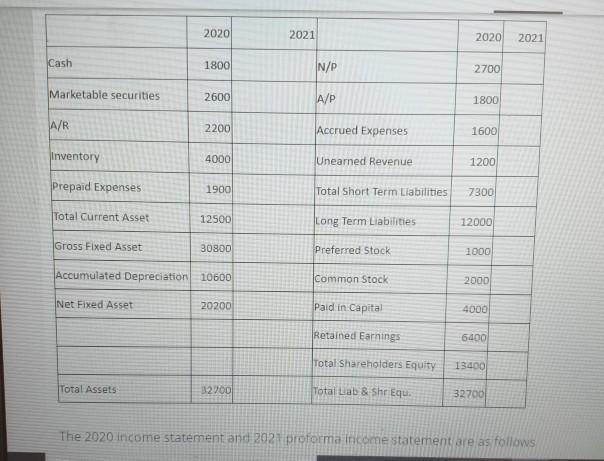

2020 2021 2020 2021 Cash 1800 N/P 2700 Marketable securities 2600 A/P 1800 A/R 2200 Accrued Expenses 1600 Inventory 4000 Unearned Revenue 1200 Prepaid

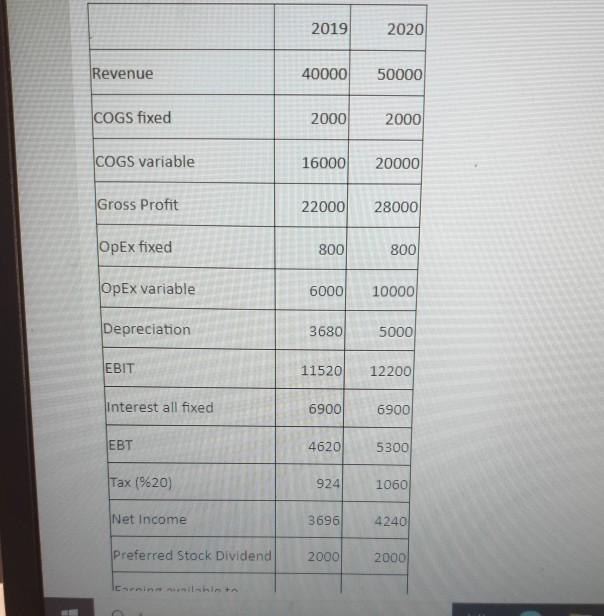

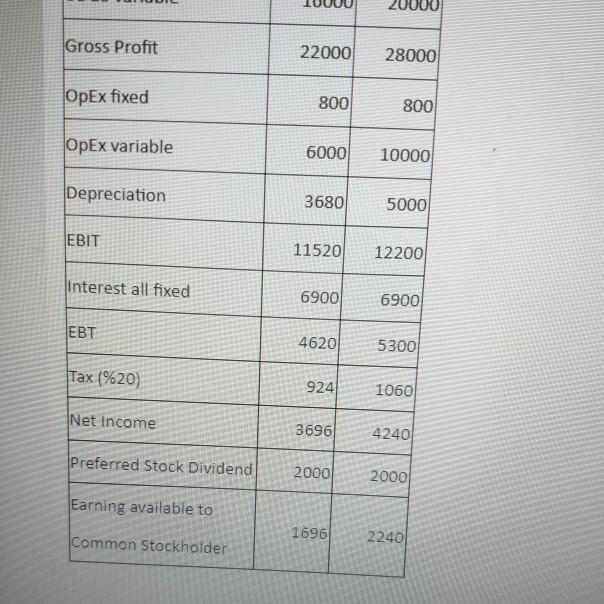

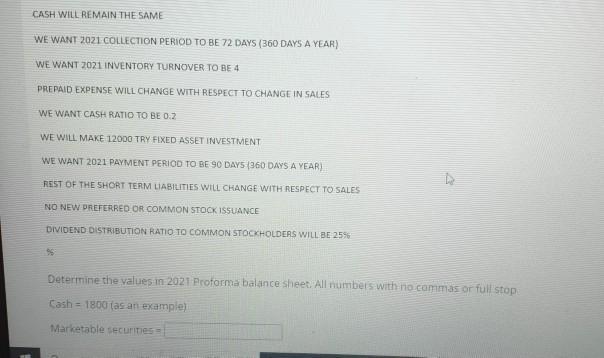

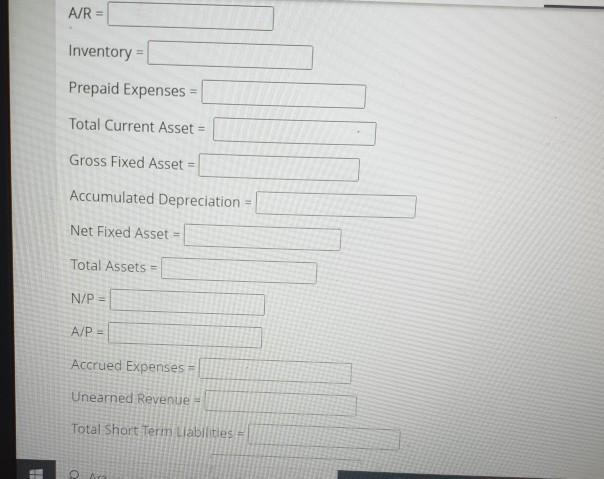

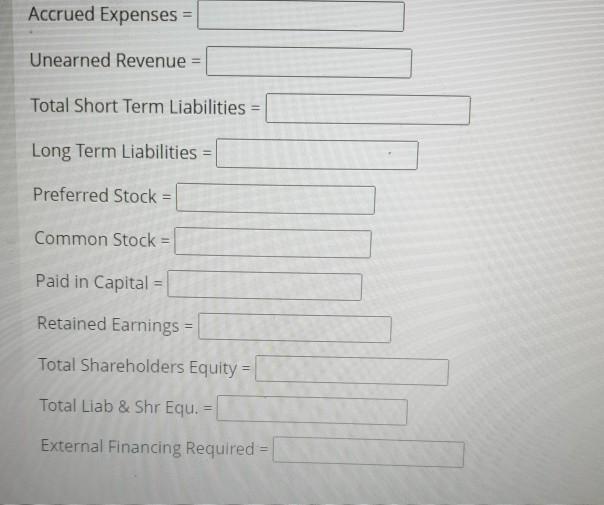

2020 2021 2020 2021 Cash 1800 N/P 2700 Marketable securities 2600 A/P 1800 A/R 2200 Accrued Expenses 1600 Inventory 4000 Unearned Revenue 1200 Prepaid Expenses Total Short Term Llabilities 1900 7300 Total Current Asset 12500 Long Term Liabilities 12000 Gross Fixed Asset 30800 Preferred Stock 1000 Accumulated Depreciation 10600 Common Stock 2000 Net Fixed Asset 20200 Paid in Capital 4000 Retained Earnings 6400 Total Shareholders Equity 13400 Total Assets 12 70 Total Liab & Shr Equ. 32700 The 2020 income statement and 202 proforma iricome statement are as follows 2019 2020 Revenue 40000 50000 COGS fixed 2000 2000 COGS variable 16000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 10000 6000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 1060 924 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 6000 10000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 924 1060 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 Earning available to 1696 2240 Common Stockholder CASH WILL REMAIN THE SAME WE WANT 2021 COLLECTION PERIOD TO BE 72 DAYS (360 DAYS A YEAR) WE WANT 2021 INVENTORY TURNOVER TO BE 4 PREPAID EXPENSE WILL CHANGE WITH RESPECT TO CHANGE IN SALES WE WANT CASH RATIO TO BE 0.2 WE WILL MAKE 12000 TRY FIXED ASSET INVESTMENT WE WANT 2021 PAYMENT PERIOD TO BE 90 DAYS (360 DAYS A YEAR) REST OF THE SHORT TERM LIABILITIES WILL CHANGE WITH RESPECT TO SALES NO NEW PREFERRED OR COMMON STOCK ISSUANCE DIVIDEND DISTRIBUTION RATIO TO COMMON STOCKHOLDERS WILL BE 25% Determine the values in 2021 Proforma balance sheet. All numbers with ino.commas or full stop Cash = 1800 (as an example) Marketable securities A/R = Inventory = !! Prepaid Expenses = %3D Total Current Asset = Gross Fixed Asset = Accumulated Depreciation Net Fixed Asset = Total Assets = N/P A/P = Accrued Expenses = Unearned Revenue = Total Short Term Liabilities = O Ar Accrued Expenses = %3D Unearned Revenue: Total Short Term Liabilities = %3D Long Term Liabilities = Preferred Stock Common Stock= %3D Paid in Capital = Retained Earnings = Total Shareholders Equity %3D Total Liab & Shr Equ. = External Financing Required = 2020 2021 2020 2021 Cash 1800 N/P 2700 Marketable securities 2600 A/P 1800 A/R 2200 Accrued Expenses 1600 Inventory 4000 Unearned Revenue 1200 Prepaid Expenses Total Short Term Llabilities 1900 7300 Total Current Asset 12500 Long Term Liabilities 12000 Gross Fixed Asset 30800 Preferred Stock 1000 Accumulated Depreciation 10600 Common Stock 2000 Net Fixed Asset 20200 Paid in Capital 4000 Retained Earnings 6400 Total Shareholders Equity 13400 Total Assets 12 70 Total Liab & Shr Equ. 32700 The 2020 income statement and 202 proforma iricome statement are as follows 2019 2020 Revenue 40000 50000 COGS fixed 2000 2000 COGS variable 16000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 10000 6000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 1060 924 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 6000 10000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 924 1060 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 Earning available to 1696 2240 Common Stockholder CASH WILL REMAIN THE SAME WE WANT 2021 COLLECTION PERIOD TO BE 72 DAYS (360 DAYS A YEAR) WE WANT 2021 INVENTORY TURNOVER TO BE 4 PREPAID EXPENSE WILL CHANGE WITH RESPECT TO CHANGE IN SALES WE WANT CASH RATIO TO BE 0.2 WE WILL MAKE 12000 TRY FIXED ASSET INVESTMENT WE WANT 2021 PAYMENT PERIOD TO BE 90 DAYS (360 DAYS A YEAR) REST OF THE SHORT TERM LIABILITIES WILL CHANGE WITH RESPECT TO SALES NO NEW PREFERRED OR COMMON STOCK ISSUANCE DIVIDEND DISTRIBUTION RATIO TO COMMON STOCKHOLDERS WILL BE 25% Determine the values in 2021 Proforma balance sheet. All numbers with ino.commas or full stop Cash = 1800 (as an example) Marketable securities A/R = Inventory = !! Prepaid Expenses = %3D Total Current Asset = Gross Fixed Asset = Accumulated Depreciation Net Fixed Asset = Total Assets = N/P A/P = Accrued Expenses = Unearned Revenue = Total Short Term Liabilities = O Ar Accrued Expenses = %3D Unearned Revenue: Total Short Term Liabilities = %3D Long Term Liabilities = Preferred Stock Common Stock= %3D Paid in Capital = Retained Earnings = Total Shareholders Equity %3D Total Liab & Shr Equ. = External Financing Required = 2020 2021 2020 2021 Cash 1800 N/P 2700 Marketable securities 2600 A/P 1800 A/R 2200 Accrued Expenses 1600 Inventory 4000 Unearned Revenue 1200 Prepaid Expenses Total Short Term Llabilities 1900 7300 Total Current Asset 12500 Long Term Liabilities 12000 Gross Fixed Asset 30800 Preferred Stock 1000 Accumulated Depreciation 10600 Common Stock 2000 Net Fixed Asset 20200 Paid in Capital 4000 Retained Earnings 6400 Total Shareholders Equity 13400 Total Assets 12 70 Total Liab & Shr Equ. 32700 The 2020 income statement and 202 proforma iricome statement are as follows 2019 2020 Revenue 40000 50000 COGS fixed 2000 2000 COGS variable 16000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 10000 6000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 1060 924 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 6000 10000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 924 1060 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 Earning available to 1696 2240 Common Stockholder CASH WILL REMAIN THE SAME WE WANT 2021 COLLECTION PERIOD TO BE 72 DAYS (360 DAYS A YEAR) WE WANT 2021 INVENTORY TURNOVER TO BE 4 PREPAID EXPENSE WILL CHANGE WITH RESPECT TO CHANGE IN SALES WE WANT CASH RATIO TO BE 0.2 WE WILL MAKE 12000 TRY FIXED ASSET INVESTMENT WE WANT 2021 PAYMENT PERIOD TO BE 90 DAYS (360 DAYS A YEAR) REST OF THE SHORT TERM LIABILITIES WILL CHANGE WITH RESPECT TO SALES NO NEW PREFERRED OR COMMON STOCK ISSUANCE DIVIDEND DISTRIBUTION RATIO TO COMMON STOCKHOLDERS WILL BE 25% Determine the values in 2021 Proforma balance sheet. All numbers with ino.commas or full stop Cash = 1800 (as an example) Marketable securities A/R = Inventory = !! Prepaid Expenses = %3D Total Current Asset = Gross Fixed Asset = Accumulated Depreciation Net Fixed Asset = Total Assets = N/P A/P = Accrued Expenses = Unearned Revenue = Total Short Term Liabilities = O Ar Accrued Expenses = %3D Unearned Revenue: Total Short Term Liabilities = %3D Long Term Liabilities = Preferred Stock Common Stock= %3D Paid in Capital = Retained Earnings = Total Shareholders Equity %3D Total Liab & Shr Equ. = External Financing Required = 2020 2021 2020 2021 Cash 1800 N/P 2700 Marketable securities 2600 A/P 1800 A/R 2200 Accrued Expenses 1600 Inventory 4000 Unearned Revenue 1200 Prepaid Expenses Total Short Term Llabilities 1900 7300 Total Current Asset 12500 Long Term Liabilities 12000 Gross Fixed Asset 30800 Preferred Stock 1000 Accumulated Depreciation 10600 Common Stock 2000 Net Fixed Asset 20200 Paid in Capital 4000 Retained Earnings 6400 Total Shareholders Equity 13400 Total Assets 12 70 Total Liab & Shr Equ. 32700 The 2020 income statement and 202 proforma iricome statement are as follows 2019 2020 Revenue 40000 50000 COGS fixed 2000 2000 COGS variable 16000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 10000 6000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 1060 924 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 6000 10000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 924 1060 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 Earning available to 1696 2240 Common Stockholder CASH WILL REMAIN THE SAME WE WANT 2021 COLLECTION PERIOD TO BE 72 DAYS (360 DAYS A YEAR) WE WANT 2021 INVENTORY TURNOVER TO BE 4 PREPAID EXPENSE WILL CHANGE WITH RESPECT TO CHANGE IN SALES WE WANT CASH RATIO TO BE 0.2 WE WILL MAKE 12000 TRY FIXED ASSET INVESTMENT WE WANT 2021 PAYMENT PERIOD TO BE 90 DAYS (360 DAYS A YEAR) REST OF THE SHORT TERM LIABILITIES WILL CHANGE WITH RESPECT TO SALES NO NEW PREFERRED OR COMMON STOCK ISSUANCE DIVIDEND DISTRIBUTION RATIO TO COMMON STOCKHOLDERS WILL BE 25% Determine the values in 2021 Proforma balance sheet. All numbers with ino.commas or full stop Cash = 1800 (as an example) Marketable securities A/R = Inventory = !! Prepaid Expenses = %3D Total Current Asset = Gross Fixed Asset = Accumulated Depreciation Net Fixed Asset = Total Assets = N/P A/P = Accrued Expenses = Unearned Revenue = Total Short Term Liabilities = O Ar Accrued Expenses = %3D Unearned Revenue: Total Short Term Liabilities = %3D Long Term Liabilities = Preferred Stock Common Stock= %3D Paid in Capital = Retained Earnings = Total Shareholders Equity %3D Total Liab & Shr Equ. = External Financing Required = 2020 2021 2020 2021 Cash 1800 N/P 2700 Marketable securities 2600 A/P 1800 A/R 2200 Accrued Expenses 1600 Inventory 4000 Unearned Revenue 1200 Prepaid Expenses Total Short Term Llabilities 1900 7300 Total Current Asset 12500 Long Term Liabilities 12000 Gross Fixed Asset 30800 Preferred Stock 1000 Accumulated Depreciation 10600 Common Stock 2000 Net Fixed Asset 20200 Paid in Capital 4000 Retained Earnings 6400 Total Shareholders Equity 13400 Total Assets 12 70 Total Liab & Shr Equ. 32700 The 2020 income statement and 202 proforma iricome statement are as follows 2019 2020 Revenue 40000 50000 COGS fixed 2000 2000 COGS variable 16000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 10000 6000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 1060 924 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 6000 10000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 924 1060 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 Earning available to 1696 2240 Common Stockholder CASH WILL REMAIN THE SAME WE WANT 2021 COLLECTION PERIOD TO BE 72 DAYS (360 DAYS A YEAR) WE WANT 2021 INVENTORY TURNOVER TO BE 4 PREPAID EXPENSE WILL CHANGE WITH RESPECT TO CHANGE IN SALES WE WANT CASH RATIO TO BE 0.2 WE WILL MAKE 12000 TRY FIXED ASSET INVESTMENT WE WANT 2021 PAYMENT PERIOD TO BE 90 DAYS (360 DAYS A YEAR) REST OF THE SHORT TERM LIABILITIES WILL CHANGE WITH RESPECT TO SALES NO NEW PREFERRED OR COMMON STOCK ISSUANCE DIVIDEND DISTRIBUTION RATIO TO COMMON STOCKHOLDERS WILL BE 25% Determine the values in 2021 Proforma balance sheet. All numbers with ino.commas or full stop Cash = 1800 (as an example) Marketable securities A/R = Inventory = !! Prepaid Expenses = %3D Total Current Asset = Gross Fixed Asset = Accumulated Depreciation Net Fixed Asset = Total Assets = N/P A/P = Accrued Expenses = Unearned Revenue = Total Short Term Liabilities = O Ar Accrued Expenses = %3D Unearned Revenue: Total Short Term Liabilities = %3D Long Term Liabilities = Preferred Stock Common Stock= %3D Paid in Capital = Retained Earnings = Total Shareholders Equity %3D Total Liab & Shr Equ. = External Financing Required = 2020 2021 2020 2021 Cash 1800 N/P 2700 Marketable securities 2600 A/P 1800 A/R 2200 Accrued Expenses 1600 Inventory 4000 Unearned Revenue 1200 Prepaid Expenses Total Short Term Llabilities 1900 7300 Total Current Asset 12500 Long Term Liabilities 12000 Gross Fixed Asset 30800 Preferred Stock 1000 Accumulated Depreciation 10600 Common Stock 2000 Net Fixed Asset 20200 Paid in Capital 4000 Retained Earnings 6400 Total Shareholders Equity 13400 Total Assets 12 70 Total Liab & Shr Equ. 32700 The 2020 income statement and 202 proforma iricome statement are as follows 2019 2020 Revenue 40000 50000 COGS fixed 2000 2000 COGS variable 16000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 10000 6000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 1060 924 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 20000 Gross Profit 22000 28000 OpEx fixed 800 800 OpEx variable 6000 10000 Depreciation 3680 5000 EBIT 11520 12200 Interest all fixed 6900 6900 EBT 4620 5300 Tax (%20) 924 1060 Net Income 3696 4240 Preferred Stock Dividend 2000 2000 Earning available to 1696 2240 Common Stockholder CASH WILL REMAIN THE SAME WE WANT 2021 COLLECTION PERIOD TO BE 72 DAYS (360 DAYS A YEAR) WE WANT 2021 INVENTORY TURNOVER TO BE 4 PREPAID EXPENSE WILL CHANGE WITH RESPECT TO CHANGE IN SALES WE WANT CASH RATIO TO BE 0.2 WE WILL MAKE 12000 TRY FIXED ASSET INVESTMENT WE WANT 2021 PAYMENT PERIOD TO BE 90 DAYS (360 DAYS A YEAR) REST OF THE SHORT TERM LIABILITIES WILL CHANGE WITH RESPECT TO SALES NO NEW PREFERRED OR COMMON STOCK ISSUANCE DIVIDEND DISTRIBUTION RATIO TO COMMON STOCKHOLDERS WILL BE 25% Determine the values in 2021 Proforma balance sheet. All numbers with ino.commas or full stop Cash = 1800 (as an example) Marketable securities A/R = Inventory = !! Prepaid Expenses = %3D Total Current Asset = Gross Fixed Asset = Accumulated Depreciation Net Fixed Asset = Total Assets = N/P A/P = Accrued Expenses = Unearned Revenue = Total Short Term Liabilities = O Ar Accrued Expenses = %3D Unearned Revenue: Total Short Term Liabilities = %3D Long Term Liabilities = Preferred Stock Common Stock= %3D Paid in Capital = Retained Earnings = Total Shareholders Equity %3D Total Liab & Shr Equ. = External Financing Required =

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of Receivables Average collection period 360days Receivable turnover Ratio 60 Days Therefore Receivable Turnover Ratio 6 Receivable Turn...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started