Question

Cindy has $9000 to invest in a portfolio. Her investment alternatives and their expected returns are: Description Expected Return 4.1% Investment RRSP (retirement) Employer's

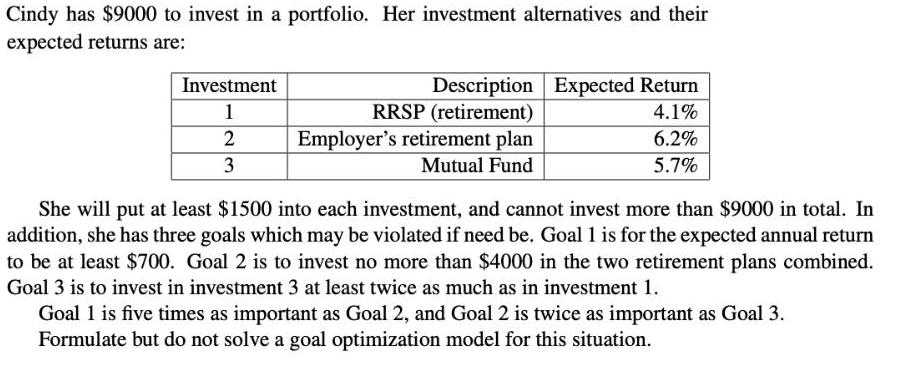

Cindy has $9000 to invest in a portfolio. Her investment alternatives and their expected returns are: Description Expected Return 4.1% Investment RRSP (retirement) Employer's retirement plan 1 2 6.2% 3 Mutual Fund 5.7% She will put at least $1500 into each investment, and cannot invest more than $9000 in total. In addition, she has three goals which may be violated if need be. Goal 1 is for the expected annual return to be at least $700. Goal 2 is to invest no more than $4000 in the two retirement plans combined. Goal 3 is to invest in investment 3 at least twice as much as in investment 1. Goal 1 is five times as important as Goal 2, and Goal 2 is twice as important as Goal 3. Formulate but do not solve a goal optimization model for this situation.

Step by Step Solution

3.48 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App