Answered step by step

Verified Expert Solution

Question

1 Approved Answer

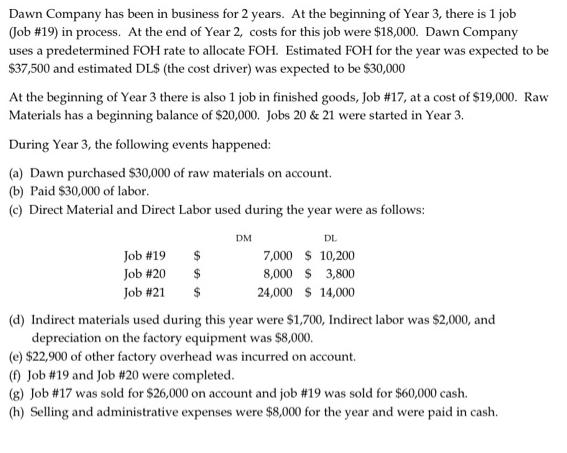

Dawn Company has been in business for 2 years. At the beginning of Year 3, there is 1 job (Job #19) in process. At

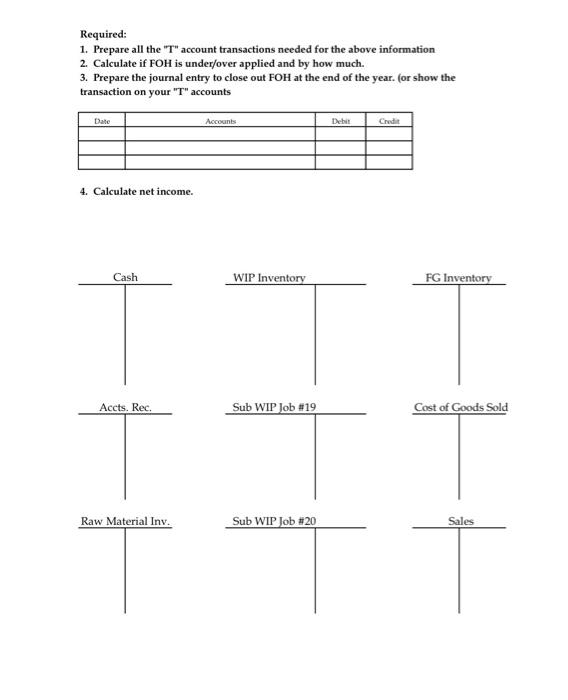

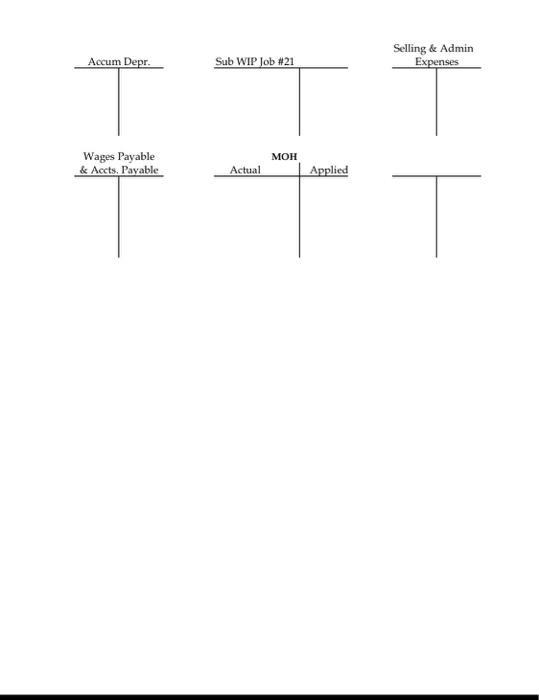

Dawn Company has been in business for 2 years. At the beginning of Year 3, there is 1 job (Job #19) in process. At the end of Year 2, costs for this job were $18,000. Dawn Company uses a predetermined FOH rate to allocate FOH. Estimated FOH for the year was expected to be $37,500 and estimated DLS (the cost driver) was expected to be $30,000 At the beginning of Year 3 there is also 1 job in finished goods, Job #17, at a cost of $19,000. Raw Materials has a beginning balance of $20,000. Jobs 20 & 21 were started in Year 3. During Year 3, the following events happened: (a) Dawn purchased $30,000 of raw materials on account. (b) Paid $30,000 of labor. (c) Direct Material and Direct Labor used during the year were as follows: Job #19 $ Job #20 $ Job #21 $ DM DL 7,000 $10,200 8,000 $3,800 24,000 $ 14,000 (d) Indirect materials used during this year were $1,700, Indirect labor was $2,000, and depreciation on the factory equipment was $8,000. (e) $22,900 of other factory overhead was incurred on account. (f) Job #19 and Job #20 were completed. (g) Job #17 was sold for $26,000 on account and job # 19 was sold for $60,000 cash. (h) Selling and administrative expenses were $8,000 for the year and were paid in cash. Required: 1. Prepare all the T account transactions needed for the above information 2. Calculate if FOH is under/over applied and by how much. 3. Prepare the journal entry to close out FOH at the end of the year. (or show the transaction on your T accounts Date 4. Calculate net income. Cash Accts. Rec. Raw Material Inv. Accounts WIP Inventory Sub WIP Job #19 Sub WIP Job #20 Debit Credit FG Inventory Cost of Goods Sold Sales Accum Depr. Wages Payable & Accts, Payable Sub WIP Job #21 Actual MOH Applied Selling & Admin Expenses T

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Predetermined overhead rate Estimated factory overhead ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started