Question

1. Assuming a discount rate of 7% for large pharmaceutical companies, what do you estimate as Genzyme?s intrinsic market value for the management scenario? Express

1. Assuming a discount rate of 7% for large pharmaceutical companies, what do you estimate as Genzyme?s intrinsic market value for the management scenario? Express in terms of firm value and as price per share. Be prepared to discuss and defend the key assumptions you made in your analysis.

2. Assuming a discount rate of 7% for large pharmaceutical companies, what do you estimate as Genzyme?s intrinsic market value for the market scenario? Express in terms of firm value and as price per share. Be prepared to discuss and defend the key assumptions you made in your analysis.

The Valuation of Genzyme

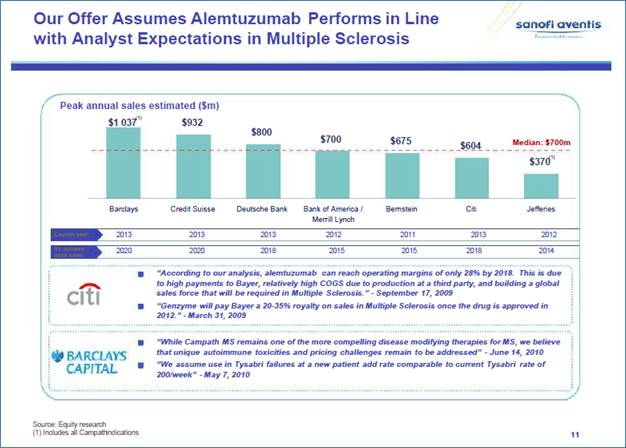

After the failed attempt to buy Genzyme from Termeer and the board in August 2010, Sanofi announced on October 5, 2010, that it would make a $69-per-share tender offer directly to Genzyme?s shareholders.?[25]Termeer remained very optimistic about the future of Genzyme and was not ready to relinquish his company?s independence. Although the $69-per-share offer valued the company at $18.5 billion, Termeer continued to view it as low considering the higher stock prices Genzyme enjoyed in 2008. He also thought the company should be worth more in light of its recently launched shareholder-friendly initiatives, Cerezyme and Fabrazyme?s return to normal production, and alemtuzumab, its promising new drug for MS.

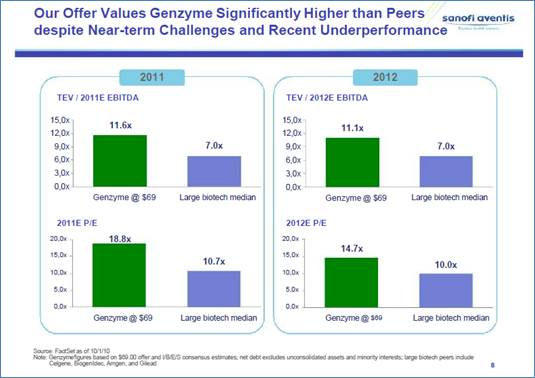

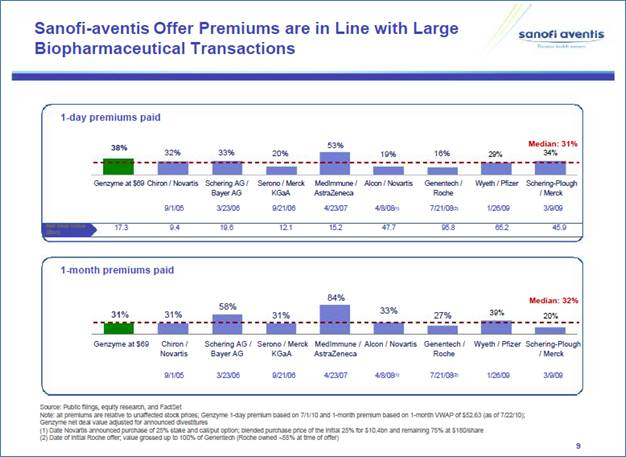

Termeer was saving the morning to review the valuation of Genzyme. For the previous year, Genzyme had used Credit Suisse and Goldman Sachs as advisors to provide valuation data for a set of biotech companies that served as ?market comparables? (?Exhibit 13, Excel Workbook) as well as information about corporate and government interest rates (?Exhibit 14, Excel Workbook). The comparables data included commonly used valuation multiples: price-to-earnings ratio (P/E), enterprise-value-to-EBITDA (EV/EBITDA), and enterprise-value-to-sales (EV/S). A recent Sanofi investor presentation argued that the $69-per-share offer was justified when compared to the valuation multiples in the biotech industry (?Exhibit 15) and was also in line with stock price premiums paid in other large biotech transactions (?Exhibit 16).

?

?

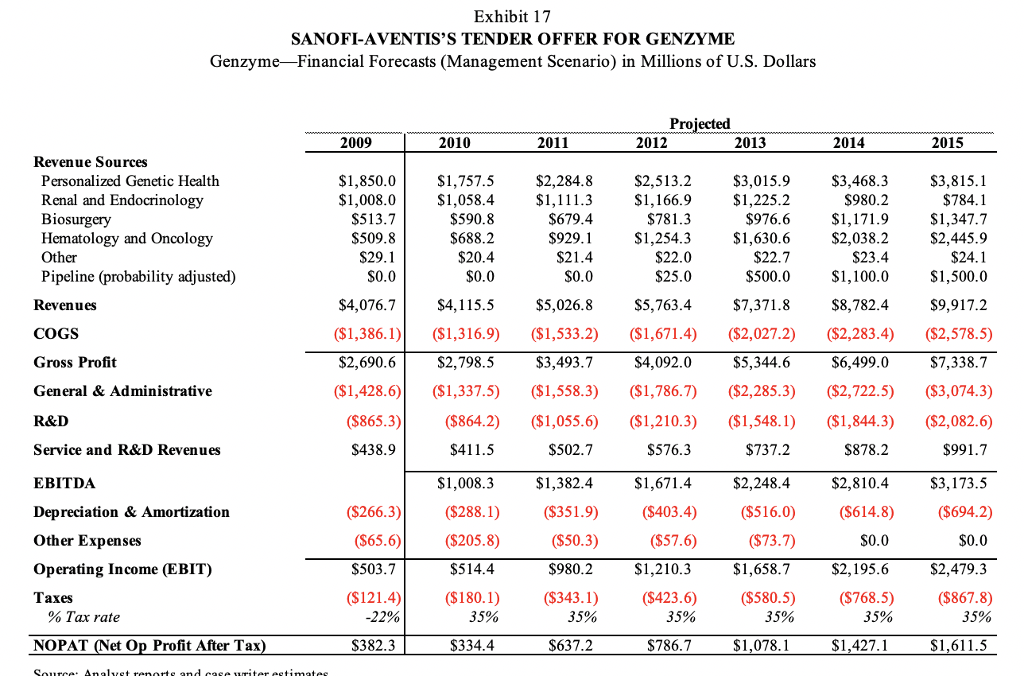

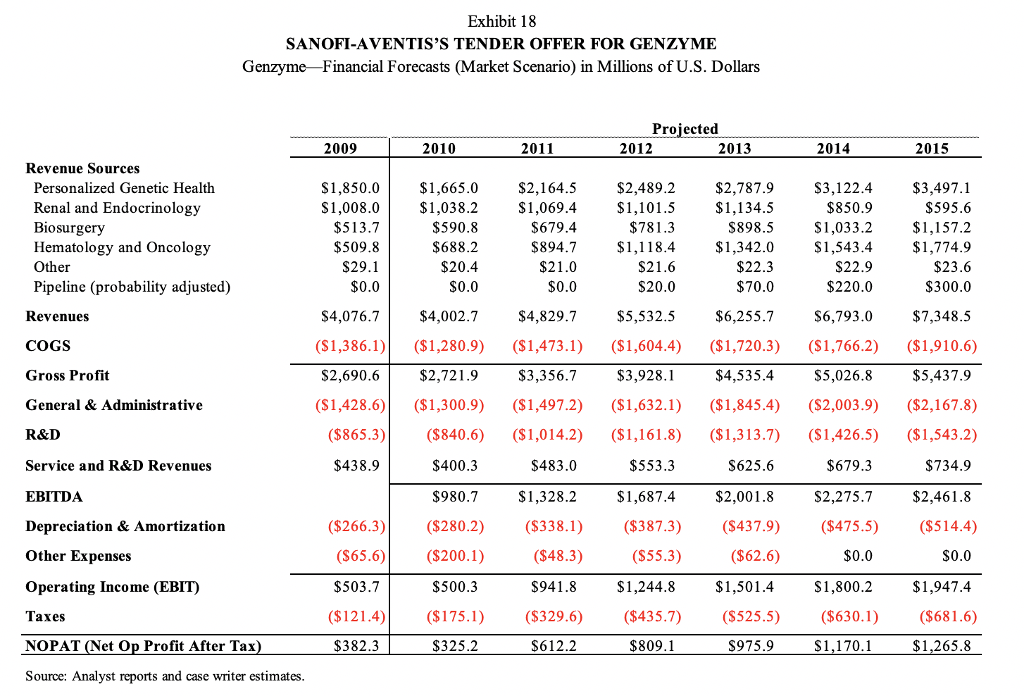

Exhibit 17 SANOFI-AVENTIS'S TENDER OFFER FOR GENZYME Genzyme-Financial Forecasts (Management Scenario) in Millions of U.S. Dollars Revenue Sources Personalized Genetic Health Renal and Endocrinology Biosurgery Hematology and Oncology Other Pipeline (probability adjusted) Revenues COGS Gross Profit General & Administrative R&D Service and R&D Revenues EBITDA Depreciation & Amortization Other Expenses Operating Income (EBIT) Taxes % Tax rate NOPAT (Net Op Profit After Tax) Source: Analyst reports and case writer estimates 2009 $1,850.0 $1,008.0 $513.7 $509.8 $29.1 $0.0 $4,076.7 ($1,386.1) $2,690.6 ($1,428.6) 2010 ($266.3) ($65.6) $503.7 ($121.4) -22% $382.3 $1,757.5 $2,284.8 $1,058.4 $1,111.3 $679.4 $929.1 $21.4 $0.0 $590.8 $688.2 $20.4 $0.0 $4,115.5 ($1,316.9) $2,798.5 ($1,337.5) ($865.3) ($864.2) $438.9 $411.5 $1,008.3 ($288.1) ($205.8) $514.4 2011 ($180.1) 35% $334.4 $5,026.8 ($1,533.2) $3,493.7 ($1,558.3) ($1,055.6) $502.7 $1,382.4 ($351.9) ($50.3) $980.2 ($343.1) 35% $637.2 2012 Projected $2,513.2 $1,166.9 $781.3 $1,254.3 $22.0 $25.0 $5,763.4 ($1,671.4) $4,092.0 ($1,786.7) ($1,210.3) $576.3 $1,210.3 2013 ($423.6) 35% $786.7 $3,015.9 $1,225.2 $976.6 $1,630.6 $3,468.3 $980.2 $1,171.9 $2,038.2 $23.4 $1,100.0 $7,371.8 $8,782.4 ($2,027.2) ($2,283.4) $5,344.6 $6,499.0 ($2,285.3) ($2,722.5) ($1,548.1) ($1,844.3) $737.2 $878.2 $1,671.4 $2,248.4 ($403.4) ($516.0) ($57.6) ($73.7) $22.7 $500.0 $1,658.7 ($580.5) 35% 2014 $1,078.1 $2,810.4 ($614.8) $0.0 $2,195.6 ($768.5) 35% $1,427.1 2015 $3,815.1 $784.1 $1,347.7 $2,445.9 $24.1 $1,500.0 $9,917.2 ($2,578.5) $7,338.7 ($3,074.3) ($2,082.6) $991.7 $3,173.5 ($694.2) $0.0 $2,479.3 ($867.8) 35% $1,611.5 Revenue Sources Personalized Genetic Health Renal and Endocrinology Biosurgery Hematology and Oncology Other Pipeline (probability adjusted) Revenues COGS Gross Profit General & Administrative R&D Service and R&D Revenues EBITDA Depreciation & Amortization Exhibit 18 SANOFI-AVENTIS'S TENDER OFFER FOR GENZYME Genzyme Financial Forecasts (Market Scenario) in Millions of U.S. Dollars Other Expenses Operating Income (EBIT) Taxes NOPAT (Net Op Profit After Tax) Source: Analyst reports and case writer estimates. 2009 $1,850.0 $1,008.0 $513.7 $509.8 $29.1 $0.0 2010 ($266.3) ($65.6) $503.7 ($121.4) $382.3 $1,665.0 $1,038.2 $590.8 $688.2 $20.4 $0.0 2011 $2,164.5 $1,069.4 $679.4 $894.7 $21.0 $0.0 ($1,300.9) ($840.6) ($1,014.2) $400.3 $483.0 Projected $980.7 $1,328.2 ($280.2) ($338.1) ($200.1) ($48.3) $500.3 $941.8 ($175.1) ($329.6) $325.2 $612.2 2012 $4,076.7 $4,002.7 $4,829.7 $5,532.5 ($1,386.1) ($1,280.9) ($1,473.1) ($1,604.4) $2,690.6 $2,721.9 $3,356.7 $3,928.1 ($1,428.6) ($1,497.2) ($1,632.1) ($865.3) ($1,161.8) $438.9 $553.3 $2,489.2 $1,101.5 $781.3 $1,118.4 $21.6 $20.0 2013 $2,787.9 $1,134.5 $898.5 $1,342.0 $22.3 $70.0 $6,255.7 ($1,720.3) $4,535.4 ($1,845.4) ($1,313.7) $625.6 $1,687.4 $2,001.8 ($387.3) ($437.9) ($55.3) ($62.6) $1,244.8 $1,501.4 ($435.7) ($525.5) $809.1 $975.9 2014 $3,122.4 $850.9 $1,033.2 $1,543.4 $22.9 $220.0 $6,793.0 ($1,766.2) $5,026.8 ($2,003.9) ($1,426.5) $679.3 $2,275.7 ($475.5) $0.0 $1,800.2 ($630.1) $1,170.1 2015 $3,497.1 $595.6 $1,157.2 $1,774.9 $23.6 $300.0 $7,348.5 ($1,910.6) $5,437.9 ($2,167.8) ($1,543.2) $734.9 $2,461.8 ($514.4) $0.0 $1,947.4 ($681.6) $1,265.8 Our Offer Values Genzyme Significantly Higher than Peers sanofi aventis despite Near-term Challenges and Recent Underperformance TEV/2011E EBITDA 15,0x 12,0x 9,0x 6,0x 3,0x 0,0x 2011E P/E 20,0 15.0 10.0 5.0 0.0x 11.6x Genzyme @ $69 2011 18.8x Genzyme @ $69 7.0x Large biotech median 10.7x Large biotech median TEV/2012E EBITDA 15,0x 12,0x 9,0x 6,0x 3,0x 0,0x 11.1x 2012E P/E 20,0x 15,0 10.0 5.0 0.0K Genzyme @ $69 2012 14.7x Genzyme @100 7.0x Large biotech median 10.0x Large biotech median of 10/1/10 Note: Deymeligures based on 360 00 ofer and consensus estimates net debt excludes unconsolidated assets and minority interests: Large biotech peers indude Bogenides, and Sanofi-aventis Offer Premiums are in Line with Large Biopharmaceutical Transactions 1-day premiums paid 38% 17.3 32% 31% 1-month premiums paid Genzyme at $69 9/105 31% Chiron/ Novartis 33% Genzyme at $69 Chiron/Novartis Schering AG Serono/Merck Medimmune/ Alcon/Novartis Genentech/ Wyeth/Pfizer Schering-Plough Bayer AG KIGOA AstraZeneca Roche /Merck 32306 9:21/06 4/2307 7/21/08 3/9/09 10.0 96.8 9/1/05 58% 20% 3/23/06 12.1 53% 31% 15.2 84% 10% 4/23/07 4/5/08 47.7 33% 16% 4/8/08 29% 27% 1/26/09 65.2 30% sanofi aventis Schering AG Serono/Merck Medimmune / Alcon/Novartis Genentech/ Wyeth / Pfizer Schering-Plough Bayer AG Roche /Merck KGaA AstraZeneca 9/21/06 7/21/08 1:25:00 Median: 31% 34% Source: Pubte fings, equity research, and Factbet Note at premtums are relative to unaffected stock phoes; Genzyme 1-day premium based on 7/1/10 and 1-month premum based on 1-month VWAP of $52.63 (of 7/22/10 Genzyme net deal value adjusted for announced divers (T) Date Novartis announced purchase of 20% state and caput option, blended purchase price of the inta 25% for $10.4bn and remaining 75% at $180share (2) Date of in Ploche offer, value grossed up to 100% of Generien (Roche owned -55% atmofor 45.9 Median: 32% 20% 3/9/09 Our Offer Assumes Alemtuzumab Performs in Line with Analyst Expectations in Multiple Sclerosis Peak annual sales estimated ($m) $1 037 $932 citi Barclays 2013 2020 BARCLAYS CAPITAL Source: Equity research (1) Includes all Compatindications Credit Suisse 2013 2020 $800 Deutsche Bank 2013 2018 $700 Bank of America/ Merrill Lynch 2012 2015 $675 Berstein 2011 2015 $604 2013 2018 sanofi aventis Median: $700m $370" Jefferies 2012 2014 "According to our analysis, alemtuzumab can reach operating margins of only 28% by 2018. This is due to high payments to Bayer, relatively high COGS due to production at a third party, and building a global sales force that will be required in Multiple Sclerosis."-September 17, 2009 "Genzyme will pay Bayer a 20-35% royalty on sales in Multiple Sclerosis once the drug is approved in 2012 March 31, 2009 "While Campath MS remains one of the more compelling disease modifying therapies for MS, we believe that unique autoimmune toxicities and pricing challenges remain to be addressed" - June 14, 2010 "We assume use in Tysabri failures at a new patient add rate comparable to current Tysabri rate of 200/week" - May 7, 2010 11

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 For the management scenario we can estimate Genzymes intrinsic market value to be 445 billion This can be expressed as a firm value by dividing the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started