3. Appen Limited (APX) is an Australian company that operates in the machine learning and artificial intelligence space; specifically, they provide data used to

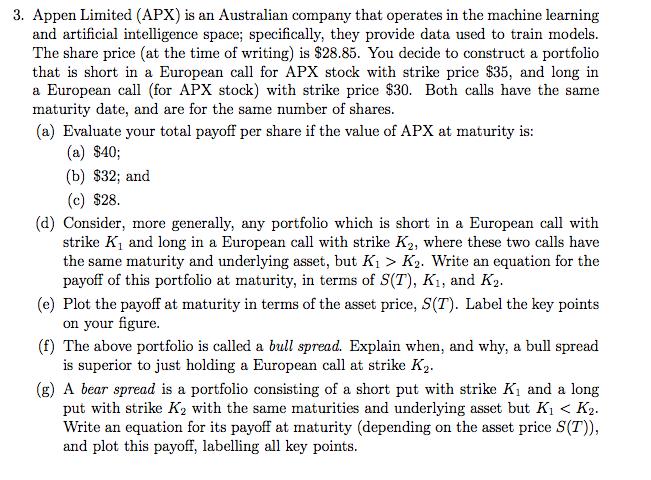

3. Appen Limited (APX) is an Australian company that operates in the machine learning and artificial intelligence space; specifically, they provide data used to train models. The share price (at the time of writing) is $28.85. You decide to construct a portfolio that is short in a European call for APX stock with strike price $35, and long in a European call (for APX stock) with strike price $30. Both calls have the same maturity date, and are for the same number of shares. (a) Evaluate your total payoff per share if the value of APX at maturity is: (a) $40; (b) $32; and (c) $28. (d) Consider, more generally, any portfolio which is short in a European call with strike K1 and long in a European call with strike K2, where these two calls have the same maturity and underlying asset, but K1 > K2. Write an equation for the payoff of this portfolio at maturity, in terms of S(T), K1, and K2. (e) Plot the payoff at maturity in terms of the asset price, S(T). Label the key points on your figure. (f) The above portfolio is called a bull spread. Explain when, and why, a bull spread is superior to just holding a European call at strike Kp. (g) A bear spread is a portfolio consisting of a short put with strike K, and a long put with strike K2 with the same maturities and underlying asset but K, < K2. Write an equation for its payoff at maturity (depending on the asset price S(T)), and plot this payoff, labelling all key points.

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

3a Evaluation of Payoff Long European Call Strike Price 30 Price at expiration S If S If S30 Payoff ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started