Answered step by step

Verified Expert Solution

Question

1 Approved Answer

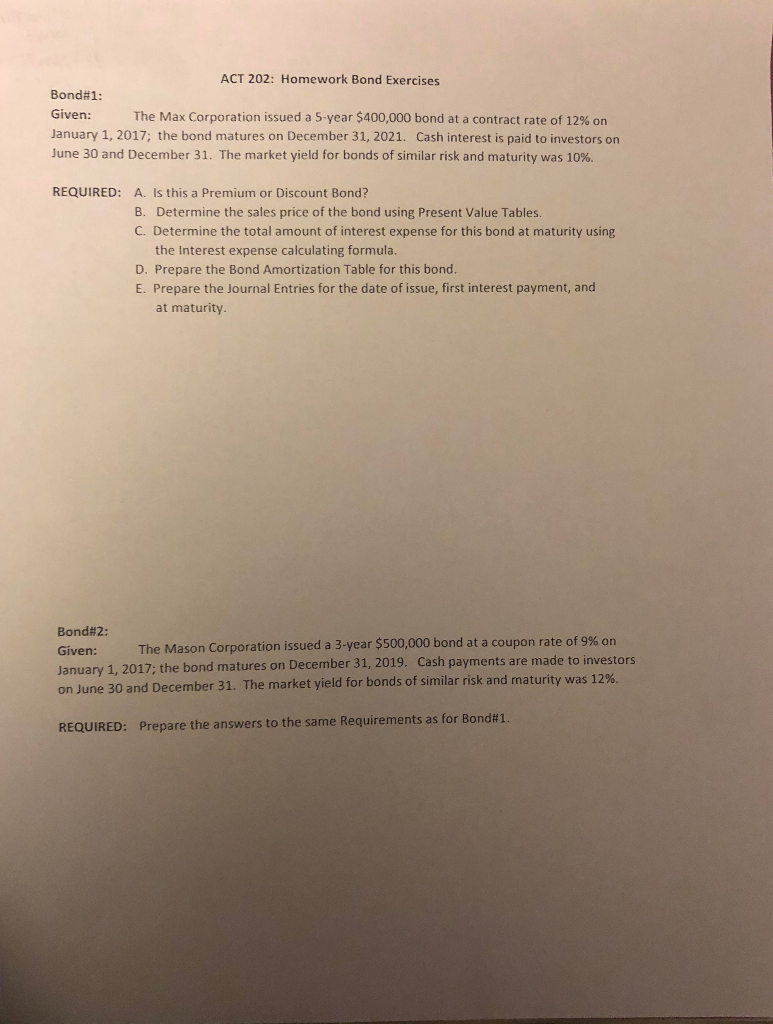

Accounting 202: Bonds Prepare a bond table for each. Using the table, not Excel. Question closed. DO NOT ANSWER ACT 202: Homework Bond Exercises Bond#1:

Accounting 202: Bonds

Prepare a bond table for each. Using the table, not Excel.

Question closed. DO NOT ANSWER

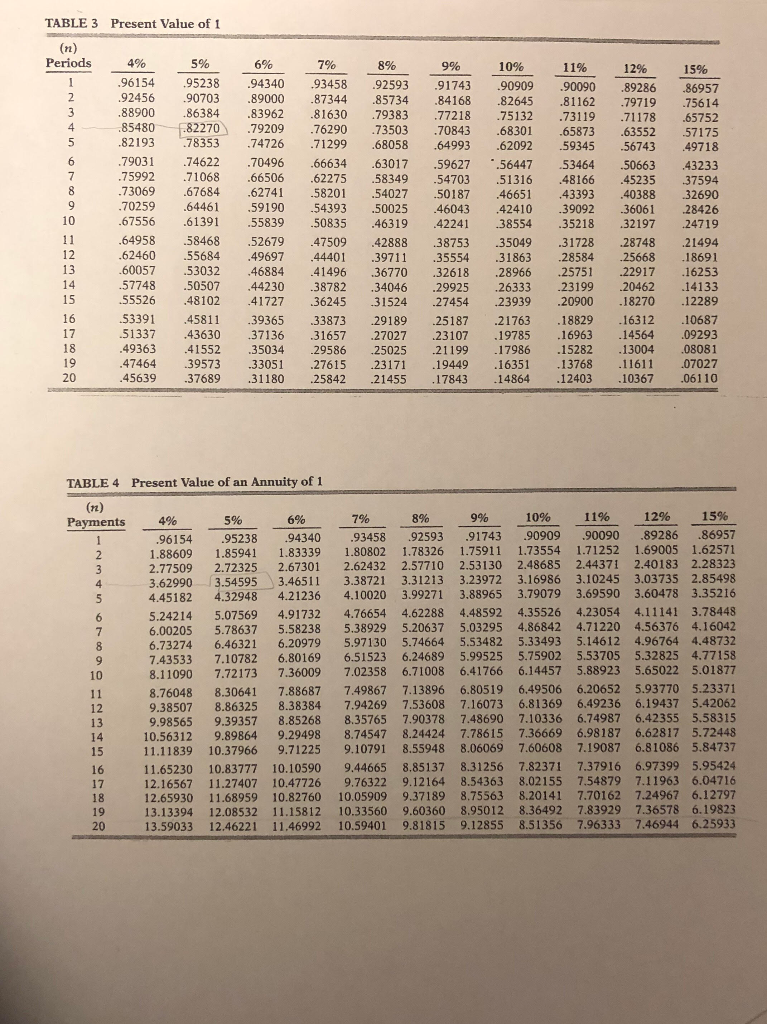

ACT 202: Homework Bond Exercises Bond#1: The MaxCorporationissuedasvears,20200bashinterests paid to investorson January 1, 2017; the bond matures on December 31, 2021. Cash interest is paid to investors on June 30 and December 31 . The market yield for bonds of similar risk and maturity was 10%. REQUIRED: A. Is this a Premium or Discount Bond? B. Determine the sales price of the bond using Present Value Tables. C. Determine the total amount of interest expense for this bond at maturity using the Interest expense calculating formula. D. Prepare the Bond Amortization Table for this bond. E. Prepare the Journal Entries for the date of issue, first interest payment, and at maturity Bond#2: Given: January 1, 2017; the bond matures on December 31, 2019. Cash payments are made to investors on June 30 and December 31. Th The Mason Corporation issued a 3-year $500,000 bond at a coupon rate of 9% on e market yield for bonds of similar risk and maturity was 12%. REQUIRED: Prepare the answers to the same Requirements as for Bond#1 TABLE 3 Present Value of 1 96154 .95238 .94340 .93458 .92593 91743 .90909 .90090 89286 86957 92456 .90703 .89000 .87344 85734 84168 82645 .81162 .79719 75614 88900 86384 83962 81630 79383 77218 75132 .73119 71178 65752 85480 82193 78353 74726 71299 68058 64993 62092 59345 56743 49718 79031 74622 70496 66634 .63017 .59627 .56447 53464 50663 43233 75992 .71068 .66506 62275 .58349.54703 51316 48166 45235 37594 73069 67684 62741 .58201 .54027 .50187 46651 43393 40388 32690 70259 .64461 59190 .54393 50025 46043 42410 39092 36061 28426 .67556 .61391 .55839 50835 46319 42241 38554 35218 32197 24719 64958 .58468 .52679 47509 42888 38753 35049 31728 28748 21494 .62460 .55684 49697 44401 39711 35554 31863 28584 25668 18691 60057 .53032 46884 41496 36770 32618 28966 25751 22917 16253 .57748 .50507 44230 38782 34046 .29925 26333 23199 20462 14133 55526 48102 41727 36245 31524 27454 23939 20900 .18270 .12289 53391 4581 39365 33873 29189 25187 21763 .18829 16312 .10687 51337 43630 37136 31657 27027 23107 .19785 16963 14564 .09293 .49363 .41552 .35034 .29586 .25025 .21199 .17986 .15282 .13004 .08081 47464 39573 33051 27615 23171 .19449 16351 13768 .11611 07027 45639 37689 31180 25842 21455 82270 79209 76290 73503 70843 68301 65873 63552 57175 15 17 18 17843 14864 TABLE 4 Present Value of an Annuity of 1 10% 11% 12% 15% 9615495238 94340 .93458 92593 .91743 90909 90090 89286 86957 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.62990 3.545953.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 5.24214 5.07569 4.917324.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 9.98565 9.393578.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933 ACT 202: Homework Bond Exercises Bond#1: The MaxCorporationissuedasvears,20200bashinterests paid to investorson January 1, 2017; the bond matures on December 31, 2021. Cash interest is paid to investors on June 30 and December 31 . The market yield for bonds of similar risk and maturity was 10%. REQUIRED: A. Is this a Premium or Discount Bond? B. Determine the sales price of the bond using Present Value Tables. C. Determine the total amount of interest expense for this bond at maturity using the Interest expense calculating formula. D. Prepare the Bond Amortization Table for this bond. E. Prepare the Journal Entries for the date of issue, first interest payment, and at maturity Bond#2: Given: January 1, 2017; the bond matures on December 31, 2019. Cash payments are made to investors on June 30 and December 31. Th The Mason Corporation issued a 3-year $500,000 bond at a coupon rate of 9% on e market yield for bonds of similar risk and maturity was 12%. REQUIRED: Prepare the answers to the same Requirements as for Bond#1 TABLE 3 Present Value of 1 96154 .95238 .94340 .93458 .92593 91743 .90909 .90090 89286 86957 92456 .90703 .89000 .87344 85734 84168 82645 .81162 .79719 75614 88900 86384 83962 81630 79383 77218 75132 .73119 71178 65752 85480 82193 78353 74726 71299 68058 64993 62092 59345 56743 49718 79031 74622 70496 66634 .63017 .59627 .56447 53464 50663 43233 75992 .71068 .66506 62275 .58349.54703 51316 48166 45235 37594 73069 67684 62741 .58201 .54027 .50187 46651 43393 40388 32690 70259 .64461 59190 .54393 50025 46043 42410 39092 36061 28426 .67556 .61391 .55839 50835 46319 42241 38554 35218 32197 24719 64958 .58468 .52679 47509 42888 38753 35049 31728 28748 21494 .62460 .55684 49697 44401 39711 35554 31863 28584 25668 18691 60057 .53032 46884 41496 36770 32618 28966 25751 22917 16253 .57748 .50507 44230 38782 34046 .29925 26333 23199 20462 14133 55526 48102 41727 36245 31524 27454 23939 20900 .18270 .12289 53391 4581 39365 33873 29189 25187 21763 .18829 16312 .10687 51337 43630 37136 31657 27027 23107 .19785 16963 14564 .09293 .49363 .41552 .35034 .29586 .25025 .21199 .17986 .15282 .13004 .08081 47464 39573 33051 27615 23171 .19449 16351 13768 .11611 07027 45639 37689 31180 25842 21455 82270 79209 76290 73503 70843 68301 65873 63552 57175 15 17 18 17843 14864 TABLE 4 Present Value of an Annuity of 1 10% 11% 12% 15% 9615495238 94340 .93458 92593 .91743 90909 90090 89286 86957 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.62990 3.545953.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 5.24214 5.07569 4.917324.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 9.98565 9.393578.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started