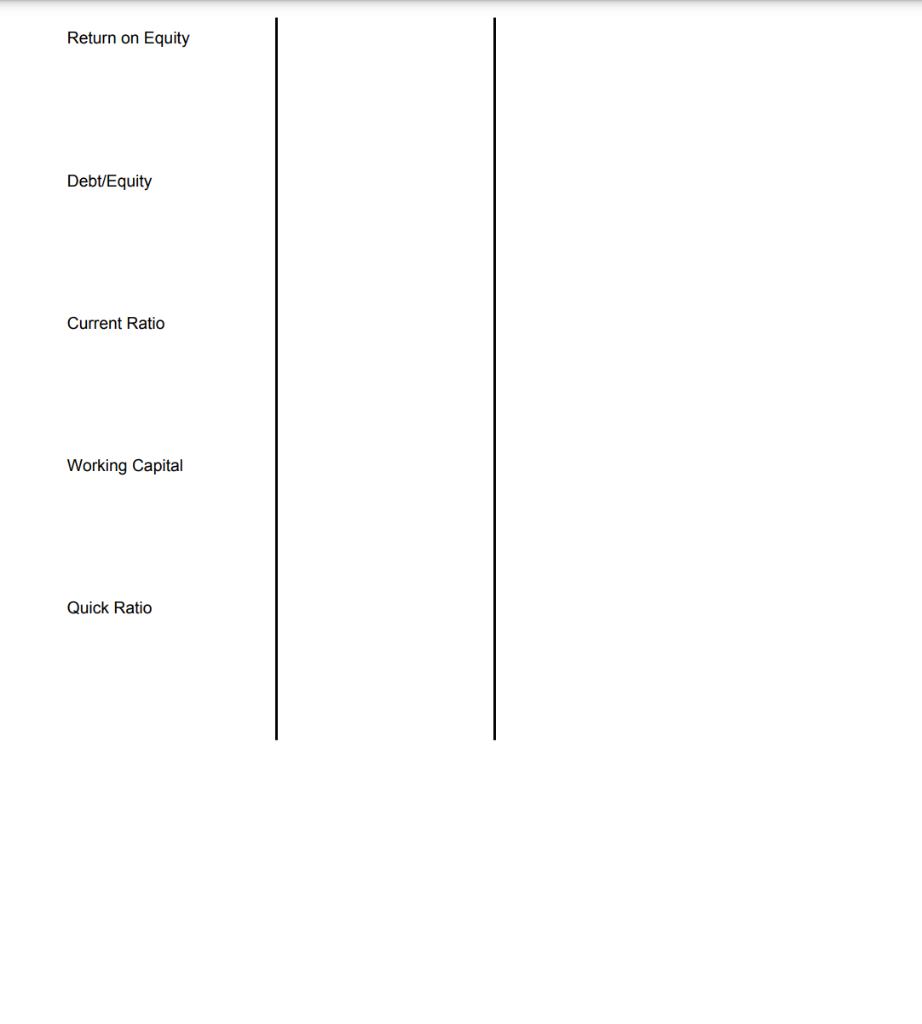

12. Based on the following financial statements for Newport Heavy Industries, Inc., on the following pages please: a) write the formula for the following ratio, b) calculate the ratio, c) give a Rule of Thumb for the ratio There are 1,000,000 common shares authorized, 100,000 issued and 2,000 shares in the treasury. Cash and Marketable Securities Accounts Receivable Less Allowance for Bad Debts Prepaids Items Inventory Other Assets Fixed Assets Less Allowance for Depreciation Accounts Payable Taxes Payable Salaries Payable Other Accrued liabilities Due Bank in 2025 Newport Heavy Industry, Inc. Financial Statement Capital Retained Earnings Dividends FORMULA Return on Sales 9/30/2020 ($000) Subtotal Subtotal Total Subtotal Subtotal Subtotal Total 375 (5) 525 (137) 182 49 77 10 35 1,035 1,070 (4) CALCULATION $250 370 15 750 1,385 388 15 1,788 318 404 722 1,066 $1,788 Newport Heavy Industry, Inc. Financial Statement Fiscal Year Ending 9/30/20 ($000) Gross Revenues Less Returns Cost of Goods Sold Depreciation Operating Expenses Tax Net Interest Expense RULE OF THUMB $1,725 (23) Subtotal Subtotal Subtotal Subtotal Total 1,702 (895) 807 25 352 430 48 382 153 $229 Return on Equity Debt/Equity Current Ratio Working Capital Quick Ratio Days Sales Outstanding GP% NCF FORMULA EBITDA Book Value of Company Book Value of Company /Share Market Value of the Company CALCULATION RULE OF THUMB

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

aFormula EPS net income shares outstanding Rule of thumb EPS should be greater than 10 b 1 Accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started