Answered step by step

Verified Expert Solution

Question

1 Approved Answer

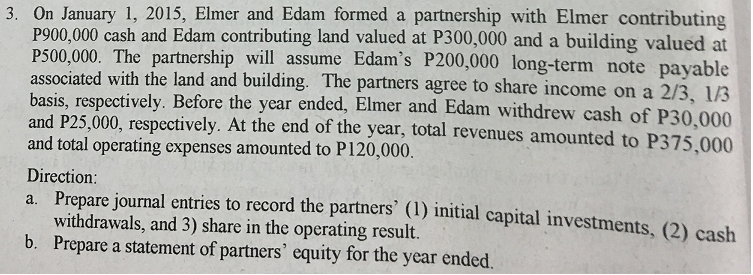

accounting 3. on January 1, 2015, Elmer and Edam formed a partnership with Elmer contributing P900,000 cash and Edam contributing land valued at P300,000 and

accounting

3. on January 1, 2015, Elmer and Edam formed a partnership with Elmer contributing P900,000 cash and Edam contributing land valued at P300,000 and a building valued at P500,000. The partnership will assume Edam's P200,000 long-term note payable associated with the land and building The partners agree to share income on a basis, respectively. Before the year ended Elmer and Edam withdrew cash of P30,000 and P25,000, respectively. At the end of the year, total revenues amounted to P375.000 and total operating expenses amounted to P120,000 Direction a. Prepare journal entries to the partners (l) initial capital investments, (2 cash withdrawals, and 3) share in the operating result. b. Prepare a statement of partners' equity for the year endedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started