Answered step by step

Verified Expert Solution

Question

1 Approved Answer

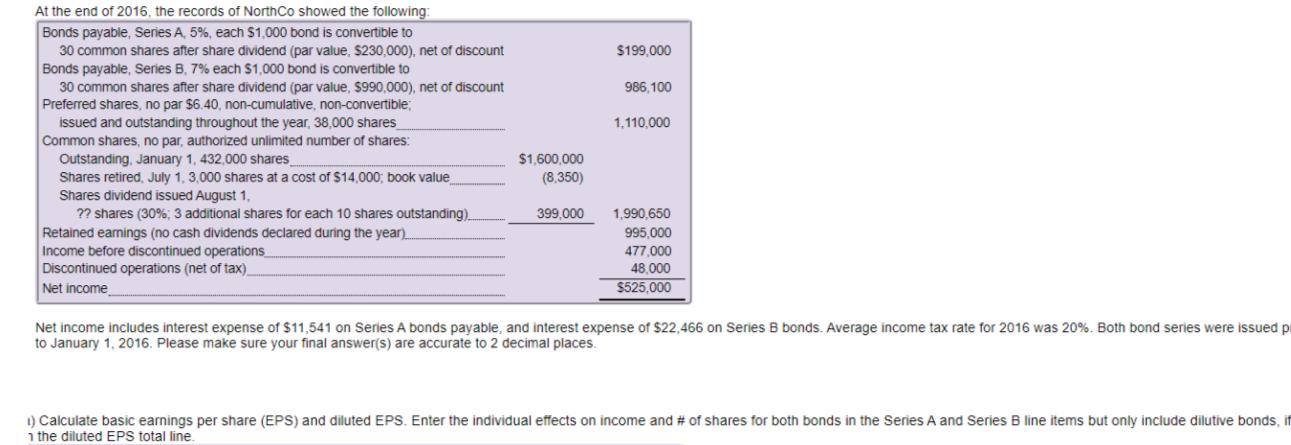

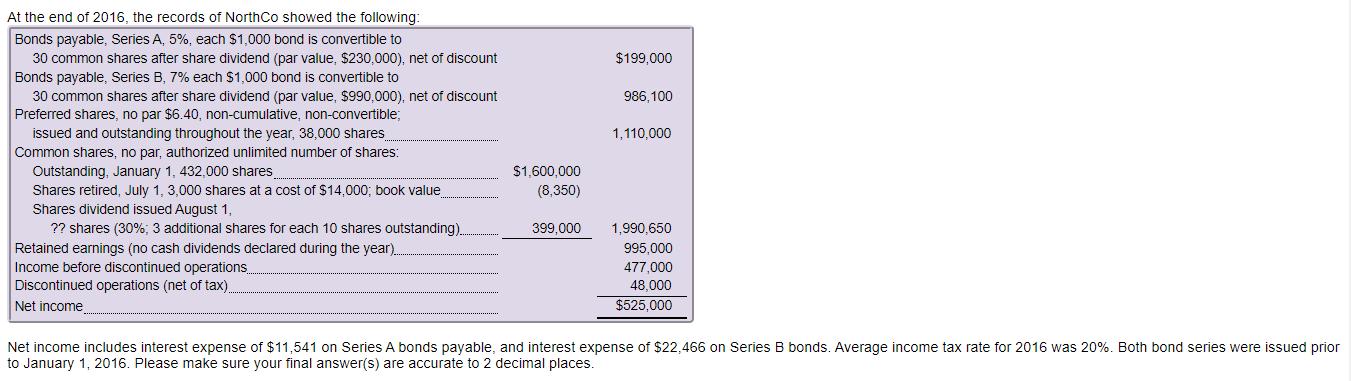

I edited the question and I downloaded a clear picture of my question At the end of 2016, the records of NorthCo showed the following:

I edited the question and I downloaded a clear picture of my question

I edited the question and I downloaded a clear picture of my question

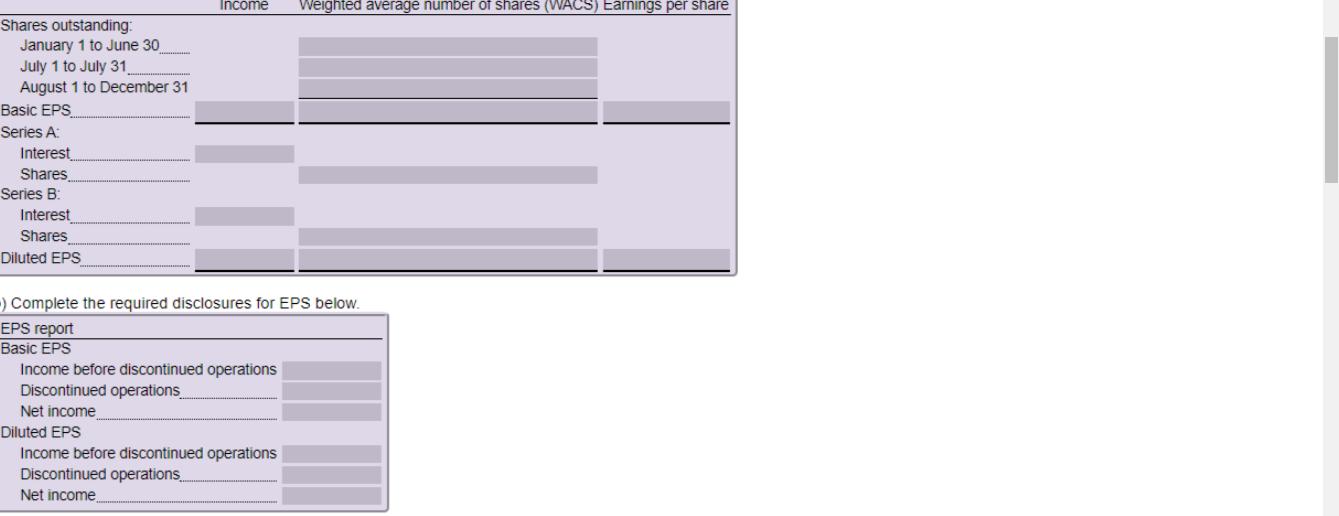

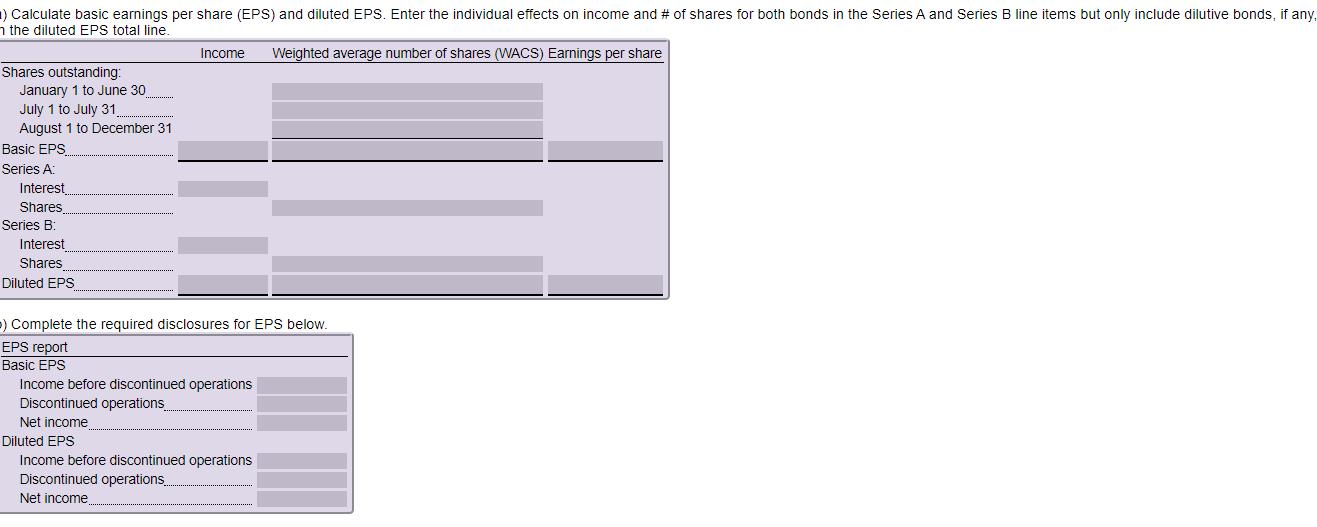

At the end of 2016, the records of NorthCo showed the following: Bonds payable, Series A, 5%, each $1,000 bond is convertible to 30 common shares after share dividend (par value, $230,000), net of discount Bonds payable, Series B, 7% each $1,000 bond is convertible to 30 common shares after share dividend (par value, $990,000), net of discount Preferred shares, no par $6.40, non-cumulative, non-convertible; issued and outstanding throughout the year, 38,000 shares Common shares, no par, authorized unlimited number of shares: Outstanding, January 1, 432,000 shares Shares retired, July 1, 3,000 shares at a cost of $14,000; book value Shares dividend issued August 1, ?? shares (30%; 3 additional shares for each 10 shares outstanding). Retained earnings (no cash dividends declared during the year). Income before discontinued operations Discontinued operations (net of tax)__ Net income $1,600,000 (8,350) 399,000 $199,000 986,100 1,110,000 1,990,650 995,000 477,000 48,000 $525,000 Net income includes interest expense of $11,541 on Series A bonds payable, and interest expense of $22,466 on Series B bonds. Average income tax rate for 2016 was 20%. Both bond series were issued p to January 1, 2016. Please make sure your final answer(s) are accurate to 2 decimal places. 1) Calculate basic earnings per share (EPS) and diluted EPS. Enter the individual effects on income and # of shares for both bonds in the Series A and Series B line items but only include dilutive bonds, if 1 the diluted EPS total line.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTIO...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started