Given the bond yields on 8/15/2018, plot the yield curve and the term structure of interest rates. Assume the bonds in the table below

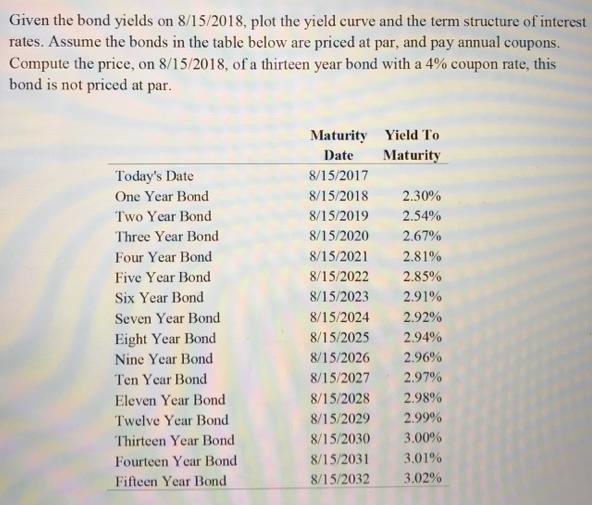

Given the bond yields on 8/15/2018, plot the yield curve and the term structure of interest rates. Assume the bonds in the table below are priced at par, and pay annual coupons. Compute the price, on 8/15/2018, of a thirteen year bond with a 4% coupon rate, this bond is not priced at par. Maturity Yield To Date Maturity Today's Date 8/15/2017 One Year Bond 8/15/2018 2.30% Two Year Bond 8/15/2019 2.54% Three Year Bond 8/15/2020 2.67% Four Year Bond 8/15/2021 2.81% Five Year Bond 8/15/2022 2.85% Six Year Bond 8/15/2023 2.91% Seven Year Bond 8/15/2024 2.92% Eight Year Bond 8/15/2025 2.94% Nine Year Bond 8/15/2026 2.96% Ten Year Bond 8/15/2027 2.97% Eleven Year Bond 8/15/2028 2.98% Twelve Year Bond 8/15/2029 2.99% Thirteen Year Bond 8/15/2030 3.00% Fourteen Year Bond 8/15/2031 3.01% Fifteen Year Bond 8/15/2032 3.02%

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

answers Above attac...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started