Answered step by step

Verified Expert Solution

Question

1 Approved Answer

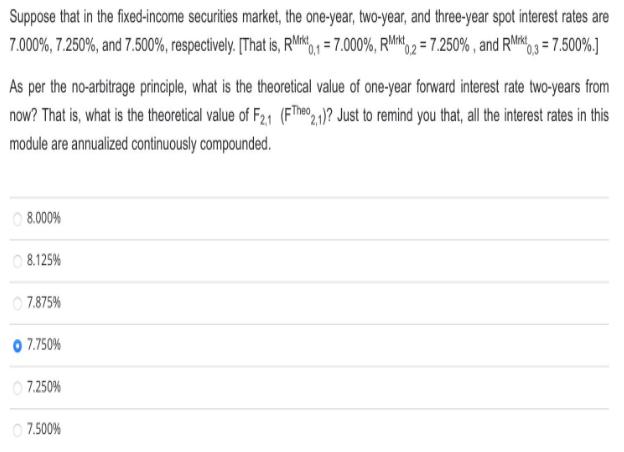

Suppose that in the fixed-income securities market, the one-year, two-year, and three-year spot interest rates are 7.000%, 7.250%, and 7.500%, respectively. [That is, RM0.1

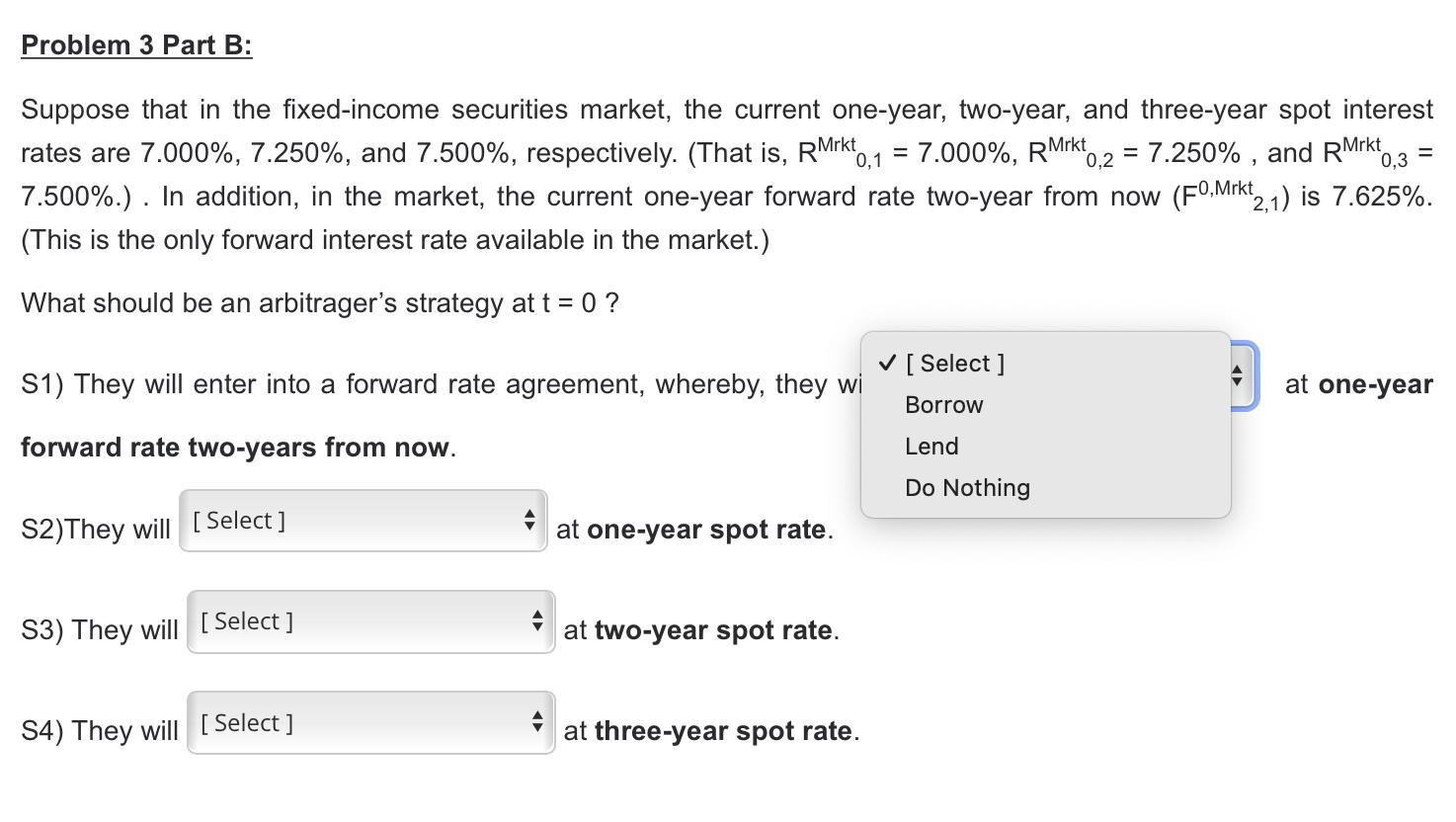

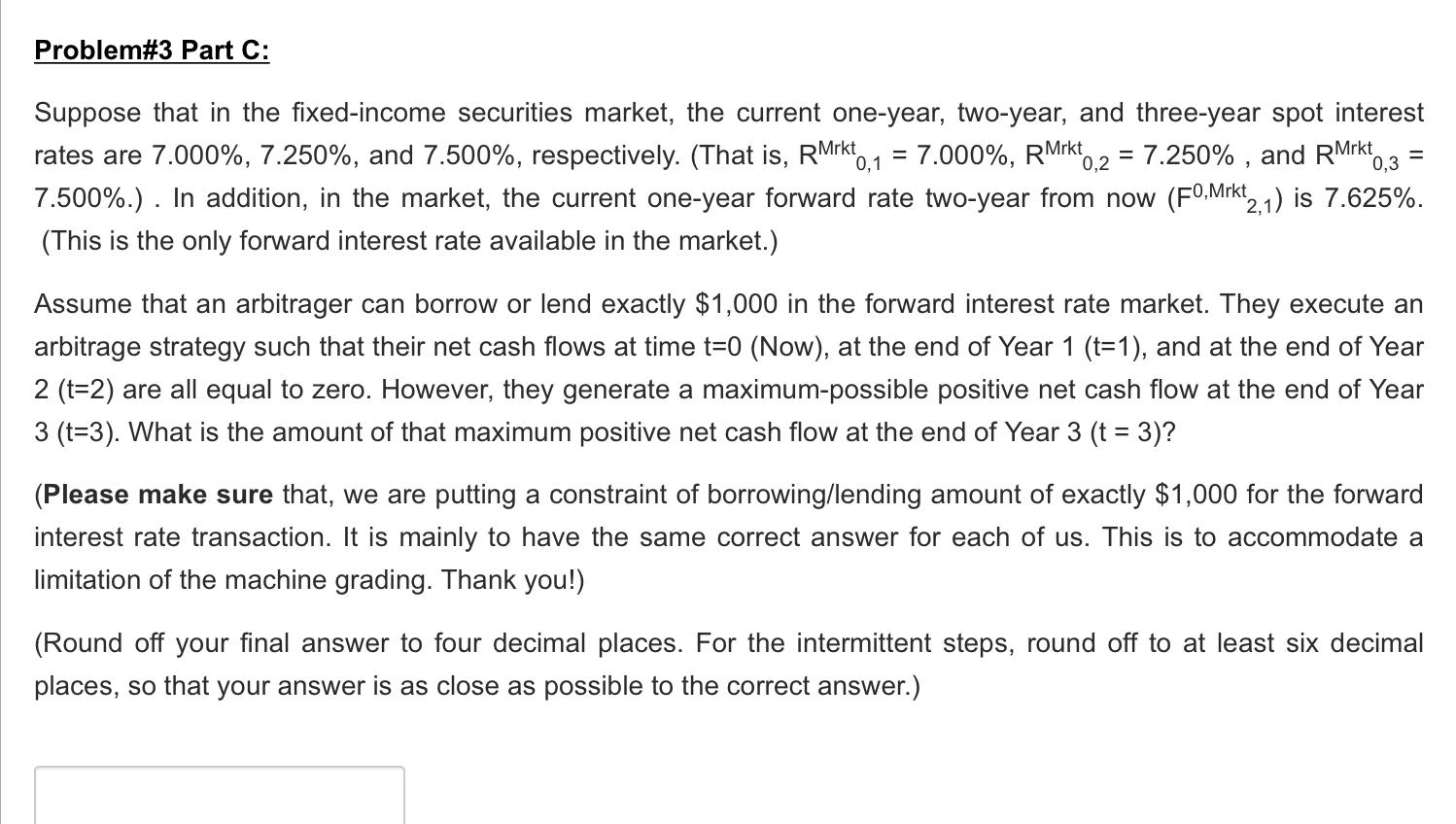

Suppose that in the fixed-income securities market, the one-year, two-year, and three-year spot interest rates are 7.000%, 7.250%, and 7.500%, respectively. [That is, RM0.1 = 7.000%, RMrkt 2 = 7.250%, and RM 0,3 = 7.500%.] As per the no-arbitrage principle, what is the theoretical value of one-year forward interest rate two-years from now? That is, what is the theoretical value of F2.1 (FThe 2,1)? Just to remind you that, all the interest rates in this module are annualized continuously compounded. 08.000% 08.125% 7.875% 7.750% 7.250% 07.500% Problem 3 Part B: 0,3 Suppose that in the fixed-income securities market, the current one-year, two-year, and three-year spot interest rates are 7.000%, 7.250%, and 7.500%, respectively. (That is, RMrkt 0,1 = 7.000%, RMrkt 0,2 = 7.250%, and RMrkt 7.500%.). In addition, in the market, the current one-year forward rate two-year from now (FO,Mrkt 2,1) is 7.625%. (This is the only forward interest rate available in the market.) What should be an arbitrager's strategy at t = 0 ? S1) They will enter into a forward rate agreement, whereby, they wi forward rate two-years from now. S2) They will [Select] S3) They will [ Select] S4) They will [Select] at one-year spot rate. at two-year spot rate. at three-year spot rate. [Select] Borrow Lend Do Nothing + at one-year Problem#3 Part C: = = Suppose that in the fixed-income securities market, the current one-year, two-year, and three-year spot interest rates are 7.000%, 7.250%, and 7.500%, respectively. (That is, RMrkt 0,1 = 7.000%, RMrkt 0,2 7.250%, and RMrkt 0,3 7.500%.). In addition, in the market, the current one-year forward rate two-year from now (FO,Mrkt 2,1) is 7.625%. (This is the only forward interest rate available in the market.) Assume that an arbitrager can borrow or lend exactly $1,000 in the forward interest rate market. They execute an arbitrage strategy such that their net cash flows at time t=0 (Now), at the end of Year 1 (t-1), and at the end of Year 2 (t=2) are all equal to zero. However, they generate a maximum-possible positive net cash flow at the end of Year 3 (t=3). What is the amount of that maximum positive net cash flow at the end of Year 3 (t = 3)? (Please make sure that, we are putting a constraint of borrowing/lending amount of exactly $1,000 for the forward interest rate transaction. It is mainly to have the same correct answer for each of us. This is to accommodate a limitation of the machine grading. Thank you!) (Round off your final answer to four decimal places. For the intermittent steps, round off to at least six decimal places, so that your answer is as close as possible to the correct answer.)

Step by Step Solution

★★★★★

3.59 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 year spot rate SR1 7 3 year spot rate SR ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started