Whirlwind Cycles is owned 100% by Daniel, a single taxpayer. Both Whirlwind Cycles and Daniel use the cash method of accounting for tax purposes.

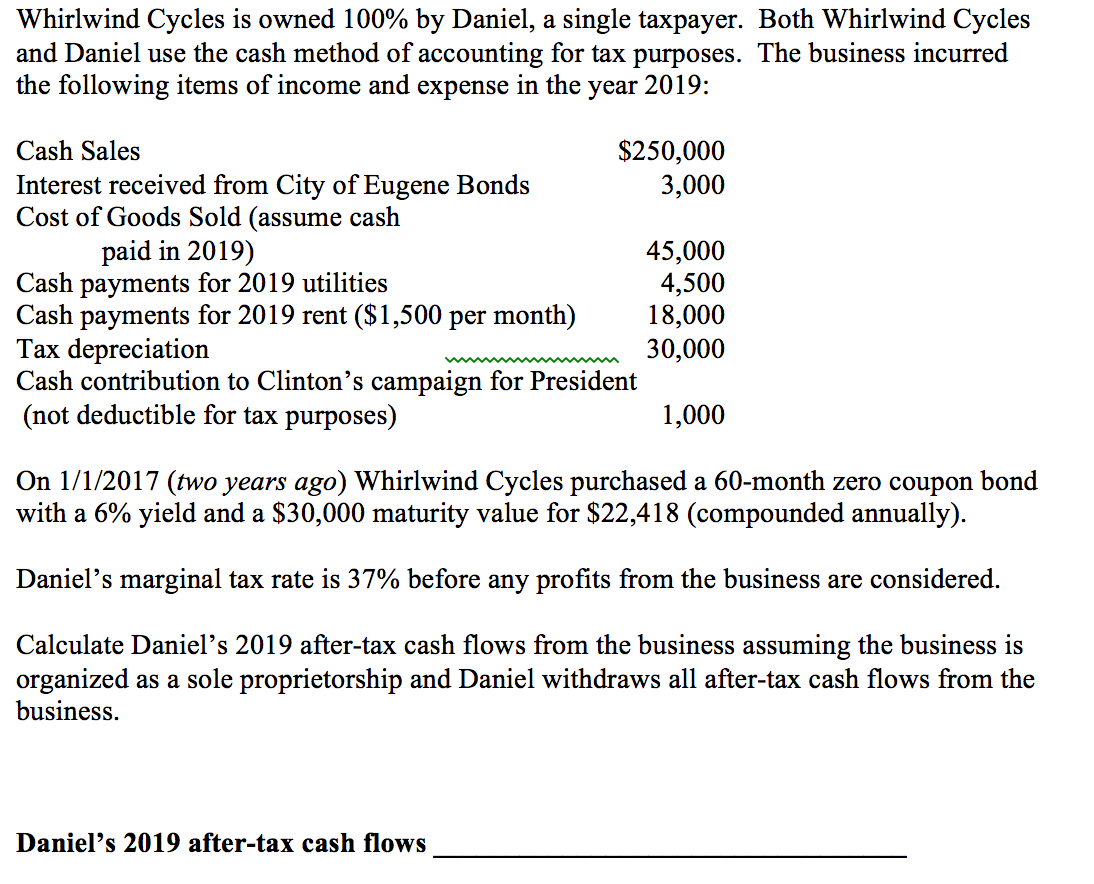

Whirlwind Cycles is owned 100% by Daniel, a single taxpayer. Both Whirlwind Cycles and Daniel use the cash method of accounting for tax purposes. The business incurred the following items of income and expense in the year 2019: Cash Sales Interest received from City of Eugene Bonds Cost of Goods Sold (assume cash $250,000 3,000 paid in 2019) Cash payments for 2019 utilities Cash payments for 2019 rent ($1,500 per month) Tax depreciation Cash contribution to Clinton's campaign for President (not deductible for tax purposes) Daniel's 2019 after-tax cash flows 45,000 4,500 18,000 30,000 1,000 On 1/1/2017 (two years ago) Whirlwind Cycles purchased a 60-month zero coupon bond with a 6% yield and a $30,000 maturity value for $22,418 (compounded annually). Daniel's marginal tax rate is 37% before any profits from the business are considered. Calculate Daniel's 2019 after-tax cash flows from the business assuming the business is organized as a sole proprietorship and Daniel withdraws all after-tax cash flows from the business.

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Cash sales 250060 t Interest recieved 3000 cogs 45000 Cash p... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards