Answered step by step

Verified Expert Solution

Question

1 Approved Answer

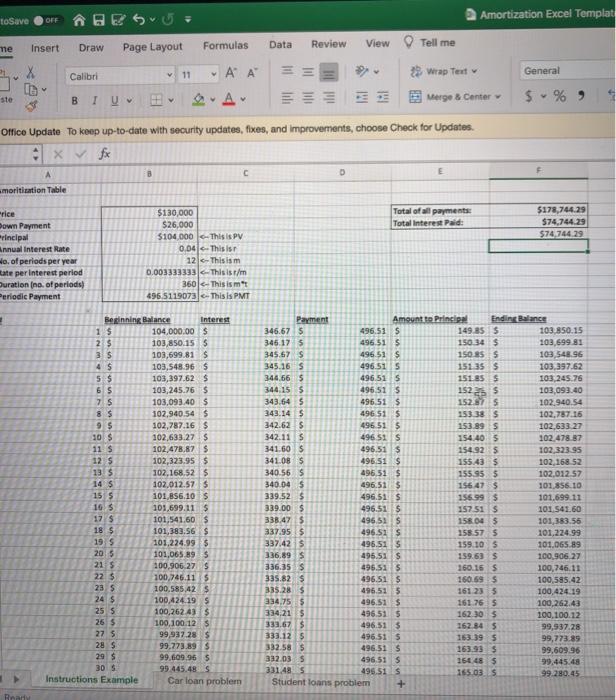

2. (2 points) In what month will the borrower begin paying more towards principal month than interest? 3. (2 points) What is the total

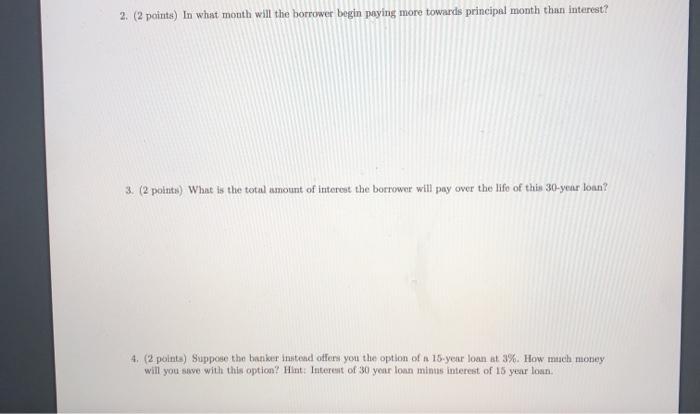

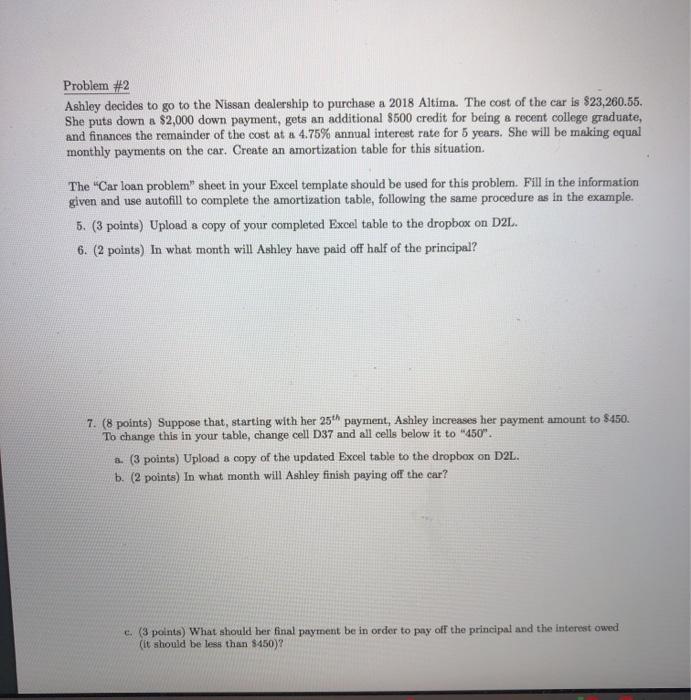

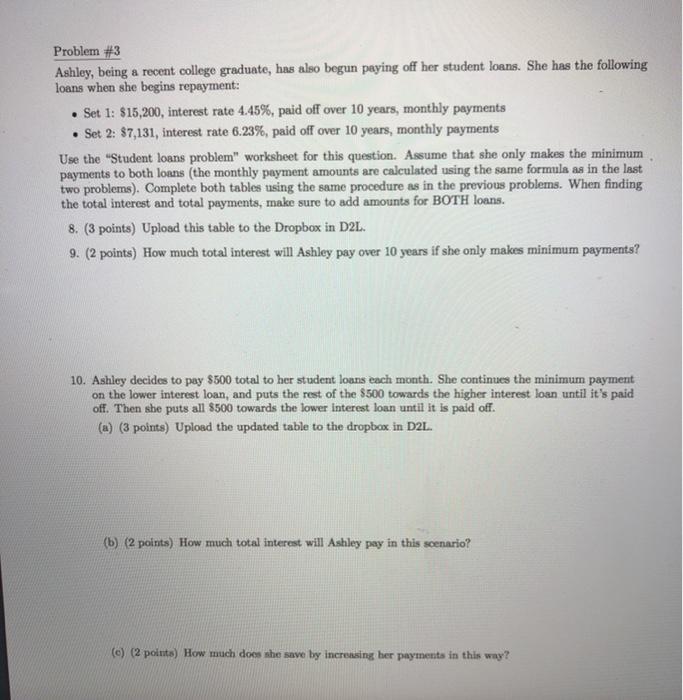

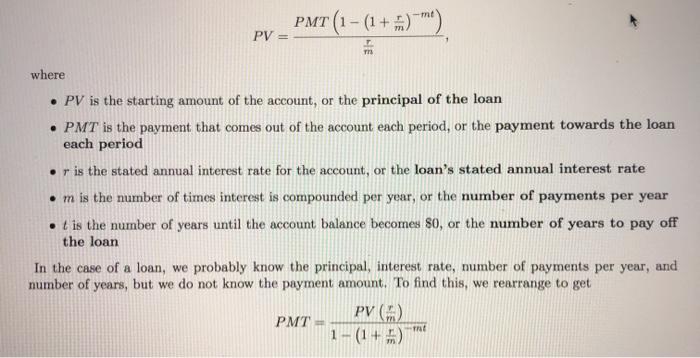

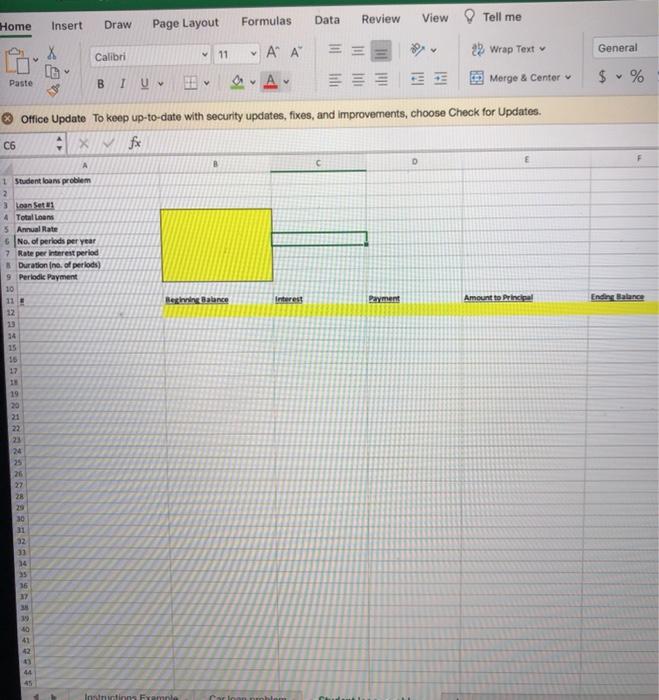

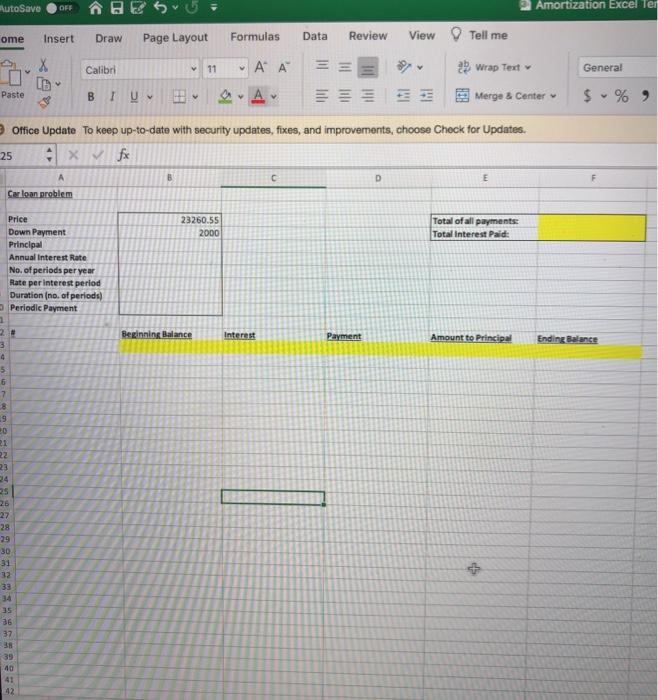

2. (2 points) In what month will the borrower begin paying more towards principal month than interest? 3. (2 points) What is the total amount of interest the borrower will pay over the life of this 30-year loan? 4. (2 points) Suppose the banker instead offers you the option of a 15-year loan at 3%. How much money will you save with this option? Hint: Interest of 30 year loan minus interest of 15 year loan. Problem #2 Ashley decides to go to the Nissan dealership to purchase a 2018 Altima. The cost of the car is $23,260.55. She puts down a $2,000 down payment, gets an additional $500 credit for being a recent college graduate, and finances the remainder of the cost at a 4.75% annual interest rate for 5 years. She will be making equal monthly payments on the car. Create an amortization table for this situation. The "Car loan problem" sheet in your Excel template should be used for this problem. Fill in the information given and use autofill to complete the amortization table, following the same procedure as in the example. 5. (3 points) Upload a copy of your completed Excel table to the dropbox on D2L. 6. (2 points) In what month will Ashley have paid off half of the principal? 7. (8 points) Suppose that, starting with her 25th payment, Ashley increases her payment amount to $450. To change this in your table, change cell D37 and all cells below it to "450". a. (3 points) Upload a copy of the updated Excel table to the dropbox on D2L. b. (2 points) In what month will Ashley finish paying off the car? c. (3 points) What should her final payment be in order to pay off the principal and the interest owed (it should be less than $450)? Problem #3 Ashley, being a recent college graduate, has also begun paying off her student loans. She has the following loans when she begins repayment: Set 1: $15,200, interest rate 4.45%, paid off over 10 years, monthly payments Set 2: $7,131, interest rate 6.23%, paid off over 10 years, monthly payments Use the "Student loans problem" worksheet for this question. Assume that she only makes the minimum payments to both loans (the monthly payment amounts are calculated using the same formula as in the last two problems). Complete both tables using the same procedure as in the previous problems. When finding the total interest and total payments, make sure to add amounts for BOTH loans. 8. (3 points) Upload this table to the Dropbox in D2L. 9. (2 points) How much total interest will Ashley pay over 10 years if she only makes minimum payments? 10. Ashley decides to pay $500 total to her student loans each month. She continues the minimum payment on the lower interest loan, and puts the rest of the $500 towards the higher interest loan until it's paid off. Then she puts all $500 towards the lower interest loan until it is paid off. (a) (3 points) Upload the updated table to the dropbox in D2L. (b) (2 points) How much total interest will Ashley pay in this scenario? (e) (2 points) How much does she save by increasing her payments in this way? PV PMT (1-(1+)) m where PV is the starting amount of the account, or the principal of the loan PMT is the payment that comes out of the account each period, or the payment towards the loan each period r is the stated annual interest rate for the account, or the loan's stated annual interest rate .m is the number of times interest is compounded per year, or the number of payments per year .t is the number of years until the account balance becomes 80, or the number of years to pay off the loan In the case of a loan, we probably know the principal, interest rate, number of payments per year, and number of years, but we do not know the payment amount. To find this, we rearrange to get PMT= PV (#) 1-(1+) -mt Home C6 Paste 10 2222=22AZARRARE 12 A 1 Student loans problem 2 3 Loan Set # 4 Total Loans 5 Annual Rate 6 No. of periods per year 7 13 34 9 Periodic Payment 15 15 17 18 19 20 21 Rate per interest period Duration (no. of periods) 23 24 25 26 27 28 29 30 31 32 IUE Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. ** N fx 33 34 35 36 37 38 39 95003: 40 V 41 42 Insert Draw Page Layout 43 (G 44 V 45 Calibri B V 11. Instructions Example V Beginning Balance Formulas ' ' A V Interest Data roblem M Review Payment View D Tell me 22 Wrap Text Merge & Center E Amount to Principal General $% Ending Balance AutoSave OFF ome Paste 25 A Car loan problem Insert 1 2# 3 4 5 6 7 8 19 20 21 22 23 24 25 26 27 X 16 V Price Down Payment Principal Annual Interest Rate 28 29 30 31 32 33 34 No. of periods per year Rate per interest period 35 36 37 38 39 40 41 42 Draw Calibri Duration (no. of periods) Periodic Payment B IUV Formulas Page Layout A A Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. x fx B 11 23260.55 2000 Beginning Balance SA Interest Data C Review View ME M Payment Tell me 2 Wrap Text D Merge & Center E Total of all payments: Total Interest Paid: Amortization Excel Ter Amount to Principal General $ Ending Balance V % 9 toSave OFF S me 21 V ste Insert X Ce A moritization Table "rice Down Payment Principal Annual Interest Rate Draw Ready Calibri B IU No. of periods per year Rate per interest period Duration (no. of periods) Periodic Payment 15 2 $ 35 45 5 $ 65 7 5 85 95 10 $ 11 S 12 S 13 S 14 5 15 5 16.5 17 S 18 $ 19 5 20:5 Page Layout Beginning Balance 21 S 22 5 V Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. xfx 23 5 24 $ 25 S 26 $ V B 27 S 28 $ 29 $ 30 $ Instructions Example V 11 Formulas $130,000 $26,000 $104,000 This is PV 0.04-This is 12

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The price of the car is 2326055 The loan amount is 2076055 2326055 2000 500 2076055 5 The payments are assumed at the end of the period EMI can be cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started