Answered step by step

Verified Expert Solution

Question

1 Approved Answer

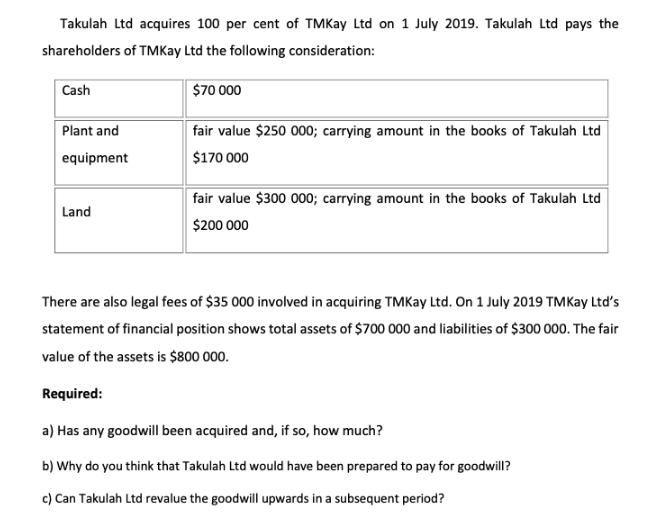

Takulah Ltd acquires 100 per cent of TMKay Ltd on 1 July 2019. Takulah Ltd pays the shareholders of TMKay Ltd the following consideration:

Takulah Ltd acquires 100 per cent of TMKay Ltd on 1 July 2019. Takulah Ltd pays the shareholders of TMKay Ltd the following consideration: Cash $70 000 Plant and fair value $250 000; carrying amount in the books of Takulah Ltd $170 000 equipment Land fair value $300 000; carrying amount in the books of Takulah Ltd $200 000 There are also legal fees of $35 000 involved in acquiring TMKay Ltd. On 1 July 2019 TMKay Ltd's statement of financial position shows total assets of $700 000 and liabilities of $300 000. The fair value of the assets is $800 000. Required: a) Has any goodwill been acquired and, if so, how much? b) Why do you think that Takulah Ltd would have been prepared to pay for goodwill? c) Can Takulah Ltd revalue the goodwill upwards in a subsequent period?

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

takulah ltd paid a total consideration if 70000 250000 300000 which is 620000 fair value of assets 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started