a) with an ieff=9% and b) with an ieff=9% as well as an inflation rate, f=6%. Also, does this change the decision in a),

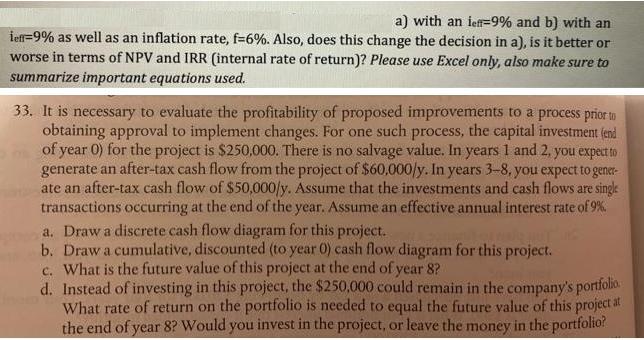

a) with an ieff=9% and b) with an ieff=9% as well as an inflation rate, f=6%. Also, does this change the decision in a), is it better or worse in terms of NPV and IRR (internal rate of return)? Please use Excel only, also make sure to summarize important equations used. 33. It is necessary to evaluate the profitability of proposed improvements to a process prior to obtaining approval to implement changes. For one such process, the capital investment (end of year 0) for the project is $250,000. There is no salvage value. In years 1 and 2, you expect to generate an after-tax cash flow from the project of $60,000/y. In years 3-8, you expect to gener- ate an after-tax cash flow of $50,000/y. Assume that the investments and cash flows are single transactions occurring at the end of the year. Assume an effective annual interest rate of 9%. a. Draw a discrete cash flow diagram for this project. b. Draw a cumulative, discounted (to year 0) cash flow diagram for this project. c. What is the future value of this project at the end of year 8? d. Instead of investing in this project, the $250,000 could remain in the company's portfolio What rate of return on the portfolio is needed to equal the future value of this project at the end of year 8? Would you invest in the project, or leave the money in the portfolio?

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Year 0 1 2 3 4 5 6 7 8 Cash Flow 25000000 6000000 6000000 5000000 50000...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started