Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following version of the portfolio selection problem that was described on pages 8-10 of the textbook: A portfolio manager in charge of

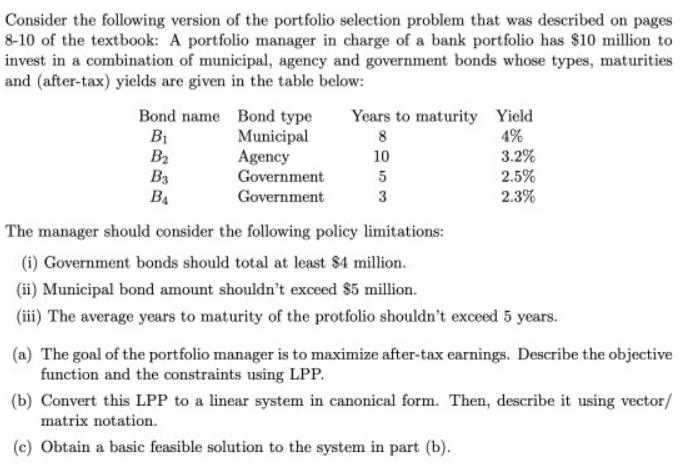

Consider the following version of the portfolio selection problem that was described on pages 8-10 of the textbook: A portfolio manager in charge of a bank portfolio has $10 million to invest in a combination of municipal, agency and government bonds whose types, maturities and (after-tax) yields are given in the table below: Bond name B B B3 BA Bond type Municipal Agency Government Government Years to maturity Yield 8 4% 10 3.2% 5 2.5% 3 2.3% The manager should consider the following policy limitations: (i) Government bonds should total at least $4 million. (ii) Municipal bond amount shouldn't exceed $5 million. (iii) The average years to maturity of the protfolio shouldn't exceed 5 years. (a) The goal of the portfolio manager is to maximize after-tax earnings. Describe the objective function and the constraints using LPP. (b) Convert this LPP to a linear system in canonical form. Then, describe it using vector/ matrix notation. (c) Obtain a basic feasible solution to the system in part (b).

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

million a Let x day to and a be the amount in invested in bonds B ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started