Question

14. A stock currently trading at $115 pays a $4 dividend in four months and ten months. A call option on the stock with

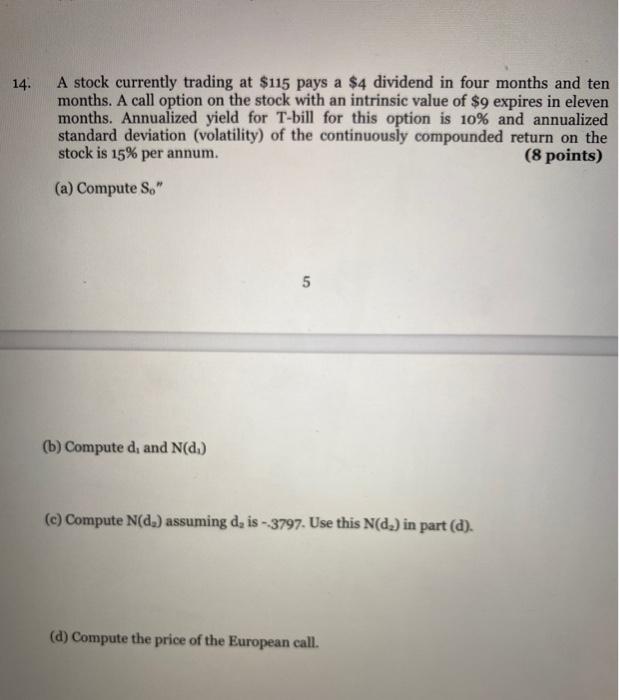

14. A stock currently trading at $115 pays a $4 dividend in four months and ten months. A call option on the stock with an intrinsic value of $9 expires in eleven months. Annualized yield for T-bill for this option is 10% and annualized standard deviation (volatility) of the continuously compounded return on the stock is 15% per annum. (8 points) (a) Compute So" (b) Compute d, and N(d.) 5 (c) Compute N(d) assuming d, is --3797. Use this N(d,) in part (d). (d) Compute the price of the European call.

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Anslnler Given Current maaliet paice cmp us 4 Dluidend paiel annualiged yrield C6 10 6 standan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Finance Putting Theory Into Practice

Authors: Piet Sercu

1st edition

069113667X, 978-0691136677

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App