Question

George and Martha, both age 50, are filing a Married Filing Jointly return for tax year 2017. They have two dependents, their two children,

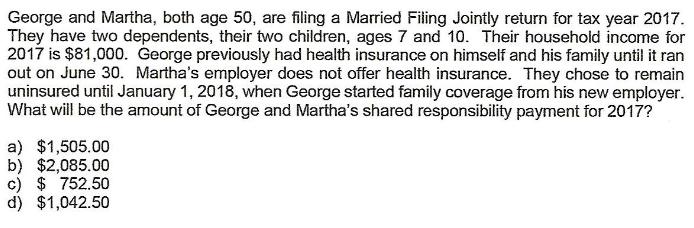

George and Martha, both age 50, are filing a Married Filing Jointly return for tax year 2017. They have two dependents, their two children, ages 7 and 10. Their household income for 2017 is $81,000. George previously had health insurance on himself and his family until it ran out on June 30. Martha's employer does not offer health insurance. They chose to remain uninsured until January 1, 2018, when George started family coverage from his new employer. What will be the amount of George and Martha's shared responsibility payment for 2017? a) $1,505.00 b) $2,085.00 c) $ 752.50 d) $1,042.50

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution The correct option is b ie ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Taxation 2020 Edition

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander, Debra Prendergast, Dan Schisler

13th Edition

1259969622, 978-1260483147

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App