Question

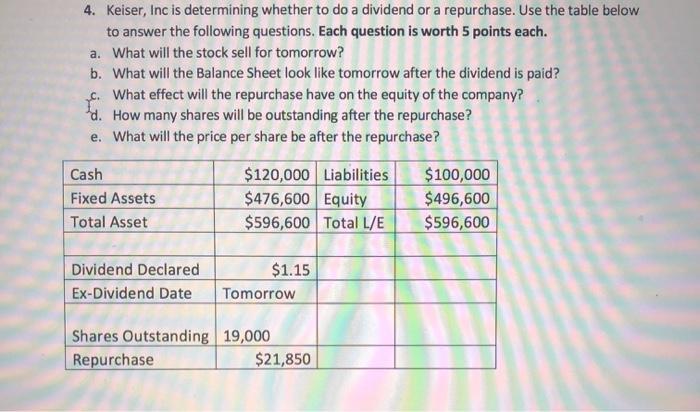

4. Keiser, Inc is determining whether to do a dividend or a repurchase. Use the table below to answer the following questions. Each question

4. Keiser, Inc is determining whether to do a dividend or a repurchase. Use the table below to answer the following questions. Each question is worth 5 points each. a. What will the stock sell for tomorrow? b. What will the Balance Sheet look like tomorrow after the dividend is paid? c. What effect will the repurchase have on the equity of the company? d. How many shares will be outstanding after the repurchase? e. What will the price per share be after the repurchase? $120,000 Liabilities $476,600 Equity $596,600 Total L/E $100,000 $496,600 Cash Fixed Assets Total Asset $596,600 Dividend Declared $1.15 Ex-Dividend Date Tomorrow Shares Outstanding 19,000 Repurchase $21,850

Step by Step Solution

3.26 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer 4 Keiser INC a Stock sell means buy shares today and sell it tomorrow As per the current Bala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting an introduction to concepts, methods and uses

Authors: Clyde P. Stickney, Roman L. Weil, Katherine Schipper, Jennifer Francis

13th Edition

978-0538776080, 324651147, 538776080, 9780324651140, 978-0324789003

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App