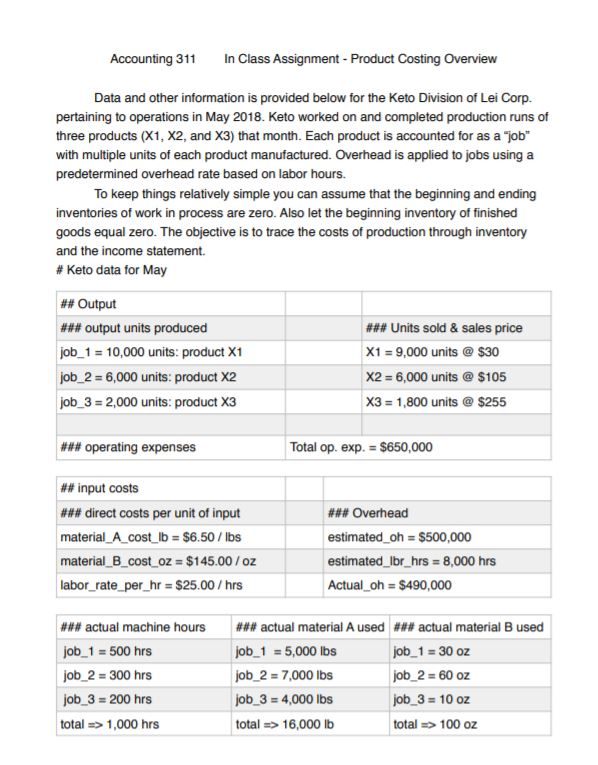

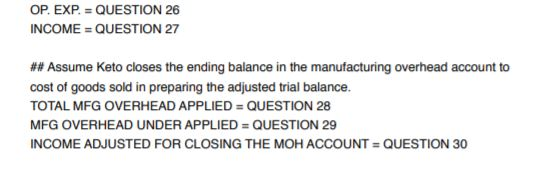

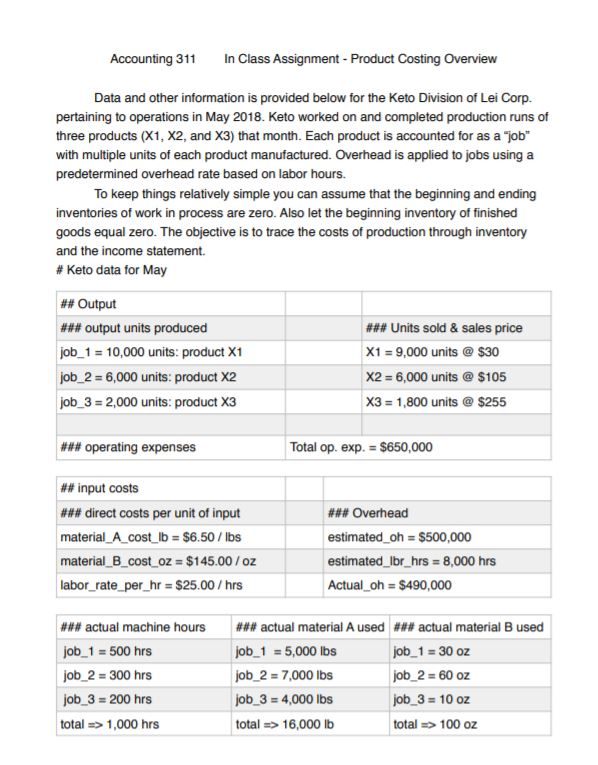

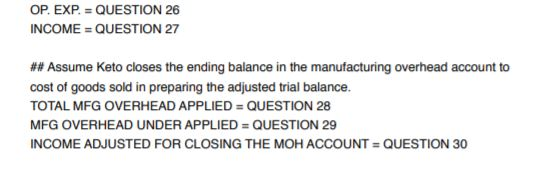

Accounting 311 In Class Assignment Product Costing Overview Data and other information is provided below for the Keto Division of Lei Corp. pertaining to operations in May 2018. Keto worked on and completed production runs of three products (X1, X2, and X3) that month. Each product is accounted for as a job with multiple units of each product manufactured. Overhead is applied to jobs using a predetermined overhead rate based on labor hours. To keep things relatively simple you can assume that the beginning and ending inventories of work in process are zero. Also let the beginning inventory of finished goods equal zero. The objective is to trace the costs of production through inventory and the income statement. # Keto data for May ## Output ### output units produced ob 1 10,000 units: product X1 job 2 6,000 units: product X2 job 3 2,000 units: product X3 ### Units sold & sales price X1 9,000 units@ $30 X2 6,000 units@$105 X3 1,800 units@$255 ### operating expenses Total op. exp. $650,000 ## input costs ### direct costs per unit of input material A cost lb $6.50 lbs material B cost oz $145.00 / oz labor rate per hr $25.00 /hrs ### Overhead estimated-oh $500,000 estimated lbr hrs 8,000 hrs Actual oh $490,000 # actual machine hours job 1 500 hrs job 2-300 hrs job 3 200 hrs total 1,000 hrs ### actual material A used #** actual material B used job 1 5,000 lbs job 2 7,000 lbs job 3 4,000 lbs total 16,000 lb job 1 30 oz job 2 60 oz job 3 10 oz total 100 oz OP, EXP. = QUESTION 26 INCOME QUESTION 27 ## Assume Keto closes the ending balance in the manufacturing overhead account to cost of goods sold in preparing the adjusted trial balance. TOTAL MFG OVERHEAD APPLIED = QUESTION 28 MFG OVERHEAD UNDER APPLIED = QUESTION 29 INCOME ADJUSTED FOR CLOSING THE MOH ACCOUNT QUESTION 30 Accounting 311 In Class Assignment Product Costing Overview Data and other information is provided below for the Keto Division of Lei Corp. pertaining to operations in May 2018. Keto worked on and completed production runs of three products (X1, X2, and X3) that month. Each product is accounted for as a job with multiple units of each product manufactured. Overhead is applied to jobs using a predetermined overhead rate based on labor hours. To keep things relatively simple you can assume that the beginning and ending inventories of work in process are zero. Also let the beginning inventory of finished goods equal zero. The objective is to trace the costs of production through inventory and the income statement. # Keto data for May ## Output ### output units produced ob 1 10,000 units: product X1 job 2 6,000 units: product X2 job 3 2,000 units: product X3 ### Units sold & sales price X1 9,000 units@ $30 X2 6,000 units@$105 X3 1,800 units@$255 ### operating expenses Total op. exp. $650,000 ## input costs ### direct costs per unit of input material A cost lb $6.50 lbs material B cost oz $145.00 / oz labor rate per hr $25.00 /hrs ### Overhead estimated-oh $500,000 estimated lbr hrs 8,000 hrs Actual oh $490,000 # actual machine hours job 1 500 hrs job 2-300 hrs job 3 200 hrs total 1,000 hrs ### actual material A used #** actual material B used job 1 5,000 lbs job 2 7,000 lbs job 3 4,000 lbs total 16,000 lb job 1 30 oz job 2 60 oz job 3 10 oz total 100 oz OP, EXP. = QUESTION 26 INCOME QUESTION 27 ## Assume Keto closes the ending balance in the manufacturing overhead account to cost of goods sold in preparing the adjusted trial balance. TOTAL MFG OVERHEAD APPLIED = QUESTION 28 MFG OVERHEAD UNDER APPLIED = QUESTION 29 INCOME ADJUSTED FOR CLOSING THE MOH ACCOUNT QUESTION 30