General Electric (GE) disclosed the following non-GAAP reconciliation for its Industrial segment from its 2018 Form 10-K. $ illions 2018 2017 2016 GE Industrial

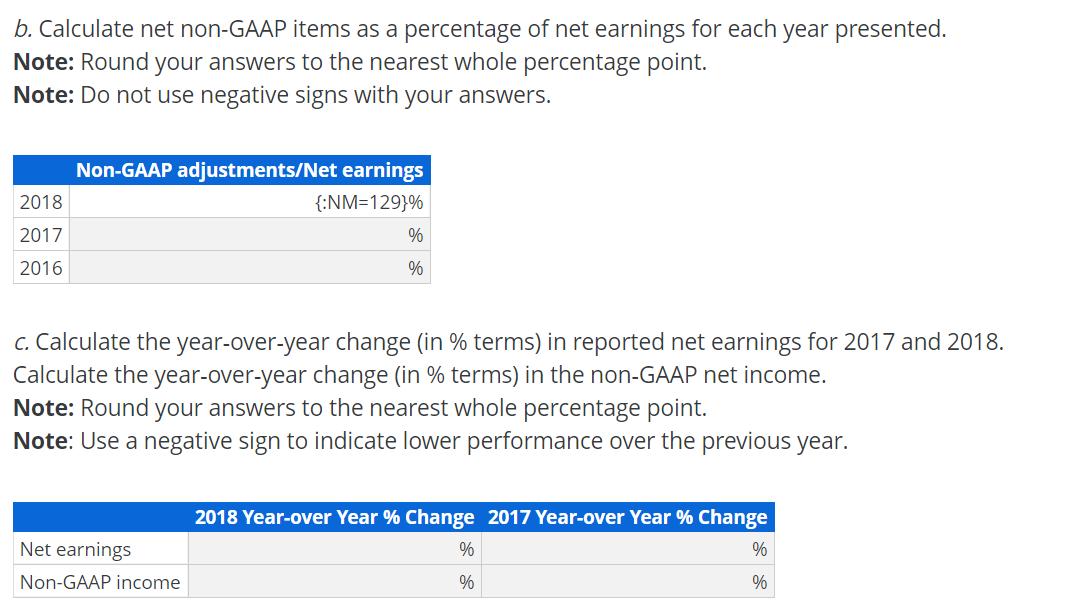

General Electric (GE) disclosed the following non-GAAP reconciliation for its Industrial segment from its 2018 Form 10-K. $ illions 2018 2017 2016 GE Industrial earnings (loss) $(20,587) $(1,841) $9,048 Less: Nonoperating pension benefit costs (net of tax) (2,184) (1,550) (1,527) Less: Gains and impairments for disposed or held for sale businesses (net of tax) 974 864 2,374 Less: Restructuring and other (net of tax) (2,948) (2,778) (2,483) Less: Goodwill impairments (net of tax) (22,371) (1,156) Less: GE Industrial U.S. tax reform enactment adjustment (38) (4,905) Adjusted GE Industrial earnings (loss) (Non-GAAP) $5,980 $7,684 $10,684 Required a. Explain how the non-GAAP items (in total) affected adjusted earnings each year. Net effect of non-GAAP adjustments in 2016: Net effect of non-GAAP adjustments in 2017: Net effect of non-GAAP adjustments in 2018: b. Calculate net non-GAAP items as a percentage of net earnings for each year presented. Note: Round your answers to the nearest whole percentage point. Note: Do not use negative signs with your answers. Non-GAAP adjustments/Net earnings 2018 {:NM=129}% 2017 2016 % c. Calculate the year-over-year change (in % terms) in reported net earnings for 2017 and 2018. Calculate the year-over-year change (in % terms) in the non-GAAP net income. Note: Round your answers to the nearest whole percentage point. Note: Use a negative sign to indicate lower performance over the previous year. 2018 Year-over Year % Change 2017 Year-over Year % Change Net earnings % % Non-GAAP income % %

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started