Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One of the ways the Bank of Canada exercises control over the monetary base is through its purchases and sales of government securities in

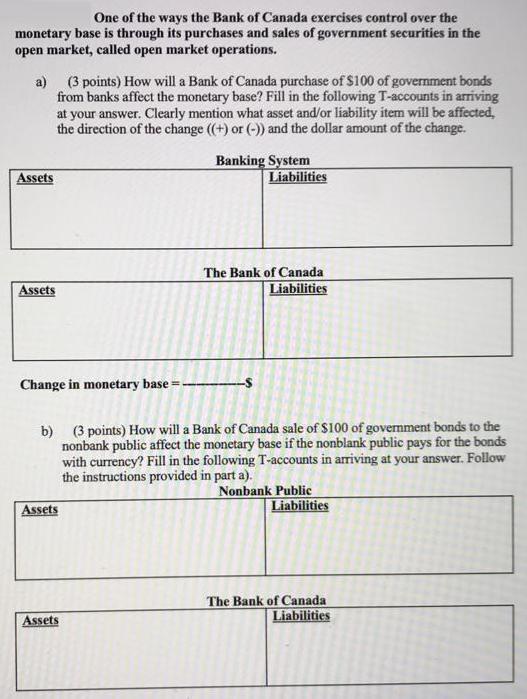

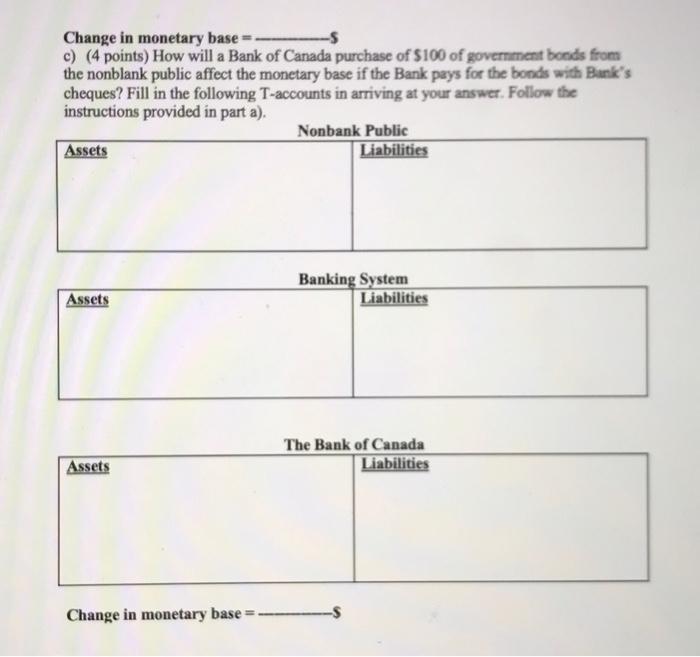

One of the ways the Bank of Canada exercises control over the monetary base is through its purchases and sales of government securities in the open market, called open market operations. a) (3 points) How will a Bank of Canada purchase of $100 of government bonds from banks affect the monetary base? Fill in the following T-accounts in arriving at your answer. Clearly mention what asset and/or liability item will be affected, the direction of the change ((+) or (-)) and the dollar amount of the change. Assets Assets Change in monetary base =- Assets Banking System Liabilities b) (3 points) How will a Bank of Canada sale of $100 of government bonds to the nonbank public affect the monetary base if the nonblank public pays for the bonds with currency? Fill in the following T-accounts in arriving at your answer. Follow the instructions provided in part a). Nonbank Public Assets The Bank of Canada Liabilities Liabilities The Bank of Canada Liabilities Change in monetary base= -S c) (4 points) How will a Bank of Canada purchase of $100 of government bonds from the nonblank public affect the monetary base if the Bank pays for the bonds with Bank's cheques? Fill in the following T-accounts in arriving at your answer. Follow the instructions provided in part a). Assets Assets Assets Change in monetary base= Nonbank Public Liabilities Banking System Liabilities The Bank of Canada Liabilities

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part A The purchase of government bonds from banks would increase the monetary base as it hands more ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started