Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.1 3.2 3.4 3.3 To finance the purchase of a tree harvester, a logging company borrows $150,000 at an annual interest rate of 12%.

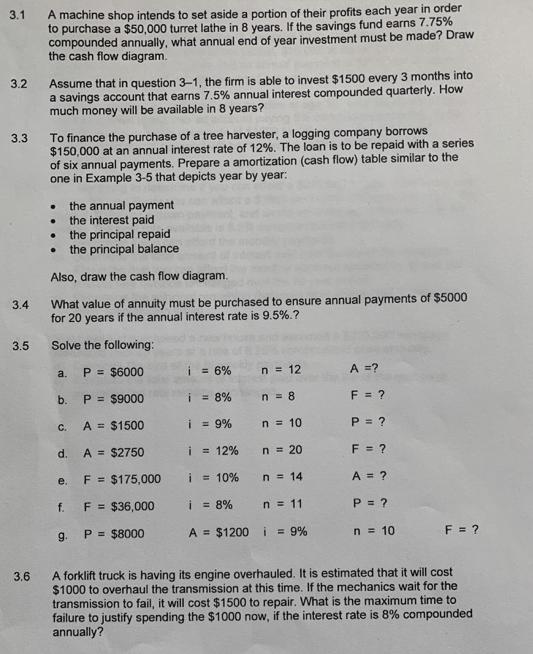

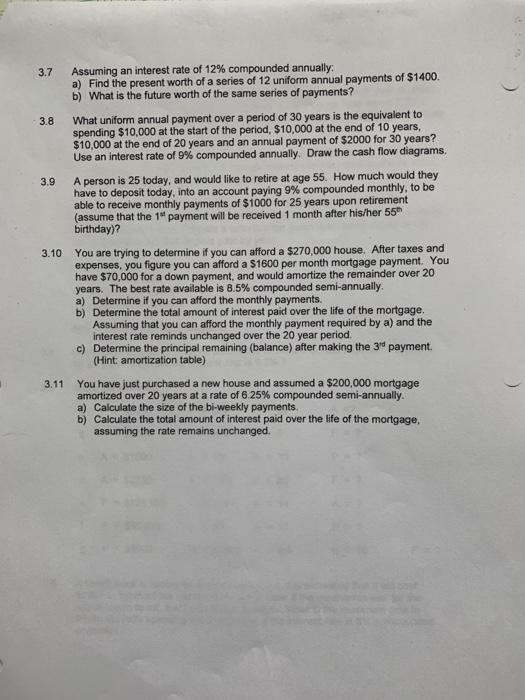

3.1 3.2 3.4 3.3 To finance the purchase of a tree harvester, a logging company borrows $150,000 at an annual interest rate of 12%. The loan is to be repaid with a series of six annual payments. Prepare a amortization (cash flow) table similar to the one in Example 3-5 that depicts year by year: 3.5 A machine shop intends to set aside a portion of their profits each year in order to purchase a $50,000 turret lathe in 8 years. If the savings fund earns 7.75% compounded annually, what annual end of year investment must be made? Draw the cash flow diagram. 3.6 Assume that in question 3-1, the firm is able to invest $1500 every 3 months into a savings account that earns 7.5% annual interest compounded quarterly. How much money will be available in 8 years? the annual payment the interest paid the principal repaid the principal balance Also, draw the cash flow diagram. What value of annuity must be purchased to ensure annual payments of $5000 for 20 years if the annual interest rate is 9.5%.? . . Solve the following: P = $6000 P = $9000 A = $1500 A $2750 F = $175,000 F = $36,000 P = $8000 a. b. C. d. e. f. 9. = 6% i = 8% i = 9% n = 12 n = 8 n = 10 n = 20 i = 10% n = 14 i = 8% n = 11 A = $1200i = 9% i = 12% A =? F = ? P = ? F = ? A = ? P = ? n = 10 F = ? A forklift truck is having its engine overhauled. It is estimated that it will cost $1000 to overhaul the transmission at this time. If the mechanics wait for the transmission to fail, it will cost $1500 to repair. What is the maximum time to failure to justify spending the $1000 now, if the interest rate is 8% compounded annually? 3.7 Assuming an interest rate of 12% compounded annually: a) Find the present worth of a series of 12 uniform annual payments of $1400. b) What is the future worth of the same series of payments? 3.8 3.9 What uniform annual payment over a period of 30 years is the equivalent to spending $10,000 at the start of the period, $10,000 at the end of 10 years, $10,000 at the end of 20 years and an annual payment of $2000 for 30 years? Use an interest rate of 9% compounded annually. Draw the cash flow diagrams. 3.11 A person is 25 today, and would like to retire at age 55. How much would they have to deposit today, into an account paying 9% compounded monthly, to be able to receive monthly payments of $1000 for 25 years upon retirement (assume that the 1st payment will be received 1 month after his/her 55 birthday)? 3.10 You are trying to determine if you can afford a $270,000 house. After taxes and expenses, you figure you can afford a $1600 per month mortgage payment. You have $70,000 for a down payment, and would amortize the remainder over 20 years. The best rate available is 8.5% compounded semi-annually. a) Determine if you can afford the monthly payments. b) Determine the total amount of interest paid over the life of the mortgage. Assuming that you can afford the monthly payment required by a) and the interest rate reminds unchanged over the 20 year period. c) Determine the principal remaining (balance) after making the 3rd payment. (Hint: amortization table) You have just purchased a new house and assumed a $200,000 mortgage amortized over 20 years at a rate of 6.25% compounded semi-annually. a) Calculate the size of the bi-weekly payments. b) Calculate the total amount of interest paid over the life of the mortgage, assuming the rate remains unchanged.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

31 Annual end of year investment 742436 Cash Flow Diagram Year 0 50000 Year 8 50000 Years 17 742436 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started