Question

__________________________________________ I have calculated (not sure if it's correct): 2019 ROE 3.74% 2018 ROE -19.85% 2019 RONA 1.91% 2019 NOPM 7.74% 2019 NOAT

__________________________________________

I have calculated (not sure if it's correct):

| 2019 ROE | 3.74% |

| 2018 ROE | -19.85% |

| 2019 RONA | 1.91% |

| 2019 NOPM | 7.74% |

| 2019 NOAT | 24.62% |

| 2018 RONA | -9.91% |

| 2018 NOPM | -39.04% |

| 2018 NOAT | 25.39% |

_______________________________________________

1. Compare ROE and RNOA for the 2 years.

• Discuss how operating and nonoperating activities of your company contributed to each year’s shareholders’ overall return, ROE.

• How did current year’s Net Operating Profit Margin (NOPM) change from last year? Identify several items that can explain the change.

• How did current year’s Net Operating Asset Turnover (NOAT) change from last year? Identify several items that can explain the change.

2. Compute Altman Z-score of your company for the recent 2 years (see Ch. 4 slide # 21 for the Z-score formula). How did your company’s bankruptcy probability change according to your computed Z-scores? For Market Value of Equity for the 2 years, use the numbers presented in the cover page of the most recent 2 years’ 10-K reports.

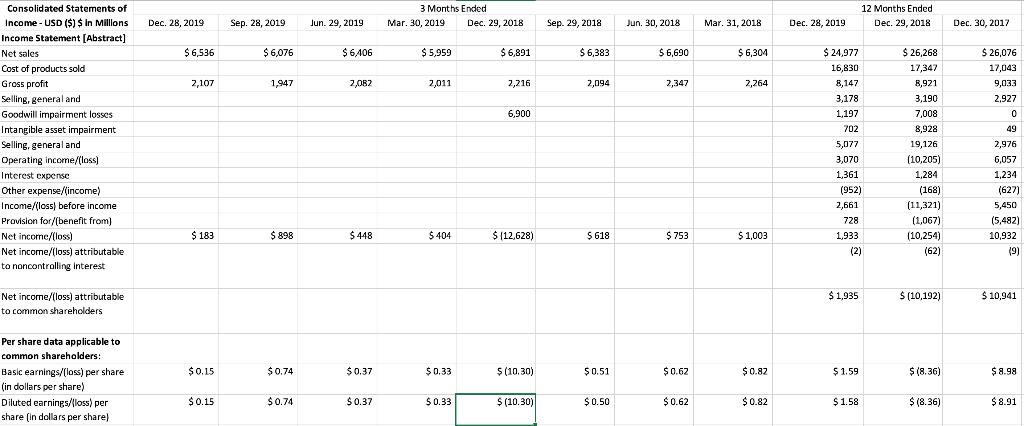

Consolidated Statements of Income - USD ($) $ in Millions Income Statement [Abstract] Net sales Cost of products sold Gross profit Selling, general and Goodwill impairment losses Intangible asset impairment Selling, general and Operating income/(loss) Interest expense Other expense/(income) Income/(loss) before income Provision for/(benefit from) Net income/(loss) Net income/(loss) attributable to noncontrolling interest Net income/(loss) attributable to common shareholders Per share data applicable to common shareholders: Basic earnings/(loss) per share (in dollars per share) Diluted earnings/(loss) per share (in dollars per share) Dec. 28, 2019. $6,536 2,107 $ 183 $0.15 $ 0.15 Sep. 28, 2019 $ 6,076 1,947 $ 898 $0.74 $0.74 Jun. 29, 2019 $6,406 2,082 $448 $ 0.37 $ 0.37 3 Months Ended Mar. 30, 2019 $ 5,959 2,011 $404 $ 0.33 $ 0.33 Dec. 29, 2018 $ 6,891 2,216 6,900 $(12,628) $ (10.30) $ (10.30) Sep. 29, 2018 $6.383 2,094 $618 $0.51 $0.50 Jun 30, 2018 $ 6,690 2,347 $ 753 $0.62 $ 0.62 Mar. 31, 2018 $ 6,304 2,264 $ 1,003 $ 0.82 $ 0.82 Dec. 28, 2019 $ 24,977 16,830 8,147 3,178 1,197 702 5,077 3,070 1,361 (952) 2,661 728 1,933 (2) $ 1,935 $1.59 12 Months Ended Dec. 29, 2018 $ 1.58 $26,268 17,347 8,921 3.190 7,008 8,928 19,126 (10,205) 1,284 (168) (11,321) (1,067) (10,254) (62) $ (10,192) $ (8.36) $ (8.36) Dec. 30, 2017 $ 26,076 17,043 9,033 2,927 0 49 2,976 6,057 1,234 (627) 5,450 (5,482) 10,932 (9) $ 10,941 $8.98 $8.91

Step by Step Solution

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

For the pay period 3rd and 4th Gross Pay 2200 Gross taxable income 162 CPP contributions 431 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started