Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. (26 pts total) Stark Industries, Inc. a profit-maximizing US firm specializing in advanced weapons systems owns a patent on the technology of Iron

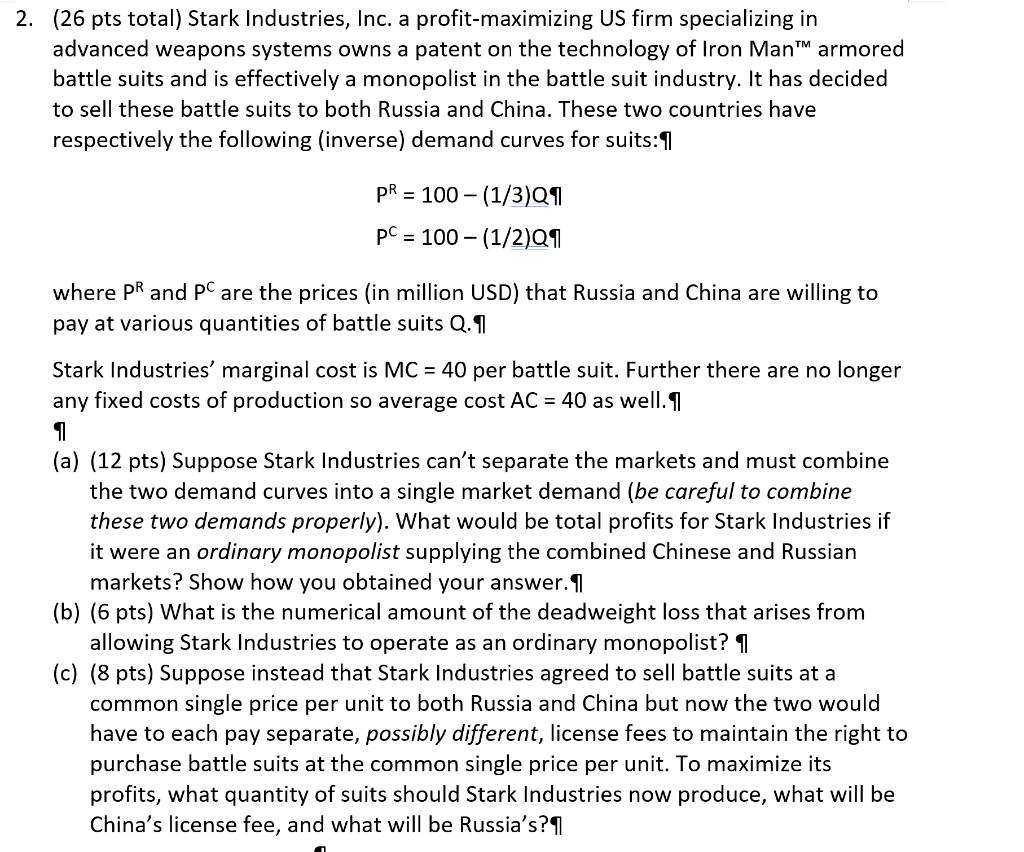

2. (26 pts total) Stark Industries, Inc. a profit-maximizing US firm specializing in advanced weapons systems owns a patent on the technology of Iron ManTM armored battle suits and is effectively a monopolist in the battle suit industry. It has decided to sell these battle suits to both Russia and China. These two countries have respectively the following (inverse) demand curves for suits:1 PR = 100 - (1/3)Q1 pC = 100 - (1/2)Q1 where PR and PC are the prices (in million USD) that Russia and China are willing to pay at various quantities of battle suits Q.1 Stark Industries' marginal cost is MC = 40 per battle suit. Further there are no longer any fixed costs of production so average cost AC = 40 as well.1 (a) (12 pts) Suppose Stark Industries can't separate the markets and must combine the two demand curves into a single market demand (be careful to combine these two demands properly). What would be total profits for Stark Industries if it were an ordinary monopolist supplying the combined Chinese and Russian markets? Show how you obtained your answer. (b) (6 pts) What is the numerical amount of the deadweight loss that arises from allowing Stark Industries to operate as an ordinary monopolist? 1 (c) (8 pts) Suppose instead that Stark Industries agreed to sell battle suits at a common single price per unit to both Russia and China but now the two would have to each pay separate, possibly different, license fees to maintain the right to purchase battle suits at the common single price per unit. To maximize its profits, what quantity of suits should Stark Industries now produce, what will be China's license fee, and what will be Russia's?1

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started