Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Malika purchased 400 shares of Airasia Bhd for RM15 per share using an initial margin of 60%. Given the maintenance margin of 40%, calculate

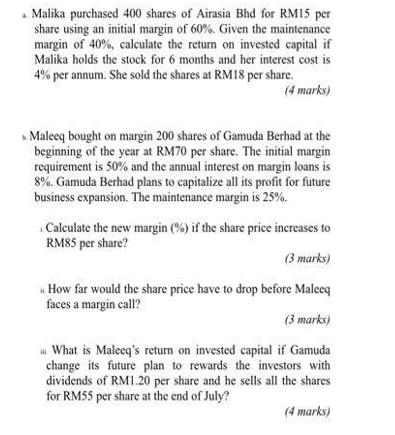

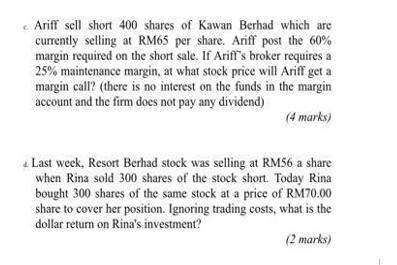

Malika purchased 400 shares of Airasia Bhd for RM15 per share using an initial margin of 60%. Given the maintenance margin of 40%, calculate the return on invested capital if Malika holds the stock for 6 months and her interest cost is 4% per annum. She sold the shares at RM18 per share. (4 marks) Maleeq bought on margin 200 shares of Gamuda Berhad at the beginning of the year at RM70 per share. The initial margin requirement is 50% and the annual interest on margin loans is 8%. Gamuda Berhad plans to capitalize all its profit for future business expansion. The maintenance margin is 25%. Calculate the new margin (%) if the share price increases to RM85 per share? (3 marks) How far would the share price have to drop before Maleeq faces a margin call? (3 marks) What is Maleeq's return on invested capital if Gamuda change its future plan to rewards the investors with dividends of RM1.20 per share and he sells all the shares for RM55 per share at the end of July? (4 marks) Ariff sell short 400 shares of Kawan Berhad which are currently selling at RM65 per share. Ariff post the 60% margin required on the short sale. If Ariff's broker requires a 25% maintenance margin, at what stock price will Ariff get a margin call? (there is no interest on the funds in the margin account and the firm does not pay any dividend) (4 marks) Last week, Resort Berhad stock was selling at RM56 a share when Rina sold 300 shares of the stock short. Today Rina bought 300 shares of the same stock at a price of RM70.00 share to cover her position. Ignoring trading costs, what is the dollar return on Rina's investment? (2 marks)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Malikas return on invested capital is calculated as follows Initial Investment 400 shares x ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started