Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One idea that the consultant had was to reduce prices to bring in more customers. If average prices were reduced ten percent (10%), and the

One idea that the consultant had was to reduce prices to bring in more customers. If average prices were reduced ten percent (10%), and the number of sales tickets (unit sales) increased to 7,5000, would the company’s income be increased? With prices reduced, what would be the new breakeven point in sales tickets and sales dollars?

How do you get the sales for 2007?

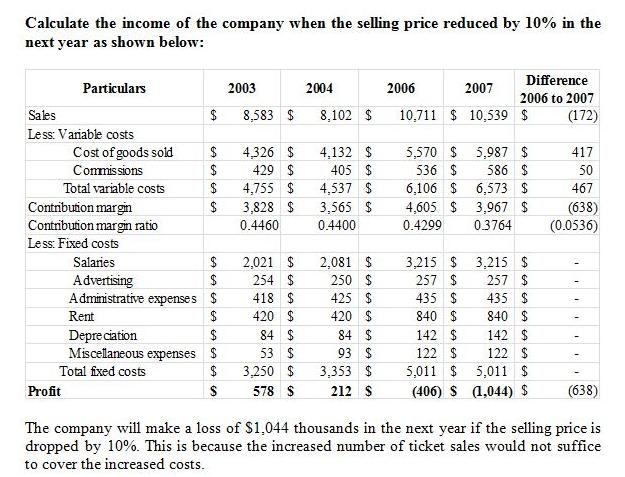

Calculate the income of the company when the selling price reduced by 10% in the next year as shown below: Difference Particulars 2003 2004 2006 2007 2006 to 2007 Sales $ 8,583 $ 8,102 $ 10,711 $ 10,539 $ (172) Le ss: Variable costs Cost of goods sold $ 4,326 $ $ $ 4,132 $ 5,570 $ 536 $ 5,987 $ 586 $ 6,573 $ 3,967 $ 417 Commissions 429 $ 405 $ 50 4,755 $ 3,828 $ 4,537 $ 3,565 $ Total variable costs 6,106 $ 467 Contribution margin Contribution margin ratio $ 4,605 $ (638) (0.0536) 0.4460 0.4400 0.4299 0.3764 Le ss: Fixed costs $ 2,081 $ 250 $ 425 $ 420 $ Salaries 2,021 $ 3,215 $ 257 $ Advertising Administrative expenses $ 3,215 $ 257 $ 435 $ 840 $ $ 254 $ 418 $ 420 $ 435 $ 840 $ Rent $ $ 84 $ Depre ciation Miscellaneous expenses $ Total fixed costs 142 $ 122 $ 5,011 $ 5,011 $ (406) $ (1,044) $ 84 $ 142 $ 53 $ 93 $ 122 $ 2$ 3,250 $ 3,353 $ Profit 578 $ 212 S (638) The company will make a loss of S1,044 thousands in the next year if the selling price is dropped by 10%. This is because the increased number of ticket sales would not suffice to cover the increased costs.

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Breakeven Point It is a point of sales where No Profit and No loss Therefore Break even point Formul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started